Major cryptocurrencies face sharp declines due to U.S. SEC lawsuits against Binance and Coinbase, while Bitcoin remains a relative safe haven. As the cryptocurrency market navigates a complex regulatory landscape, the future of the industry and its stakeholders hangs in the balance.

Search Results for: sui

SEC Chair’s Tweet Controversy: Gensler, Coinbase Lawsuit, and Crypto Community’s Call for Clarity

A recent tweet by US SEC Chair Gary Gensler addressing the ongoing Coinbase lawsuit omitted crucial context. Twitter fact-checkers added community notes emphasizing that Coinbase had sued the SEC seeking clear guidelines on issues Gensler accused them of failing. This highlights the need for transparent regulations in the rapidly evolving crypto world.

SEC Lawsuits Rattle Crypto Market: Analyzing Effects on Altcoins and Future Regulations

The SEC filed a lawsuit against Binance for allegedly violating federal securities laws, resulting in a decline of over 20% in top altcoins. Despite market unrest, experts still view Bitcoin and Ethereum as safer investment options. The outcomes of these lawsuits may influence future crypto regulations.

DeFi Lawsuit Dismissal: Exploring Legal Challenges & Future Implications for Startups

A US federal judge has dismissed a lawsuit against DeFi platform PoolTogether, stating that the plaintiff lacked standing and federal court was not the appropriate venue. The case highlights complexities in navigating the legal landscape for DeFi platforms and investors, prompting a need for better understanding and adaptation by legal systems.

Regulatory Rumble: Gensler’s Alleged Binance Ties and the SEC Lawsuit’s Legitimacy Debate

SEC Chair Gary Gensler allegedly offered to advise Binance, the crypto exchange he is currently suing. Documents reveal Gensler engaged in conversations with Binance in 2019, which could present a conflict of interest in the ongoing lawsuit. Investors should conduct their own research before making financial decisions.

SEC Lawsuits Against Coinbase and Binance: Analyzing the Impact on Crypto’s Future

The U.S. SEC has filed lawsuits against cryptocurrency exchanges Coinbase and Binance for allegedly breaking securities rules. District Court Judges Jennifer H. Rearden and Amy Berman Jackson will preside over the respective cases. The outcomes of these lawsuits could significantly impact the cryptocurrency industry and its future development.

Celebrities Face Lawsuit Over EMAX Token: Unfair Crypto Promotions & Ethical Concerns Debated

A class action lawsuit against Kim Kardashian and Floyd Mayweather resumes, alleging improper promotion of EthereumMax (EMAX) token. Judge Fitzgerald revived “unfair competition” claims, emphasizing that undisclosed paid promotion of crypto tokens is an “unscrupulous and thereby unfair practice.” The case highlights ethical concerns and potential dangers associated with celebrity-endorsed cryptocurrency projects.

Binance-SEC Lawsuit: $70 Billion Moved Through Bankrupt Banks – Regulation & Transparency Debate

A Bloomberg report reveals that Binance and its affiliates moved $70 billion through Silvergate Bank and Signature Bank, raising concerns about funds movement transparency and banks’ role in the crypto industry. The SEC’s case against Binance alleges mishandling of client funds, while the exchange claims the transfers were part of regular business operations.

CEX Trading Volume Decline: Impact of SEC Lawsuits and Rise of Decentralized Exchanges

Centralized exchange trading volumes decline, with Binance experiencing the most significant drop. However, top decentralized exchanges witnessed a 444% increase in median trading volume amid SEC lawsuits. The market share of derivatives trading reached a new record, despite an overall decrease in trading volumes. This highlights the growth of decentralized exchanges, raising questions about the necessity of increased regulation.

DeFi Lawsuit Dismissal: A Temporary Reprieve or Sign of Future Regulatory Challenges?

A recent lawsuit against DeFi startup PoolTogether was dismissed, raising questions about DeFi regulation and future legal actions. As the industry expands, both investors and regulators are debating the best way to regulate the rapidly evolving sector, with attention on decentralization and transparency.

