“The rise of Shiba Inu tokens correlates with the anticipation for Shibarium, a Shiba Inu-based blockchain. Integral to Shibarium is self-sovereign identify (SSI), providing users control over their online personal information. Furthermore, Shibarium’s focus on metaverse and gaming applications, influenced by the upcoming NFT sector, suggest a promising outlook for Shiba Inu’s future.”

Search Results for: ANT

Aptos and Shibie: Blockchain Giants Surge amidst Volatility – A Rare Opportunity or a Waiting Trap?

“Aptos, a layer-1 blockchain, sees a price surge of +20% following its new partnership with Microsoft, aiming to expand blockchain tools and services using AI. However, despite the upward-bound price move, Aptos’ indicators ring alarm bells with an oversold signal needing consolidation. Meanwhile, Shibie, a Shiba Inu-Barbie hybrid altcoin, prepares for a crypto storm, gathering popularity and funding.”

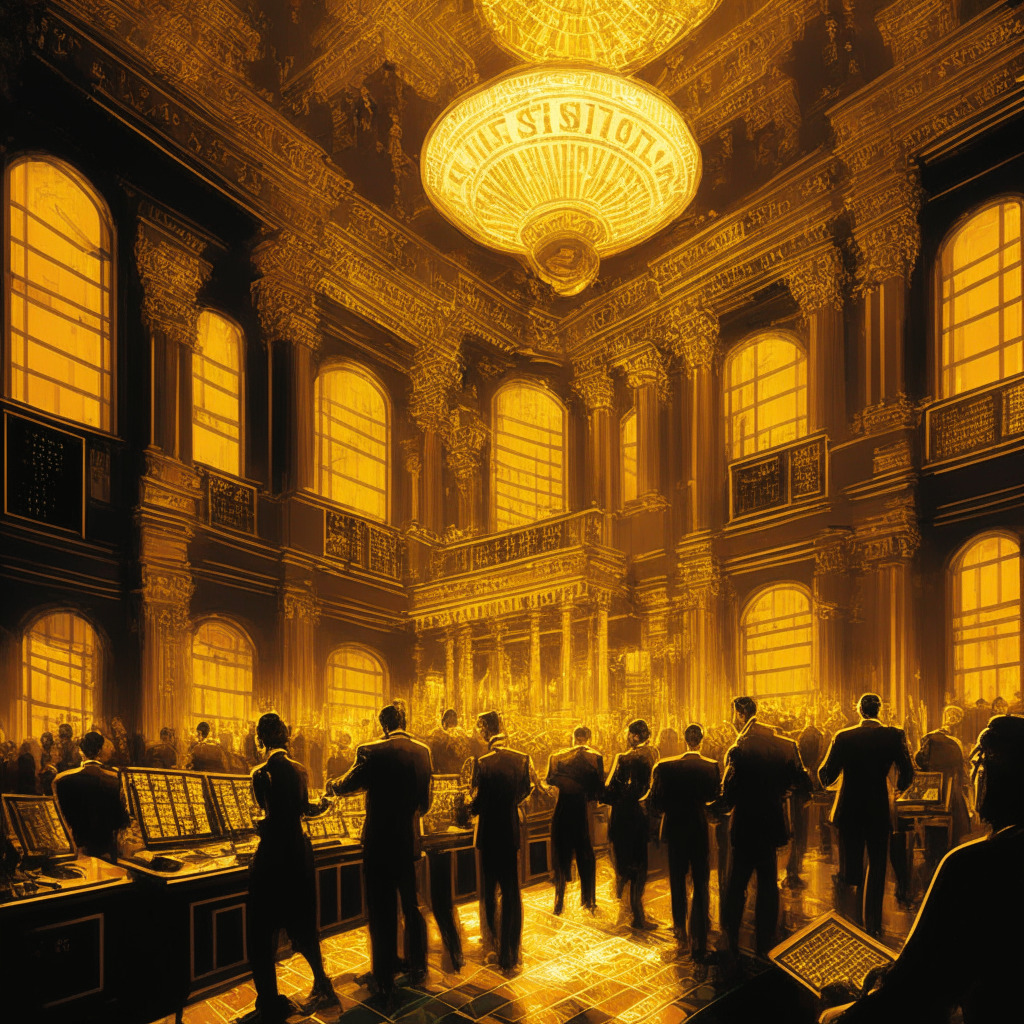

Emerging Trust in Bitcoin: Financial Giants are Getting Onboard with Cryptocurrency

