“Decentralized autonomous organizations (DAOs) manage a massive $17.2 billion in value. However, DAO governance is filled with numerous failures, underlining the need for improved DAO infrastructure and governance. Challenges of balancing decentralization and efficient product-market fit persist. Tools like Senate and Goverland aim to integrate DAO voting into single platforms, enhancing participation.”

- Kennedy’s Bold Crypto Agenda: An Independent Run for Presidency Powered by Bitcoin

- OK Group’s Rebranding: Power Consolidation or Crypto Evolution?

- The Fall of FTX’s Sam Bankman-Fried: A Cautionary Tale or Web3 Symbol’s Downfall?

- Crucial Crypto Updates: The Bitcoin Slump, Crypto Aid Israel and The Rise of BitVM

- RFK Jr’s Pro-Crypto Presidential Run: Redefining America’s Financial Future and Political Landscape

- Unraveling Ripple’s Future: Implications of CFO’s Sudden Exit on Crypto Landscape

- Unveiling the Crypto Controversy: Accountability Amidst Progress, from Bankman-Fried to Future Prospects

- Blockchain Aid: A Lifeline in Humanitarian Crises or a Cybersecurity Challenge?

- Bitmain’s Struggle but Hive’s Triumph: A Tale of Two Bitcoin ASIC Companies

- Unraveling the AnubisDAO Saga: Accountability Challenges and Transparency Paradoxes in Crypto

OpBNB’s Public Launch: Evaluating BNB Chain’s L2 Scaling Solution and its Effect on the Ecosystem

“BNB Chain’s Ethereum-compatible L2 has gone public after successfully testing its Optimism-powered layer 2 scaling platform. Aimed at providing lower gas costs and faster transactions, it displayed potential but not without some concerns, such as the week-long fund lockup during verification checks. Despite potential drawbacks, BNB Chain’s progress towards a swift, secure, and economical opBNB platform is laudable.”

Transformation or Tumult? Huobi’s Unexpected HTX Rebranding Sparks Fierce Reactions

Huobi, a renowned digital asset exchange, is undergoing a rebranding on its 10th anniversary to HTX. Amid heated discussion among crypto enthusiasts, this rebranding collaboration with blockchain security entity, CertiK, seeks to upgrade its existing infrastructure and marks the next phase in its transformative growth.

The Onslaught of Real World Assets: Pros, Cons and Impact on the Existing Blockchain Landscape

“Real World Assets (RWAs) are tangible properties making their foray onto the blockchain. Most prominent assets represented are real estate, private credit, gold and treasuries. RWAs can be purchased via a marketplace, with their value fluctuations mirroring mainstream market assets. Challenges include market movements, regulations, and fragmentation, but the potential benefits are substantial.”

Emerging Crypto Landscape in Asia: Boon or Bane for Institutional Adoption?

“Institutional adoption of digital assets in Asia is on the rise due to improved regulatory clarity, with key adopters including South Korea, Hong Kong, Japan, and Singapore. However, progress varies across countries. Despite hurdles, the digital asset market’s infrastructure has noticeably strengthened, indicating increased market maturity.”

Navigating Crypto Markets Amid Inflation Surges: A Roller-coaster Journey of Speculation and Risk

“The rising inflation and its potential impact on economic policies rattled crypto markets, leading to price volatility in Bitcoin. Despite the uncertain climate, some market participants remain optimistic, viewing risk, volatility, and speculation as essential lifelines of the crypto markets. However, due diligence remains a critical tool amidst these uncertainties.”

Unlocking Insolvency: How a New Remuneration Scheme from DCG could Revolutionize Digital Asset Recovery

Gemini Earn users might recover almost all claims due to a proposal by the Digital Currency Group (DCG). This plan, which may result in a 70-90% recovery for creditors, involves the use of digital assets, but also raises concerns about cryptocurrency market volatility. The proposal’s success crucially depends on approval and renegotiation of a significant loan. Despite potential risks, it signifies a monumental step in tackling insolvency in the digital currency sector.

Inflationary Tales: Core CPI’s Impact on Bitcoin and Emerging Economic Trends

“The core CPI showed a gain of 0.3% against an expected 0.2% increase, marking a downward yearly trend to land at 4.3%. This suggests that, despite the surge in headline inflation, if the downward trend in core inflation continues, it could dispel fears of runaway inflation.”