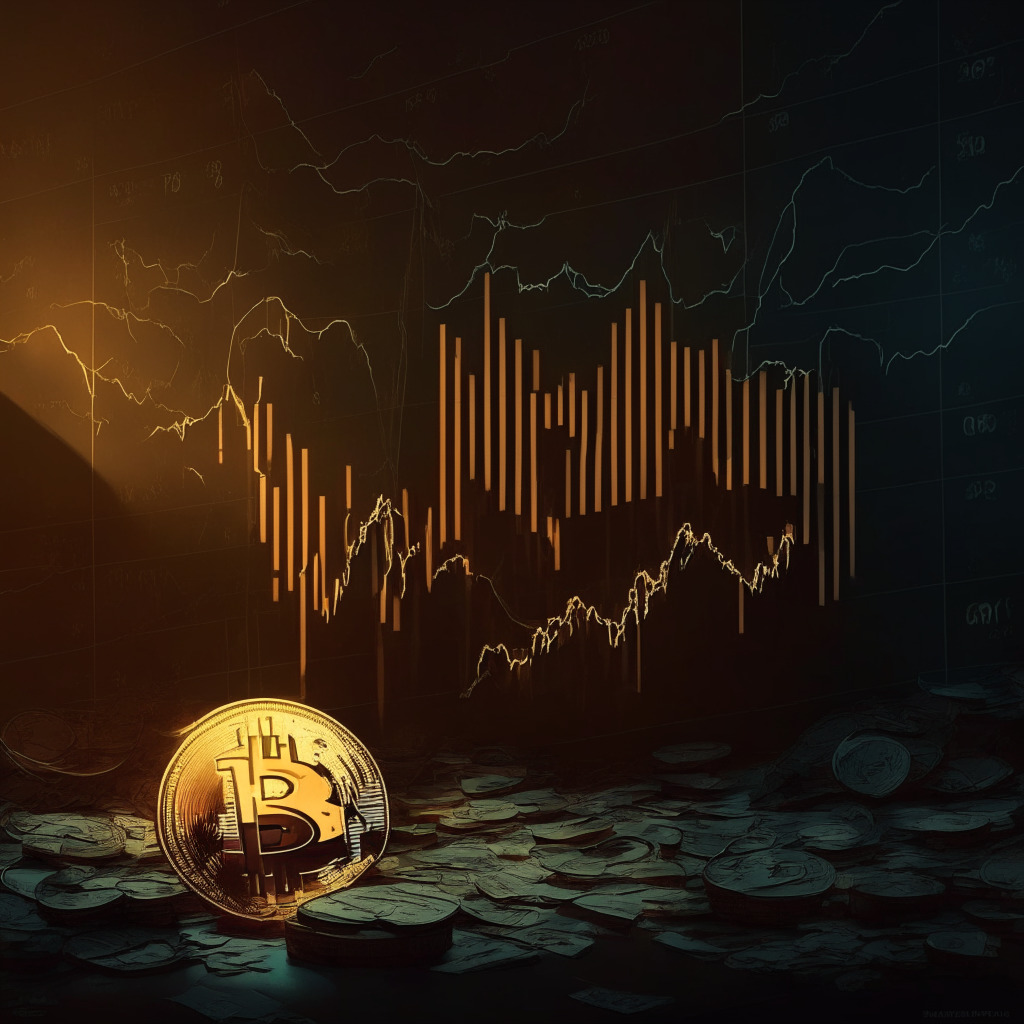

Crypto Market Downturn: SEC Lawsuits Impact and Stablecoin Balance Signals

Fellow crypto enthusiasts, a downturn in the market is linked to SEC lawsuits involving Binance and Coinbase, affecting Bitcoin, Ether, and altcoins. Stablecoin balances provide valuable insights, serving as an early indicator of buying demand and market trends.

ARK Invest Backs Coinbase Amid SEC Lawsuit: A Call for Regulatory Clarity in Crypto Space

Cathie Woods’ ARK Invest expands its holdings of Coinbase shares despite the firm’s high-profile SEC lawsuit. This highlights the ongoing struggles between crypto companies and regulators, emphasizing the need for clear guidance, cooperation, and open communication for industry growth and development.

