Arkham Intelligence recently unveiled that Grayscale is the world’s second-largest BTC holder, with over 1,750 wallet addresses and holdings worth $16.1 billion. However, Grayscale has not disclosed wallet addresses due to security concerns, igniting speculation and skepticism within the crypto community.

Search Results for: Reserve

Dissecting the Perils and Promise of Bitcoin Lending: Enlightenment from the Failures

“Bitcoin lending must innovate a sustainable model independent of government institutions. However, a lack of transparency and risk management resulted in collapsed lending firms. The proposed solution is a two-account system to separate safekeeping assets from lending, ensuring transparency and ‘ring-fencing’ risk.”

Evaluate Onchain Summer’s Impact and Jefferson’s Appointment on Crypto Market Future

‘Onchain Summer,’ an event promoting Base, Ethereum’s layer-2, saw 700,000 NFTs minted by over 268,000 users. Over $242 million in crypto assets were transferred to Base whilst facing challenges like network outages and scams. Philip Jefferson’s appointment as Federal Reserve vice chair signals potential advancements and uncertainties for the crypto sector.

Navigating the Blockchain Future: The Impact of Federal Leadership Changes on Crypto Regulation

“The leadership at institutions like the Federal Reserve significantly influence policy changes, specifically cryptocurrency and blockchain regulation. While the US Federal Reserve reportedly has no plans for a digital dollar, the recent changes in leadership may significantly impact future policy. As cryptocurrencies and blockchain technology reshape financial systems, the balance between innovation and regulation remains a focus.”

Navigating the Volatile Currents: Bitcoin’s Dip and the Subtle Shift in Market Sentiment

“The cryptocurrency market displays significant shifts with Bitcoin bids at their lowest since March. This could be a test of strength between bulls and bears. A noticeable lack of bullish momentum and prospect of Bitcoin retracing its steps emerges as a growing concern.”

Rollercoaster Predictions: Bitcoin’s Potential Rise to $22K Amidst Market Uncertainty

“Despite the gloomy market sentiment and legal hurdles from SEC, market analysts forecast Bitcoin could hit the $22K mark. U.S. inflation drop and Federal Reserve’s liquidity drainage could push investors to alternative assets like Bitcoin. However, serious challenges still remain.”

Death Cross in Bitcoin’s Path: A Forecast of Decline or A Misleading Index?

The impending Bitcoin death cross, a bearish signal indicating short-term price momentum drop, could signify a market decline, strongly influenced by the strengthening U.S. dollar and perilous macro developments. Interestingly, Bitcoin’s death cross historically, hasn’t consistently yielded negative returns, poking holes in expectations of a straightforward decline.

From Spook Shock to Fresh Start: Tracing the Crypto Market’s Recovery and Future Prospects

Justin Sun, founder of Tron, predicts a bullish future for the crypto market at the recent Korea Blockchain Week 2023. Noting past market shocks, he expresses certainty about a new industry cycle in the next two years. Despite concerns over tightening regulations, Sun believes cryptographic technology remains a global priority with god momentum behind dollar-pegged stablecoins in Asia and the resurgence of Hong Kong’s role in the crypto landscape.

Global Push for Cryptocurrency Regulations: The G20’s Unified Front and India’s Leadership Role

“Under India’s G20 presidency, efforts are increasing to develop global cryptocurrency regulations. The dialogue includes both viewing cryptocurrency as a threat and an opportunity. The aim is to harness the potential of cryptocurrencies while mitigating inherent risks through unified global cooperation.”

Unmasking yPredict: A Data-Driven Trading Solution Built on Blockchain Technology

“yPredict, a trading research and analysis platform, combines AI and financial expertise, offering data-centric tools for insightful investment choices. It runs on the Polygon Matic chain using YPRED tokens, which allow access to predictive models and participation in the platform’s decision-making process. Its diverse analytical tools go beyond price predictions.”

Ethereum’s Struggle: Battling Market Fear Amid Shaky Support Levels

Despite Ethereum’s 31.3% price surge between March 10 and 18, there are concerns about the crypto’s ability to maintain this upward momentum. Rising bearish sentiment, decreases in key ETH price metrics, and negative market developments are troubling the ecosystem. There are fears over potential liquidation of some $4.8 billion ETH deposits held in the Grayscale Ethereum Trust, amid declining smart contract transactions and investor interest. Ethereum’s position is further pressured by its competitors like Visa integrating Solana blockchain and Coinbase planning to convert old versions of USDC to a new format.