Bankruptcy and Redemption: Gemini Earn’s Potential Recovery amidst Crypto Market Turbulence

“A proposed remuneration deal for retail creditors of the Gemini Earn program promises a possible recovery of 95-110% of their claims. The payout is contingent on an agreement within diverse Genesis creditor groups and the final form of the agreement.”

Navigating Rough Waters: Crypto Exchanges and Market Liquidity Amidst Regulatory Pressure

“The world of cryptocurrency is experiencing significant change amidst SEC scrutiny and exchange turbulence. Key developments include the unexpected departure of Binance.US’s CEO, BitMEX’s introduction of a prediction market, and concerns around FTX’s proposed changes in crypto assets.”

AI’s Controversial Role in Music: The Grammy Drama Around AI-Generated Drake Song

“The CEO of the Recording Academy clarified misconceptions regarding an AI-generated Drake song. Despite the song being written by a human, the vocals were not legally obtained nor approved by the artist or label, disqualifying it for Grammy consideration. This highlights issues around copyright law in the context of AI and the need for regulations to keep pace with technology’s evolution.”

Pantera Capital’s Pivot Toward Asia: Blockchain Investment’s New Frontier Amid US Regulatory Ambiguity

“Pantera Capital is refocusing its investment approach on middle-tier, blockchain-focused entities due to a surge in interest rates, affecting company valuations. This strategic shift comes amidst rising investor interest in AI following the crypto market turbulence. Meanwhile, Asia emerges as a new hub for blockchain ventures, despite legal uncertainties in the US.”

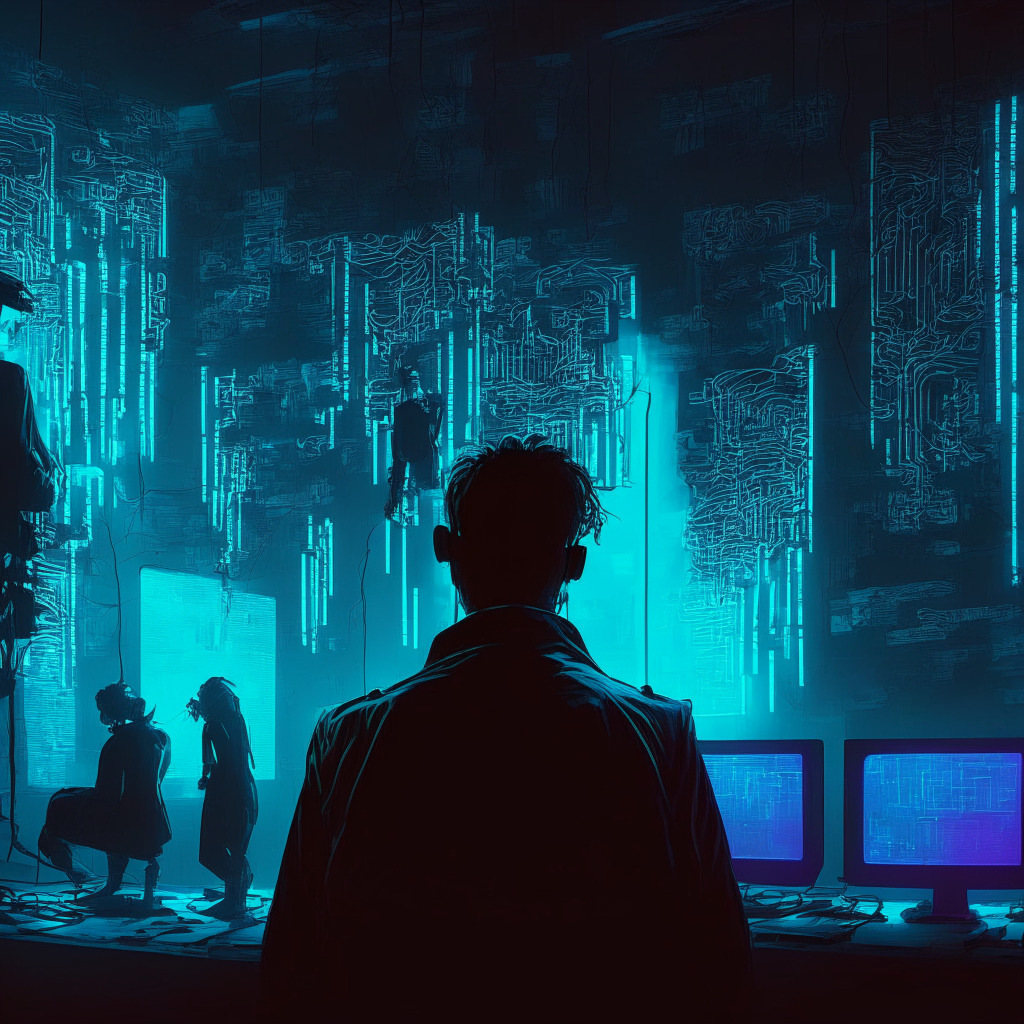

Unmasking Lazarus: North Korea’s $55 Million Cryptocurrency Heist Reveals Growing Security Concerns

