As crypto and equity markets face a dip, Federal Reserve governors’ hawkish comments and debt deal signs have grabbed investor attention. Bitcoin has lost 3.2% in 24 hours, with ether declining by 2.8%. This month, Bitcoin may potentially register its first negative monthly return.

Search Results for: Nasdaq

AI Market Whirlwind: RNDR Token & Nvidia Stock Boom Amid Metaverse Predictions

Render Network’s decentralized GPU rendering solutions and RNDR token are gaining interest amid a growing AI narrative. RNDR has outperformed major cryptocurrencies with a 5% value increase, coinciding with Nvidia’s AI-fueled stock surge. The buzz surrounding AI and potential connections with Apple’s upcoming AR/VR headset also contribute to RNDR’s rising attention.

Cricket Legend AB de Villiers Dives into Crypto, NFTs, and Web3 Investment Platform

Cricket legend AB de Villiers shares his journey into Web3 and cryptocurrencies, highlighting his experience with NFTs and becoming an ambassador for Ethereum-based investment platform, Common Wealth. He emphasizes the importance of simplifying processes for newcomers and cautiously investing in the volatile crypto market.

Navigating Crypto Amid Federal Reserve’s Liquidity Tightening and Debt Ceiling Debates

Crypto enthusiasts should note Cleveland Fed President Loretta Mester’s support for liquidity tightening and consistent interest rate policy, as her comments impacted Bitcoin’s value. The market’s response demonstrates the significance of global economic events and Federal Reserve policy decisions on the cryptocurrency landscape.

Debt Ceiling Deal Impact on Bitcoin: Crypto Market Reaction & Future Outlook

Bitcoin steadied after dropping below $28,000 due to progress on a debt ceiling deal, while government debt may prove favorable for the crypto market. Analysts suggest bitcoin’s resilience amid monetary tightening could be due to factors like store-of-value, NFTs, and supply/demand dynamics.

Binance’s Move to Bank Collateral: Reducing Risk or Impacting Market Dominance?

Binance is reportedly exploring options to allow select institutional clients to keep their trading collateral in banks, reducing counterparty risk amidst growing concerns over exchange failures. The exchange is in discussions with Swiss-based FlowBank and Liechtenstein-based Bank Frick as potential candidates for this service, as they continue to adapt to evolving regulatory requirements.

AI Boom and Tech Stocks Fuel RNDR Rally: Durable Growth or Short-Lived Hype?

RNDR cryptocurrency rallies alongside tech stocks, driven by the AI narrative and its unique integration of Apple ecosystem, Metaverse, AI, and 3D rendering capabilities. Future growth may depend on collaborations with tech giants and staying at the forefront amid competitive AI technologies and GPUs.

Crypto Market Rises with Debt Ceiling Deal: Will Fed Policy Meeting Impact the Trend?

The cryptocurrency market, including Bitcoin and Ethereum, experienced a boost alongside the stock market as U.S. lawmakers reach a tentative deal for the federal government’s debt ceiling. The outcome of the upcoming Federal Reserve policy rate meeting may impact the cryptocurrency market’s upward trajectory.

US Inflation Surge: Brace for Fed Hike and Its Impact on Crypto Markets

U.S. inflation and consumer spending surge, leading to increased expectations of a Federal Reserve Hike. The Personal Consumption Expenditures (PCE) Price Index rose to 4.4% in April 2023, with interest rates futures anticipating a 25 bps rate hike in June.

Debt Ceiling Negotiations Impact on Bitcoin: Analyzing Market Trends and Future Predictions

The ongoing debt ceiling negotiations are a primary concern for crypto investors, impacting Bitcoin and the broader crypto market. Market analysts believe regulatory developments and next year’s Bitcoin halving event could significantly influence the crypto market, while recent U.S. labor market data has not affected asset prices, signifying a shift in market sentiment.

Navigating Crypto Investments Amidst Market Uncertainty: 7 Coins to Watch Now

The US stock market attempts recovery as cryptocurrencies like LEO, AI, TON, NEO, SPONGE, ECOTERRA, and YPRED gain attention for their growth potential amidst market fluctuations. These cryptos showcase impressive technical analysis or strong fundamentals, offering promising investment options in uncertain times.

