“CommEx, despite acquiring Binance’s Russian division, insists it’s an independent start-up – an assertion drawing intrigue and speculation due to overlaps with Binance’s style and technology. Alongside this, Binance is facing shrinking market presence due to escalating regulatory scrutiny, adding complexity to the crypto landscape dynamics.”

Search Results for: ada

Gold Rush or Bitcoin Boom: Costco’s Sell-out Sparks Investment Potential Debate

“Gold and Bitcoin do battle as reliable investment options in times of economic turmoil. With gold’s steady reputation and Bitcoin’s digital-age appeal, both asset types present enticing opportunities for value preservation and capital growth despite differing volatility levels and market dynamics.”

Google Cloud Joins Polygon PoS Network: Boost to Cryptosphere or Threat to Decentralization?

Google’s entry into the Polygon PoS network could lift the blockchain’s credibility and promote mainstream adoption. But worries about centralization arise, potentially favoring powerful players over blockchain’s spirit of decentralization. With Google Cloud as a validator, maintaining a balance between corporate involvement and the founding principles of decentralization is essential.

Bullish Moves: Top Altcoins Poised to Break Resistance; A Detailed Crypto Market Outlook

“The crypto market outlook brightens as major altcoins like BTC, ETH, BNB, ADA, and SOL attract attention. However, while trading these digitized assets, crypto pioneers suggest ensuring safety, conducting meticulous research before making investment or trading moves.”

Valkyrie Shifts Strategy: From Ether Futures to ETFs, What’s the Real Story Behind?

Valkyrie, an asset management firm, has refrained from preemptive Ether futures contract purchases, instead awaiting the sanction of an exchange-traded fund (ETF) by the SEC. This move signifies a shift from earlier plans to advance purchases in anticipation of a combined Bitcoin and Ether Strategy ETF.

Zumo’s Compliance with FCA Guidelines: Signifying Innovation and Commitment in Crypto Industry

Zumo, a digital asset-as-a-service platform, became the first cryptocurrency company to incorporate the Financial Conduct Authority’s new financial promotions technical flow guidelines. These rules aim to protect consumers investing in cryptocurrencies. Zumo’s adherence signifies commitment to regulation, user protection, and industry integrity.

Unveiling the Shadows: Binance Russia’s Acquisition by CommEx Raises Intriguing Questions

Binance Russia has been acquired by an obscure firm, CommEx, whose owners’ identity remains a mystery. However, CommEx has been busy building its platform independently while employing several ex-Binance staff. The debate about the real ownership of CommEx continues to heat up due to their adamant secrecy.

Unraveling the Crypto Carousel: SEC vs Binance, and the Circle Defence

The blog post discusses the legal fight between the SEC and cryptocurrency exchange Binance over the classification of digital assets as securities. It also touches on Circle’s argument that stablecoins linked to the U.S. dollar, such as BUSD and USDC, shouldn’t be categorised as securities. The outcome of the legal battle could greatly impact the future of cryptocurrency regulations.

Epic Games’ Layoff and FTX Scandal: Cautionary Tales from the Digital Frontier

“Epic Games, maker of Fortnite, laid off 16% of its workforce due to ‘unrealistic’ metaverse ambitions. Its spending exceeded earnings, with CEO Tim Sweeney citing the Creator program, permitting players to build and sell content, as a contributing factor.”

Exploring Russia’s Pivot to Crypto: Boosting Trade Ties or Cannibalizing Traditional Banking?

Russian entrepreneurs aim to use “digital assets” and a “unified digital currency” for trade with BRICS and other nations. The idea of utilizing digital financial assets (DFAs), which may encompass digitized commodities, CBDCs, digital securities, cryptoassets, and stablecoins, in international payments is garnering attention. The possibility of creating a unified digital currency for cross-border transactions is also being evaluated.

Turmoil in Crypto Markets: The Rise and Fall of Frontier and the Promise of Launchpad XYZ

“Despite Frontier’s (FRONT) recent price decreases, potential consolidation could signal another surge. However, careful observation of key levels is crucial. Meanwhile, Launchpad XYZ is constructing the infrastructure for simplified Web 3.0 investing, aiming to unlock blockchain potential for mainstream audiences and prioritize education, accessibility, and simplicity.”