Rise of Crypto Staking Amidst Gloomy Blockchain Atmosphere: Can It Be the Future?

“Staking in the crypto world is showing resilience amidst a challenging year, with a 292% surge in total value locked (TVL) for liquid staking protocols. Ethereum staking is recovering, especially due to the ‘Merge’ event that transitioned Ethereum to live staking platform. It’s compared with the ‘on-chain equivalent of government bonds’, promising a safer alternative than DeFi lenders.”

Crypto Exchanges and Bitcoin: A New Strategy or a Conflict of Interest?

Bitfinex, a renowned crypto exchange, is reportedly keeping Bitcoin on its balance sheet, potentially converting a portion of trading fees into the cryptocurrency. This strategic move indicates an endorsement of Bitcoin’s long-term value and shows strong belief in cryptocurrencies. However, concerns have been raised over potential market sway and fairness issues.

Tether’s Ascent: Top Holder of US Treasury Bills and What That Means for Crypto

“Tether, one of the world’s leading buyers of US Treasury bills, has increased its holdings to $72.5 billion. Despite the complexities expansion brings, this represents the growing mainstream acceptance of digital currencies and their incorporation into the traditional financial world.”

Qredo’s Crypto Winter Survival: Staff Cuts, Refocusing Efforts and Ramped-up Security

“Crypto infrastructure provider Qredo is reportedly laying off around 50 staff members, including key executives, reducing the firm’s headcount to around 130. The layoffs are part of a resizing strategy, an attempt to endure the difficult crypto market while refocusing efforts to save approximately 50% of its expenses.”

$40 Million Crypto Heist: Stake.com’s Unprecedented Security Breach and Quick Recovery

Stake, a popular crypto betting platform, suffered a shocking $40 million exploit in early September, starting with irregular transactions. Despite the massive security breach, Stake assured users that funds would be protected and possibly restored soon, reaffirming the resilience of some crypto platforms.

Unveiling the Digital Euro: Europe’s Step Towards CBDCs and What It Means For You

ECB executive Fabio Panetta recently detailed the European Commission’s plans for a digital Euro, asserting this could establish Europe as a leader in central bank digital currencies (CBDCs). The mission focuses on safeguarding European monetary sovereignty, preserving fiscal freedom, and ensuring privacy and data security. However, concerns remain over the compatibility of a digital Euro with existing financial structures.

KEB Hana Bank Seizes Future of Blockchain with BitGo Partnership: A Dive into South Korea’s Digital Asset Market

South Korea’s KEB Hana Bank partners with BitGo, a leader in crypto custody and security, to offer digital asset custody services from 2024. The partnership is expected to enhance consumer protection and trust in South Korea’s digital asset market and improve the quality of Hana Bank’s digital asset custody operations. The collaboration also aims to capitalize on blockchain security technology, backed by BitGo’s recent funding of $100 million.

Bitcoin’s Rough September: The Impact of Regulatory Delays and Inflation Worries

Bitcoin’s value declines amidst regulatory delays and macroeconomic concerns linked to a rising US budget deficit. Despite regulatory setbacks, positive outlook on a potential Bitcoin ETF remains. Australian “Digital Assets (Market Regulation) Bill 2023” undergoes examination, aiming to balance innovation and consumer safety in the digital asset ecosystem.

