The UN report raises concerns about AI-generated deepfakes spreading hate and misinformation on social media, highlighting the importance of responsible AI use. It emphasizes the need to ensure information integrity, urging stakeholders to implement secure, ethical, and human rights-compliant measures for AI applications.

Search Results for: RSI

Model Collapse: The Risks of AI Learning from AI-Generated Content & How to Prevent It

Researchers from UK-based universities warn of “model collapse” in AI, where AI learning from AI-generated content leads to polluted training data and disconnect from reality. Ensuring AI models access real, human-produced data for accurate understanding and simulation is crucial to prevent this phenomenon.

BOCI Issues Tokenized Security in Hong Kong: Excitement, Concerns, and Blockchain’s Future

BOCI, the Bank of China’s investment bank subsidiary, has issued 200 million Chinese Yuan ($28 million) worth of digital structured notes on the Ethereum blockchain. This marks BOCI as the first Chinese financial institution to issue a tokenized security in Hong Kong, with UBS playing a crucial role in product origination. The development showcases growing interest in digital assets and blockchain technology among traditional financial institutions.

Crucial XRP Lawsuit Documents: Ripple vs SEC Showdown and Crypto Industry Implications

The long-awaited release of crucial documents in the XRP lawsuit, including the infamous Hinman Ethereum speech, could potentially sway the legal battle in favor of either the SEC or Ripple Labs. The outcome may impact the future of crypto industry regulations, innovation, and market conditions.

Shiba Inu Coin’s Bearish Sentiment vs Potential Upswing: Analyzing the Recent Sell-off

Shiba Inu coin experienced a severe sell-off, breaking through critical support levels and hitting a two-year low. However, buyers are actively defending the $0.0000056 support level, indicating a potential upswing and a possible temporary recovery of 20% in SHIB price.

Bitcoin at $25,000: Bottom Reached or More Fluctuations Ahead? The Debate Rages On

As Bitcoin hovers around $25,000, the market’s potential direction remains uncertain. Facing substantial resistance and support levels, Bitcoin’s next move depends on a breakout from its current consolidation range. Investor indecision and mixed sentiment is evident, making it crucial for crypto enthusiasts to stay informed on market trends and developments.

Luna Classic’s Resilience Amid Market Challenges: Balancing Opportunity and Risk

Luna Classic faces headwinds from market concerns and long-term resistance but shows resilience. Positive developments include efforts to restore the USTC stablecoin, ongoing Luna token burns, and community support. Investors should watch Terra’s developments and consider diversifying their crypto holdings for optimal risk-reward balance.

Economic News Takes Center Stage: Impact on Crypto and Financial Markets

The upcoming week shifts focus from crypto-specific events to economic news, with critical events like the US Consumer Price Index release, Federal Open Market Committee’s June meeting results, and the European Central Bank’s rate hike decision expected to significantly impact both cryptocurrency and traditional markets.

Polygon 2.0 Blueprint: Exciting Potential or Cause for Concern in Blockchain Evolution

The upcoming Polygon 2.0 blueprint announcement, focusing on topics like future PoS chain, token utility, and community governance, could significantly impact blockchain technology. However, healthy skepticism is warranted as competition with Ethereum and potential internal conflicts pose challenges.

SEC Stabilization Act: Restructuring the Agency & Dismissing Gensler Amid Crypto Tensions

US Congressman Warren Davidson announced the SEC Stabilization Act, aiming to restructure the agency and dismiss Chair Gary Gensler amid criticism over his approach to crypto market regulation. The ongoing Ripple lawsuit highlights tensions between the SEC and the XRP community, with investors and the industry calling for clear oversight.

DeeLance Disrupts Freelancing with Crypto, NFTs and Web3: Pros, Cons, and Main Conflicts

DeeLance aims to disrupt freelancing through a blockchain-based platform utilizing cryptocurrency, NFTs, and an escrow system for payments. Their ecosystem includes an NFT marketplace, metaverse, and comprehensive freelancing and recruitment platform with lower fees, enabling a fair and transparent environment for freelancers and employers.

AI and Crypto Collaboration: Opportunities, Risks, and the Future of Tech Integration

AI conferences gain popularity as crypto-focused events seemingly dwindle, yet pitting crypto against AI may be misguided. With potential for collaboration in areas like Web3 projects and decentralized AI models, experts argue that blending these two tech worlds can create a cohesive ecosystem, enhancing capabilities and minimizing risks in the evolving tech landscape.

