U.S. crypto giant, Coinbase, negotiates with top-tier Canadian banks to bring crypto banking mainstream in Canada, amidst regulatory ambiguity back home. The company’s director, Lucas Matheson, praises Canada’s ‘engagement-focused regulation’ allowing companies like Coinbase to explore and grow whilst staying within regulatory norms.

Search Results for: central bank digital currency

Central African Republic on Track to Tokenize Land: A Blockchain Leap or Misstep?

The Central African Republic is making waves in the crypto world by tokenizing its land and resources on the Sango blockchain platform. This innovative approach includes the use of technology for citizenship acquisition, land ownership, and diverse investments, thus enticing potential investors and promoting a “new era of financial empowerment through blockchain technology”.

Binance Controversy: Balancing Digital Freedom and International Sanctions Compliance

Binance, a popular cryptocurrency exchange, circumvented sanctions on two Russian banks by renaming them for local payment options. Critics argue this move may increase regulatory control over crypto markets. Meanwhile, supporters believe it demonstrates crypto’s independence from traditional financial systems and governmental interference. Binance’s actions have raised questions about crypto exchanges’ responsibility to respect international regulations.

European Legislation on Cryptocurrency: A Leap Forward or Bank Lobby Win?

“The European Parliament has passed a bill allowing banks to hold up to two percent of their capital in cryptocurrencies from January 2025, signaling evolution in global cryptocurrency regulation. However, Stefan Rust, ex-CEO of Bitcoin.com, views the bill as favoring financial institutions more than common investors.”

Unveiling the eAUD: The Future of Australia’s Digital Currency and Its Challenges

The Reserve Bank of Australia’s (RBA) central bank digital currency (CBDC) project results suggest a potential to enhance efficiency and resilience in the payment system. However, obstacles such as “legal, regulatory, technical and operational considerations” might delay the actual implementation of CBDC in Australia.

Testing the Digital Waters: Russia’s Central Bank Propels CBDC Projects Amid Skepticism

“The Russian banks MTS and PSB are testing the digital ruble, aiming for a national rollout between 2025-2027. With real-world applications like PSB’s digital wallet and promising transaction fees, skepticism still surrounds the quick adoption of this Central Bank Digital Currency (CBDC).”

Bridging Crypto and Traditional Finance: EDX Markets Teams Up with Anchorage Digital

EDX Markets, a major institutional crypto exchange, is partnering with regulated platform Anchorage Digital. The goal of this collaboration is to bridge traditional finance and the digital asset landscape with the launch of EDX Clearinghouse. This initiative aims to enhance security, governance, risk, and compliance solutions in cryptocurrency.

Financial Misconduct and Crypto: The Sam Bankman-Fried Story Paralleling Global Cryptocurrency Concerns

Sam Bankman-Fried faces allegations of fraud and money laundering involving his crypto exchange, FTX. Meanwhile, the Bank of International Settlements and financial stability directors raise concerns about crypto’s potential to enhance financial risks in underdeveloped economies. Balancing financial stability with fostering innovation remains a critical challenge.

Cryptocurrency Adoption in Emerging Economies: A Boon or a Bane?

“Emerging economies are becoming cryptocurrency adoption centers due to unstable fiat currencies and limited banking access. However, a study by the Bank for International Settlements suggests that cryptocurrencies have “amplified financial risks”. The authors propose regulation rather than an outright ban, aiming to channel innovation into socially useful directions.”

Banking on the Digital Ruble: Heralding a New Era or Stoking Controversy?

The Russian Central Bank’s proposal classifies the digital ruble, as a “high-quality liquid asset”. This could usher a dramatic reconfiguration of how financial institutions perceive and maintain liquid assets, potentially revolutionizing cross-border payment methods. However, this shift is viewed with apprehension among commercial banks.

Decentralized Social Media vs Meme Coins: Qrolli’s Growth and Wall Street Memes’ Potential Risks

“Friend Tech’s Qrolli, a decentralised media platform, empowers content creators with monetized content, NFTs, and more. Meanwhile, Wall Street Memes, an anticipated 2023 meme coin, pays homage to anti-bank sentiment, with tokens dedicated to community rewards and presale.”

