Chinese tourists are flooding into Hong Kong due to its lenient stance on cryptocurrencies, contrasting mainland China’s strict regulations. Hong Kong, fostering a thriving crypto scene, offers the privilege of buying digital assets with cash, often skipping standard identity verification. This crypto-friendly approach highlights a global, regional, and polarized view on cryptocurrencies.

Search Results for: 2018

LunarCrush’s $5 Million Funding: Advancing Crypto Decisions with Social Media Trends

“LunarCrush, a platform helping crypto investments by tracking social media trends, has obtained $5 million in Series A funding. Their new Social Search tool allows users to search across multiple social media platforms, tailoring content to align with their personal interests.”

Unearthing Bitcoin’s Energy Efficiency: A Tale of Progress and Ongoing Challenges

“Coinmetrics reports highlight a noteworthy enhancement in Bitcoin network’s energy efficiency by about 60% since July 2018, due to the arrival of superior, more efficient machines. Additionally, CoinShares’ research indicates that a substantial 74.1% of Bitcoin mining energy originates from renewable sources.”

Significant Improvements in Bitcoin’s Energy Efficiency: Promise or Peril?

Bitcoin’s energy efficiency has improved by about 60% since 2018 due to more efficient mining systems. This gain in efficiency is critical as concerns rise about the environmental impact of Bitcoin mining activities. This progress is matched with a trend towards sustainable energy sources, with 74.1% of Bitcoin’s mining power now coming from renewable energy sources.