Burning Man and DAOs: A Hybrid Model for Decentralized Governance and Broader Adoption

“Decentralized Autonomous Organizations (DAOs) could gain broader acceptance and adoption by marrying central planning with decentralized governance. This hybrid model could allow DAOs to gain recognition outside the crypto sphere, potentially fostering broader appeal and breaking away from their crypto rigidity.”

Embracing Digital Assets: A Rewarding Yet Daunting Shift for Traditional Financial Institutions

Adding digital assets to traditional portfolios has its unique opportunities and challenges. Navigating the novel landscape of digital assets requires risk management, understanding of blockchain technology, robust cybersecurity protocols, and a focus on legal compliance amidst evolving regulations. Embracing digital assets is a transformative journey redefining conventional financial systems.

Expanding Horizons: Ledn’s Ethereum Yield Product & Coinbase’s Regulatory Campaign

Ledn is introducing an Ethereum yield product in response to user demand for simpler staking alternatives. Their new offering is “ring-fenced,” providing a safety layer against bankruptcy. Ledn is also launching a stablecoin Growth Account, though not available in the U.S. or Canada. Meanwhile, Coinbase is seeking clearer crypto regulations, despite skepticism due to political and regulatory concerns.

Tottenham Hotspur Embraces Blockchain: Balancing Fan Monetization and Complex Regulations

Tottenham Hotspur embraces blockchain technology, partnering with the Chiliz blockchain to launch a Web3 fan token unlocking unique privileges. However, the absence of comprehensive blockchain token regulation presents potential challenges for fans and sport entities navigating this technology.

Pepe Coin’s Resurgence Vs The Rise of TG.Casino: Navigating the Crypto Gaming Space

While Pepe Coin (PEPE) recently saw a 5% rise and a 91% increase in trading volume, its future remains uncertain with potential resistance looming. On the other hand, TG.Casino ($TGC), a budding crypto gaming ecosystem, offers promising growth with robust encryption, a functional token system and swapping capabilities, urging prospective investors to look closely at the disrupting token’s merits.

Soaring Altcoins: Compound’s (COMP) Remarkable Climb and the Potential of TG.Casino (TGC)

“COMP altcoin witnesses a steady rise with a notable increase in the number of wallets and transactions, hinting at a bullish trend and a possible breakout. The booming DeFi platform, Compound, shows an 87% surge in unique active wallets and a 75% transactions boost, attracting users in the lending and borrowing sectors. Increased usage of platforms like Compound reflects their inherent future potential.”

Bitcoin Halving 2024: Boon or Bane for Miners, and the Ripple Effects on the Blockchain Ecosystem

“Blockchain technology continues to break boundaries as it evolves at a rapid pace. Despite the uncertainty of the upcoming Bitcoin halving event in 2024, the resilience and adaptability of blockchain remain indisputable, making its future exciting.”

Europe’s Rising Role in Driving Institutional Cryptocurrency Adoption: A Regulatory Perspective

The recent Blockchain Expo in Amsterdam highlighted Europe as the key driver for institutional cryptocurrency adoption due to its favorable regulatory climate. The European Union’s Markets in Crypto-Assets (MiCA) regulation is implicated as a safety net, offering a regulatory framework for the emerging sector and ensuring user protection, which are lacking in countries like the United States.

Meta AI vs OpenAI’s ChatGPT: The Dawn of a New Social Media Interaction Era and Its Ramifications

“Mark Zuckerberg sets to launch Meta AI, interacting across platforms like Instagram and Facebook. Aiming to outdo OpenAI’s ChatGPT, Meta tailors AI products to distinct use cases and entertainment, scheduled to release to selected U.S users and integrate with upcoming smart glasses.”

Cryptocurrency Market: A Tug of War Between Bulls and Bears in Flux

“In the ebb and flow of the cryptocurrency market, BTC held its ground despite the fluctuating market and signs of trader stagnation. Investment in the market continues, potentially signaling a market reversal. However, competitive tension and high unpredictability dominate, urging traders to tread cautiously amidst volatility.”