Nvidia’s Surging Market Cap: Impact on AI Firms, Crypto, and Investor Strategies

Nvidia Corp experiences a historic surge in share price, nearing a $1 trillion market cap. Amid a global financial crisis, Nvidia’s growth signals strong potential in the AI industry. Investors should analyze market conditions, understanding risks and rewards tied to assets, as investing in technology and cryptocurrencies remains subject to volatility.

Crypto Markets Tumble Amid US Debt Ceiling Fears and UK Inflation: Analyzing the Impact

Crypto markets faced a shake-up as concerns over UK inflation and Janet Yellen’s U.S. debt ceiling warning sent prices spiraling. The Federal Open Market Committee minutes revealed divided opinions on rate hikes, affecting investor confidence. Major cryptocurrencies, including Bitcoin and Ether, experienced significant declines, reflecting reduced investor optimism.

Rejuvenated Bitcoin Diversification: Boosting Portfolio Performance with Lowered Risk

The declining correlation between bitcoin and equities makes a strong case for including BTC in diversified portfolios. A disciplined rebalancing strategy with minor BTC allocation can effectively improve overall risk profiles, enhancing traditional portfolio performance.

Debt Ceiling Deal Talks Loom Over Crypto Market: Analyzing Pros, Cons & Main Conflict

As the debt ceiling deadline nears, Republican leader Kevin McCarthy expresses optimism about a deal amid market uncertainty. Financial markets, including the crypto space, are impacted by the ongoing delay in debt talks. Investors should closely monitor the situation and research before making investment decisions.

Crypto Exchanges: Order Books Vs. Automated Market Makers – Weighing Pros & Cons

Cryptocurrency exchanges offer two main methods of transferring assets: order books and automated market makers (AMMs). Order books resemble traditional stock exchanges, while AMMs, found in decentralized exchanges, function through liquidity pools backed by user deposits. Both centralized and decentralized exchanges provide unique benefits to crypto traders.

Crypto Stagnation Amid Stock Market Dip: Decoupling or Temporary Standstill?

Cryptocurrencies remain stagnant amid ongoing regulatory issues and macroeconomic uncertainties, with the market’s capitalization of approximately $1.3 trillion seeing little progress. However, the correlation between Bitcoin and traditional assets like the S&P 500 is decreasing, indicating a potential decoupling as macro catalysts emerge. An interesting development is that 62.13% of Bitcoin’s total supply has remained unmoved for over a year, reflecting the commitment of Bitcoin ‘hodlers.’

Bitcoin Ordinals and BRC-20 Tokens: Saylor’s Skepticism and Vision for Blockchain Future

At the Bitcoin 2023 conference, Michael Saylor discussed Ordinals, a concept similar to NFTs on the Bitcoin blockchain, expressing both skepticism and support for their potential use cases. He also addressed concerns about BRC-20 tokens and unregistered securities and advocated for a free-market approach without censoring transactions on the Bitcoin network.

Tokenization Trend Booms: $220M Market Cap, DeFi Integration, and Regulatory Challenges

Tokenization of financial securities on the blockchain is gaining momentum, with a market cap of over $220 million. Firms like Matrixport, Backed Finance, Ondo, and Franklin Templeton create tokenized government bonds and ETFs, predominantly on Ethereum. This trend enables new opportunities, improved lending efficiency, and promises innovation in finance; however, it requires a supportive regulatory landscape to reach its potential.

Marathon Digital’s Strategy in Bear Market: Navigating Price Protection and Energy Efficiency

Marathon Digital Holdings navigates bear market with a price protection strategy and increased hash rate, achieving a quarterly record of 2,195 BTC mined. The company’s energy-efficient fleet and foreign partnerships, like the joint venture in Abu Dhabi, help position it for ongoing expansion.

