“80 Chinese accounts promoting cryptocurrency were shut down on Sina Weibo, raising concerns about blockchain freedoms. These accounts, with 8 million followers, were part of ongoing crackdowns following China’s 2021 cryptocurrency ban with primary objective of protecting property safety.”

- Kennedy’s Bold Crypto Agenda: An Independent Run for Presidency Powered by Bitcoin

- OK Group’s Rebranding: Power Consolidation or Crypto Evolution?

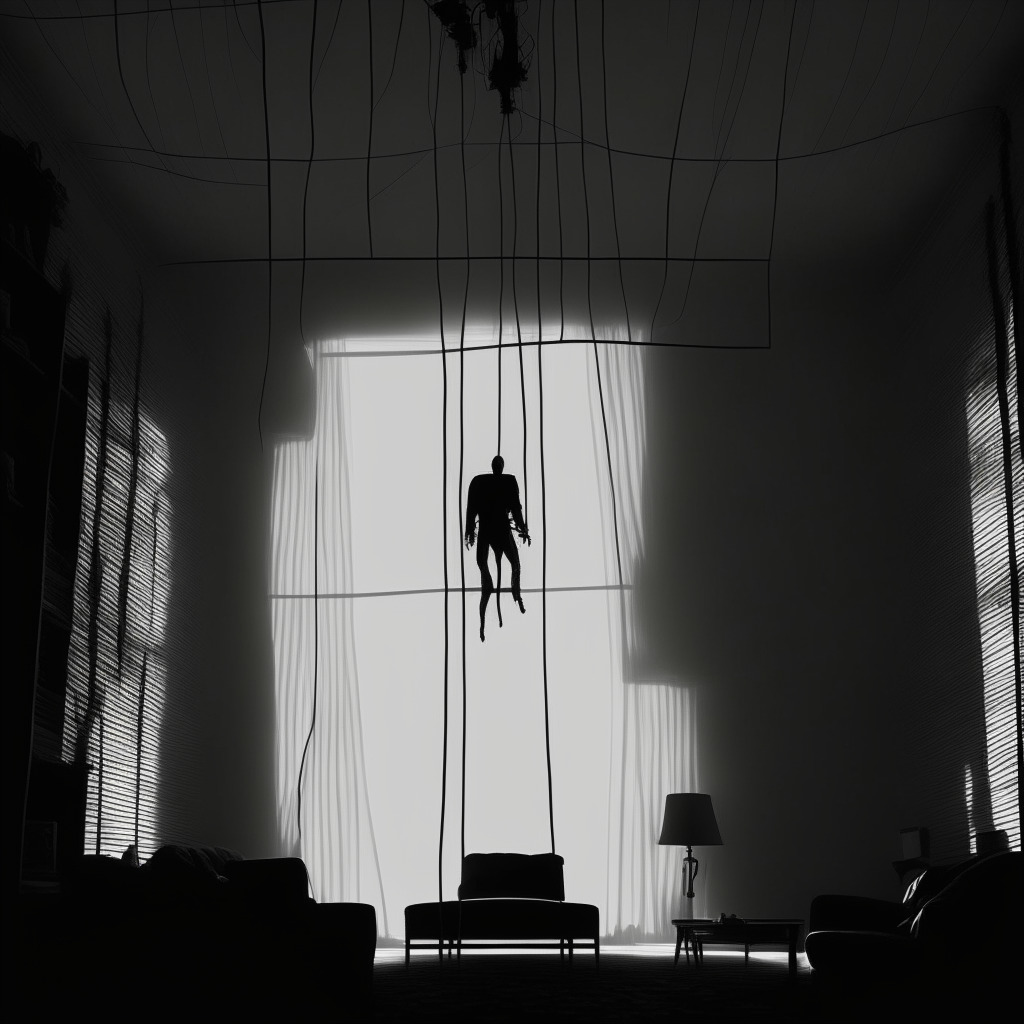

- The Fall of FTX’s Sam Bankman-Fried: A Cautionary Tale or Web3 Symbol’s Downfall?