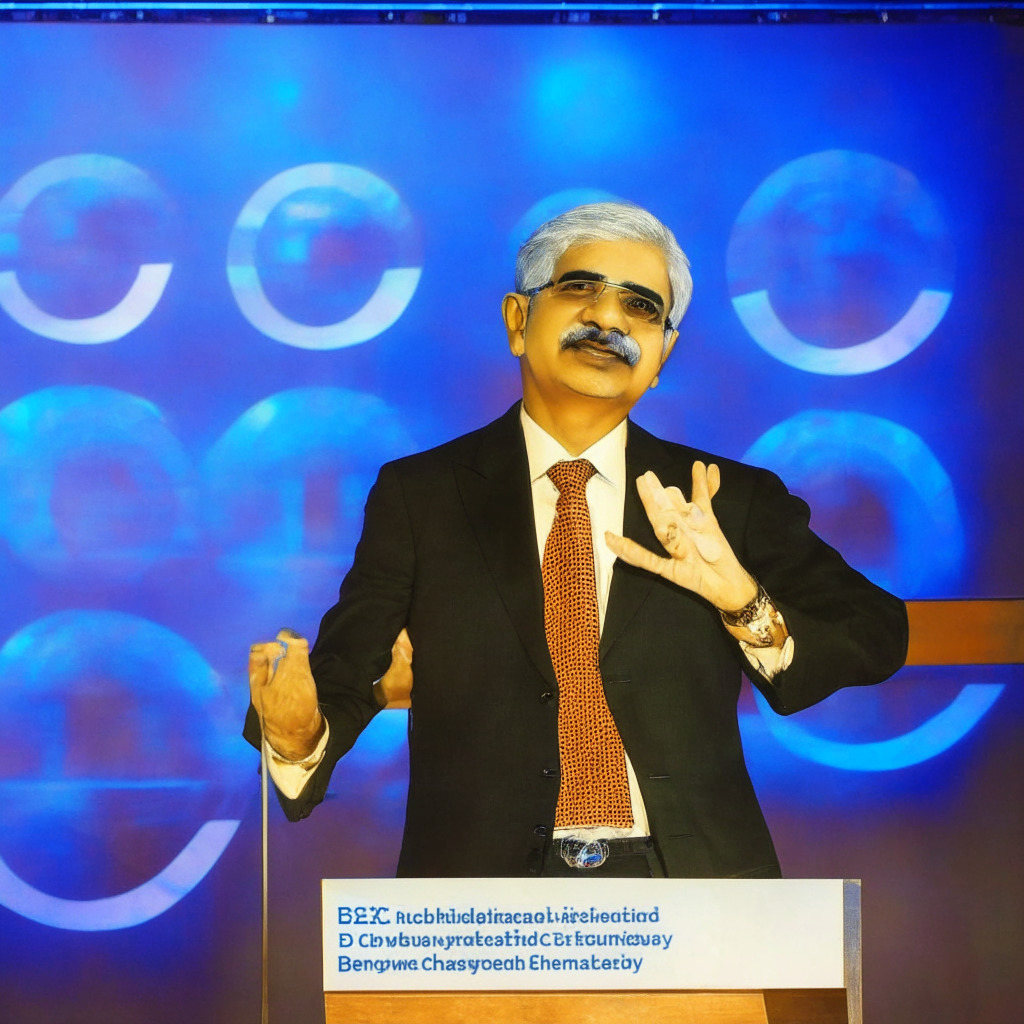

Unleashing the Power of CBDCs: India’s Approach to Revolutionizing Global Finance

Reserve Bank of India’s Governor, Shaktikanta Das, emphasized the transformative potential of Central Bank Digital Currencies (CBDCs) in a recent G20 TechSprint Finale address. He outlined their potential to revolutionize international payment landscape by reducing costs and increasing transparency. India, currently testing its own CBDC, engages in comprehensive data collection and analysis for future policies. They also invite innovative solutions for cross-border CBDC platforms.

Approaching $22,000 BTC Amid Bearish Derivatives and Uncertain Regulations

“Recent data on Bitcoin futures highlights a potential correction to a $22,000 BTC. This is amid bearish derivate trends and U.S. regulatory uncertainties including postponed BTC ETFs and potential indictment of leading cryptocurrency exchanges Binance and Coinbase by the DOJ.”

Newly Elected Singapore President and His Challenging Influence on Crypto Regulations

Singapore’s new president, Tharman Shanmugaratnam, with past finance roles may reshape fintech policies. His views on cryptocurrency, from ‘slightly crazy’ to its potential significant role in finance, could impact Singapore’s crypto regulatory balance amidst the aftermath of local crypto establishments’ failures.