Bitcoin Holds Strong Amidst Powell’s Soft Interest Rate Stance: Market and Economic Implications

Bitcoin holds below $27,000 as Federal Reserve Chair Jerome Powell indicates that credit stress in the banking sector might soften interest rate hikes, triggering a surge in BTC price. Powell’s statement impacts economic growth, hiring, and inflation, affecting upcoming interest rate decisions and the evolving economic outlook. This highlights the delicate balance between market factors and implications for cryptocurrency and the wider financial system.

Crypto Market Cautious Ahead of Powell Speech: Impact on Bitcoin and Investor Sentiment

As the crypto market remains cautious, Bitcoin hovers below $27,000 amidst hawkish comments from central bank officials and anticipation of Jerome Powell’s upcoming speech. The market’s risk-averse sentiment may be influenced by Powell’s possible hawkish address.

Unemployment Drops, Markets React: Crypto’s Growing Role in Economic Shifts

The recent decrease in weekly unemployment benefits and continuing claims has impacted U.S. stocks, with the Dow Jones Industrial Average falling and the cryptocurrency market experiencing a marginal decline. Stronger-than-expected jobless claims increase recession fears while the labor market remains highly competitive.

Ripple Acquires Metaco: Boon for Crypto Custody or Integration Challenge?

Ripple acquires Swiss digital asset custodian and tokenization provider Metaco for $250 million, aiming to expand its enterprise services. With access to Ripple’s customer base and resources, Metaco’s growth is expected to accelerate as they target the booming institutional crypto custody market, predicted to reach $10 trillion by 2030.

Debt Ceiling Negotiations: Will They Fuel Bitcoin Adoption and Protect Wealth?

Bitcoin experiences slight downward consolidation, hovering below $27,000 amid US debt ceiling negotiations. Analysts believe debt ceiling resolution could benefit Bitcoin as events like these highlight the traditional financial system’s weaknesses and drive demand for crypto alternatives.

Leveraged Bitcoin Futures ETFs: Reshaping Investment Landscape or Fueling Market Manipulation?

Valkyrie filed an application for a leveraged Bitcoin futures-based ETF, which differs from its existing BTF fund. With the SEC blocking attempts at a spot Bitcoin ETF, the debate over futures vs. spot-based ETFs continues, raising questions about the regulator’s understanding of the relationship between Bitcoin futures and the cryptocurrency’s spot price.

Bitcoin Rises Above $27,000: Debt Ceiling Talks to Determine Safe-Haven Status

Bitcoin climbs above $27,000, with a 1.6% increase in 24 hours, while Ether experiences a 1% rise. The upcoming debt ceiling talks may shed light on investors’ perception of bitcoin as a safe haven amidst regulatory uncertainties. However, concerns about low crypto market liquidity persist.

Coinbase Co-founder’s $50M Stock Investment: Bold Confidence or Risky Gamble?

Coinbase co-founder Fred Ehrsam has invested $50 million in the company’s stock despite an 85% decrease since its listing two years ago. Ehrsam’s bullish move follows similar purchases by other insiders, showcasing unwavering conviction in Coinbase’s future potential and the wider cryptocurrency market.

Bitcoin’s Struggle at $25K: Bulls vs Bears, UK Seizing Crypto & the Market’s Future Direction

Bitcoin recently experienced a 10% price decline, raising questions about its key $25,000 support level. As market sentiment and price action influence Bitcoin’s future direction, long-term holders continue accumulating tokens despite the cryptocurrency’s decline. Monitoring the price will help determine the market’s direction in the coming days.

