Coinbase Chief Legal Officer Paul Grewal urged Congress to adopt a draft bill outlining a regulatory framework for cryptocurrency transactions, following a lawsuit by the SEC against the company. Grewal criticized the SEC’s enforcement-only approach, instead advocating for transparent legislation applied equally to all. The proposed bill aims to classify digital assets and determine regulatory authority.

Search Results for: Commodity Futures Trading Commission

Navigating the Crypto Regulatory Landscape: CFTC’s Approach and Balancing Innovation

The CFTC Chair Rostin Behnam dismissed claims of being a “light touch regulator” in the cryptocurrency space, emphasizing the commitment to imposing a necessary regulatory framework adaptable to the evolving crypto landscape. Lawmakers consider legislation clarifying when digital assets are securities and the registration process for intermediaries.

Conflicting Crypto Classification: CFTC vs SEC Showdown and Its Impact on Investors

Conflicting opinions between the CFTC and SEC on cryptocurrency classification create uncertainty in digital asset regulation. SEC Chairman Gary Gensler asserts all cryptocurrencies, apart from Bitcoin, qualify as securities, while CFTC Chairman Rostin Behnam reaffirms Ethereum as a commodity. As regulatory debates continue, understanding the evolving landscape is essential for safe crypto investment.

Crypto Regulation Debate: Balancing Market Stability and Innovation Amid SEC Lawsuits

The House Agriculture Committee’s recent hearing on crypto spot market regulation highlights the need for clear industry regulations. CFTC Chair Rostin Behnam emphasized crypto token classification, regulatory clarity, and concerns over financial instability. The SEC’s charges against Binance and Coinbase further underline the urgent need for a proper regulatory framework to protect investors and promote innovation.

Crypto Tax Compliance Pressure and North Korea’s Alleged Laundering: A Troubling Connection

The crypto industry faces increasing pressure for tax compliance as US Congress members urge Treasury and IRS to implement regulations. Meanwhile, funds from the $35 million Atomic Wallet hack are traced to Sinbad.io, allegedly involved in laundering over $100 million in cryptoassets.

Binance vs. SEC: Crypto Community Trusts the Exchange Amid Legal Challenges and Uncertainty

In a recent Twitter poll, over 85% of 127k voters expressed trust in Binance over the US SEC, reflecting the crypto community’s dissatisfaction with the SEC’s regulatory approach. Binance and other prominent crypto players face SEC charges, yet Binance maintains users’ support despite ongoing legal challenges and investigations.

CFTC Greenlights Cboe For Crypto Derivatives Expansion: Analyzing Implications and Risks

The CFTC has granted Cboe Global Markets approval to expand its range of crypto-related products as a derivatives clearing organization. This allows Cboe to offer clearing services for digital asset futures on a margin basis while implementing risk-reduction measures, signaling an evolving relationship between traditional finance and digital assets.

Navigating the Crypto Bill Debate: Balancing Innovation and Investor Protection

U.S. lawmakers are introducing a crypto bill to provide regulatory clarity for Bitcoin and cryptocurrency industry amid significant market growth. Major players like Coinbase, Robinhood, and CFTC will testify before Congress, discussing regulations and fostering responsible innovation while protecting investors.

Revealed: Binance’s Influence Over Affiliate Binance.US Bank Accounts Raises Concerns

Bank records reveal Guangying Chen, a senior executive at Binance, as the primary operator for several Binance.US bank accounts, raising concerns about Binance’s influence over its supposed independent affiliate. This disclosure intensifies scrutiny as Binance faces legal action from U.S. regulatory agencies.

US House Agriculture Committee Hearing: Balancing Crypto Regulation and Innovation

The US House Agriculture Committee’s hearing, “The Future of Digital Assets: Providing Clarity for Digital Asset Spot Markets,” aims to discuss legislation for regulating cryptocurrencies, with important figures like CFTC Chairman Rostin Behnam and Coinbase Chief Legal Officer Paul Grewal testifying. Balancing strict regulations and fostering innovation remains a challenge in shaping the digital asset industry’s future.