“CoinEx, a renowned crypto exchange, fell victim to a major security breach, allegedly by North Korean hackers, Lazarus Group, leading to an estimated loss of over $55 million. This instance amplifies the need for robust security measures and user caution to prevent similar future incidents.”

Coinbase CEO Confirms Lightning Network Integration: A Strategic Move to Enhance Transaction Efficiency

Coinbase CEO, Brian Armstrong, recently announced the firm’s plan to bring the Bitcoin Lightning Network into its operations. This second-layer solution improves transaction speeds, enabling competition with more efficient solutions. Coinbase’s move is expected to give them a competitive advantage in the increasing crypto market competition.

North Korean Cyber Attack on CoinEx: Unraveling the $54 Million Crypto Heist

North Korean cyber operatives are suspected for a recent $54 million security breach on CoinEx exchange involving multiple tokens. CoinEx assures users remaining assets are secured. This incident prompts crypto enthusiasts to re-evaluate security measures and trust in platforms, indirectly showcasing the resilience of blockchain technology.

Downturn on Stellar Lumens Vs. Rise of Bitcoin BSC: The Tug of War in Cryptocurrency Market

“Stellar Lumens faced a downturn despite recent campaigns, while Bitcoin BSC demonstrates potential by combining traditional Bitcoin tokenomics with Binance Smart Chain’s features, optimized transaction times, minimal fees, and a greener mechanism. Despite these advancements, understanding risks in the crypto space remains critical.”

Ponzi Vs Pyramid Schemes: Deceptive Practices in the Crypto-realm

Cryptocurrency enthusiasts are often seduced by potential quick profits, but this leads to fraudulent schemes like Ponzi and pyramid strategies. These practices rely on incoming investments to pay earlier investors, resulting in a lack of transparency and significant financial losses.

Crypto Turmoil: BitBoy Ben Armstrong’s Legal War against Hit Network

BitBoy Crypto founder, Ben Armstrong, has initiated a lawsuit against Hit Network CEO Timothy ‘TJ’ Shedd Jr. and Timothy Shedd Sr., accusing them of manoeuvring him out of his own company. The lawsuit alleges the defendants restricted Armstrong’s access to company accounts, mismanaged funds, and defrauded the company. Amid the controversy, the value of governance token BEN has decreased.

Unfolding the Future of opBNB: Layer-2 Protocol’s Promise Amid Market Competition

“BNB Chain developers launched opBNB, a layer 2 protocol enhancing Ethereum’s functionality. The protocol successfully processed 4,000 transactions per second (TPS), significantly higher than Ethereum’s 17 TPS limit. Despite facing a competitive blockchain market, BNB Chain plans network activities and airdrop incentives to attract initial users to the robust, fledgling network.”

Komainu and Hidden Road Partnership: Elevating Trust in Crypto or Fueling Centralization?

“Institutional investors and partnerships may significantly inspire trust in the crypto industry. The recent alliance between Komainu and Hidden Road engages a secure, regulated custody platform, opening the digital asset marketplace to secure transactions and fostering industry growth and longevity.”

Opera’s New Step into Blockchain: Introducing MiniPay Stablecoin Wallet in Africa

Opera plans to launch a non-custodial stablecoin wallet, MiniPay, in Africa. This wallet, built on the Celo blockchain, allows users to send or receive stablecoins using their mobile numbers. However, concerns about high fees and unreliable service remain. MiniPay will only support Celo Dollar, aimed to prevent user confusion with multiple currencies. Despite the recent downturn in fintech, the blockchain sector maintains resilience in Europe.

Unveiling the Future: How Polygon’s $1 Billion Bet on ZK-Rollups Revolutionizes Blockchain Technology

Polygon co-founder Sandeep Nailwal believes strongly in the potential of zero-knowledge proof (ZK-proof) technology for Ethereum scaling, as evidenced by allocating $1 billion towards its development. Nailwal proposed a unified scalability system where recursive ZK-proof technology merges different blockchain ZK-proofs into a common layer, dramatically improving cross-chain transaction times.