- Crucial Crypto Updates: The Bitcoin Slump, Crypto Aid Israel and The Rise of BitVM

- RFK Jr’s Pro-Crypto Presidential Run: Redefining America’s Financial Future and Political Landscape

- Unraveling Ripple’s Future: Implications of CFO’s Sudden Exit on Crypto Landscape

- Unveiling the Crypto Controversy: Accountability Amidst Progress, from Bankman-Fried to Future Prospects

- Blockchain Aid: A Lifeline in Humanitarian Crises or a Cybersecurity Challenge?

- Bitmain’s Struggle but Hive’s Triumph: A Tale of Two Bitcoin ASIC Companies

- Unraveling the AnubisDAO Saga: Accountability Challenges and Transparency Paradoxes in Crypto

Unveiling the Veils of DeFi: The Road to Normalization Amidst Risks and Rewards

“Cross-chain bridge Synapse experiences a value sink due to a SYN tokens dump by an anonymous liquidity provider. This highlights potential insecurities in the DeFi space, underscoring the necessity for protective measures and consistent market analysis.”

Sybil Attack on Connext Network: Exploring Security vs Convenience in Decentralized Trust Systems

The Connext Network, a protocol for native blockchain bridges, recently endured a ‘sybil attack’— a suspicious wallet exploited the protocol’s token airdrop, making over 200 claims. This unexpected event underscores the critical balance between security and convenience in decentralized trust systems.

Coinbase Upsizes Debt Repurchase Amid Financial Uncertainty: A Bold Move or a Risky Bet?

Coinbase has increased its debt repurchase initiative to $180 million indicating financial strength, despite reporting a net loss of $430 million in Q1 2022. Meanwhile, Visa expands its support for USDC settlements on Solana blockchain, potentially revolutionizing cross-border transactions despite potential risks.

VISA Leverages Solana Blockchain and USDC Stablecoin for Faster International Payments

“VISA has enhanced its stablecoin settlement ability with Circle’s USDC stablecoin on the high-speed Solana blockchain, making it one of the first financial institutions to harness Solana for scaled settlements. VISA’s integration of stablecoins like USDC on global blockchain networks aims to improve international settlements speed and give clients a modern option to conveniently transact funds.”

Rise of Bitcoin Derivative Coins amidst Shaky Crypto Market: A Focus on Bitcoin BSC

‘Bitcoin BSC’, a stake-to-earn model ‘Bitcoin clone’ derivative coin makes a striking entry, despite fluctuations in the crypto market. This efficient and scalable proof-of-stake protocol exhibits lower transaction costs and builds on BNB Smart Chain, offering potential substantial upside for early investors.

Tether’s Ascent: Top Holder of US Treasury Bills and What That Means for Crypto

“Tether, one of the world’s leading buyers of US Treasury bills, has increased its holdings to $72.5 billion. Despite the complexities expansion brings, this represents the growing mainstream acceptance of digital currencies and their incorporation into the traditional financial world.”

El Salvador’s Bitcoin Venture: Crypto Education in Schools Amidst Security and Regulation Concerns

El Salvador is incorporating Bitcoin learning programs into school curricula by 2024, in partnership with non-profit organization, My First Bitcoin (MFB), and the Education Ministry. A pilot to provide Bitcoin “base knowledge” starts September 7 with 150 teachers. The move promises a significant stride towards a crypto-literate world but also presents challenges including possible fraud and lack of uniform regulations.

Navigating the Cryptosphere: The Courting of Controversy and Confidence by Crypto Lawyer Heaver

Irina Heaver, a prominent crypto lawyer, faces scrutiny and threats due to her outspoken critique of certain altcoins and their founders. Despite these challenges, Heaver insists on informing her followers about potential lawsuits in the crypto industry and exposing questionable projects.

₿trust Acquisition of Qala: A Turning Point for Bitcoin Development in Africa or Cause for Concern?

₿trust, a non-profit backed by Twitter co-founder Jack Dorsey, recently acquired Qala, a body aiming to enhance Bitcoin and Lightning engineers’ skills in Africa. The integration aligns with ₿Trust’s mission to stimulate Bitcoin open-source developers’ learning globally, particularly in the Global South, potentially changing the region’s involvement in Bitcoin development.

Navigating the Uncertain Waters of AI Progress and Blockchain Fluctuations

“Baidu, China’s tech powerhouse, has released over 70 AI models with over 1 billion parameters each. Recent models show up to a 50% improvement in efficiency. However, the rapid expansion of AI technology raises concerns about misuse and privacy.”

