Immutable is set to launch its Ethereum-based gaming platform, Immutable zkEVM, aiming to enhance the revenue model, player experience, and developer journey in the gaming world. With over 50 games committed to it, the platform is also planning technical upgrades to ensure better compatibility with Ethereum, aiming to foster a harmonious operational relationship between the two platforms.

Search Results for: CEL

Cybersecurity vs User Experience: Harmonizing the Dual-edged Sword of the Crypto Space

The recent SIM-swap scams targeting Friend.tech users signify a trade-off between user experience and enhanced security in the crypto-space. Such scams, exploiting cell phone numbers to loot the victim’s accounts, contributed to heightened cybersecurity concerns. Security firms suggest enforcing two-factor authentication and removal of phone numbers from social media accounts as potential solutions.

From Luxurious Lifestyles to Fugitive Status: The Rollercoaster Ride of Three Arrow Capital’s Founders

“Three Arrow Capital, heavily invested in the Terra protocol’s UST stablecoin, faced a significant deficit with the crypto market’s downfall, defaulting on $3.5 billion credit obligations. The subsequent fallout includes the apprehension of the founder, a 4-month prison sentence, and a nine-year investment ban in Singapore.”

PayPal and the NFT Market: Innovative Strides or Potential Disaster?

“PayPal has lodged an application for an NFT marketplace patent, hinting at a system facilitating the transfer and purchase of NFTs. However, the volatility of NFTs and regulatory gray areas surrounding digital assets pose potential risks and challenges.”