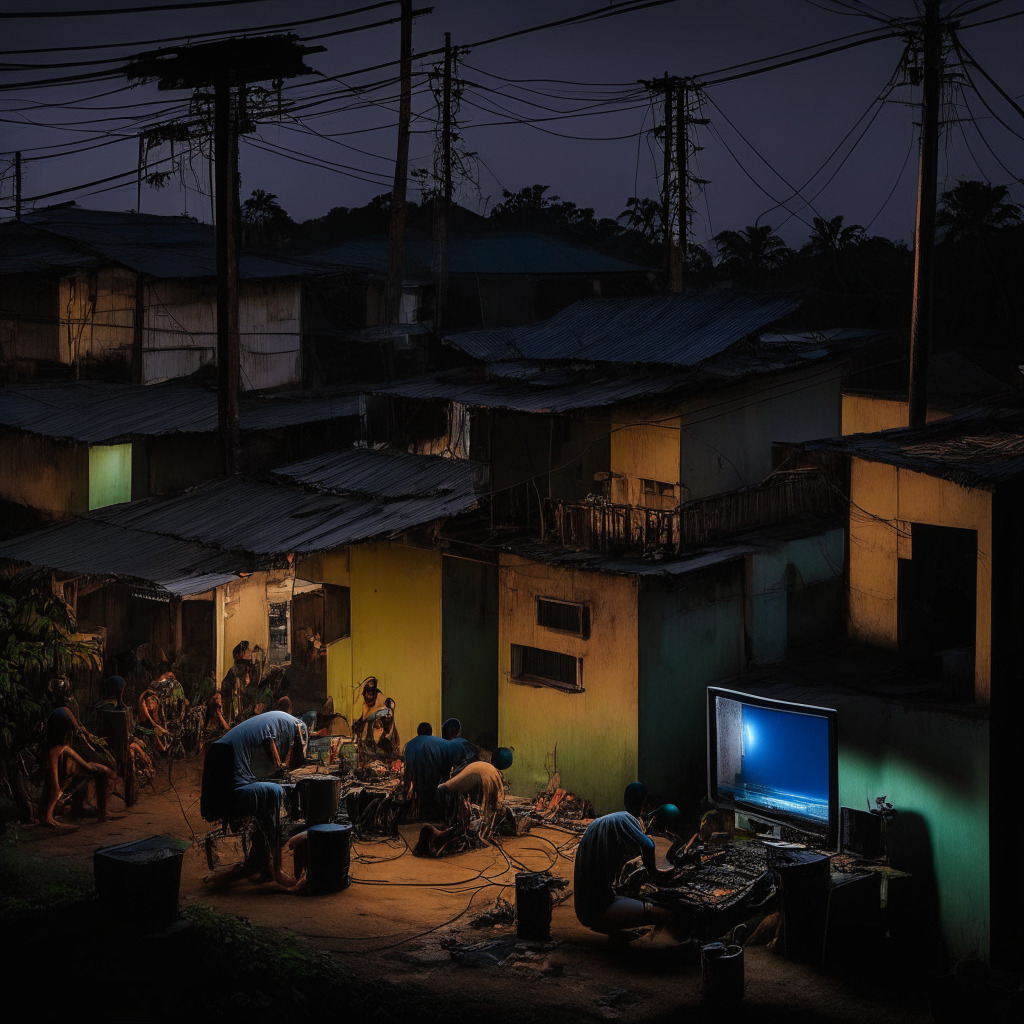

Illegal Crypto Mining in Sarawak: A Double-Edged Sword of Technological Advancement and Risk

“Illegal crypto mining operations in the residential areas of Sarawak, Malaysia, have resulted in recurrent power disruptions. Investigations revealed 74 unauthorised cryptocurrency mining servers connected to direct tapping cables, risking short circuits, fires, and even loss of life. Unrecorded consumption caused substantial economic damage, prompting utility firms, police, and anti-corruption agencies to develop new electricity theft detection methods.”

