Evertas, the crypto insurance underwriter for digital assets, has recently announced an expansion of its offerings, increasing the coverage limits and including mining operations in its portfolio. The insurer’s per-policy coverage limit will rise to $420 million, almost tripling the previous amount of risk transfer available to blockchain-focused projects, and adding mining operation coverage for up to $200 million per policy. According to Evertas, these are the highest coverage limits available.

This comes just six months after the company raised $14 million in a series A funding round led by Polychain Capital, reportedly bringing the firm’s total outside funding to $19.8 million when accounting for its initial seed funding of $5.8 million. Evertas, based in Chicago, is one of only a handful of insurers focusing on cryptocurrency and digital assets and is reportedly the only one given official coverholder status by Lloyd’s of London.

Despite most cryptocurrency exchanges offering some form of loss coverage, there are numerous situations where an account holder could lose access to their assets, and these cannot be tracked through account or on-chain activity. Many insurers do not provide comprehensive coverage, forcing customers to mix and match policies. Evertas’ new policy limits aim to ease this pain point, providing greater scalability and speed by making it “now possible to get a full, high-limit underwriting from a single source.”

The cryptocurrency insurance space is relatively new compared to more traditional sectors like home and life insurance. Experts say that less than one percent of all cryptocurrency assets are insured through traditionally underwritten policies. This represents a significant amount of exposure, particularly as the global cryptocurrency market is expected to grow significantly by 2030.

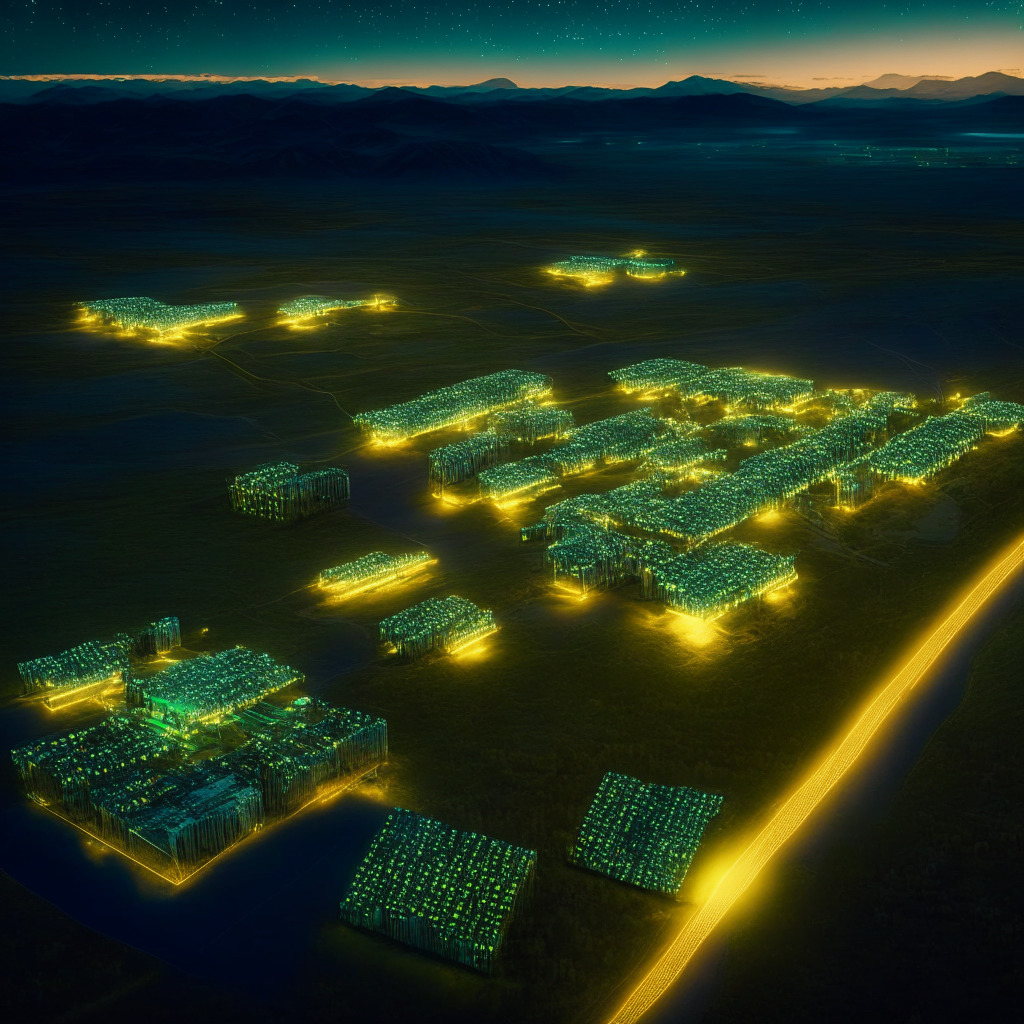

The increase in coverage limits and expansion into mining operations showcase Evertas’ commitment to providing accessible and comprehensive insurance for those involved in the blockchain and cryptocurrency sectors. As the market continues to grow, it remains to be seen whether other insurance providers will follow suit and offer similarly extensive coverage to meet the needs of digital asset owners and businesses working in this sphere.

Source: Cointelegraph