Japan’s FSA Suggests Crypto Tax Reforms: An Effort to Revitalize the Digital Asset Landscape

Japan’s top financial regulator, the Financial Services Agency (FSA), has proposed changes to the country’s tax laws regarding digital asset profits. This move aims to better align Japan’s stance on cryptocurrencies with global standards, reduce financial burdens on local businesses, and foster innovation within the blockchain industry.

Qredo’s Crypto Winter Survival: Staff Cuts, Refocusing Efforts and Ramped-up Security

“Crypto infrastructure provider Qredo is reportedly laying off around 50 staff members, including key executives, reducing the firm’s headcount to around 130. The layoffs are part of a resizing strategy, an attempt to endure the difficult crypto market while refocusing efforts to save approximately 50% of its expenses.”

Decoding the Complex World of Blockchain through Solana’s Lens: Real-World Solutions and Challenges

Raj Gokal, co-founder of blockchain protocol Solana, is addressing blockchain scalability through decentralized physical infrastructure networks (DEPIN). He emphasizes well-thought-out factors to create a scalable blockchain system. Despite challenges in industries such as real estate, Solana is working towards stable and reliable Web3 infrastructure, critical for institutional adoption. As industry practices evolve, the blockchain future becomes increasingly tangible.

$40 Million Crypto Heist: Stake.com’s Unprecedented Security Breach and Quick Recovery

Stake, a popular crypto betting platform, suffered a shocking $40 million exploit in early September, starting with irregular transactions. Despite the massive security breach, Stake assured users that funds would be protected and possibly restored soon, reaffirming the resilience of some crypto platforms.

Crypto Market’s Complex Dance: The Rise of Deribit and Shifting Investor Sentiments

“The crypto market performance has been tepid this week with Bitcoin staying below $26,000. Despite SEC revisiting its denial of Grayscale’s ETF bid, other application avenues remain restrained. Deribit, a crypto derivatives platform, saw a 17% surge in trading volume, indicating strong activity in the global crypto options market.”

Rollbit Coin’s Rise and Stake’s Fall: A Tale of Two Casinos in the Blockchain Era

“The Rollbit Coin (RLB) has seen a 4% price increase, despite being down 9% on the week. This comes as rival online casino, Stake, suffers a $41 million hack. Overall, RLB has grown 9,000% over the year, making it a top-performing token. Some believe more growth is possible if Stake’s user base shifts due to this hack.”

DeFi Drama: The Synapse-Nima Capital Incident and Crypto Bankruptcy Profit Surge

“In an unexpected move, Nima Capital’s withdrawal of liquidity from the DeFi cross-chain bridge Synapse caused a dramatic decrease in the value of SYN tokens, causing uproar in the crypto community. Despite this, Synapse reassures users of their platform’s security system integrity. Additionally, the escalating complexity of cryptocurrency bankruptcy cases is resulting in a staggering profit for legal practitioners.”

Swyftx’s ‘Learn and Earn’ Initiative: A Catalyst for Crypto Literacy or a Risky Lure?

Swyftx, an Australian tech venture, has begun a ‘Learn and Earn’ program to encourage understanding of the crypto-market, with rewards for participants. However, the initiative could inadvertently encourage naive investment. Nevertheless, with courses designed to identify scams, Swyftx aims to improve crypto literacy and discernment in a market filled with digital currencies and potential frauds.

Lawyers, Accountants, and Consultants: The Unforeseen Winners in Crypto Bankruptcy Cases

“In the volatile, uncertain world of cryptocurrency, it isn’t the mining companies or exchanges that are most profitable, but the lawyers, accountants, and consultants, whose wealth originates from the industry’s instability. Its high legal, accounting, and consultancy fees, reaching $700 million in 2022-23, result from complex, time-consuming bankruptcy cases.”

Stellar Lumens’ Impressive Comeback vs Launchpad XYZ’s Potential: Breaking Down the Future of Crypto

Stellar Lumens has experienced a 12% comeback ahead of the Stellar Development Foundation’s announcement. As a key player in stablecoin blockchains, its recovery rally signifies a 16% increase from its double-bottomed support. Its underlying strength suggests a potential 32.68% increase, painting a bullish picture for both new and experienced investors.