Blockchain Soars Amid Fintech Investment Slump: A Sustained Rise or Temporary Swell?

“While the Europe, Middle East, and Africa region experienced a 50% dip in fintech investments in the first half of 2023, the crypto sector showed a noteworthy increase in investments. Blockchain and crypto businesses captured a significant share in key European markets amidst the global fintech market downturn.”

Ripple Migration: A Wake-Up Call on Regulatory Clarity in the Crypto Industry

Ripple CEO Brad Garlinghouse revealed that 80% of the company’s recruitments in 2021 will be in nations with clear regulatory landscapes like Singapore, Hong Kong, U.K., and Dubai, due to the ongoing legal frost with the U.S. SEC. This underscores how uncertain regulations can impact global industry growth.

Landmark Sentencing in OneCoin Scandal Raises New Regulatory Questions for Crypto World

OneCoin’s co-founder, Karl Greenwood, received a 20-year sentence for his role in the $4 billion pyramid scheme. OneCoin, which falsely claimed to be a cryptocurrency, caused losses for over 3.5 million victims. This case underscores the urgent need for industry regulation to prevent similar crypto-related scams.

Is PayPal’s Ethereum-based Stablecoin, PYUSD, Truly 100% Asset-Backed? Examining the Claims

“PayPal’s Ethereum-based stablecoin, PYUSD, has full asset backing, primarily from U.S. Treasury reverse repurchase agreements, says Paxos. Though overcollateralization safeguards assets, it could limit profits. Some PYUSD assets are in uninsured cash deposits, reflecting typical banking risks. PYUSD’s transparent operation may soothe some investors while raising others’ skepticism.”

Blockchain Revolution: The Dual Stance of BOE’s New Deputy on Crypto Stability and Risk

Sarah Breeden, the incoming deputy governor of financial stability at the Bank of England, believes that cryptocurrencies are currently not a significant threat to financial stability. Though highlighting risks linked with digital assets, she underlines the potential of crypto technology in bolstering financial systems.

Sudden Rise of EmotiCoin and Wall Street Memes: Boom or Bubble Waiting to Burst?

“EmotiCoin’s (EMOTI) unique Reverse Split protocol systematically reduces total supply by -20% every 4 hours, potentially driving a price surge. However, it’s important to beware the risk characterising such market excitement. In parallel, Wall Street Memes, a new coin project, despite promising substantial presale returns, carries significant risks, especially regarding the motivations of large investors.”

Resilience of Cryptocurrencies Amidst CPI Data Release and Rising Oil Prices

“Bitcoin stands strong despite predicted CPI growth due to escalating oil costs. There’s been a small rise in the CoinDesk Currency Select Index and ether remains resilient. However, this rally might be a result of short covering and liquidity crunch rather than real sentiment change. A continued momentum in Bitcoin’s value requires steady close above critical resistance levels. Meanwhile, Curve’s CRV token trends downwards.”

Feasibility of Central Bank Digital Currencies: Breaking Down the Findings of Project Sela

“Project Sela, a joint initiative led by BIS, and the central banks of Hong Kong and Israel, points to the feasibility of CBDCs settling on centralized ledgers while ensuring privacy. Addressing cost factors and potential risks, it put forth an efficient solution, ‘Access Enabler,’ that allows network settlement without merchants retaining users’ CBDC. This opens a promising pathway for digital currencies to potentially become a universally accepted retail payment form.”

India’s Paradoxical Supremacy in Global Crypto Index: High-Tax-Averse or Accelerator?

“India has topped the Global Crypto Adoption Index 2023, despite strict tax regulations on crypto trades. The tax schemes paradoxically stimulating a shift in transaction methods, thus driving the adoption of digital currencies, particularly in struggling economies like India, Nigeria, and Vietnam.”

Bridging the Gap: Emurgo’s Bold Move to Strengthen Cardano’s Blockchain Ecosystem

“Emurgo, a key contributor to Cardano blockchain, plans to address identified gaps within the ecosystem. The focus will be on incorporating decentralized identity (DID) solutions and layer-2 sidechains. Additionally, Emurgo explores zero-knowledge rollups and optimistic rollups, while acknowledging challenges in developer experiences due to specialized programming knowledge requirements. The outcomes of Emurgo’s efforts remain to be seen.”