David Rubenstein, founder of the Carlyle Group, expressed confidence in Bitcoin’s future and its increasing importance in financial assets. His views underscore the growing interest from major firms in Bitcoin and its acceptance as a regulation-free virtual currency.

Fantom’s Quagmire: SpiritSwap Closure Hints at Multichain Risks and Opportunities

“SpiritSwap, a DEX on the Fantom blockchain, plans to cease operations following a Multichain crisis that emptied its treasury, impacting operations and dropping TVL drastically. The co-founder’s arrest and subsequent issues have raised questions about the future of projects associated with Multichain protocols.”

Venture Capital Giants Faced with Lawsuit over Crypto Exchange Scandal: Unmasking their Role

“In a class-action lawsuit, 18 top venture capital firms, including Temasek, Sequoia Capital, Sino Global and Softbank are accused of endorsing the apparently bankrupt crypto exchange, FTX. The plaintiffs argue they portrayed a deceptive picture of safety and stability about the exchange, despite concerns of fraudulent activities and negligence of securities laws.”

Ethereum’s Untold Recovery: The Underdog’s Struggle Against Vibrant Altcoins and Market Calibration

“Ethereum (ETH) boasts a remarkable 55% return since the start of the year. Technical indicators suggest a potential short-term surge for the altcoin, despite a recent sell-off. Guided by a promising Bitcoin ETF approval, the general cryptocurrency sphere is likely to experience a surge, with ETH, the dominant blockchain platform, benefiting greatly. Factors like its transition to a proof-of-stake consensus mechanism and being chosen by PayPal for its stablecoin deployment could catapult ETH to around $2,500 by year-end.”

Surging Meme Coins and August’s Anticipated ER-20 Token Splurge: A Crypto Roller Coaster Ride

“One in question, Pepe Coin (PEPE), witnessed an approximate leap of 9% in valuation amidst a market rally, emerging as the third-largest meme coin by market capitalization. Meanwhile, BTC20, another ER-20 token, promises faster transactions, greener operations, and anchoring the decentralized finance (DeFi) world.”

Crypto Giants Report Stellar Q2 Profits Despite Regulatory Scrutiny: Unpacking the Figures

“Major crypto firms displayed strong financial performance last quarter due to a surge in crypto asset prices. Companies like MicroStrategy and Block reported significant profits and revenue increases, attributed to growing Bitcoin sales despite market fluctuations. The overall health of the crypto market shows its resilience and potential growth.”

Dormant Bitcoin: Positive Long-Term Holding or Impending Threat from Financialization?

The latest data reveals that 13.3 million Bitcoins, about 68.54% of the total circulating supply, remained unspent for a year, indicative of a bias towards holding for long-term gains. However, these positive implications must also consider Bitcoin’s increasing financialization, which might disrupt potential market upswing.

Unraveling Privacy Issues and Centralization Concerns: A Deep Dive into Tech Giants’ AI Training and Crypto Evolution

In response to a backlash over AI data scraping without consent, Zoom has revised its terms of service. Many users expressed intentions to discontinue Zoom use, due to terms allowing the extraction of user data for AI training. The company now clarified it will not use user-generated content for AI training without explicit approval. This reveals the balance tech companies must maintain between consumer privacy and innovation.

Bitcoin’s Triumphant Rally Surpasses Underperforming Crypto Hedge Funds: A 2023 Reversal

Despite attempts to shield investments from volatility, crypto hedge funds underperformed in H1 2023 with a modest 15.2% return, compared to Bitcoin’s 83.3% return. Factors include defensive approaches during industry turmoil, closure of crypto-friendly banks, and a murky regulatory situation. The underperformance underscores the importance of maintaining a balanced portfolio for long-term security and rewards.