Binance Privacy Coin Delist: Overreaction or Regulatory Compliance Necessity?

Binance recently delisted privacy coins like Monero and ZCash in several countries, raising concerns. Privacy coins can comply with regulations and provide user adoption benefits. Exchanges should collaborate with regulators to maintain privacy while ensuring legal compliance, instead of banning privacy coins without obligation.

SEC vs. Ripple: How Hinman’s Decentralization Views Shape the Future of Crypto Regulation

The SEC’s modification of William Hinman’s biography page has sparked speculation among digital asset enthusiasts, given his relevance in the ongoing Ripple-XRP case. Hinman’s 2018 speech on decentralization and the regulatory classification of Bitcoin and Ethereum may influence legislative proposals targeting the digital assets industry, potentially leading to significant SEC oversight and Safe Harbor provisions for certain projects.

Binance Faces SEC Charges: Balancing Innovation and Compliance in Crypto

The SEC has charged Binance Holdings Ltd. and its US affiliates with multiple offenses, alleging blatant disregard for federal securities laws and placing investors’ assets at significant risk. The mounting regulatory pressure highlights the evolving landscape and the industry’s need to adapt practices to ensure market safety and stability.

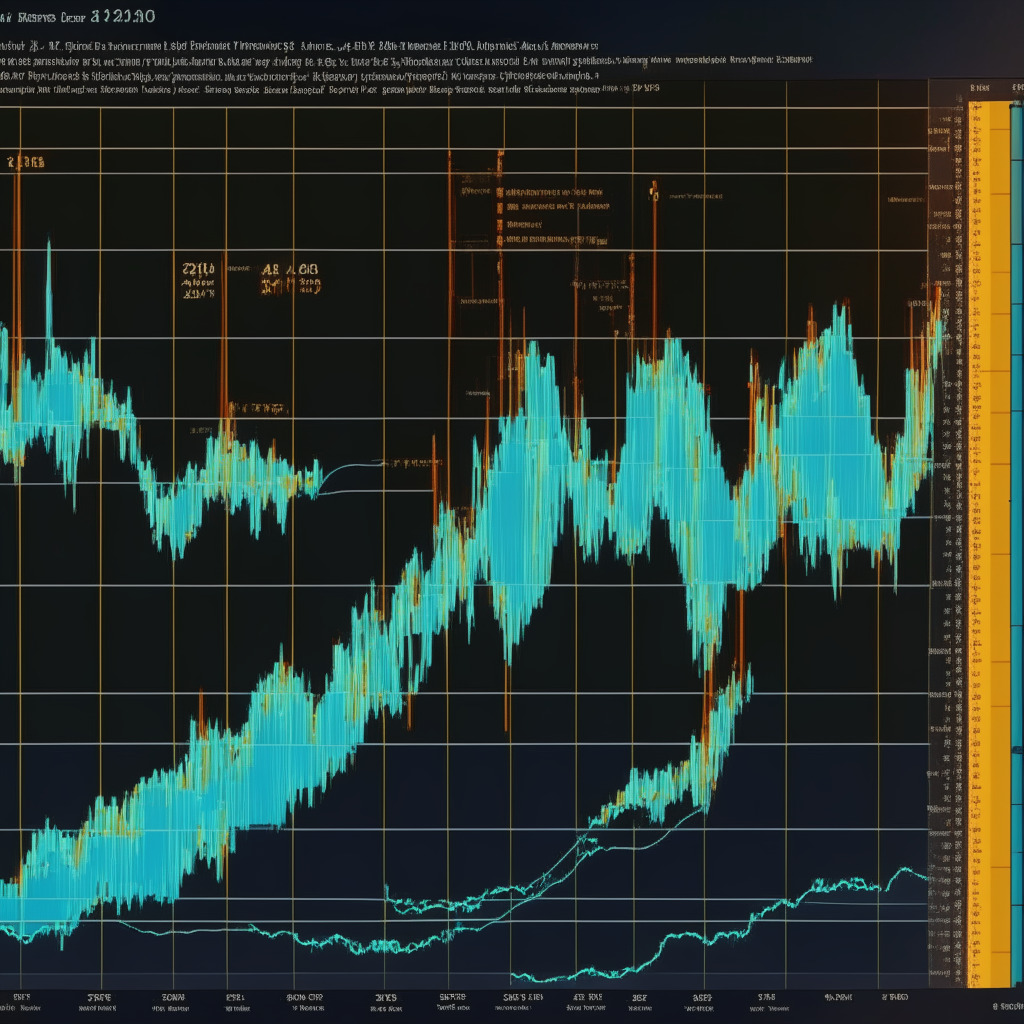

Crypto Market Drop: Unraveling the SEC’s Binance Lawsuit and Exploring Low-Cap Crypto Gems

The cryptocurrency market witnessed a significant intraday drop after the SEC announced a lawsuit against Binance, Binance.US, and founder Changpeng Zhao. The lawsuit accuses them of offering unregistered securities, causing Bitcoin and Ether to drop 5% and 4% respectively. This adds to the growing uncertainty in the crypto industry.

CBDCs: Balancing Economic Growth, Privacy, and Government Surveillance Risks

Concerns over government surveillance in central bank digital currencies (CBDCs) persist, with only 9% of Consensus 2023 attendees believing a surveillance-free government-backed digital currency is possible. To mitigate these concerns, suggestions include adopting open-source code, transparent minting processes, and allowing users control over their financial data. Balancing economic growth and privacy remains a pertinent challenge in embracing digital currencies.

Binance vs SEC: Unveiling the Regulatory Conflict in the Crypto World