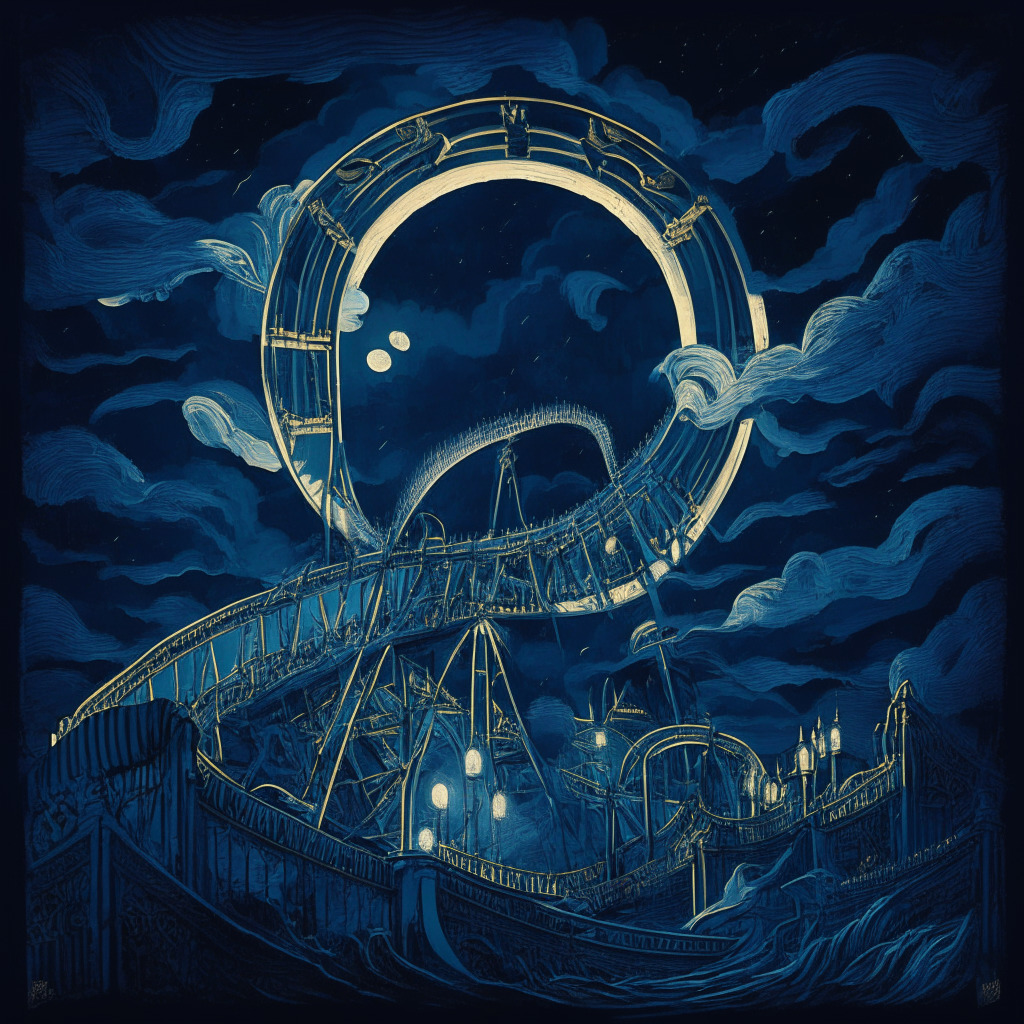

Crypto Roller Coaster: Harnessing Bitcoin’s Volatility for Profit and the Pattern behind It

“Despite Bitcoin’s roller-coaster price swings, the key to successful investment lies in understanding its repetitive mid-point tests and not relying on leverage, but using diligent strategies over a diverse portfolio. Don’t mistake market sentiment for blockchain’s underlying value.”

Crypto Boom in Entertainment: A Star-struck Prosperity or a Celebrity Trap?

“Cryptocurrency’s allure and volatility make headlines as Korean celebrities like Seo Chul-goo and Park Kyung publicly reveal financial pitfalls. The growth and innovation within crypto, such as blockchain technology, reshapes sectors but requires financial literacy and risk management beyond the hype.”

Unraveling the Shin Hyun-Seong Case: Ripple Effects on Cryptocurrency Stability, Market and Trust

Shin Hyun-Seong, Terraform Labs’ co-founder, faces indictment in South Korea related to illicit profits from the sale of Terra and Luna cryptocurrencies. The prosecution asserts Shin manipulated transactions, spread false information about the project, and sold coins just before a market crash, resulting in substantial unlawful earnings and raising crucial questions for the future of crypto industry.

Transparency vs Regulation: The Terraform Labs Controversy and Blockchain Future

“The incident involving Terraform Labs’ co-founders highlights regulatory challenges in the cryptocurrency sector. Despite potential market instability, these actions assure investors of accountability. This illustrates the urgent need for regulation balancing growth and investor protection in the rapidly evolving digital currency market, emphasizing transparency and responsibility.”

The Graph: Revolutionizing Blockchain Data or Risky Investment?

“The Graph is a decentralized indexing system that simplifies the development of decentralized applications (DApps). Using a protocol and open-source APIs called “Subgraphs”, it arranges blockchain data, enhancing the speed and efficiency of data retrieval. Despite offering revolutionary prospects for data exchange, it requires staking GRT tokens, posing potential financial risks.”

Navigating the European Commission’s Approach to Metaverse Strategy: A Blockchain Perspective

“As the European Commission prepares its strategy on the metaverse, there are high expectations but skepticism too. Key policy issues include property rights, technological standards, and privacy. While regulation is desired, it brings potential challenges, especially potential restrictions on smart contract legality. There’s also concern about Big Tech monopolising the emerging field. These unfolding regulatory chapters will be pivotal to advocates of blockchain and cryptocurrencies, emphasized by the risk metaverse regulation may have on the crypto universe.”

China’s Drive Towards Integrating Digital Yuan with Social Security Cards: Boon or Bane?

“Chinese state-run banks aim to integrate the digital yuan with government-issued social security cards in an initiative promoting digital payments. This assists the elderly and rural populations with low smartphone ownership, while addressing the issue of unbanked individuals within these demographics.”

Debating Real-Time Payments: Blockchain Innovations vs Traditional Banking Upgrades

New technologies like blockchain, stablecoins, and central bank digital currencies (CBDC) aim to expedite cross-border payments. However, existing infrastructures like Wise, which uses established systems, already process 55% of such payments instantly. Central banks worldwide are also introducing real-time retail payment systems, indicating growing diversification of instant payment options.