Mantle’s $4.2 Billion Treasury: Why the New Economics Committee Can be Both a Blessing and a Curse

“Mantle community is establishing an economics committee to manage its $4.2 billion treasury, largely consisting of its governance token MNT and stablecoins USDC and USDT. The formation expresses a desire for accountability and democracy in decision making, but raises questions about the solidity of Mantle’s financial base due to crypto volatility.”

Anticipating the Impact: Imminent U.S. Crypto Tax Overhaul & Its Potential Consequences

The U.S. is preparing for an overhaul of tax regulations concerning cryptocurrencies, causing uncertainty among crypto firms and industry insiders. These regulations aim to guide businesses on reporting customers’ tax positions, potentially legitimizing the crypto sector. However, timelines and specific implications remain uncertain, stirring industry anxieties and prompting calls for clearer guidelines.

PayPal Dives into Crypto: Anticipating the Impact and Uncertainties of PayPalUSD Stablecoin

PayPal has entered the cryptocurrency market by creating its own U.S. dollar-pegged stablecoin, PayPalUSD. This move signifies mainstream acceptance of blockchain technology, but also raises concerns of centralized control and potential market manipulation in what has been a decentralized sphere.

Universities as Powerhouses of Web3 Talent: LBank Labs’ CEO Insight and the Resultant Implications

“Czhang Lin, CEO of LBank Labs, emphasizes the crucial role of universities in the future of Web3. Despite the current market sentiment, Lin maintains there is potential for student-led talent in emerging technologies like AI and Web3. He observed a growing interest among students in decentralized finance (DeFi), liquid staking derivatives (LSD), zero-knowledge (ZK), and decentralized applications (DApps), indicating a possible paradigm shift in the future.”

Anticipating Bitcoin’s Bull Market: Whales, Fish and the Vital 200-week SMA

In the unpredictable crypto market, analysts suggest that Bitcoin could undergo a “full bull” upswing in the coming month. This potential uptrend is indicated by increased activity among Bitcoin’s whale investors. However, Bitcoin price needs to sustain above its 200-week simple moving average for this to happen.

Memecoins Meet Science: The Intersection of Cryptocurrency and Quantum Computing Through LK99

The emergence of LK99 memecoins, sparked by South Korean scientists’ claim to a zero energy loss superconducting material, reflects the fusion of science with cryptocurrencies. This intriguing intersection offers both promise and speculation towards the future of blockchain.

Anticipating the Next Bull Run: Evaluating BTC’s Market Stance Amidst Dipping Prices

Despite Bitcoin’s current tight trading range, some bullish industry traders believe that conditions have reset for a potential surge. Using Bitcoin’s market cap dominance and its relative strength index (RSI) as evidence, they claim that significant upside moves are still ahead. However, this optimistic prediction does not erase the potential risks of the volatile crypto-market, emphasizing the importance of self-conducted research.

Litecoin’s Halving Event: Advantages, Drawbacks, and the Impact on Cryptocurrency Landscape

“Litecoin, a Bitcoin derivative, recently executed its third halving event, cutting block subsidy, a miners incentive, from 12.5 LTC to 6.25 LTC. Although some miners anticipated this, detractors worry it could negatively affect enthusiasm due to reduced rewards.”