The U.S. Securities and Exchange Commission (SEC) has filed a lawsuit against crypto exchange Binance and CEO Changpeng “CZ” Zhao, accusing them of violating federal securities laws. The SEC claims that Binance acted as an unlicensed stock exchange, raising concerns about its legitimacy and security. This case highlights the ongoing conflict between cryptocurrency’s decentralized nature and the need for regulatory oversight to ensure safety and stability in the market.

Richard Teng: The Key to Binance’s Regulatory Future or a Mere Illusion?

Binance, facing numerous regulatory challenges, may find a way forward with potential CEO successor Richard Teng, a civil servant-turned-crypto executive. Teng’s background in Singapore’s central bank and Abu Dhabi’s free-trade zone makes him an exceptional candidate to guide Binance through its regulatory storm and help the company navigate complex regulatory landscapes.

SEC Lawsuit Against Binance: Impact on Crypto Market and Balancing Regulation with Innovation

The SEC has filed a lawsuit against Binance and CEO Changpeng Zhao, accusing them of violating securities regulations in the US. This has caused Binance’s BNB token price to drop 8% and affected major cryptocurrencies like Bitcoin and Ethereum. As the case unfolds, the crypto market awaits further developments and potential price impacts, raising questions about balancing regulatory oversight with fostering innovation in the blockchain and cryptocurrency space.

Binance Lawsuits and Crypto Regulations: Striking a Balance for Market Future

The crypto market faces regulatory challenges, with Binance facing lawsuits from the CFTC and SEC. The classification of top cryptocurrencies as securities adds confusion, emphasizing the need for comprehensive regulatory guidelines to balance innovation and investor protection.

Proposed Crypto Bill: Balancing SEC Power and Fair Regulation in Digital Asset Industry

A drafted crypto bill proposed by Republican lawmakers aims to establish a clear framework for digital assets and hold regulatory bodies like the SEC and CFTC accountable for their actions, potentially changing the way digital assets are regulated. The bill could encourage fair enforcement practices, ensure consumer safety, and support innovation within the cryptocurrency markets.

Bipartisan Efforts for Clear Digital Asset Regulations: Can SEC and CFTC Find Common Ground?

Two Republican lawmakers from the US House Financial Services Committee and the House Agriculture Committee are working on a discussion draft to regulate digital assets, aiming to establish clarity in determining when a digital asset is considered a security. The draft legislation, “Digital Asset Market Structure Discussion Draft,” proposes a process for treating digital assets and seeks a unified path for SEC and CFTC jurisdictions.