SEC Lawsuits Shake Crypto Industry: Examining Stand with Crypto NFT & Impact on Advocacy

The SEC’s legal action against Binance and Coinbase has intensified concerns over regulation in the crypto industry. In response, the Stand with Crypto movement was created utilizing NFTs on the Zora platform, advocating for regulatory clarity despite criticisms of virtue-signaling.

Binance Lawsuit Reveals Accounting Firm’s Concerns Over Commingling Funds

A recent court filing reveals that Binance’s accounting firm, Armanino, warned the exchange about mixing client and company funds and highlighted “significant deficiencies” in its business practices. Despite raising concerns and suggestions for improvement, the impact on the ongoing SEC lawsuit remains uncertain.

Coinbase Staking Continues Amid Lawsuits: Confident Move or Risky Gamble?

Coinbase continues to operate its crypto staking service amidst lawsuits with state and federal regulators, aiming to diversify revenue beyond transaction fees. The decision has sparked debate on its potential risks and long-term implications for the crypto landscape.

Coinbase CEO Defends Company amid SEC Lawsuit: Clarity Needed in Crypto Regulations

In a recent interview, Coinbase CEO Brian Armstrong defended the company against an SEC lawsuit, highlighting the lack of clear cryptocurrency guidelines in the U.S. He expressed confidence in navigating the legal proceedings, stating that only a small percentage of assets traded on Coinbase are categorized as securities. Armstrong believes the legal battle could eventually provide regulatory clarity for the digital asset space.

Binance CEO Summoned by US Court Amid SEC Lawsuit: Analyzing the Implications and Conflicts

The US District Court issued a summons for Binance CEO Changpeng Zhao following the SEC suing the exchange for alleged unregistered securities operations. Binance and its CEO have 21 days to respond once served. Former Binance.US CEO Catherine Coley’s testimony in a previous SEC investigation resurfaces in the new case against the cryptocurrency exchange.

Binance vs Coinbase Lawsuits: Debating Crypto Securities, Regulations, and Legal Battles

The SEC filed lawsuits against Binance and Coinbase, focusing on registration violations, fraud, and market manipulation allegations. Both exchanges disagree with the claims, and the legal battles may center on digital asset classification as securities, making compliance crucial for future operations.

SEC Lawsuit Impact on Memecoins: Analyzing Pepe Coin Struggles and yPredict.ai Potential

Amid turbulent times in the crypto market, memecoin markets thrive, while Pepe coin struggles with legal concerns. Traders seek resources like yPredict.ai, an AI-powered platform providing real-time signals to predict market trends for enhanced decision-making. Stay cautious in volatile cryptocurrency markets.

Binance Lawsuit Fallout Hits Crypto Space Hard, While Ecoterra Rises as Pre-Sale Safe Haven

The SEC vs. Binance lawsuit impacts major projects like BNB, SOL, MATIC, and ADA, causing market turbulence. Meanwhile, investors seek refuge in promising pre-sales like Ecoterra, an eco-friendly blockchain project. Amid uncertainties, research and cautious approach are essential for investments.

SEC Lawsuits Against Binance and Coinbase: Cramer’s Criticisms and Crypto Market Reactions

The SEC’s lawsuits against Binance and Coinbase have generated debate among market observers and crypto enthusiasts, with Jim Cramer’s criticism and exchange management’s response adding fuel to the fire. The outcome of these legal proceedings will significantly impact the broader cryptocurrency ecosystem.

Binance vs FTX: Unraveling the Ethics in Crypto Exchanges Amidst the SEC’s Lawsuits

Binance addresses its differences from other exchanges amid SEC lawsuit, emphasizing wallet transparency and denying funds mismanagement. The statement alludes to the troubled FTX exchange, accused of mismanaging consumer assets and lending money to Alameda Research. The controversy highlights potential conflicts of interest in the crypto industry.

