“Bitcoin, currently trading around $26,111, is facing mining challenges and a slowdown in trading activity due to cost exceeding potential profit. Despite this, long-term investors remain hopeful with potential catalysts such as Bitcoin ETF decisions forthcoming.”

Search Results for: Bitcoin mining

Bitcoin’s Rising Mining Difficulty: Potential Price Surge and Market Impact

“The Bitcoin mining difficulty recently hit an all-time high of 55.62 trillion hashes. This difficulty, adjusted every two weeks, affects mining speed and is tied to Bitcoin’s network computational power. High mining difficulty could push prices up as miners anticipate a Bitcoin value rebound and invest more resources into mining.”

Lone Bitcoin Miner Strikes Gold: Examining The Underdog Win in Crypto’s Expansive Arena

On August 18, a solo Bitcoin miner, with an estimated hash power of 1 PH/s, successfully claimed the complete reward of 6.25 Bitcoins for solving block 803,821 using Solo CKpool mining service. This relatively low-power miner striking it big, despite the dominance of behemoth mining pools, emphasizes the importance of platforms like Solo CKpool that provide opportunities for individual miners.

Impending Bitcoin Boom? Examining Market Signals and Global Economic Factors

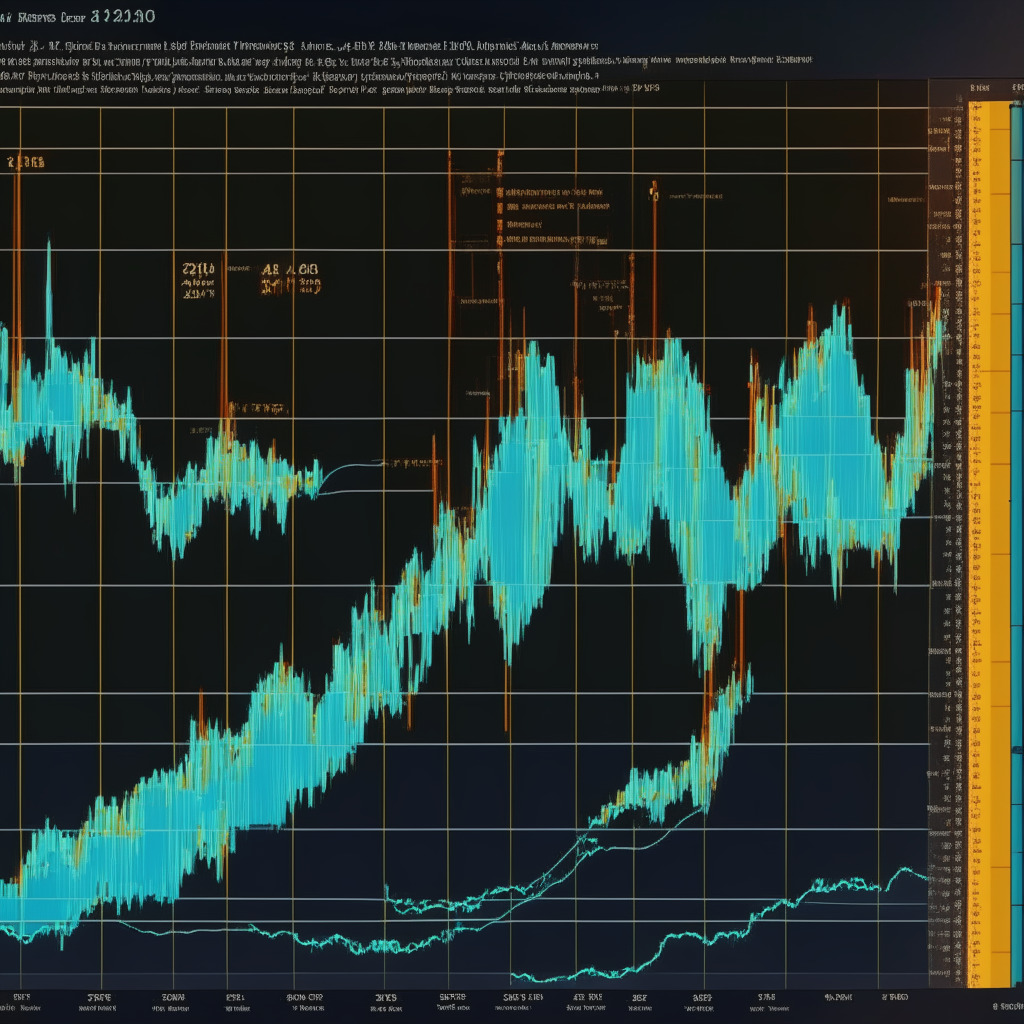

“A decline in Bitcoin’s short-term holders and record-low volatility could suggest an impending bull market. A recent report indicates this narrow trading range has happened only twice in Bitcoin’s history, prompting speculation about significant market movement. However, these indicators don’t guarantee outcomes with shifting global economic conditions.”

Blockstream’s Big Bet: Investing $50M in Undervalued ASIC Mining Gear Amid Bitcoin Recovery

“Blockchain firm Blockstream plans to raise $50 million for the bulk purchase of undervalued ASIC mining equipment. Partnering with STOKR, they aim to launch the Blockstream ASIC Note, with most investments expected in Bitcoin. This strategy indicates a promising future despite the declining price of ASIC miners and Bitcoin’s recent price recovery around $30,000.”

Examining Bitcoin’s Future: Corporate Involvement and Market Dynamics Amidst Price Surge

“The future of Bitcoin holds a blend of custodial and self-sovereign methods, with market adjusting to the effective mix. Key factors for Bitcoin custodians are technical, political, and natural. If BTC surges above $30,200, it could potentially reach $30,600-$31,000.”

Bitcoin ETF Forecast: Boon or Mirage? Examining the Road to Crypto Market Regulation