Shifting Power in Crypto: Decline in Exchange Balances and Rise in Self-Custody Trend

Goldman Sachs’s analysis indicates a substantial decrease in BTC and ETH held on exchanges in June, suggesting a shift towards self-custody among crypto holders. This trend coincides with increasing uncertainties about potential regulatory actions against cryptocurrencies and concerns about exchange security breaches.

China’s Crypto Future at Risk: The Impact of Pan Gongsheng’s Potential PBoC Governor Role

The appointment of well-known crypto-sceptic, Pan Gongsheng, within the People’s Bank of China, is triggering fresh concern for cryptocurrency prospects in the nation. His possible promotion hinders hopes of China softening towards digital currencies and may pose a significant barrier in global crypto integration.

Depleting Cryptocurrency Supply on Exchanges: The Shift Toward Self-Custody

“Dwindling levels of Bitcoin and Ethereum on exchanges highlight the growing preference for self-custody, according to a Goldman Sachs study. Regulatory uncertainties and cybercrime risks are seen as key reasons. This shift also reflects the ease of withdrawing staked Ether, pushing investors to stake rather than hold on exchanges.”

Tokyo and Hong Kong: Rising Crypto Hubs or Regulatory Challenges? Pros and Cons Debated

Tokyo and Hong Kong are emerging as prominent crypto hubs as they proactively attract crypto businesses and implement regulatory safeguards. Despite challenges, their clear support for the industry signals a shifting landscape and underscores the importance of adaptability in the crypto ecosystem.

Balancing Crypto Innovation and Regulation: Learning from the Ichioka Case

The CFTC charged a New York City man, William Koo Ichioka, with misappropriating over $21 million from investors in a commodity interest pool. His fraudulent scheme highlights the need for balancing investor protection and market innovation as the cryptocurrency space faces regulatory scrutiny.

Emerging Darknet Task Force: Unveiling Future of Crypto Regulation and Criminal Adaptation

The “Darknet Marketplace and Digital Currency Crimes Task Force” showcases the growing concern related to digital currencies in crime. This task force, consisting of agents from various federal agencies, seeks to dismantle criminal organizations taking advantage of digital currencies’ anonymity and raises questions about the future of cryptocurrencies and the increasing need for regulatory measures.

Revival of Gods Unchained: Epic Games Store Launch, Mobile Expansion, and Immutable’s Future Plans

NFT game Gods Unchained is set for a revival in 2023 with its launch on the popular Epic Games Store, attracting a larger audience. Developer Immutable Games Studio plans to introduce new game modes, a major expansion pack, and expand to iOS and Android platforms to enhance user experience and accessibility.

Ethereum Co-founder’s Connection to Prometheum: Overzealous Scrutiny or Valid Concern?

The connection between Ethereum co-founder Vitalik Buterin and Wanxiang Blockchain Labs has re-entered the spotlight due to Prometheum, a firm partly owned by Shanghai Wanxiang Blockchain and praised by SEC Chairman Gary Gensler for regulatory compliance. This connection raises questions about the intricate relationships between crypto companies and their founders, impacting the industry’s push for regulatory acceptance.

Blockchain Revolution: Disruptive Potential vs Regulatory and Safety Concerns

The blockchain revolution has garnered attention for its potential for disruption and advancement. This technology enables greater transparency and decentralization, transforming industries such as decentralized finance (DeFi). However, concerns about safety, criticisms, and regulatory hurdles call for adaptability, diligence, and collaboration within the community to unlock blockchain’s full potential.

Tether and Kava Partnership: Stablecoin Expansion Amid Reserve Concerns

Tether plans to launch USDT tokens on Kava, a scalable layer-1 blockchain, providing Kava’s community access to the dependable stablecoin. Despite concerns about USDT’s stability and reserves, this partnership strengthens Tether’s position as a market-leading stablecoin.