BRICS Digital Currency Debate: The Future of Global Trade or Merely a Fantasy?

Experts from Brazil anticipate BRICS summit discussions on a potential digital fiat currency, with workgroups likely being established for the initiative. A collective digital currency could potentially replace the US dollar in trade deals among BRICS nations despite sceptical voices. Individual nations within the BRICS alliance, including China, Russia, and Brazil, have already initiated their own Central Bank Digital Currency (CBDC) projects.

Navigating the Digital Ruble: A Breakthrough or a Step Towards Financial Surveillance?

“The Central Bank of Russia is testing the digital ruble, a central bank digital currency (CBDC), with potential benefits like offline payment capability discussed. However, journalist Anastasia Tselykh raises concerns over benefits for ordinary citizens, and the implications of easier tracking of citizens’ money.”

Harnessing the Power of Digital Yuan: China’s Big Blockchain Push and Its Consequences

Shanghai and Suzhou cities aim to accelerate the adoption of China’s Central Bank Digital Currency, Digital Yuan. The move follows the People’s Bank of China’s revelation that $250 billion worth of Digital Yuan transactions have been processed nationwide. Despite the significant figure, it represents a minor part of the Chinese economy, motivating these bustling cities to advance digital currency promotion.

Cryptocurrency in China: A Cat and Mouse Game of Capital Control and Legal Dilemmas

“Mr. Chen, a Chinese individual, was sentenced to nine months for aiding a $13,104 USDT transaction. Viewed as money laundering by authorities due to Chen’s personal bank information involvement, this reflects China’s stringent crypto stance linked to capital control regulations.”

Unraveling Russia’s Digital Ruble: Combatting Corruption or Dodging Sanctions?

“The adoption of blockchain technology, like Russia’s digital ruble, offers potential to combat corruption by shrinking the shadow economy. It provides transparency in transactions and the possibility of reducing grey economy risks. Special offline wallets also allow it to reach areas where the internet hasn’t yet penetrated.”

Mastercard’s Venture into Central Bank Digital Currencies: Paradigm Shift or Adventurous Detour?

“Mastercard has initiated a unique forum for stakeholders in the crypto domain to deliberate on the issue of central bank digital currencies (CBDCs). CBDCs are not the same as cryptocurrencies as they are digitized versions of existing fiat currencies backed by issuing governments. Mastercard’s CBDC alliance aims to foster groundbreaking innovations and efficiencies in the digital asset space.”

CBDCs: Kazakhstan’s Digital Currency Ambitions and the Power Shortages Plaguing Crypto Miners

Former Soviet nations like Kazakhstan are making strides towards embracing Central Bank Digital Currency (CBDC). Echoing Russia and Belarus’ approach, Kazakhstan proposes its CBDC as an ‘add-on’ to existing cash and non-cash payment forms. Despite certain challenges with digital currencies, the nation anticipates full implementation of its CBDC by 2025.