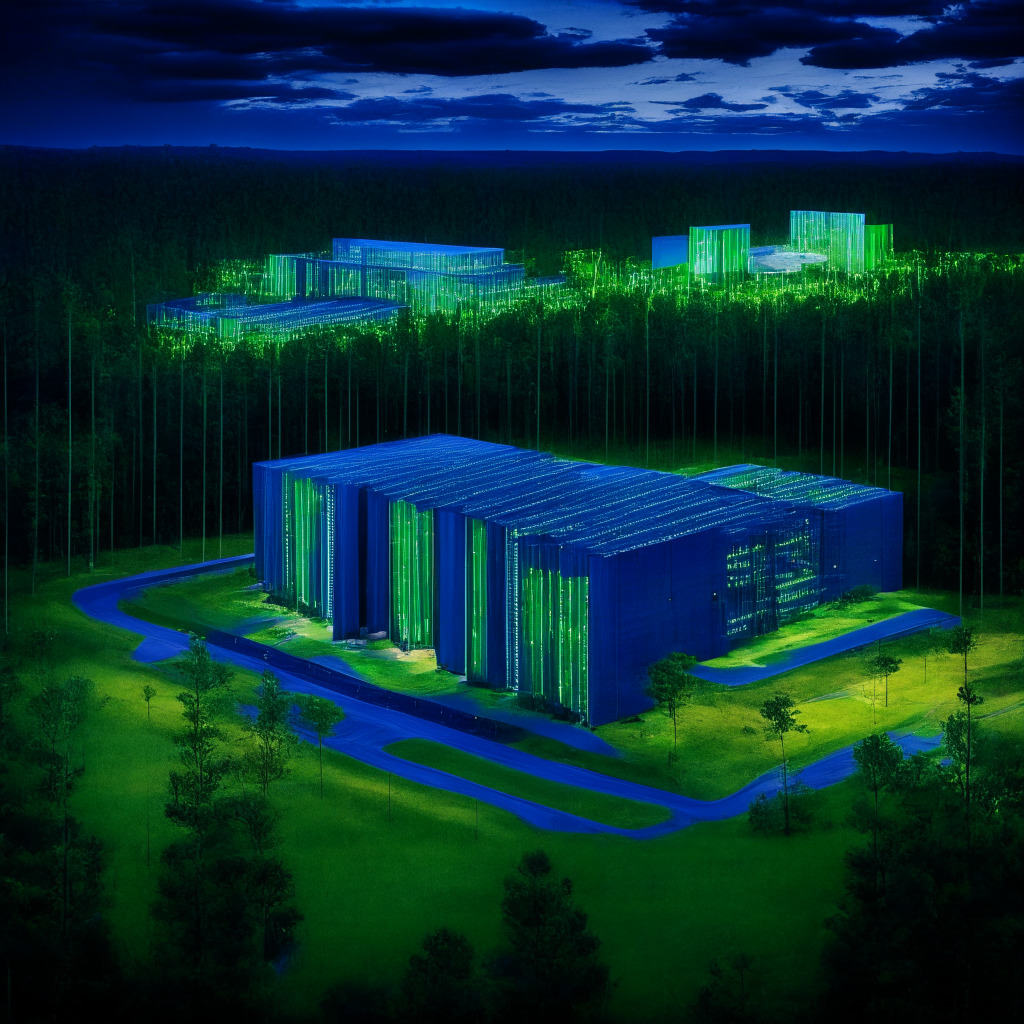

Bitcoin Mining Giants Take the Green Leap: Genesis Digital Assets Expands in South Carolina

Genesis Digital Assets (GDA) inaugurated three eco-friendly data centers in South Carolina, contributing to over 2% of the total Bitcoin network hash rate. These expansions notably utilize local energy resources, strengthen local energy grids, and align with GDA’s clean energy ethos, potentially leading crypto mining towards a more sustainable, eco-friendly future.

Crypto Giant’s Expansion: Genesis’ New Data Centers and the Push for Eco-Friendly Mining

Genesis Digital Assets has expanded their cryptocurrency mining operations with three new data centers in South Carolina, marking its strategic move into the North American market. CEO, Andrey Kim, emphasizes the company’s aspiration for industry leadership in environmentally-friendly Bitcoin mining.

Binance Marches Back Into Japan: Strategic Move or Risky Gamble for the Crypto Giant?

“Binance, a leading global cryptocurrency exchange, recently launched its Japan-based branch amid earlier regulatory issues. Their presence in Japan, acquired through Sakura Exchange Bitcoin, aims to boost the Japanese digital-asset markets and aligns with the Prime Minister’s plans for promoting Web3 innovations.”