“The chances for the launch of a US spot Bitcoin ETF have recently escalated to 65%, up from 1% a few months ago. This increase is linked to recent changes in the crypto market and renewed applications by investment managers like Blackrock. However, skepticism remains due to history of past rejections by the U.S. regulators, with the 2023 deemed as a potential breakthrough year for Bitcoin ETFs.”

Bitcoin’s Resilience to Federal Reserve’s Interest Rate Hike: Examining the Interplay

Despite recent Federal Reserve’s interest rates hikes, Bitcoin has shown considerable resilience, maintaining price stability. The crypto market, even considered a separate entity, is influenced by traditional financial systems’ decisions. The story highlights the interplay between cryptocurrencies and conventional financial scenarios.

Bitcoin Copyright Brawl: Examining Craig Wright’s Pursuit of Blockchain Identity and Ownership

Craig Wright, claiming to be Bitcoin’s creator, is set to argue his copyright case against several Bitcoin Core developers and companies, alleging violation of his Bitcoin copyright. This upcoming trial on this contested claim will test Wright’s assertion of being Satoshi Nakamoto. The final verdict, expected in early 2024, promises intriguing revelations.

Soaring Bitcoin Speculations in 2023: Examining BTC20’s Potential and the $50,000 Dream

“Bitcoin’s price dance hovers just above $29,500, with potential to reach $50,000 by 2023. However, caution at this point is crucial as impending bearish demeanour could emerge. Meanwhile, emerging cryptocurrency BTC20 is gaining momentum, turning heads with a funding milestone of over $469,600 three days post-launch.”

Bitcoin and the Balancing Act: Market Unrest, Mining Pressure and the Value Clash

“The Bitcoin market has seen unrest due to a large transaction by the US government and increasing mining challenges. Amid this, Bitcoin’s price trends show upward potential in the face of varying market pressures. Its future depends on its ability to surpass key resistance levels amid these complex conditions.”

Navigating the Bitcoin Halving Ripple Effect: A Dive into AI Infrastructure and Mining Future

“Hut 8 Mining has ventured into the AI infrastructure space, a sector that has grown from a $95 billion to a $900 billion opportunity in recent years. The company aims to balance traditional data centers and Bitcoin mining centers, despite potential challenges associated with Bitcoin ‘halving’ and dwindling data center inventory.”