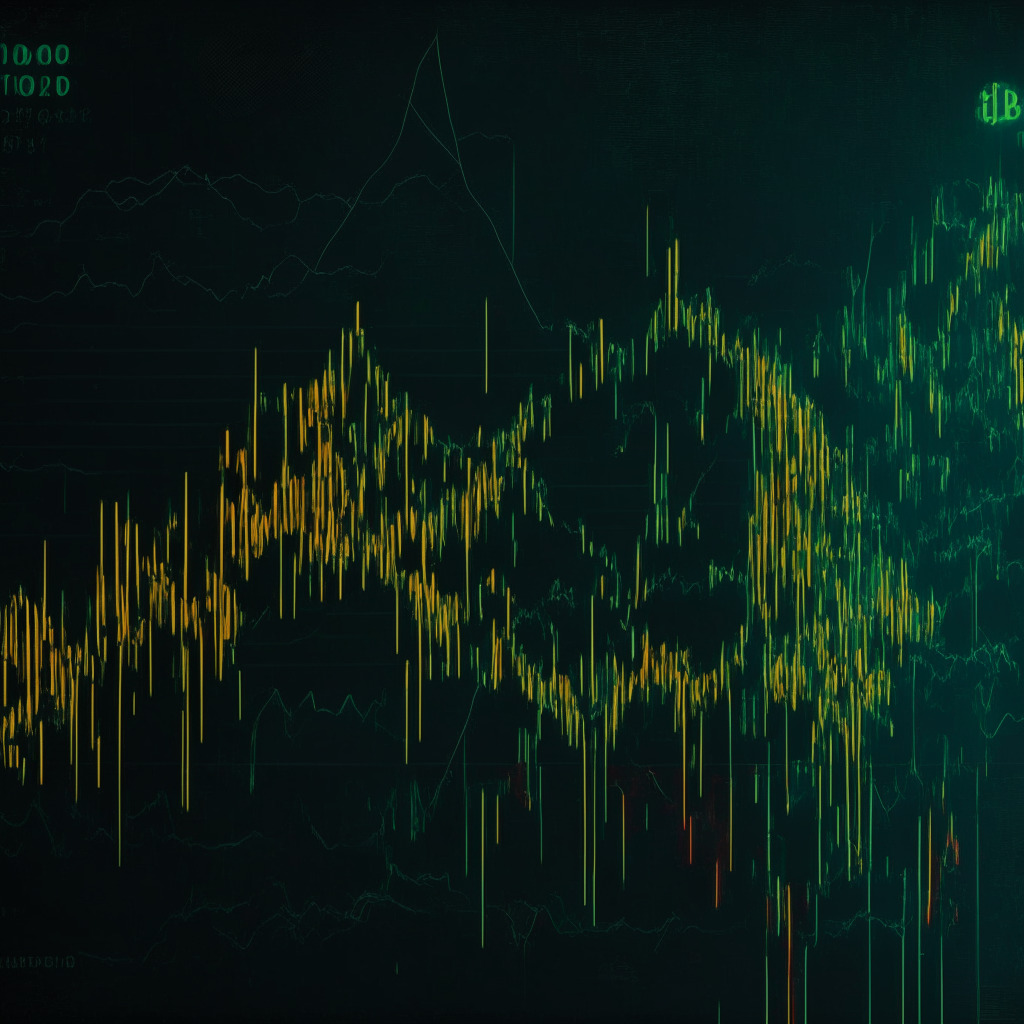

Bitcoin Downtrend: Analyzing Market Shifts, Liquidity, and Future Predictions

The cryptocurrency market experiences a significant shift with Bitcoin falling to its lowest value since March 17 at $26,160. Factors like low liquidity and potential downturn in traditional risk assets contribute to this decline. Investors should exercise caution, stay informed, and make decisions based on thorough research and analysis.

Hut 8 Mining’s Q1 Revenue Plunge: Disputes, Technical Issues and the Path to Recovery

Hut 8 Mining’s Q1 revenue dropped 64% to C$19 million ($14.16 million) due to ongoing energy provider disputes and technical difficulties affecting mining capacity. The company’s merger with U.S. Bitcoin Corp. offers potential for recovery and industry expansion despite current challenges.

Navigating Growth and SEC Scrutiny: The Dual-Faced Journey of Marathon Digital Holdings

Marathon Digital Holdings reports better-than-expected Q1 loss per share due to a surge in Bitcoin prices and increased production. However, the company faces another SEC subpoena investigating potential violations of federal securities law. Despite challenges, Marathon continues to focus on growth, expansion, and debt reduction.