India’s SBI Leaps into Digital Realm: UPI Integration with Digital Rupee, A Step into the Future

“India’s largest public sector bank, SBI, has integrated UPI with the Digital Rupee, enabling 300 million UPI users and 500 million merchants to enhance their digital transactions. The ‘eRupee by SBI’ application potentially fuels secure and rapid exchanges, increasing national digital currency usage in regular transactions. However, the excitement around cryptocurrencies remains muted within the Indian government.”

Blockchain’s Rising Star in Global Finance: A Glimpse at India’s NPCI and London Stock Exchange Group’s Approach

“India’s National Payments Corporation is recruiting a blockchain expert, indicating a growing faith in blockchain’s potential in finance. Concurrently, the London Stock Exchange Group is leveraging blockchain to create a platform for traditional financial assets, possibly becoming the first major global exchange to establish a blockchain-powered ecosystem.”

Navigating the September Storm: BTC’s Price Balancing Act Amid Dividing Viewpoints and Influencers

“BTC enters September at a critical juncture, with assumptions of a possible ‘double top’. Some predict bearish downslide to $23,000, while optimists strive to revive market momentum. A promising scenario emerges as 40% of BTC supply lies dormant for three years, potentially leading to a price rise due to demand-supply competition.”

Ethereum’s Staking Limit, Argentina’s Bitcoin Surge, and Blockchain Security: Weekly Crypto Roundup

“In an evolving crypto landscape, Ethereum staking providers limited their ownership to 22%, towards decentralization. Bitcoin adoption rises in Argentina contrasting El Salvador’s caution. Binance addresses regulatory environment while security concerns persist despite OpenZeppelin’s Defender 2.0 upgrade. NFTs, CBDCs progress, and stricter crypto regulations emerge.”

Bitcoin Plunge and Emerging Altcoins: Prospects and Pitfalls in Today’s Market

“The recent increase in Bitcoin’s exchange net flow coincides with a decrease in price, suggesting that long-term holders are selling their reserves. Also, a decline in Bitcoin velocity indicates a weak market. Analysts suggest seeking refuge in altcoins like PARROT, ANUBIS, and SOJU which are showing promising growth.”

Digital Rupee and Yes Bank Integration: A Gateway to Mass Adoption or a Breeding Ground for Risks?

“The digital rupee’s integration with Yes Bank’s app UPI extends its reach to millions of merchants in India, potentially driving its mass adoption. However, concerns regarding security, volatility and regulation of cryptocurrencies remain, alongside increasing competition. Despite these challenges, digital currencies showcase resiliency with digital rupee transactions worth $134 million reported within two months.”

Preserving Decentralization: Ethereum Staking Giants Pledge to Self-Limit Market Share

Several leading Ethereum liquid staking providers, including Rocket Pool, StakeWise, Stader Labs, Puffer Finance, and Diva Staking, are adopting a self-limiting strategy to own no more than 22% of the Ethereum staking market, thus working to avoid a potential increase in staking centralization. This move is in contrast to entities like Lido Finance, which advocates for growth and dismisses the self-limitation approach.

Bitcoin ETFs and Crypto ATMs: The Balancing Act of SEC Regulations in the Crypto World

“The United States Securities and Exchange Commission (SEC) is delaying its decision on applications for a spot Bitcoin ETF from institutional giants. Additionally, the crypto ATM industry is under scrutiny for alleged illegal behavior and high usage fees, while facilitating convenience and anonymity. Regulatory development is vital for the industry’s well-being and participant safety.”

The Balancing Act: Crypto ATMs Between Accessibility and Accountability

The crypto ATM industry in the U.S is expanding despite concerns about illegal activities, according to the Federal Reserve Bank of Kansas City. While these ATMs cater to cash users and provide convenience, their high fees and potential for facilitating scams pose significant risks. Effective regulation is necessary to balance industry growth and user protection.

Navigating the Labyrinth of Bitcoin: An Asset Worth Understanding

“Bitcoin is the best performing asset for seven out of the last ten years, yet wealth advisors are still reluctant to support investments in this asset class. While Bitcoin’s predictable, finite supply can provide a buffer against inflation, its frequent value fluctuations present challenges. Nonetheless, it is a robust construct that can drastically reshape monetary transactions, making it an intriguing asset to watch.”