The Lightning Network, a Bitcoin layer 2 protocol, aims to address Bitcoin’s scaling issues, such as high transaction fees and slow blocks. While promising, it remains experimental, and a more pragmatic view suggests that it may not solve all types of transactions. Diversified thought and constant innovation keep the cryptocurrency space robust and resilient.

Search Results for: RSI

Unveiling Web3’s Impact on the Beauty Industry: Opportunities, Challenges, and Innovations

Leading beauty brands are engaging Web3-native consumers through digital artistry and innovative technology, such as NYX Professional Makeup’s beauty-focused decentralized autonomous organization (DAO), GORJS. Blockchain technology offers unique opportunities for skincare and makeup enthusiasts, improves transparency, and eliminates counterfeit products. This paves the way for a more sustainable and innovative future within the beauty industry.

Hinman Speech Documents: Ripple Vs SEC Showdown and Future of US Crypto Regulations

As the June 13, 2023 deadline for making public the Bill Hinman speech documents nears, the ongoing Ripple Vs SEC lawsuit amidst a hostile US crypto market regulatory environment is seen as a beacon of hope for the crypto community. The Hinman speech documents are controversial due to the former SEC director’s assertion that Ethereum’s decentralized nature transforms it from a security to a non-security. The imminent release of these documents could play a pivotal role in shaping US crypto regulations and the Ripple Vs SEC lawsuit outcome.