Flash Pump on Binance.US: Bitcoin Hits $138K, Liquidity Concerns Resurface

Binance.US recently experienced a ‘flash pump’ that saw Bitcoin briefly spike to $138,000 on its USDT market, a 400% increase. This anomaly, lasting only a few seconds, raises concerns about the exchange’s ability to provide a smooth trading experience amidst ongoing liquidity struggles and regulatory scrutiny.

Ava Labs Integrates AvaGPT to Enhance User Support: Innovation Meets AI Limitations

Ava Labs introduces AvaGPT, employing OpenAI’s ChatGPT technology to provide quick assistance to Avalanche users while ensuring complex queries are handled by their customer support. Through a partnership with Kapa AI, AvaGPT becomes an integral part of Ava Labs Core platform. However, Ava Labs acknowledges AI limitations and maintains transparency on the accuracy of chatbot information.

Navigating Murky Crypto Regulation: Analyzing SEC, Ripple, and the Safe Harbor Debate

The ongoing SEC vs Ripple case highlights the need for regulatory clarity in the cryptocurrency space. The “Safe Harbor Proposal” and Ethereum’s “safe harbor” designation have stirred debates about fair regulations, fostering innovation, and protecting investors from potential hazards.

Crypto Investors Holding Tight Amid Uncertainty: On-Chain Data vs. Market Boredom Dilemma

Bitcoin’s dormant supply hit a new all-time high of 15.2 million BTC, while exchange balances plunged to their lowest since January 2018. Roughly 146,000 BTC per month is moving into illiquid wallets, suggesting a “gradual and steady” accumulation phase over the next six months, despite market uncertainty and regulatory scrutiny.

IMF’s Support for CBDCs: Will Ripple’s XRP Play a Key Role in Global Interoperability?

The IMF offers support to governments in developing Central Bank Digital Currencies (CBDCs) and creating a global platform for CBDC interoperability. Ripple Labs explores CBDC use cases, aided by the recognition of XRP’s cross-border payment capabilities by the IMF. Concerns arise as CBDCs development could lead to increased centralization and surveillance.

SEC vs Binance.US Showdown: Unearthing Past Statements and Facing New Legislation

The U.S. SEC’s intention to freeze Binance.US’s assets faced a setback as Judge Amy Berman Jackson advised bilateral negotiations. Meanwhile, HKMA urges banks to accept crypto exchanges as clients, and the European Parliament passes the EU Artificial Intelligence Act, impacting governance of AI technologies.

How Revealing Hinman Documents in Ripple-SEC Case May Benefit Ethereum and the Crypto Sphere

JPMorgan analysts believe that the release of the Hinman documents in the Ripple vs SEC legal battle could benefit Ethereum. Internal SEC messages from 2018 suggest ether did not resemble a security, which could create a “regulatory gap” for decentralized tokens. This may influence US congressional efforts to regulate the cryptocurrency industry, potentially enabling ether to dodge the security designation.

Stable Crypto Weekend Meets Regulatory Developments: Market Impact and the Future of Decentralization

The cryptocurrency market showed stability over the weekend, while a federal judge approved a temporary agreement between the SEC and Binance. This agreement ensures only Binance.US employees access customer funds amidst ongoing legal developments and increased emphasis on decentralization in the industry.

SEC Stabilization Act vs Gensler’s Future: Analyzing Impacts on Crypto Markets and ETFs

The SEC Stabilization Act seeks to fire SEC Chair Gary Gensler and redistribute power within the agency, while BlackRock applies for the first spot Bitcoin ETF in the U.S. Amidst these developments, the crypto market continues to evolve and face uncertainties, highlighting the importance of staying informed.

Legal Battles Escalate for Terra Co-Founders: Alleged Fake Passports and Political Ties

The legal battles involving Terra co-founder Do Kwon and former CFO Han Chang-joon intensify as Montenegrin authorities expedite investigations regarding their alleged use of fake passports. Both deny any involvement in illegal financing of Montenegrin political campaigns, with the case highlighting potential risks and complexities in the blockchain and cryptocurrency industry.