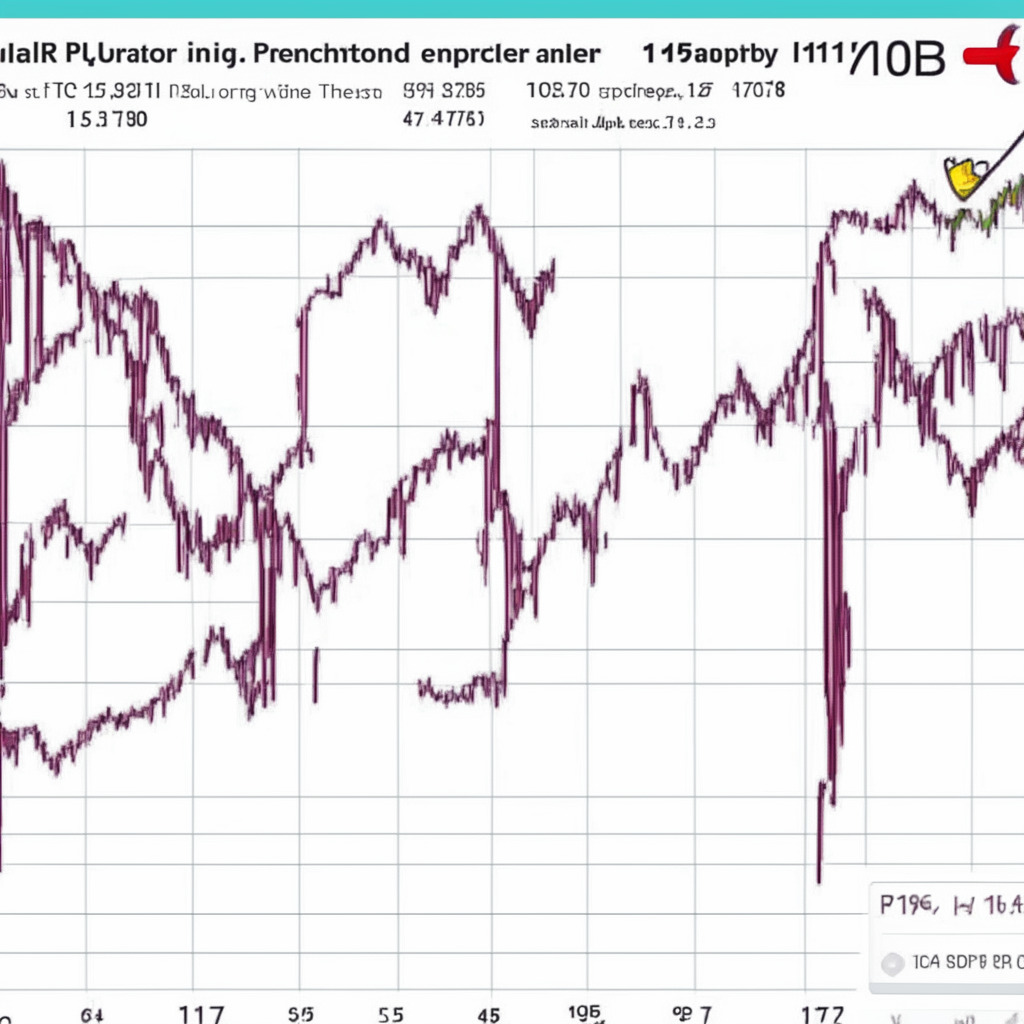

LUNC Price Rollercoaster: Analyzing Volatility, Support Levels, and Future Trends in Crypto Markets

The LUNC price faces high volatility and uncertainty due to the balance between the downsloping trendline and the $0.000082 support level. Current bearish market conditions may push the price below this threshold, but mixed market indicators suggest investors should conduct thorough research before taking action.

Andrew Tate Interview Sparks Debate: AI-Infused TateGPT Token’s Future Pros & Cons

A new Tate and AI-themed token, TateGPT, aims to achieve a longer life cycle than previous Tate tokens. With AI integration and association with controversial influencer Andrew Tate, this token captures the interest of investors and traders.

SEC Ex-Official’s Stark Warning: Crypto Platform Dangers, Regulatory Issues & DEX Alternatives

Former SEC Enforcement Division chief, John Reed Stark, warns cryptocurrency investors to “Get out of crypto platforms now” due to regulatory ambiguities and insufficient customer protection measures on centralized exchanges. Decentralized alternatives, offering better security and compliance, gain traction as concerns over legal scrutiny and cybersecurity grow.

MATIC Crash: Potential Recovery or Further Decline? Analyzing Market Indicators

The recent altcoin crash caused MATIC price to plunge to $0.518, a 45% tumble within a week. Despite a sharp lower price rejection, a potential recovery faces intense supply at $0.687 and $0.744. Observing market conditions and cryptocurrency trends is vital for investment decisions.

Soaring Stablecoin Popularity in Turkey: Escaping Lira Crisis and Prospering Crypto Market

As Turkey faces economic turmoil and the lira’s value drops, investors are turning to cryptocurrencies, particularly stablecoins like Tether, as a safe haven. With regulations making it difficult to buy dollars or gold, stablecoins offer protection against high inflation, attracting Turkish residents seeking to preserve their wealth amidst ongoing financial crisis.

Crypto Industry’s Resilience Against Regulatory Pressure: The Antifragile System Explained

Blockstream CEO Adam Back believes that the crypto industry is resilient enough to withstand regulatory pressures and continue its growth. With alternative solutions and strategies available, the market’s survival is ensured even amid regulatory actions against major exchanges like Binance and Coinbase.