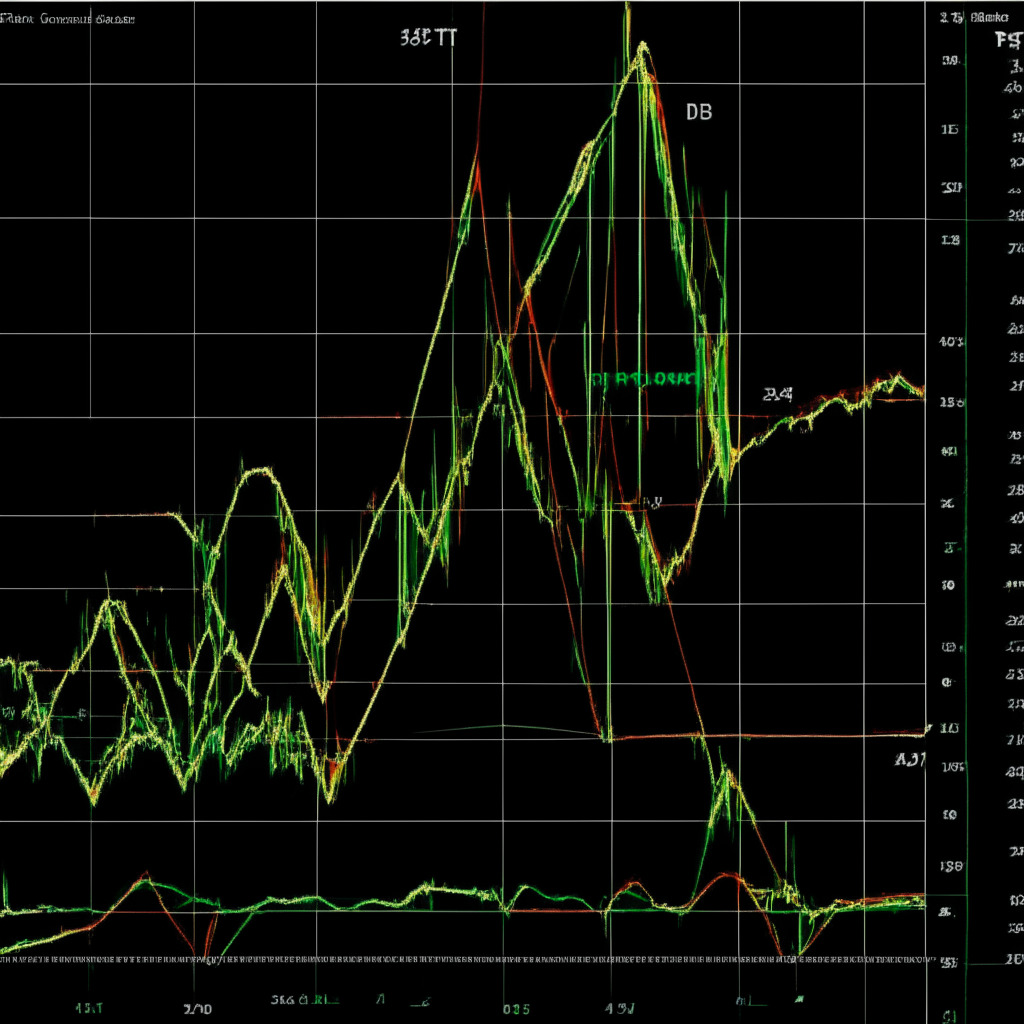

Bitcoin Bearish Reversal: Prospects of Recovery Rally or Further Downtrend?

The Bitcoin price recently experienced a bearish reversal, with a 5% decline over the week. A breakdown below the $26,500 support level may trigger further drops. Technical indicators, including MACD and EMA, confirm the potential for a downtrend continuation. Caution and research are advised before entering the market.

Apple’s WWDC 2023: Unveiling the Future or Fueling Speculation? Pros and Cons Explored

Apple’s WWDC 2023 keynote might introduce iOS 17, watchOS features, and possibly mixed reality technology like the Reality Pro headset and xrOS. However, amid excitement, skepticism and thorough market research are essential before investing in emerging technologies or related assets like cryptocurrencies.

