The U.S. Senate’s passage of the Biden-McCarthy debt ceiling deal led to a recovery in crypto and stock markets, with Bitcoin and Ethereum prices rallying. However, low “institutional excitement” and volatile market conditions persist, highlighting the need for thorough research before investing.

Search Results for: US Federal Reserve

Navigating Crypto Investments Amid US Debt Ceiling Crisis: Key Tokens to Watch

This article highlights the recent decline in Bitcoin and other leading cryptocurrencies, which coincides with the U.S. House of Representatives voting to suspend the national debt ceiling. Amid economic turbulence, cryptocurrencies such as WSM, IOTA, ECOTERRA, LTC, YPRED, XLM, and DLANCE emerge as noteworthy purchase considerations. The Wall Street Memes token ($WSM) presale is gaining attention and drawing investment.

Impending US Labor Data: Potential Impact on Bitcoin and Interest Rate Decisions

The upcoming US labor market data release on June 2nd may trigger volatility in the Bitcoin market, as it factors into expectations for future interest rate hikes from the Federal Reserve. Its potential impact on both the Federal Reserve’s interest rate decisions and Bitcoin’s market performance will be closely monitored by crypto enthusiasts.

US Default Averted: Market Optimism Fuels Crypto Rally and Debate on Future Prospects

US futures surged on Thursday as the House of Representatives passed a crucial deal averting a dangerous US default. Combined with hints of a pause in interest-rate hikes, this sparked optimism in the market. Positive trends were observed in S&P 500, Dow Jones Industrial Average, and Nasdaq Composite futures, while tech-heavy Nasdaq experienced a slight setback. The broader cryptocurrency market may also be impacted by this development.

Debt Ceiling Turmoil: Eroding Trust in USD and Bitcoin’s Journey as Safe-Haven Asset

Blackrock CEO Laurence Fink suggests that the US debt ceiling turmoil has eroded global trust in the dollar, potentially benefiting Bitcoin as a hedge against inflation and debt. Market analysts note Bitcoin’s utility as a finite-supply safe-haven asset, but caution that its future value remains uncertain due to market factors and ongoing events.

Crypto Market Volatility Looms as US Debt Ceiling Lifts and Liquidity Tightens

Crypto markets may face a downturn as liquidity tightening resumes after the U.S. debt ceiling is lifted, resulting in the replenishment of the U.S. Treasury General Account (TGA) and the Federal Reserve winding down its balance sheet. This scenario could pressure cryptocurrency prices in the coming months, affecting risk assets like cryptocurrencies and metaverse projects.

Crypto and Equity Markets Dip: Impacts of Federal Reserves and Debt Deals Unveiled

As crypto and equity markets face a dip, Federal Reserve governors’ hawkish comments and debt deal signs have grabbed investor attention. Bitcoin has lost 3.2% in 24 hours, with ether declining by 2.8%. This month, Bitcoin may potentially register its first negative monthly return.

Surge in US Job Openings May Prompt Rate Hike: Implications for the Crypto Market

U.S. job openings rose unexpectedly in April, surpassing economists’ expectations and showing a solid labor market recovery. The Federal Reserve may consider raising interest rates in June, potentially impacting both equities and the crypto market.

Navigating Crypto Amid Federal Reserve’s Liquidity Tightening and Debt Ceiling Debates

Crypto enthusiasts should note Cleveland Fed President Loretta Mester’s support for liquidity tightening and consistent interest rate policy, as her comments impacted Bitcoin’s value. The market’s response demonstrates the significance of global economic events and Federal Reserve policy decisions on the cryptocurrency landscape.

Surge in Republican Opposition to CBDCs: Privacy Concerns vs Financial Inclusion Benefits

Recent opposition from Republican lawmakers to a central bank digital currency (CBDC) raises concerns over government surveillance and privacy threats, as they argue a digital dollar could grant federal officials unprecedented access to individuals’ financial data. The future of the Federal Reserve’s potential pilot program remains uncertain amid intensified debate surrounding CBDCs.