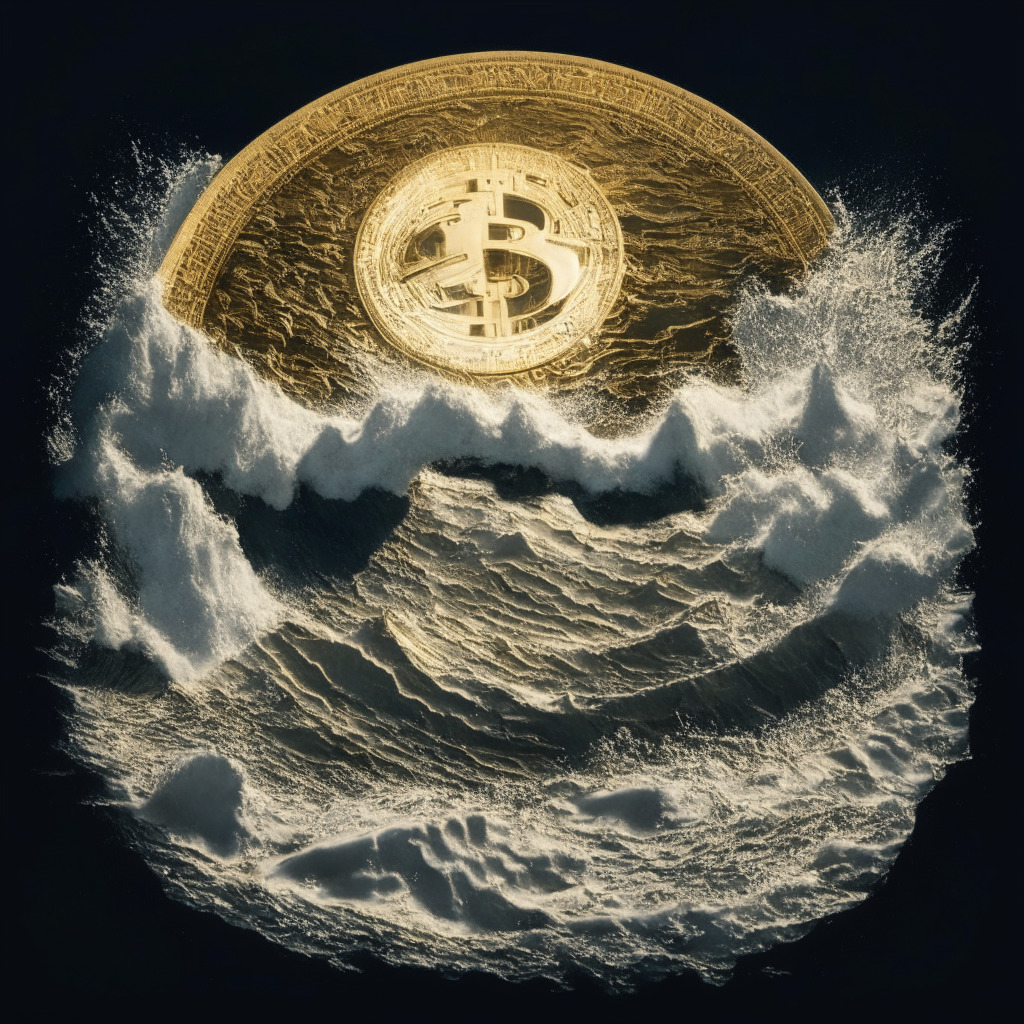

Surge in Cryptocurrency Bull Market: Unravelling the Dynamics and Potential Risks

“Digital currencies are creating significant influences in financial markets, with macroeconomic factors causing market shifts. The future of cryptocurrencies seems promising as institutional investors increasingly embrace them. However, with inherent risks and uncertainties, it’s crucial to make well-researched decisions while envisioning future trends.”

The Trial of FTX’s CEO: Unraveling Fraud Allegations and Crypto Regulation Impact

“The trial of former FTX CEO, Sam Bankman-Fried, is sparking discussions about cryptocurrency regulations. Accused of using customer funds for personal gain, his trial highlights pressing issues surrounding trust and accountability in crypto markets. The verdict may influence future regulatory decisions in this burgeoning technological domain.”

Decentralized Lending Protocol Shutdown vs. El Salvador’s Cryptocurrency-Powered Growth: A Tale of Crypto’s Dynamic Landscape

“Yield Protocol, a decentralized lending protocol, plans to cease operations by end of 2023 due to unsustainable business demand and mounting regulatory pressures. Meanwhile, El Salvador launches renewable energy Bitcoin mining operation, Volcano Energy, exemplifying the industry’s dynamic nature.”

Unleashing the Bull: Bitcoin’s Prospects Amid Rising U.S Treasury yields and Looming Economic Unrest

Recent developments in the US economy, such as rising treasury yields and national debt, suggest a bullish future for Bitcoin. Former crypto exchange CEO, Arthur Hayes, speculates this could lead to mass liquidity injections, possibly triggering a Bitcoin bull run. However, the volatile interplay between these economic factors also warrants caution.

Ripple vs SEC: The Unresolved Story in the Crypto Legal World

In the ongoing legal battle between Ripple and the SEC, Judge Torres recently rejected the SEC’s planned appeal. While some view this as a significant win for Ripple, other experts warn against premature celebration. Refusal of the appeal doesn’t signal outright defeat for the SEC, but only means they have to appeal everything at once post-trial. However, a challenging factual record could make a successful appeal more difficult.

Crypto Regulation Variance: SEC vs Coinbase and Argentina’s Proposed Digital Currency

“The SEC and Coinbase are in court, debating securities registration for crypto assets. Meanwhile, Argentina’s presidential candidates propose differing cryptocurrency solutions to economic issues: introducing a digital currency or supporting Bitcoin and abolishing the central bank.”

Crypto Wallet Sanctions: A Necessary Countermeasure or a Threat to Blockchain Progress?

“US authorities sanctioned a series of crypto wallets connected to fentanyl manufacturing, casting a sceptical light on the blockchain sphere. These developments spotlight identity concealment and transaction monitoring issues on blockchain platforms. Balancing the issue, blockchain’s global scalability brings potential for a more democratised financial future, requiring robust regulations and security measures.”

FTX Scandal: A Closer Look at the Impact on Crypto Regulations and Market Trust

“Bankman-Fried’s trial, following suspicious activities at FTX, serves as a crucial reminder of transparency and regulation’s importance in chaotic cryptocurrency markets. The case could spur stricter regulations and an environment to easily track illegal activities, despite resistance from the crypto community.”