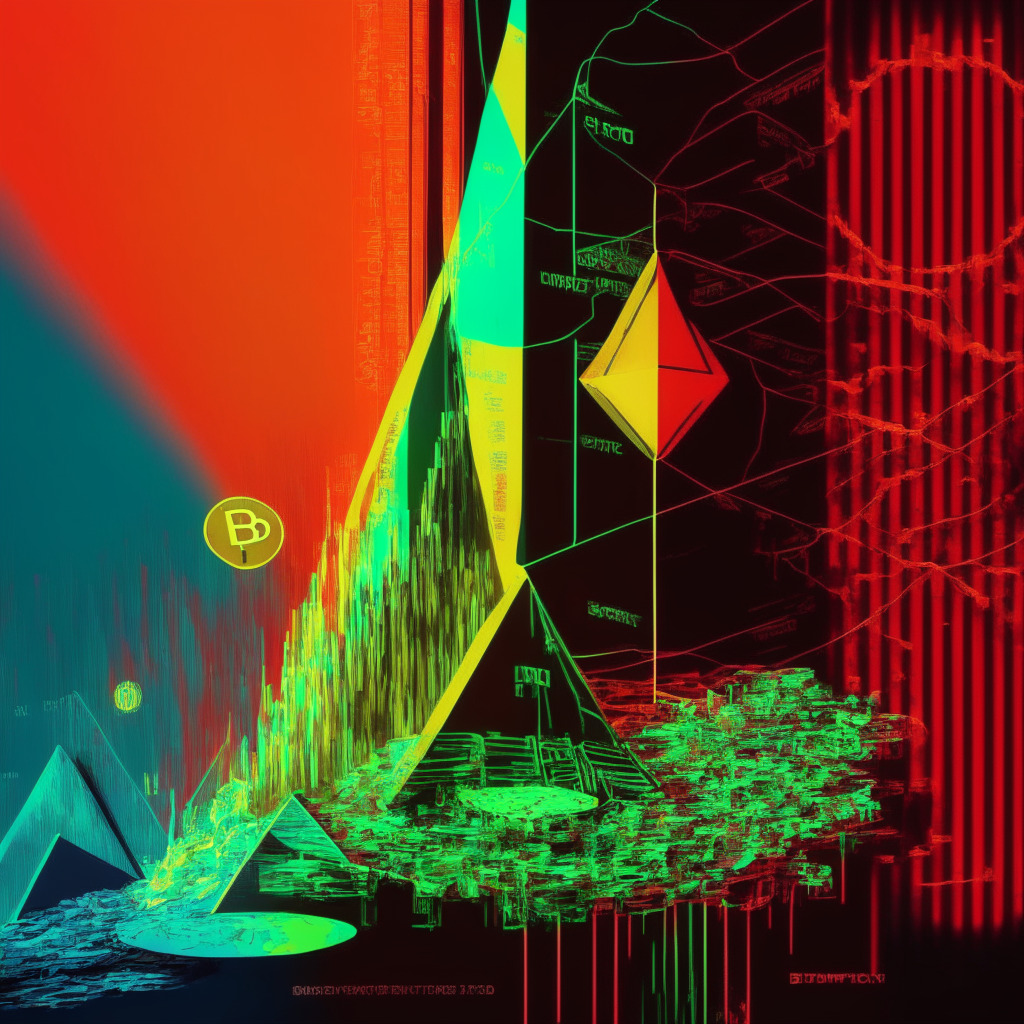

SEC Lawsuit Against Binance: Impact on Crypto Market and Balancing Regulation with Innovation

The SEC has filed a lawsuit against Binance and CEO Changpeng Zhao, accusing them of violating securities regulations in the US. This has caused Binance’s BNB token price to drop 8% and affected major cryptocurrencies like Bitcoin and Ethereum. As the case unfolds, the crypto market awaits further developments and potential price impacts, raising questions about balancing regulatory oversight with fostering innovation in the blockchain and cryptocurrency space.

Binance Lawsuit Shakes Crypto Markets: DEXs vs Centralized Exchanges Debate Intensifies

Crypto markets faced a downturn as Binance was charged by the SEC, resulting in Bitcoin and Ethereum losing 2.5% and 2% respectively. The SEC alleges Binance misused consumer funds and engaged in unauthorized security sales, raising concerns about centralized exchanges and the need for better compliance.

SEC Accuses Binance of Violating Securities Laws: Impact on Crypto Industry and Market Safety

The US SEC has accused Binance, BAM Trading, and CEO Changpeng ‘CZ’ Zhao of violating securities laws, alleging that BNB, BUSD, and Binance.US staking investment products count as unregistered securities, and suggesting Binance has commingled customer funds. These allegations could have a significant impact on the crypto industry and potentially lead to monetary penalties.

Velodrome DEX Upgrade: Exciting Features vs. Falling VELO Price – Which Wins?

Velodrome DEX is set for a significant upgrade on June 15th, improving user experience, security, and introducing new features. As the largest DEX on Optimism layer 2 network, the redesign includes better smart contract architecture amid recent VELO price drops. Its long-term outlook remains positive, emphasizing continuous innovation and unpredictable market nature.

UK Considers Appointing a Crypto Tsar: Will It Strengthen Regulation and Innovation?

The Crypto and Digital Assets All Parliamentary Group (APPG) has published 53 recommendations for the UK government, including the appointment of a ‘Crypto Tsar’ to ensure a coordinated regulatory approach for the crypto and digital assets space. The report emphasizes the need for protecting consumers, promoting economic growth, and fostering innovation as the sector continues to grow rapidly.

XRP’s Rally Amidst SEC Battle: Could it Outperform Bitcoin and Altcoins in 2021?

XRP has seen an impressive 15.5% increase in the past 30 days, leading analysts to predict it could potentially outperform Bitcoin and other major cryptocurrencies this year. However, XRP’s performance hinges on the outcome of Ripple’s ongoing legal battle with the SEC. Ripple’s strong market indicators, coupled with positive developments in the lawsuit, paint a promising picture for XRP’s future in the crypto market.