Bitcoin Rebound Falters: US Dollar Strength, High Interest Rates and the Search for New Drivers

Bitcoin rebounds to $27,800 but remains on track for its first monthly loss since December, down approximately 5%. The lackluster performance is due to changing Fed rate expectations and the strengthening USD. Experts believe a new market driver is needed for Bitcoin’s price to rise.

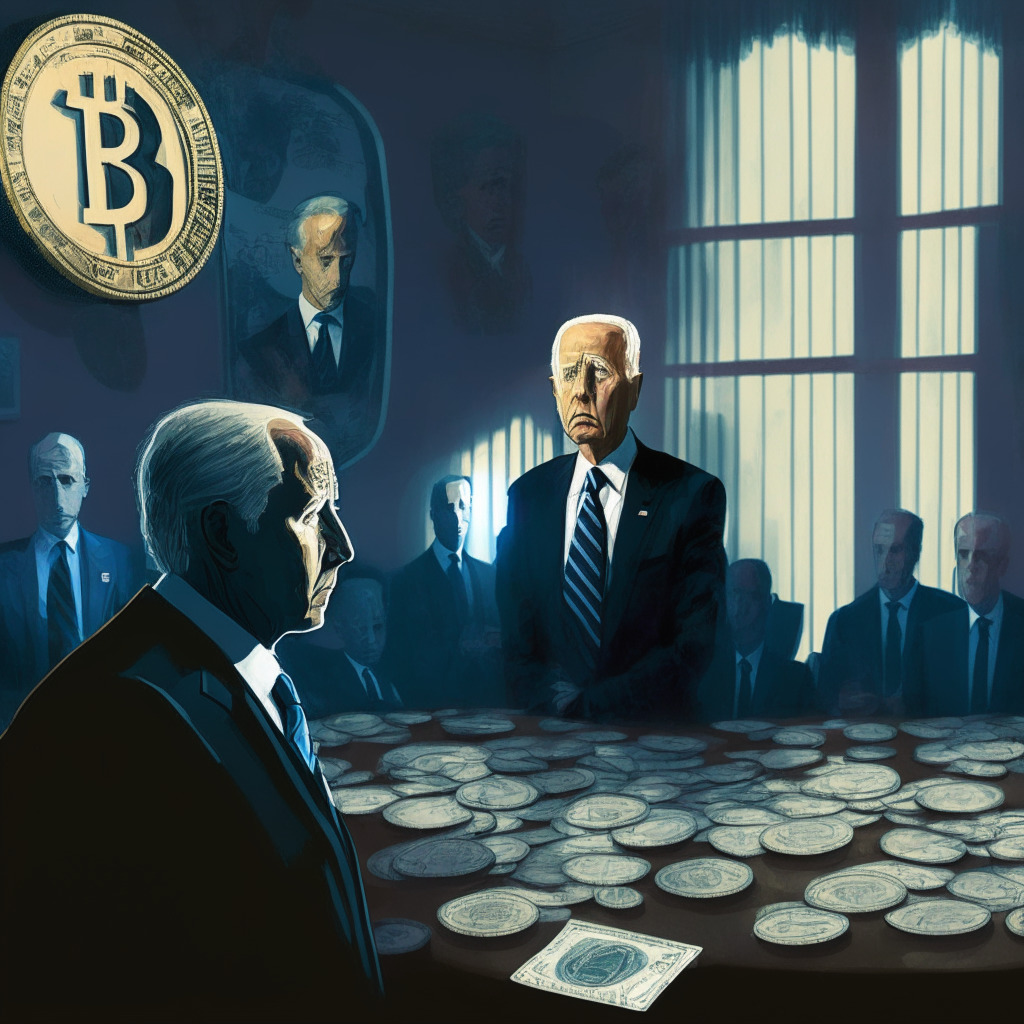

US Debt Ceiling Agreement Fuels Bitcoin’s Rally: Will the Bullish Trend Continue or Correct?

Bitcoin’s value sees an uptick amid US debt ceiling discussions, as a preliminary agreement is reached between President Joe Biden and Republican leader Kevin McCarthy. The debt ceiling agreement could impact the Federal Reserve’s money-printing activities, potentially benefiting Bitcoin due to its inverse trading relationship with the USD. However, a significant barrier at the $28,300 level may affect Bitcoin’s upward trajectory.