Crypto Market Rocked: Binance & Coinbase Face SEC Lawsuits, $600M Negative Net Outflows

The SEC’s lawsuits against Binance and Coinbase, accusing them of unregistered offers and sales of securities and operating as an unregistered broker, have resulted in $600 million in negative net outflows for both exchanges. This development raises questions about the future of crypto exchanges, regulation, and the global crypto market’s direction.

Crypto Market Surges Amidst SEC Lawsuits: Analyzing Resilience and Volatility Factors

The cryptocurrency market surged on Wednesday, with Bitcoin rising over 4% to nearly $27,000, and Ethereum surpassing the $1,850 mark. The growth occurred amidst SEC lawsuits against crypto exchanges Coinbase and Binance, demonstrating the market’s resilience despite recent legal challenges. Investors should remain cautious due to the market’s volatility.

Crypto Rollercoaster: SEC Lawsuits, Market Reactions, and the Path to Industry Maturity

The cryptocurrency market experienced fluctuations as Bitcoin dropped to a three-month low, largely due to the SEC suing popular exchanges Coinbase and Binance. Despite initial concerns, the market’s quick recovery indicates ongoing investor confidence in digital assets amidst growing regulatory scrutiny.

Kim Kardashian’s Crypto Lawsuit: Influencer Transparency and Investor Diligence

Kim Kardashian faces an ongoing crypto-related lawsuit accusing her of scamming investors by promoting EthereumMax without disclosing payment. This highlights the responsibilities and legal consequences influencers face when promoting cryptocurrencies without proper disclosure, emphasizing the need for transparency and thorough market research by investors.

SEC Lawsuits, Coinbase Petition, and the Future of Crypto Regulation: Balancing Innovation and Protection

The Third Circuit recently requested a response from the SEC regarding a pending petition for rulemaking from Coinbase, as concerns increase over regulatory clarity in the crypto market. The ongoing uncertainty highlights the critical need for clear regulatory frameworks, balancing investor protection and industry growth, ultimately determining the future of the entire crypto market.

SEC Lawsuit’s Impact on Crypto: Driving Talent Away or Policing the Industry?

The recent SEC lawsuit against Binance and Coinbase has sparked debate in the crypto community, with some criticizing the regulatory body’s approach as “unacceptable” and “lazy.” Concerns include driving crypto companies away from the US, uncertainty in rules and guidance, and potential weakening of consumer confidence in cryptocurrencies. Efforts are ongoing to develop effective regulations.

SEC Lawsuits vs Crypto Exchanges: Commodities or Securities Showdown

The SEC’s allegations against Binance and Coinbase center on whether tokens qualify as securities or commodities. A probable judgement later this year could set the tone for the future of the crypto landscape. The primary concern is deciphering the optimal regulatory framework for digital financial instruments like stablecoins and cryptocurrency tokens.

Binance Faces Class-Action Lawsuit Over Stolen Crypto: Examining the Implications and Future of Regulation

Binance faces a class-action lawsuit for allegedly profiting from transactions involving stolen cryptocurrency. Plaintiff Michael Osterer claims that Binance failed to verify lawful ownership of 7.2 BTC and 449 ETH stolen from his Coinbase account, and suggests that the exchange willingly facilitates money and cryptocurrency laundering on its platform. The lawsuit could have significant implications for the crypto economy and future regulations.

SEC Lawsuit vs. Binance: Impact on South Korean Market and Gopax Acquisition

The SEC lawsuit against Binance could potentially impact its acquisition of South Korean crypto trading platform Gopax. The country’s financial watchdog, the Financial Service Committee, is currently reviewing the acquisition amidst concerns over alleged securities law violations and requests to freeze Binance.US assets.

Cardano’s Turbulent Future: SEC Lawsuits, Delisting Threats and RSI Patterns Unraveled

Cardano (ADA) has declined 9% within the past week after the SEC labeled it a security. Despite the turbulence, ADA gained 38.5% since the beginning of the year. However, the SEC’s actions might lead to exchanges delisting the altcoin, which could significantly impact its price.