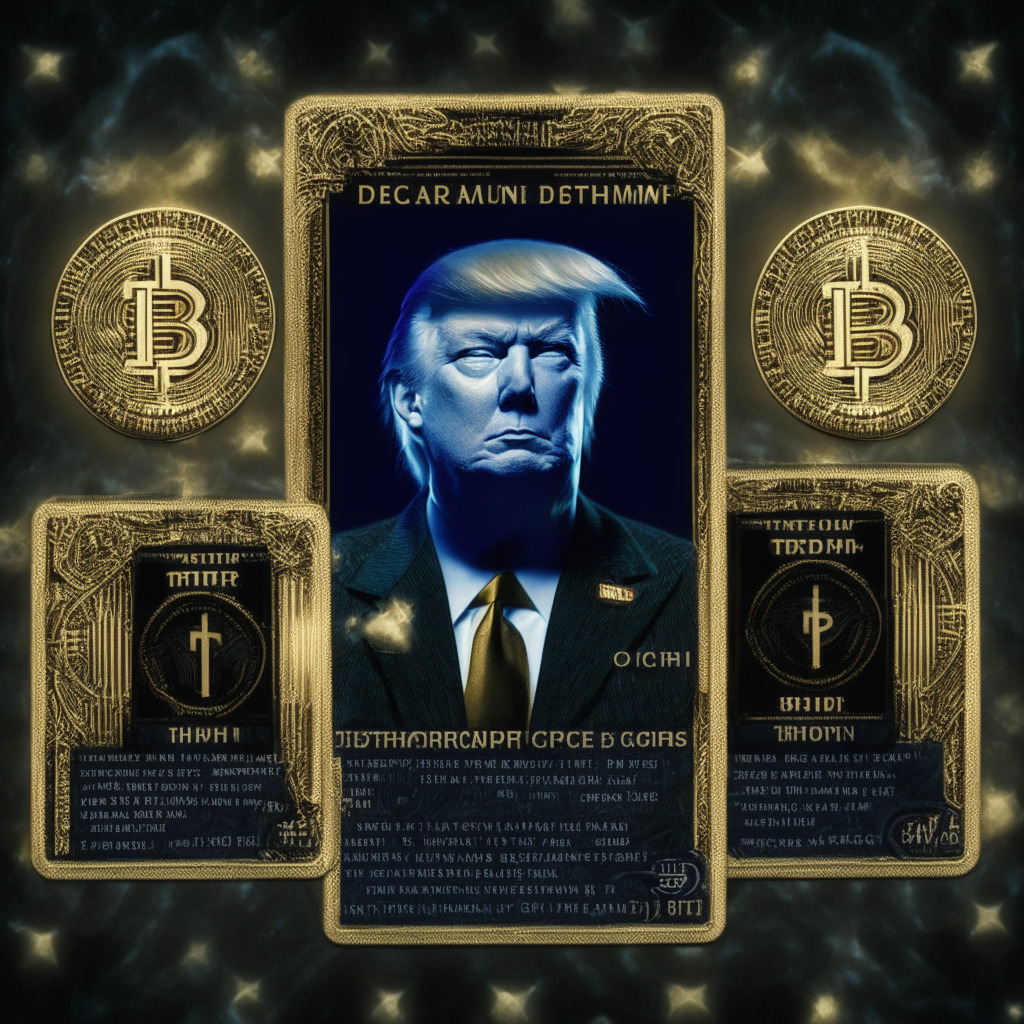

Secret Cryptography: Trump’s Hidden Digital Assets Stir Presidential Crypto Debates

Former US President Donald Trump reportedly holds $2.8 million in a digital wallet, a larger sum than previously disclosed. Trump’s venture into the crypto domain began with his NFT endeavor, Trump Digital Collectible Cards. The discovery shows his deepened involvement in cryptocurrency. Meanwhile, other presidential candidates voice their crypto policies, underlining the rising influence of cryptocurrencies on the political stage.

Zimbabwe’s Gold-Backed Digital Tokens: A Bold Tackle on Bloating Inflation

Zimbabwe’s Reserve Bank is preparing to release Gold-Backed Digital Tokens (GBDT), also known as ZiG, designed for public use. This nationwide project aims to educate Zimbabweans on the benefits and usage of digital currency, while managing inflation and offering an alternative investment to the US dollar.

Leveraging China’s Digital Yuan for Green Financing: Pros, Cons, and Future Potentials

Zhongshan Jewelly Optoelectronics Technology, a Guangdong-based firm, has secured over $276,000 from China’s first digital yuan-powered green finance loan. Using the digital yuan offers cost-effective, efficiency for enterprises, with real-time fund transfer and no incurring handling and service fees. Meanwhile, its traceability can prevent misappropriation of green funding loans.

Zimbabwe’s Launch of Gold-Backed Digital Tokens: A Bold Move in Turbulent Economic Times

Zimbabwe’s central bank is contemplating the introduction of gold-backed digital tokens (GBDT) for retail transactions as an alternative to the heavily relied upon US dollar. The GBDTs are backed by physical gold reserves and offer divisibility, making them more convenient and value-preserving. These could potentially help in combating the crippling inflation rate and provide a base for a future central bank digital currency ecosystem.