Dorsey Backs Pro-Crypto Kennedy for 2024 Presidency: Blockchain Future vs Vaccine Skepticism

Twitter co-founder Jack Dorsey endorses pro-crypto presidential candidate Robert F. Kennedy, Jr. for the 2024 elections. Kennedy aims to protect individual rights to hold and use Bitcoin, resist government intrusion, and end the corrupt merger of state and corporate power.

Asian Markets Rally Amid Fed Expectations: How Bitcoin Navigates Inflation and Volatility

Asian stock markets rally amid anticipation of the US Federal Reserve holding off on interest rate hikes, while Bitcoin trades below $27,000. Inflation concerns may lead to a surge in Bitcoin value as a safe haven. Investors should conduct thorough research before entering the volatile cryptocurrency market.

Atomic Wallet Heist: Centralization vs Security & Balancing Convenience with Crypto Safety

The cryptocurrency industry faces another setback as nearly $35 million worth of tokens were stolen from Atomic Wallet, a centralized storage service. This raises questions about security in centralized wallet services and highlights the trade-offs between centralization and security in the crypto space.

Crypto in Politics: Jack Dorsey Backs Pro-Bitcoin Presidential Candidate RFK Jr.

Twitter CEO Jack Dorsey supports pro-crypto Democrat candidate Robert F. Kennedy Jr., who accepts Bitcoin donations for his presidential campaign. Kennedy criticizes CBDCs as tools to suffocate dissent and condemns a proposed 30% tax on crypto mining.

Bitcoin Memecoins Debate: Network Congestion vs. Blockchain Flexibility and Growth

The recent surge in Bitcoin-based memecoins has caused network congestion and higher gas prices, leading some developers to contemplate removing these coins from the network. However, critics argue that memecoins have played a significant role in the growth of the Bitcoin blockchain, and their removal could hinder its flexibility as a digital asset platform. Open dialogue is needed to weigh the benefits and drawbacks while ensuring long-term sustainability.

Crypto Influencer Endorsements: Navigating the Risks After FTX Collapse and Legal Repercussions

The collapse of crypto exchange FTX has led to crypto firms and influencers re-evaluating endorsement deals due to potential legal repercussions. A $1 billion class-action lawsuit against influencers promoting FTX crypto fraud serves as a wake-up call, reminding them of possible legal action if a promoted company turns unfavorable. Both influencers and crypto firms are now growing more cautious about endorsement deals.

Bitcoin Breakout and Regulatory Clarity: Balancing Innovation, Growth, and Global Competition

Bitcoin’s recent breakout highlights the importance of regulatory clarity for its continued success. Strict US crypto regulations push innovation elsewhere, while countries like the UK, UAE, Brazil, Japan, EU, Australia, and Singapore establish their own cryptocurrency centers. Achieving regulatory clarity can support innovation, industry growth, and mitigate risks, maintaining the US as a global leader in cryptocurrency innovation.

Bullish Signs for Bitcoin, ADA, QNT, RNDR, and RPL: Analyzing Breakout Potential

Bitcoin price chart flashes a bullish sign, indicating potential breakouts for ADA, QNT, RNDR, and RPL. As major cryptocurrencies attempt recoveries, questions arise over whether bulls could surpass resistance levels and lead the rally.

XRP’s Potential $10 Mark in 2023: Investment Surge, Price Analysis, and Eco-Friendly Alternatives

XRP experienced a recent $2 billion capital surge, sparking speculation around potential price trajectories. While technical indicators suggest bullish sentiment, predicting specific movements remains a challenge. Exploring alternative investments like WSM and Ecoterra can help diversify portfolios and navigate the fluctuating crypto market.

Rounding Bottom Pattern Predicts Render Token Uptrend: Analyzing AI Crypto Rally Potential

The Render token price recently displayed a rounding bottom pattern, suggesting a potential uptrend. A trendline governs the ongoing recovery rally, and after a resistance breakout at $2.45, a 24% rally is anticipated. The formation of the rounding bottom pattern indicates a steady recovery for RNDR, with no major resistance expected until the $3.3 mark.