Bitcoin Heated Pools and Beyond: Unleashing Crypto Mining’s Creative Potential

Imagine taking a dip in water warmed by bitcoin miners; a unique system uses heat exchangers to transfer the heat produced from ASICs to the water. Cryptocurrency enthusiasts are finding creative ways to incorporate mining into daily life, from heating pools to powering greenhouses and calming noisy infants.

Bitcoin’s Monthly Loss, Mining Stocks Surge, and VC Investment: A Crypto Market Analysis

In May, Bitcoin experienced its first monthly loss since December 2022, but indicators like the futures market and VC investment reveal underlying optimism. Mining stocks showed notable gains, while VC investment surpassed $1 billion for the first time since September 2022. Increasing network activity and recent feature additions suggest the crypto market may be gradually regaining momentum.

Valkyrie Bitcoin ETF Filing Amid SEC Pressure: Examining Future of Crypto ETFs & Industry Conflict

Valkyrie Funds has filed an application with the SEC for a Bitcoin ETF, joining other companies like BlackRock, Invesco, and WisdomTree. The proposed Valkyrie Bitcoin Fund aims to provide investors a cost-effective way to invest in Bitcoin, using the CME CF Bitcoin Reference Rate Variant as a benchmark.

Merging Giants: Hut 8 Mining & US Bitcoin Corp to Form $990M North American Crypto Powerhouse

Bitcoin miners Hut 8 Mining and U.S. Bitcoin Corp plan to merge, creating a $990 million North American crypto mining giant, Hut 8 Corp. The merger aims to expand revenue, adopt a diversified business model, and capitalize on their financial position.

CleanSpark’s $9.3M Expansion: Mining Efficiency vs Uncertain Profitability in Bitcoin Industry

Bitcoin mining firm CleanSpark acquires two mining sites in Georgia for $9.3 million, aiming to achieve a 16 exahash per second (EH/s) hash power target by 2023. The acquisition contributes to a 15% increase in computing power, positioning CleanSpark as an energy-efficient miner. However, long-term profitability amidst market challenges remains uncertain.

Bitmain Mining Rigs Claim 76% of Bitcoin’s Hashrate: Decentralization & Energy Efficiency Debate

Recent research by Coinmetrics reveals that three Bitmain mining rig models hold a 76% share of Bitcoin network computing power, highlighting energy efficiency’s role in modern mining. The report also shows a 60% improvement in the network’s energy efficiency since July 2018, with 33.6 joules per terahash consumed today compared to 89.3 J/TH in 2018.

Bitcoin’s Uncertain Week: Examining Market Volatility, Legal Battles, and Potential Growth

Bitcoin enters an uncertain week with support below $26,000, influenced by legal battles in the US. Key factors to watch include US macroeconomic data, SEC conflicts with exchanges, and legal proceedings involving Coinbase and Binance. Despite the precarious situation, Bitcoin’s strong network fundamentals and potential macro shifts present opportunities for recovery and growth.

El Salvador’s Bitcoin Journey: Tether’s $1 Billion Renewable Energy Investment for Mining

Tether commits to El Salvador’s $1 billion Volcano Energy project, harnessing renewable energy for future Bitcoin mining operations. This strategic investment aims to create value while addressing the environmental impact of Bitcoin mining, fostering sustainable infrastructure and advancing digital currencies.

Bitcoin Momentum Amid US Nonfarm Payroll and Mining Expansion: Risks and Rewards

Bitcoin’s price gains momentum as market participants anticipate positive outcomes from the US Non-Farm Payroll data release and its impact on the US dollar. Growing demand in cryptocurrency mining and CFTC’s reassessment of risk management regulations create a bullish momentum for Bitcoin.

New Mining Investments Amidst 44% Decline in Bitcoin Profits: Examining Resolute Companies

Despite a 44% decline in Bitcoin mining profitability over the past year, companies like CleanSpark continue to expand, with CleanSpark recently purchasing 12,500 Antminer S19 XP units for $40.5 million. As mining difficulty reaches an all-time high, the industry demonstrates resilience and optimism, aiming for greater efficiency and productivity.