Balancing Bitcoin’s Future: Centralization, Innovation and Regulatory Choices

“Michael Saylor, CEO of MicroStrategy, believes that the increasing centralization of Bitcoin by corporations is beneficial for technical, political, and natural reasons. He sees the future of Bitcoin involving a blend of institutions, individuals, centralizing, and decentralizing forces.”

Unraveling Brazil’s Crypto Tax Reform: A Blessing or Curse for the Digital Age?

Brazil’s Congress is considering a bill to tax cryptocurrency as “financial assets”, specifically those held by Brazilians overseas. If passed, the legislation would level the tax field between crypto and traditional assets, potentially benefiting local exchanges. The bill might attract greater activity to Brazil’s national crypto exchanges and global players to establish local offices. However, there are concerns that the increased taxation could hamper the growth of the sector or deter foreign investment.

Navigating Blockchain: Innovations, Challenges, and the Intriguing Future of Cryptocurrency

“A telling report by Glassnode indicates that long-term crypto holders are showing tenacity, with Coinbase and Binance creating waves in the sector. Coinbase launched its Ethereum layer-2 blockchain, whereas Binance became the first fully licensed crypto exchange in El Salvador.”

Navigating the Future: Bank of Canada’s Perspective on Central Bank Digital Currencies

The Bank of Canada’s recent report examines the potential adoption of Central Bank Digital Currencies (CBDCs), noting that Canadians currently see no compelling reason to switch from traditional forms of payment. The report suggests that the elimination of physical cash could result in the majority relying more heavily on electronic payments and might significantly impact those dependent primarily on cash transactions. Despite potential interest, the bank warns of considerable barriers to universal CBDC acceptance. The bank proposes enhancing internet access, providing low-cost banking options, and fostering collaboration with retail and financial sectors to facilitate digital payment integration, while maintaining efficiency and confidence in the cash system.

Digital Rubles in Russia: Exploring the Future of Transit Payments with Blockchain

Russia’s Central Bank is launching a digital ruble pilot project, starting from August 15, involving smaller retailers across 11 cities. This digital finance experiment aims at integrating the digital ruble into the Moscow Metro system, offering passengers the ability to pay through digital wallets or purchase smartcards using the digital ruble. Despite challenges, the Russian Central Bank remains confident about this futuristic transaction method.

Rethinking CBDC Adoption in a Well-Banked Nation: A Canadian Perspective

The Bank of Canada questions the adoption of Central Bank Digital Currencies (CBDCs) in a recent study, pointing to Canadians’ weak incentives for a switch given their well-established financial system. The discussion emphasizes on the continued importance of cash, especially for emergencies, listing out barriers for both users and merchants to broadly adopt a CBDC.

Navigating the Waters of a Digital Pound: The UK’s Leap into CBDC’s Future

“The Bank of England is advancing in the world of cryptocurrencies, establishing a new Central Bank Digital Currency (CBDC) Academic Advisory Group. Tasked with facilitating interdisciplinary discussions on a potential digital pound, this group is aimed at managing a multifaceted assembly of expertise, spanning from monetary policy to law, marketing and more. Their success could pave the way for a sustainable and successful digital pound in the future.”

Crypto Tokens for Digital Signatures: A Bold Leap for India Amid Crypto Ambiguity

India’s Ministry of Electronics and Information Technology plans for a web browser that will allow users to use crypto tokens for digital signatures. This, despite the absence of legislative guidelines for cryptocurrency, marks a compelling development in India’s ambiguous stance on cryptocurrencies.

Unfurling the Future of Finances: Russia’s Digital Ruble Takes the First Leap

Russia is set to launch a pilot program for its digital ruble with 600 participants and 30 retailers. This Central Bank Digital Currency (CBDC) initiative follows China’s digital yuan strategy and could see the digital ruble in active use by 2025, transforming the country’s financial landscape. The token has potential for making and receiving cross-border payments.

Digital Yuan Adoption: Genuine Demand or Orchestrated Push? Unraveling the Intricacies

China’s digital yuan adoption is surging, with tax payments through the currency totaling $51.3 million from January to June 2023. However, most transactions occur through a CBDC tax payment platform operated by Postal Savings Bank’s Hunan Branch, raising questions about true adoption rates.