Crypto Anonymity Mirage: Shifting Narratives and Impact on Blockchain Adoption

The illusion of crypto anonymity persists despite the permanent, public record of blockchain transactions. However, increasing transparency and the growing acceptance of real identities will erode this image, fostering healthier growth and more widespread adoption of crypto and blockchain technology.

LUNC Breakout: Analyzing Opportunities, Resistance Levels, and Market Risks in Terra Classic

LUNC price breaks above the overhead trendline with an 8% jump, offering buyers an opportunity for a short-term upswing to $0.0001. However, potential challenges like regulatory actions and market volatility may impact LUNC’s price. Exercise caution and conduct thorough market research before investing.

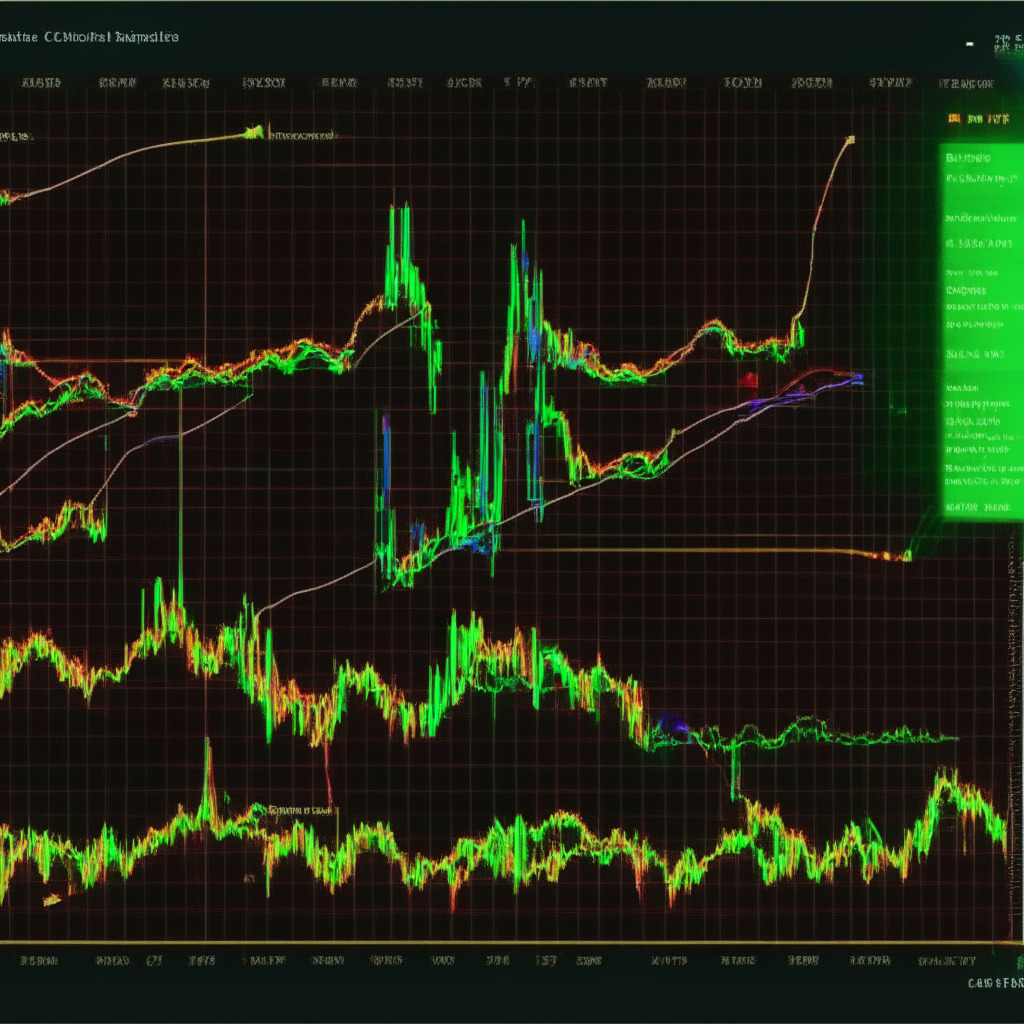

Bitcoin’s Next Move: Analyzing Potential Scenarios and Market Trends

Bitcoin recently recovered from a low of $26,600, trading above $27,000, causing discussions about its next potential target. Factors influencing future trajectory include market sentiment, technical indicators, and macroeconomic conditions, thus warranting deep market trend analysis and exploration of possible scenarios.

Elizabeth Warren’s Crypto Crackdown: Protecting vs Stifling the Industry

US Senator Elizabeth Warren plans to introduce a bill closing cryptocurrency loopholes, asserting crypto payments fuel the Chinese fentanyl trade. The controversial stance sparks mixed reactions and divides political leaders, while raising questions on the future of the cryptocurrency industry amid regulatory scrutiny.

Layer 2 Summer 2024: Ethereum’s Booming Future or Baseless Hype?

Ethereum enthusiast Anthony Sassano predicts a “Layer 2 summer” in the crypto market by next year, driven by technical advancements, reduced fees, and innovative projects. The anticipated improvements aim to make Layer 2 solutions more affordable and accessible, potentially attracting millions of new participants to the Ethereum ecosystem. However, the excitement comes with skepticism as potential risks and challenges tied to the technology persist.

Ethereum Price Recovery: Can We Expect a $2,000 Milestone Soon? Pros and Cons Examined