IMF’s US Rate Hike Advice: The Impact on Crypto Markets and Inflation Control

The IMF advises the US Federal Reserve to maintain interest rate hikes and adopt stringent fiscal policy to minimize federal debt. The tightening of fiscal policies and potential rate hikes might impact stock and crypto markets, causing a temporary decrease in Bitcoin value.

US Inflation Surge: Brace for Fed Hike and Its Impact on Crypto Markets

U.S. inflation and consumer spending surge, leading to increased expectations of a Federal Reserve Hike. The Personal Consumption Expenditures (PCE) Price Index rose to 4.4% in April 2023, with interest rates futures anticipating a 25 bps rate hike in June.

US Stock Market Rally: Rate Hike Impact on Crypto and Traditional Investments

The recent US stock market rally raises questions about another potential rate hike, impacting both traditional and cryptocurrency markets. While a rate hike could signal confidence in the economy, ongoing debt ceiling uncertainty may lead the Federal Reserve to adopt a cautious approach.

US Debt Ceiling Crisis: Impact on Bitcoin, Crypto Market, and De-dollarization Debate

The U.S. debt ceiling crisis presents a precarious outcome for Bitcoin, the crypto market, and risk assets, possibly impacting the dollar’s global reserve currency status. To navigate this uncertain market, investors must stay informed and adopt adaptable investment strategies, avoiding impulsive reactions to market trends.

Crypto Market Turmoil: US Debt Default Deadline, Recovery Hopes, and 2024 Watershed Moment

Cryptocurrencies like Bitcoin and Ethereum may experience massive selloffs due to the approaching US debt default deadline, predicts Blockchain.com CEO Peter Smith. However, cryptocurrencies are expected to bounce back soon after any initial impact. The ongoing debt ceiling talks have led to Bitcoin investors panicking and prices dipping, highlighting the need for market vigilance.

US Debt Ceiling Crisis: Impact on Bitcoin Options and Market Uncertainty

As the US faces a debt ceiling crisis, Bitcoin options market displays a six-month bias towards weakness, with the call-put skew at its lowest since March. Investors now show a preference for put options, aligning with recent trends in the S&P 500 market. The uncertainty surrounding debt ceiling negotiations impacts bond markets, and Bitcoin’s price fell by 10%, as the US dollar’s appeal as a safe haven grows.

Florida’s CBDC Ban Sparks Debate: Privacy Concerns vs Financial Inclusion Prospects

Florida recently banned Central Bank Digital Currencies (CBDCs), igniting debates on the potential drawbacks of CBDCs, including surveillance and financial habit control. Governor Ron DeSantis voices concerns over central authority imposing environmental, social, and governance criteria, while proponents cite increased financial inclusion and monetary policy control benefits. The future of CBDCs in the U.S. remains uncertain.

Federal Reserve Uncertainty: Top Crypto Picks Amid Market Downturn & Interest Rate Debate

The Federal Reserve’s uncertainty regarding interest rate changes has impacted the crypto market, with the total market cap declining by 2.98%. Despite this downturn, cryptocurrencies like KAVA, AI, RNDR, ECOTERRA, TON, YPRED, and DLANCE show potential growth opportunities due to strong fundamentals or technical analysis. Investors should consider these factors along with global economic factors affecting the market.

US Debt Ceiling Dilemma: Impact on Crypto and Stock Markets, Weighing Pros and Cons

The US debt ceiling situation may significantly impact stocks and cryptocurrency markets, with potential “catastrophic” global consequences. The outcome could lead investors to sell off stocks and cryptocurrencies and purchase high-yield Treasury bills. However, Bitcoin may rally in the coming weeks amid a weakening US dollar dominance.

Debt Ceiling Crisis Looms: US Economy on the Edge as Biden and McCarthy Struggle to Agree

As the June 1 deadline approaches, the impasse between President Biden and House Speaker McCarthy on raising the US government’s debt ceiling could lead to an unprecedented debt default, impacting the US economy and global markets. With the Treasury’s cash reserves dwindling, both parties need to find a resolution to avoid disastrous consequences.