Crypto Market Mirage: Bitcoin’s Dance on the $28,000 Line – Hope or Despair?

Bitcoin, following a triumphant surge past the $28,000 mark, succumbed to market volatility and slid down to $27,500. This displays a profound market unpredictability with imminent oscillatory patterns that can potentially steer investors towards safety, driving capital away from cryptocurrencies. However, a symmetrical triangle pattern suggests a possible bullish momentum.

Navigating the Flux: Subtle Downturns vs Growth Potential in the Crypto Market

“As BTC, ETH, BNB, and XRP encounter slight market decrement, ADA and SOL show modest increments, displaying resilience and growth potential amidst the volatile crypto market. Could these, against the slight market retreat, indicate an approaching upturn?”

The $75 Million Crypto Deal That Disrupted Tom Brady’s Life and FTX’s Failure

“Cryptocurrency market has expanded beyond exchanges, attracting diverse individuals including sports legends like Tom Brady. The financial collapse of FTX, however, has underlined the unpredictability and risks in the crypto world, highlighting the importance of caution and due diligence.”

Unfolding the DRAM Narrative: A Dirham-Backed Stablecoin Amid Regulatory Challenges

“Distributed Technologies Research has developed DRAM, a Dirham-backed stablecoin listed on DeFi protocols Uniswap and PancakeSwap. The stablecoin aims to bring stability to countries with high inflation, linked to UAE’s native currency performance. However, regulatory limitations present challenges to its acceptance and growth.”

The Urgency of Global Cooperation in Crypto Regulation: Lessons from Banco de Portugal’s Governor

Mário Centeno, governor of Banco de Portugal, advocates for a universal framework for crypto regulation due to the global nature of digital assets. He believes national efforts alone won’t adequately protect investors, warning against potential regulatory arbitrage and exploitation of gaps by less ethical participants.

Shaping AI Future: Samsung, Tenstorrent Alliance, and the Global Politics Surrounding AI Chips

Samsung partners with Canadian startup Tenstorrent to develop AI chips, using advanced Samsung manufacturing processes. This innovation, fuelled by a successful funding round, has the potential to create high-performance computing solutions for global customers. However, challenges remain in a fluctuating AI chip market and evolving geopolitical dynamics.

Navigating the Metaverse Decline: Lamina1’s Defiant Journey Amidst AI Deepfake Controversies

Despite decreased interest in the metaverse, Neal Stephenson’s Blockchain project, Lamina1, continues its vision, organizing events to encourage metaverse-driven experiences. CEO Rebecca Barkin expresses optimism, noting the continued investment in digital experiences, gaming, and new technological explorations.

Ethereum Stays Strong Amidst Market Dip: Exploring New Altcoin Opportunities and Risks

“ETH experienced a slight dip of 3.5% but overall displays a significant 39% gain since the start of the year. The 30-day moving average continues to ascend, suggesting a promising outlook. Newcomer altcoins like Meme Kombat (MK) also show promise, but investments should be researched thoroughly due to high risks.”

Crypto Banking Risks Exposed: Unpacking the Silvergate Bank Collapse and the Future of Fintech

Silvergate Bank’s demise, largely due to over-reliance on high-risk cryptocurrency deposits and internal managerial faults, raises questions about the risk exposure involved in being a single-industry lender. Amidst this, the crypto lender, Celsius Network, plans a recovery with a reorganisation plan, a move which is closely watched by regulators and businesses banking on crypto.

Legal Clash: Binance, FTX, and the Battle for Crypto Dominance

This lawsuit targets Binance and CEO Changpeng Zhao over allegations of unfair competition and monopoly, claiming Zhao’s actions catalysed the downfall of rival crypto exchange, FTX. The case also examines Binance’s sudden decision to liquidate FTT tokens, Zhao’s misleading claims, and his damaging disclosures on Twitter. Furthermore, it involves the SEC’s scrutiny of Binance.

Debut of Ethereum Futures ETFs: A Tepid Response, or Just the Beginning?