The Shaky Future of Bitcoin: Examining Market Fluctuations, Adoption, and Crypto Utility

Bitcoin faces a 6.5% monthly drop but maintains a 68% year-to-date gain. To attract more investment, real utility and development must be demonstrated, according to John Wu, president of Ava Labs Inc. Increased network activity, including BRC20 standard Bitcoin Ordinals and NFTs, has impacted transaction fees and network congestion.

Tether Energy: Advancing Bitcoin with Sustainable Mining in Uruguay – Pros and Cons

Tether announces its dedication to advancing Bitcoin by investing in renewable energy production and sustainable Bitcoin mining in Uruguay through a new venture called Tether Energy, promoting eco-friendly practices within the cryptocurrency industry.

Green Proofs for Bitcoin: Incentivizing Sustainable Mining Practices and Balancing Criticism

Green Proofs for Bitcoin, launched by Energy Web, aims to incentivize sustainable practices in the bitcoin mining industry. By offering transparency into companies’ decarbonization initiatives, it bridges the gap between sustainable miners and potential investors, encouraging a more environmentally friendly future.

Green Proofs of Bitcoin: A Step Towards Sustainable Crypto Mining and Transparency

Energy Web has launched the Green Proofs of Bitcoin (GP4BTC) registry, aiming to address environmental concerns by tracking miners’ energy inputs and their impact on electric grids. The registry evaluates miners on renewable energy credit purchases and participation in demand response programs, promoting transparency in their energy sources and supporting a greener crypto industry.

Bitcoin and Cardano Upside Momentum: Examining Key Catalysts and Market Uncertainties

Bitcoin is building upside momentum and Cardano (ADA) price is seeing considerable movement, but a significant breakout may not be smooth. Traders should monitor Bitcoin and Cardano for bullish confirmations as US Federal Reserve Chair Jerome Powell’s speech could serve as a catalyst.

End of Bitcoin Downturn? Examining Dormancy, RSI, and MACD for Future Price Trajectory

In light of an $8 billion trading volume influx, the future valuation of Bitcoin has become a hot topic. With 40.083% of the total Bitcoin supply dormant for over three years, investor behavior and key technical indicators may reveal potential price trajectories and the end of cryptocurrency’s recent downturn.

Crypto Market Meltdown: Examining Bitcoin and Ethereum Price Plunges and What Lies Ahead

The collapse of Bitcoin price below the 200-weekly moving average has sparked a massive sell-off in the crypto market, with BTC dipping under $26,100 and Ethereum falling over 5% to below $1,750. Factors like market uncertainty and weakening momentum contribute to a bearish outlook.

Bitcoin’s Uncertain Short-Term Fate: Examining Market Indicators and Upcoming CPI Data

As Bitcoin’s short-term outlook remains uncertain, traders anticipate the May 10 US CPI data release to potentially bring market volatility. However, conflicting perspectives on BTC’s price action and underlying uncertainty call for investor caution and thorough research when considering varying opinions, indicators, and macroeconomic influences at play.

Binance.US Bitcoin Premium: Examining Market Impact and Trading Risks

Binance.US reportedly sells BTC at a $700 premium over the market price, raising questions about the potential influence of price disparities on overall market dynamics and trading activities. This comes amid recent withdrawal issues faced by Binance, emphasizing the need for traders to stay vigilant about price fluctuations and evaluate the advantages and potential drawbacks of trading on premium-priced exchanges.

Crypto Clash: Memecoin Mania, NFT Downturn, and Mining Stocks Outshine Bitcoin

In April, memecoins’ rise led to a decline in NFT collectibles, with key metrics such as volume and active wallets plunging. However, the NFT lending market experienced a 16.13% increase in new users, indicating consistent growth in this niche sector. Cryptocurrency mining stocks also performed impressively, outperforming Bitcoin’s returns.