Shiba Inu’s Potential Recovery and the Rise of Newcomer Sonik Coin: A Comparative Analysis

“The Shiba Inu (SHIB) token’s price has declined notably but shows promising signs of recovery. Increasing trading volumes and high-value transfers hint at growing market interest. With the relaunch of Shibarium, a layer-two network, the SHIB ecosystem’s future could be bright. However, high-risk assets like crypto offer no guarantees.”

Poland’s Rise as the Blockchain Hub: Reflections from ETH Warsaw Event

“Poland is bolstering its status as a significant blockchain hub within the EU, with ETH Warsaw, the region’s largest blockchain event. The conference highlighted innovation in the crypto world, expressed growing employment preference for those proficient with Web3 and notably recognized the potential of digital currencies and blockchain technology in transforming traditional markets.”

Unveiling the Digital Euro: Europe’s Step Towards CBDCs and What It Means For You

ECB executive Fabio Panetta recently detailed the European Commission’s plans for a digital Euro, asserting this could establish Europe as a leader in central bank digital currencies (CBDCs). The mission focuses on safeguarding European monetary sovereignty, preserving fiscal freedom, and ensuring privacy and data security. However, concerns remain over the compatibility of a digital Euro with existing financial structures.

Dwindling Short-Term Bitcoin Profitability and the Wait for ETF Approval: What’s at Stake?

“Short-Term Holder Spent Output Profit Ratio (STH-SOPR) for Bitcoin fell, indicating less profitable conditions for short-term Bitcoin holders. Amid a Bitcoin price correction, these holders face potential sales that could trigger further price descents. Meanwhile, Bitcoin ETF applications are delayed, cooling investor enthusiasm.”

BitGo and Hana Bank Alliance: A Boost to Crypto Or Regulatory Quagmire?

BitGo, a California-based crypto custodian, plans to collaborate with South Korea’s Hana Bank in unleashing crypto custody services in 2024, dipping the traditional banking industry further into the digital currency revolution. The partnership signifies another vital step towards mainstream acceptance of digital currencies, however, it is important to carefully navigate regulatory challenges.

Deribit’s Resilience: Prospering in Crypto Trading Amidst Global Derivatives Slump

Despite a global slump in derivatives activity, Deribit’s crypto trading volume demonstrated resilience, with the total activity of options, futures, and perpetual futures rising 17% compared to the previous month. This strong performance can be attributed to successful option contracts execution, allowing Deribit to control nearly 90% of global crypto options activity, highlighting its considerable market influence.

Decentralized Exchange Market Boom: The POW Token Phenomenon Vs Wall Street Memes Anticipation

“The decentralized exchange market (DEX) is experiencing a surge, with the POW token (“Pepe of Wall Street”) increasing in value by over +3,000%. This is part of a general upswing in on-chain trading activity called ‘On-Chain Summer’.”

Dogecoin’s Future: Will the Meme Token Gain Traction or Fade Away?

“Despite a slight market dip, Dogecoin (DOGE) showed potential stability with a 2% gain in the last 24 hours. However, its overall gains remain modest and investors remain uncertain. Developments like DOGE-based swaps on Robinhood and potential Twitter integration could boost its adoption, yet the road ahead is still unclear due to a potentially oversaturated meme-token market.”

Euro Digital Currency: Savior or Stumbling Block? A Review of the Potential Pitfalls and Progress

The digital euro by the European Union could face obstacles in non-euro states due to necessary international agreements between the EU and third-countries. Complex issues surrounding Central Bank Digital Currency (CBDC) usage, like unresolved legal queries concerning usage and jurisdiction, may hinder its implementation.

Navigating the Financial Landscape: Cryptocurrency Adoption Divide Among World Exchanges

“A study by the World Federation of Exchanges reveals contrasting sentiments within the financial landscape about cryptocurrency integration. With 41% of global exchange respondents now active in cryptocurrency, there’s a significant industry shift. Nevertheless, one-third remain resistant. While retail investors are interested in digital assets like NFTs and stablecoins, institutional investors prefer security tokens and custody services.”

Boosting Web3 Startups: Cronos Lab’s Accelerator Program Amid Security Concerns

“Cronos Labs has launched a recruitment phase for its $100M accelerator program, aiming to support early-stage projects that promote the adoption of decentralized applications (DApps). However, this strategy can inadvertently lure scammers using government-owned website URLs to dupe victims and access their crypto wallet holdings.”