SEC-Registered Crypto Exchanges: Boon or Bane for Digital Assets Future?

A proposed bill could allow crypto exchanges to register with the U.S. SEC, enabling trading of digital securities, commodities, and stablecoins in one place. However, it faces caveats such as lack of Democratic support and ongoing SEC authority over asset jurisdiction.

Elon Musk’s DOGE Lawsuit, Silvergate Bank Liquidation, and CBN’s Crypto Ban: A Tumultuous Week in Crypto

Elon Musk faces a proposed class action lawsuit by investors alleging manipulation of Dogecoin (DOGE) cryptocurrency, causing billions in losses. Meanwhile, private bank Xapo integrates with the SEPA network, and the US CFTC invites comments on risk management program changes.

Binance Market Share Shrinks by 25%: Regulatory Pressure and Market Conditions to Blame

Binance’s market share has dropped by 25% due to increased regulatory scrutiny from the US and termination of a zero-fee trading campaign. Other crypto exchanges, such as Huobi and OKX, have witnessed increased market shares since March.

Bitcoin Momentum Amid US Nonfarm Payroll and Mining Expansion: Risks and Rewards

Bitcoin’s price gains momentum as market participants anticipate positive outcomes from the US Non-Farm Payroll data release and its impact on the US dollar. Growing demand in cryptocurrency mining and CFTC’s reassessment of risk management regulations create a bullish momentum for Bitcoin.

CFTC’s Risk Management Revamp: Balancing Crypto Security and Innovation

The CFTC is considering a revamp of risk management rules in response to emerging technologies like digital assets and their associated risks. Commissioner Christy Goldsmith Romero emphasizes the need for updated regulations, striking a balance between protecting investors and fostering industry growth while dealing with cryptocurrency adoption.

Digital Asset Regulation: Bridging the Divide Between CFTC and SEC in Upcoming Congressional Hearing

US lawmakers will discuss “The Future of Digital Assets: Providing Clarity for Digital Asset Spot Markets” in a congressional hearing on June 6. Collaboration between regulatory committees like the CFTC and SEC is essential to address concerns in the digital assets space, focusing on effective guidelines and fostering innovation while safeguarding consumer interests.

Binance Denies Layoffs Amid Growth: Balancing Talent Density and Regulatory Compliance

Binance denies cutting 20% of its staff, instead emphasizing its exponential growth and cyclical talent density audits. The company faces regulatory scrutiny from the CFTC, IRS, and federal prosecutors over crypto derivatives and inadequate AML/KYC adherence, highlighting tensions between market growth and regulatory compliance.

Cryptocurrency Turmoil: Navigating Regulatory Shifts and Unexpected Market Surges

Cryptocurrencies face a bear market due to Federal Reserve’s tightening monetary policies, causing Bitcoin to drop 3% within 24 hours. Meanwhile, the CFTC issues warnings for companies to counter risks in clearing digital asset transactions, and XRP sees an 8% increase in value amid settlement speculations in the SEC/Ripple legal case.

XDC Network and SBI VC Trade: Bridging Blockchain and Japanese Trade Finance Market

The XDC Network is partnering with SBI VC Trade to expand its presence in the Japanese market and enhance the trading experience. This collaboration aims to streamline the trade finance sector by improving transparency, traceability, and cost reduction while fostering blockchain adoption in the international trade and finance industries.

CFTC Advisory on Digital Assets: Balancing Innovation and Compliance in Blockchain Future

The CFTC issued a staff advisory to derivatives clearing organizations, emphasizing compliance in areas related to digital assets: system safeguards, conflicts of interest, and physical deliveries. These concerns highlight the balance between fostering innovation in the digital asset space, and protecting investors and businesses. Regulators’ efforts contribute to a more secure and sustainable ecosystem for digital assets.

Increased CFTC Crypto Oversight: Balancing Regulation, Innovation, and Market Security

CFTC’s Division of Clearing and Risk (DCR) is increasing scrutiny on cryptocurrencies, focusing on potential risks and adherence to core principles. The move aims to provide security and clarity for investors while balancing innovation and market stability in the rapidly evolving crypto industry.