AI vs Human Authored Content: Google’s Policy Shift Raises Questions on Web Knowledge Reliability

“In a significant policy shift, Google now accepts content generated by artificial intelligence (AI). This change brings several issues to light: defining quality content, distinguishing between human and AI-written work, and the reliability of AI-produced content. This shift may escalate unchecked and unsourced information on the internet.”

Chase UK’s Crypto-Restriction Sparks Controversy: A Clash Between Banks and Blockchain Innovation

“JPMorgan Chase subsidiary, Chase UK, has decided to restrict crypto-related transactions, triggering criticism. Coinbase CEO Brian Armstrong slammed the move as ‘totally inappropriate’, aggravating existing friction between traditional banks and the cryptocurrency market, highlighting regulatory uncertainties and disputes in operating Crypto. The restrictions imposed could potentially hinder crypto growth and innovation.”

Decoding Terra Luna Classic’s Potential Turnaround: Governance Proposals and the Rise of New Altcoins

The Terra Luna Classic cryptocurrency sees encouraging performance following the endorsement of governance proposals aimed at slowing USTC minting and suggesting a burn of this stablecoin. This could potentially re-peg the value of USTC and initiate LUNC’s recovery rally. Increasing short-term support hints that LUNC may soon bounce back, if said proposals are effectively implemented.

Shifting Sands: How Stringent Crypto Regulations Impact the Future of Exchange Platforms in Europe

“Crypto exchange Gemini discontinues its services in the Netherlands due to stringent regulations instituted by the Dutch central bank. Gemini intends to comply with the Markets in Crypto-Assets Regulation (MiCa), before reopening for Dutch users. These regulatory tightening trends raise questions about the future of crypto platforms in the European Union.”

Kraken’s Expansion in Europe: Spearheading the Crypto Revolution with Key Regulatory Approvals

Crypto exchange Kraken has secured regulatory approvals in Spain and Ireland, furthering its expansion plans in Europe. With a Virtual Asset Service Provider license and an EU e-money license, Kraken will provide digital asset exchange and custodial wallet services.Investment into regulatory framework positions Europe as a promising arena for crypto growth.

Sanctioned Wallets and Blockchain’s Crime Deterrence: Navigating Regulation and Innovation

“The US Treasury recently sanctioned an Ethereum wallet linked to illicit fentanyl trafficking, underlining how blockchain technology can help curb illegal activities. Despite its anonymity, the crypto world can be vulnerable to exploitation by nefarious entities. While some see increased scrutiny as encroachment on privacy rights, without regulation, the blockchain could become a haven for miscreants.”

The Tug of War: Crypto Trading Bots vs Human Traders – Who Outshines Whom?

“Trading bots in cryptocurrency markets can significantly ease trading burdens by automating 24/7 operations. However, they lack human intuition vital for sudden market shifts. Thus, human oversight and periodic manual intervention remain imperative for maintaining balanced operations and effective trading strategies.”

Bitcoin vs. Bitcoin Minetrix: A New Contender in the Crypto Mining Arena

“Bitcoin Minetrix ($BTCMTX), offers a decentralized mining solution based on cloud computing where stakers earn credits for Bitcoin mining. Utilizing Ethereum’s secured smart contract platform, it helps reduce costs and automatically manages user allocations. Despite the enticing benefits, potential investors must consider market state and the ever-evolving crypto landscape.”

Crypto Recognition in China: Bitcoin’s Status Shift and Its Implications for Global Finance

“Shanghai’s Second Intermediate People’s Court has legally recognized Bitcoin as a distinct, irreplaceable digital asset. This recognition contradicts Beijing’s blanket ban, hinting at a potential change in China’s cryptocurrency approach. The decision holds significant implications for regulation, global perception of cryptocurrencies, and the integration of digital currencies into traditional finance.”

Understanding the Dark Winter of Bitcoin: Waning Interest, Trust, and Transparency Concerns

Daily Bitcoin trading volumes have notably decreased, similar to 2018’s lows, as per CryptoQuant data. Prevailing uncertainty, partly from the US Central Bank’s interest rate actions, is spurring a Bitcoin holding trend. Despite challenges, the resolute belief in blockchain and cryptocurrencies reflects the crypto ecosystem’s resilience and adaptability.