Federal Reserve Rate Hikes: Impact on BTC Price and Investor Preferences for Ethereum

US Fed officials consider more rate hikes despite debt ceiling crisis, potentially impacting BTC price. St. Louis President James Bullard suggests raising interest rates twice this year, while Minneapolis Fed President Neel Kashkari believes in raising rates over 6% to curb inflation. Smart money seems more inclined to invest in Ethereum over Bitcoin, indicating a possible shift in investor preferences.

White House Crypto Policies Amid Debt Ceiling Crisis: Balancing Regulation & Innovation

The White House is actively addressing cryptocurrency policy amid concerns over the debt ceiling and potential economic consequences. President Biden seeks a debt deal that doesn’t protect crypto traders and wealthy tax evaders, while the US Treasury warns of potential economic danger without an agreement. Striking a balance between regulation and innovation in crypto is crucial as investors and traders closely monitor upcoming economic events and policies.

US Banking Crisis: Crypto Downturn & Big Returns for Risk-Takers, Weighing Pros & Cons

The recent US regional banking crisis highlights the disparity between major Wall Street banks and smaller institutions, affecting US banking stocks. Investor Michael Burry purchased shares in beleaguered banks, and amidst market uncertainty, the crypto market experiences a downturn.

Crypto Market Cautious Ahead of Powell Speech: Impact on Bitcoin and Investor Sentiment

As the crypto market remains cautious, Bitcoin hovers below $27,000 amidst hawkish comments from central bank officials and anticipation of Jerome Powell’s upcoming speech. The market’s risk-averse sentiment may be influenced by Powell’s possible hawkish address.

Bitcoin Dips Below $27,000: Analyzing Market Impact and Federal Reserve’s Role

Bitcoin dipped to lows of $26,380 on Bitstamp amid expectations of an interest rate hike by the United States Federal Reserve in June. Factors such as low jobless claims data and hawkish Fed comments contribute to downward pressure, as traders maintain potential bearish targets around $25,000.

Stablecoin Regulation Debate: Balancing State vs. Federal Control for Innovation & Security

The House Committee on Financial Services’ new Subcommittee on Digital Assets, Financial Technology, and Inclusion debated two proposed bills for stablecoin regulation, highlighting the need for a balance between state and federal control. The ongoing discussion emphasizes finding a suitable middle ground that fosters innovation and guarantees stakeholders’ best interests.

Stablecoin Regulation Debate: US Lawmakers’ Divide and the Future of Digital Dollar

The US House Financial Services Committee’s digital assets panel debated on stablecoin regulations, highlighting divides between Republican and Democratic ideas. Both parties do align in addressing risks to consumers and maintaining the US dollar’s role in global commerce. Lawmakers are paying heightened attention to stablecoin regulations and wider crypto topics, marking progress in US oversight of the industry.

Stablecoin Regulation: Balancing Innovation and Consumer Protection in the US Market

California Rep. Maxine Waters has introduced a draft bill to regulate stablecoins in the United States, focusing on payment stablecoin issuers’ requirements, digital dollar research, and related subjects. Supporters say a clear regulatory framework would ensure oversight and consumer protection, while critics argue it could hinder innovation and limit the broader adoption of cryptocurrencies.

Fed Rate Hike Pause: Boon or Bane for Crypto Market? Exploring Expert Opinions and Impact

Speculations surround the US Federal Reserve’s possible pause of interest rate hikes in June 2023, with a 73% likelihood. While many view it as a market stabilizer, some experts argue the strong economy may warrant resumed rate hikes. Investors prepare for the crypto market’s reaction to upcoming Federal Reserve decisions.

Crypto Markets and the Looming US Recession: Surviving the Economic Storm

The potential for a US recession looms over crypto markets, impacting cash flow and real-world utility. Crypto’s survival will depend on the recession’s root cause, duration, and severity. Tokens with real-world impact are likely to be more resilient. Focus on profit margins and cash flow remains critical for startups and investors.