Ethereum price formed a bullish morning star candle at a recently breached resistance trendline, suggesting a potential recovery. With market sentiment supporting a bullish recovery and a breakout from the wedge pattern, Ethereum could rise to levels between $2,020 and $2,120. However, uncertainty remains considering the required 30% rally to reach $2,500.

US Crypto Mining Tax Proposal: Impacts, Reactions, and the Future of Regulation

The proposed Digital Assets Mining Energy (DAME) tax, which aimed to impose a 10-30% tax on electricity used for crypto mining, failed to make its way into a U.S. debt ceiling bill. The tax’s potential impact on global emissions, renewable energy incentives, and the uncertain regulatory environment stirred debates within the crypto community, highlighting the need for governments to embrace and properly regulate the evolving blockchain future.

Elon Musk’s Dogecoin Tweets: Insider Trading Allegations and Market Implications

Allegations against Elon Musk regarding insider trading connected to his Dogecoin tweets have fueled investor concern and added ambiguity to Dogecoin’s future. Amid market uncertainty, traders and investors should closely observe price movements and adapt their strategies in the fluid crypto landscape.

Ethereum Rivals Visa, Tether Hits Highs, and Global Crypto Trends: A Weekly Roundup

This week, Ethereum’s transaction volume rivaled Visa, Tether’s market cap hit a record high, and an Ethereum ICO wallet resurfaced with $15 million. Binance dominated headlines with trading discounts and privacy coin delisting news, while CBDC discussions, crypto regulations, and global partnerships shaped the future of the industry.

Uniswap Scam Exposes Sophisticated Deception: How to Stay Safe in Crypto

The crypto community experienced a sophisticated scam involving a fraudulent Uniswap website, complete with a fake Zoom recording featuring imposters posing as Uniswap executives. The incident highlights the importance of vigilance and thorough research in the ever-changing world of blockchain and cryptocurrency.

Bitcoin’s $27K Surge Amid Rising Unemployment: Signals and Future Trajectory Debate

Bitcoin’s price recently soared above $27,000, amidst a weakening labor market and economic uncertainty. Technical analysis indicates possible breakout, with resistance zone between $27,000 and $27,500. Staying informed and engaged with market developments is essential for crypto enthusiasts.