Dubai’s Crypto Expansion: VARA Grants Operational License to Japan’s Nomura Subsidiary

“Dubai’s Virtual Asset Regulatory Authority (VARA) expands crypto services throughout the United Arab Emirates by granting an operational license to Laser Digital, the crypto branch of the Japanese financial giant Nomura. This approval empowers Laser Digital to offer diverse crypto services, including broker-dealer services and investment management. This aligns with Dubai’s strategic positioning as a regional cryptocurrency hub.”

AI Takes the Lead: Tech Giants’ Focus Shifts, but is Intel Lagging Behind?

“Major tech firms including Google, Microsoft, Intel, and Meta, have significantly increased their focus on Artificial Intelligence (AI) innovation, resulting in a shift towards an AI-centric technology landscape. However, it’s crucial to balance this with other critical tech components.”

Prospective President DeSantis: Halting the War on Crypto and Spurning CBDCs

Presidential hopeful Ron DeSantis pledges to halt the “war on Bitcoin and cryptocurrency” if elected President, criticizing the current administration’s approach to digital assets. DeSantis equates potential US plans for a central bank digital currency (CBDC) to those in China, expressing mistrust over government control of finances and stifling economic freedom.

Decentralized Freelance Giant DeeLance Shakes Up $761 Billion Recruitment Sector: A New Era Dawns

“Decentralized freelance platform, DeeLance, is set to innovate the $761 billion recruitment sector. Raising $1.7million in presale, the native currency $DLANCE is expected to rise by 20%. DeeLance envisions a crypto and NFT-driven metaverse for freelancers, offering a $100K $DLANCE token giveaway and promising secure, low-fee working environment with verifiable ownership transfer via NFTs.”

Awakening Giants: What Dormant Crypto Wallets Coming to Life Means for the Blockchain Future

A cryptocurrency whale recently reclaimed $74M in ETH trapped for years in the Ethereum Name Service auction, shocking observers. Other dormant wallets holding substantial assets have recently been activated, demonstrating both the immense potential and volatility of cryptocurrency. However, unclaimed deeds pose questions about the process of reclaiming such funds. Users should verify their addresses to claim their holdings in this intriguing blockchain development.

Riding the Bitcoin Wave: Eager Anticipation Meets Rational Skepticism Amid Potential MACD Cross Event

Market participants eagerly await a potential bullish cross on Bitcoin’s moving average convergence/divergence (MACD) indicator, typically a long-term bull signal. However, sudden volatility could lead to a breakdown. Despite historical indications of a positive trend after similar instances, existing market uncertainties call for cautious anticipation amongst stakeholders in the cryptocurrency market.

Unmasking Tech Giants: Are Apple’s App Store Policies Stifling Crypto Innovation?

“Recent actions in the technology sector highlight the relationship between tech giants and blockchain and nonfungible tokens (NFTs). A probe into Apple’s App Store policies by US lawmakers aims to analyze if these guidelines indirectly slow technological progress. The lawmakers raise concerns about the impact of Apple’s rules on innovations like distributed ledger technology and NFTs, and potential negative consequences on the US’s status in emerging technology.”

BlackRock and the Anticipation of Bitcoin Spot ETFs: A Glimmer of Hope or a Brewing Storm?

BlackRock, along with Fidelity and Ark Investments, have filed for Bitcoin spot ETFs potentially signalling a new wave of institutional investments into digital assets. This would grant investors direct access to Bitcoin, possibly cause a price surge, but could also lead to capital outflows from mining stocks to more regulated, potentially profitable Wall Street financial products.

Cryptocurrency Crossroads: Santos Scandal Meets RFK Jr’s Bitcoin Vision

“The Santos incident reveals a complex intertwining of political intrigue, crypto manipulation, and scams, while figures like Robert F. Kennedy Jr. demonstrate a supportive stance towards cryptocurrency. This highlights the intersection of politics, regulation, and digital finance in unanticipated ways.”

The Thrills and Spills of Home Crypto Mining: Endurance Amid Industry Giants

The world of crypto mining has evolved into a dominion of large-scale mining and finance behemoths, making individual mining increasingly doubtful due to high electricity and equipment costs. Despite these challenges, diehard enthusiasts continue to innovate solutions, believing in the potential of the crypto market.