The debut of nine new Ethereum futures exchange-traded funds (ETFs) drew under $2 million in trades on their first day, questioning their viablility. Commentary suggests investors might lean towards spot ETF products over futures – a potential trend for future product innovations.

Dismissed Lawsuit Against Terraform Labs: A Twisted Tale of Fraud, Regulation and Crypto ETFs

“Investors have dropped a lawsuit against Terraform Labs amidst cryptomarket volatility. While Terraform and its co-founder, Do Kwon, face regulatory scrutiny and ongoing legal troubles, financial firm Volatility Shares has postponed its ETH futures ETF launch. Amid uncertainty, the need for investor due diligence and risk assessment becomes increasingly important.”

Deciphering the Grey Areas: Blockchain Regulations in Light of the FTX Debacle

“The sequential nature of the blockchain forms the bedrock of cryptocurrencies, yet it faces regulatory scrutiny. An incident involving Sam Bankman-Fried of FTX has catalyzed attention towards regulations around blockchain. Amid this, Taiwan and Hong Kong have imposed stringent rules on crypto exchanges. Regulation, seen as essential to prevent crises like the FTX debacle and ensure trust in this booming market, hangs in the balance as the blockchain leaps into the future.”

Singapore’s Crypto Haven Status: An Alluring Opportunity or a Regulatory Minefield?

GSR Markets, a subsidiary of cryptocurrency market maker GSR, has secured in-principal approval for a Major Payment Institution (MPI) license from the Monetary Authority of Singapore. This may speed up the adoption of Web 3.0 and boost business investments in the APAC region, while demonstrating Singapore’s favorable stance toward cryptocurrencies.

Rising Star: Wall Street Memes Coin’s Astonishing Journey from Debut to 4th Most-Traded Meme Coin

Wall Street Memes ($WSM) has become the fourth most traded meme coin globally within a week of its listing on OKX, with nearly $60 million worth of $WSM traded. This new player in the meme coin market has gained popularity due to its connection with Elon Musk and its distinct feature – a staking system for users. While $WSM’s future seems promising, potential risks and challenges specific to meme coins should be considered carefully.

The Great Crypto Juxtaposition: RNDR vs TG.Casino – Risks, Rewards and the Investor’s Tightrope

“Render’s token RNDR shows resilience with a 6% surge despite a previous 57% market fall. Meanwhile, the crypto universe welcomes a new entrant, TG.Casino, integrating casino excitement with blockchain technology. Both present diverse opportunities and risks in the dynamic world of cryptocurrencies.”

Blockchain’s Bloodbath: Fathoming the $332 Million September Crypto Wealth Drainage

“September 2023 heralded a significant blow to the crypto world, with a staggering $332 million lost to various exploits, scams, and hacks. The biggest loss, however, came from exploits, causing about $329.8 million damage. High-profile cyber attacks underscore the need for enhanced security in the crypto-ecosphere and highlight the potential misuse of cryptocurrency.”

Cryptocurrency’s ‘Uptober’: A Bullish Mirage or a Substantial Surge?

This October recorded an unexpected upsurge in crypto heavyweights like Bitcoin and Ethereum, rooting positive forecasts. The sudden increase liquidated $70 million in short positions and substantiated ‘Uptober’ as a bullish month for cryptocurrencies. However, this optimism should be paired with calculated vigilance due to market unpredictability.

VanEck Promises 10% of Future Earnings to Ethereum’s Core Developers: A Game Changer?

VanEck announced it will dedicate 10% of upcoming earnings from its Ethereum futures ETF to Ethereum’s core developers, via The Protocol Guild. Other crypto-communities including Lido Finance and Uniswap are also supporting the Ethereum network, with $12 million raised publicly so far.

VanEck’s Philanthropic Twist to Ether Profits meets an Ominous FTX Hacker: A Tense Duality for Ethereum Investors

“Asset manager VanEck has committed to donate 10% of profits from its forthcoming Ether futures exchange-traded fund (ETF) to Ethereum core developers for ten years. In collaboration with several crypto-supporting groups, the aim is to strengthen the Ethereum network. However, activity in the wallet of a major hacker could indicate a selling trend, potentially impacting Ether’s price.”