Ethereum Price Plunge: Analyzing Key Transitions and Future Support Levels

Ethereum’s price decreased by 9.3% and may further plummet to a support trendline at $1651, with minor consolidation at the $1700 support level. Three key transitions affecting the network’s growth are being watched closely, while Ethereum may experience a minor relief rally and the daily RSI indicated oversold territory.

DeFi Exploit Costs Sturdy Finance 442 ETH: Analyzing Security and Future Safeguards

Sturdy Finance, a DeFi lending protocol, recently suffered an exploit resulting in a loss of 442 ETH (around $768,800). The platform has paused activity for investigation. The attacker allegedly manipulated the price oracle of a collateral pool, draining funds from Sturdy using a re-entrancy attack.

Cardano’s Uncertain Future: Market Challenges and Promising Competitors like Ecoterra

Cardano (ADA) experienced an 8% increase within 24 hours, partially recovering from its recent drop partly due to SEC action against Binance and Coinbase. However, with unclear signs of substantial recovery and possible delisting by other US-based exchanges, ADA’s future remains uncertain.

XRP Recovery Amid Market Turmoil: Assessing Prospects and Risks in Crypto Investing

XRP price recovers to $0.516186 after a 1% increase, overcoming market instability caused by SEC actions against Binance and Coinbase. With ongoing Ripple-SEC case developments favoring Ripple, potential for XRP price surge increases, reaching $1 or even $5 during the next bull market.

Cardano, Solana, Polygon vs SEC: Battle for Token Clarity and Market Recovery

The Input-Output Global (IOG), responsible for Cardano development, and foundations behind Solana and Polygon, are disputing recent SEC allegations that their tokens are securities. They aim to clear the tokens and maintain operations despite market fluctuations and uncertainty, urging cautious investor decision-making.

Bitcoin & Ethereum’s 7% Dip: Causes, Market Predictions, and Future Scenarios

This article discusses the recent 7% dip in Bitcoin and Ethereum, factors contributing to the downturn, and potential future scenarios. It covers A16z Crypto’s international expansion, Tether demand in Turkey, and regulatory actions by the SEC, while providing market predictions for both cryptocurrencies.

Bitcoin Stability Amid SEC Crackdown: How Altcoins Suffer & Future Market Implications

Amid the SEC’s crackdown on the crypto market, Bitcoin exhibits commendable stability, maintaining support above $25,000 and its market share approaching 50%. However, altcoins experience instability, with SEC allegations implicating tokens like Solana, Polygon, and Algorand.

Bitcoin Whales Accumulate Amid Dominance Shift: Analyzing Market Trends and Risks

Bitcoin whales accumulated nearly 60,000 BTC during a recent 10% price correction, according to a report by Santiment. As altcoins experience market turbulence, Bitcoin’s dominance reaches 50% for the first time since April 2021, suggesting bear market characteristics and investors shifting funds into safe-haven large-cap coins.

Andreessen Horowitz’s London Expansion: Pros, Cons, and the Future of Crypto Regulation

Andreessen Horowitz (a16z) is opening its first office outside the U.S. in London, aiming to capitalize on a predictable business environment and welcoming stance toward blockchain technology. The firm will also launch a Crypto Startup School program in Spring 2024 and collaborate with U.K. universities to promote blockchain education.

SHIB Price Breakdown: Bullish Reversal Surfacing or Deeper Plunge Ahead?

The SHIB price experienced a decisive breakdown on June 5th, hinting at a significant downfall for this memecoin. However, support at the $0.00000572 level suggests the possibility of a bullish reversal. With unstable aggressive selling and potential technical indicators, the SHIB price outlook remains uncertain, warranting thorough research before investing.

Crypto Wash Trading Regulations: Balancing Tax Evasion Prevention and Innovation

Democrats push for tighter regulations on cryptocurrency wash trading to address tax evasion, as the IRS doesn’t currently treat cryptocurrencies as securities. Regulators aim to balance fostering innovation while protecting investors and the broader financial system from fraudulent activities.

Regulatory Pressure on Crypto Exchanges: Why Long-Term HODLers Remain Unfazed

Recent regulatory pressure on Binance and Coinbase by the SEC has had minimal impact on Bitcoin long-term holders, with only 0.004% of the Long-Term Holder Supply being liquidated on these platforms. Despite the uncertain regulatory environment, confidence among long-term Bitcoin holders remains strong, showcasing resilience and trust in the asset’s potential.

Cardano Plunges 41.7% in a Week: Are Investors Accumulating or Panic Selling?

The recent 41.7% plunge in Cardano’s ADA price has raised concerns about its future. However, a long-tail rejection candle at $0.24 support level indicates intense buying activity and oversold RSI slope signals possible discounts. Although recovery seems plausible, the market’s direction remains uncertain, urging thorough research before investing.

Polygon Price Plunge: Analyzing the Potential for Recovery Amid Bearish Crypto Market

In a bearish crypto market, Polygon coin price dropped 45.4% to reach $0.5 support level. With growing buying pressure at this mark, a recovery may be on the horizon. MATIC’s recent integration with Kraken’s NFT platform and key resistance levels are crucial factors in potential rallies.