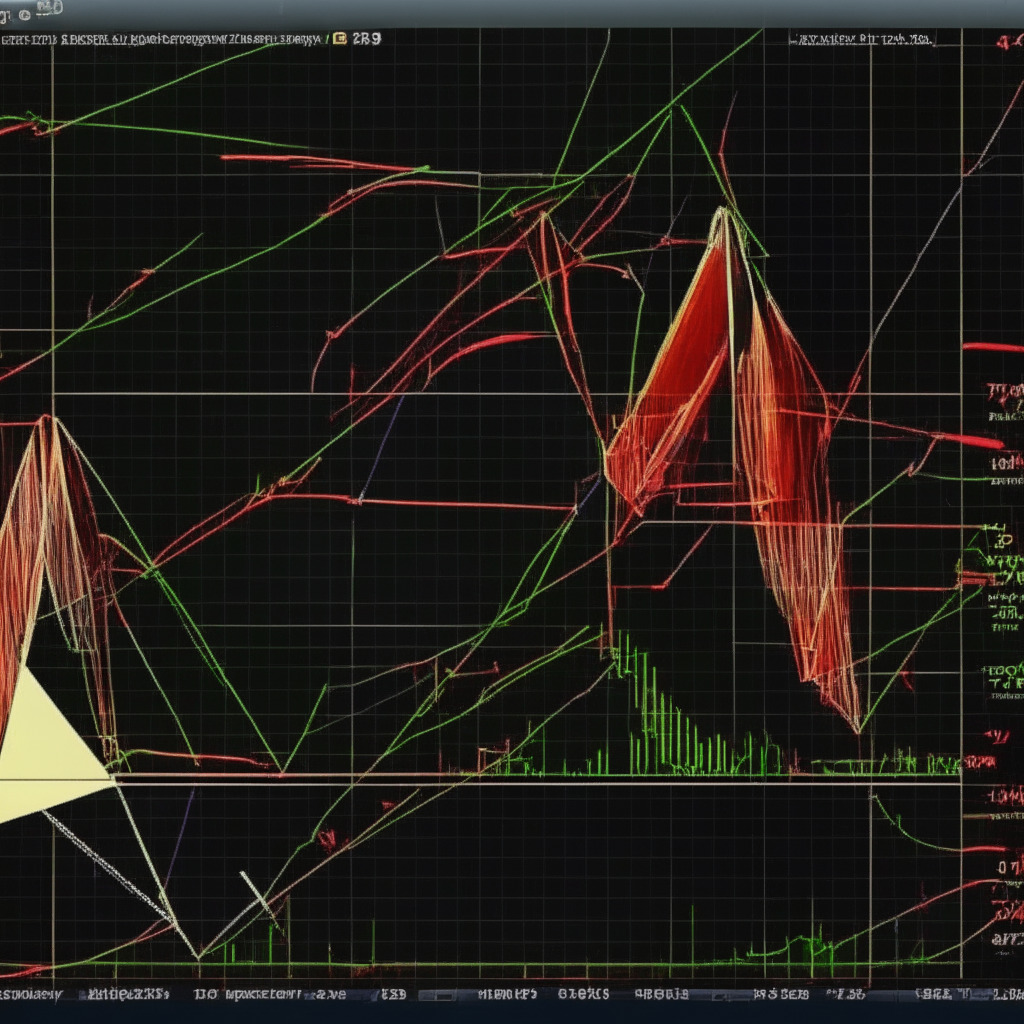

The world’s largest crypto exchange,Binance, is currently facing legal action in the U.S. from the Securities and Exchange Commission (SEC). This has put the native token of the crypto exchange, BNB, under intense selling pressure. In a week, the altcoin’s market value has dropped 17.5%, plunging to a low of $253.3. However, it is crucial to note that the support at this level aligns with the long-standing support trendline of the triangle pattern, indicating a high accumulation zone for BNB.

The Binance Coin price’s daily chart highlights the formation of a symmetrical triangle pattern. The triangle comprises two converging trendlines, creating a shrinking range that could eventually lead to a remarkable movement in the breakout direction. At the time of writing, the BNB price traded at $262.6 and continued to hover above its long-coming support trendline. With an intraday gain of 0.3%, the daily chart displays long-tail rejection at this multiple-month support level, signaling that buyers might be accumulating at this point.

A bullish reversal from the triangle pattern’s support trendline could present traders with a bullish swing opportunity. The daily Relative Strength Index (RSI) slope dives into the oversold region, suggesting that seller activity has gone overboard and more buyers might take advantage of the discounted price. If the bullish momentum increases, it could trigger a bullish reversal, pushing the BNB price back to higher levels. The potential rally could thrust prices back to the overhead trendline near the $315 mark, exhibiting a 20% growth potential.

On the contrary, a breakdown below the aforementioned trendline will negate the bullish thesis. Theoretically, a bullish reversal from the triangle pattern’s support trendline could initiate a new bull cycle, providing a short-term trading opportunity that may lead the price back to $300 and meet the above trendline. Nevertheless, a sustained recovery rally can only be expected if the price breaches the overhead trendline.

The Exponential Moving Average (EMA) demonstrates a bearish crossover between the 50 and 200-day EMA, which may increase selling pressure in the market. This could then trigger a minor consolidation above the trendline.

In conclusion, while the Binance Coin is currently under selling pressure, the support trendline within the symmetrical triangle pattern may offer traders a bullish swing opportunity. However, it is essential to keep an eye on market conditions and conduct thorough research before investing in cryptocurrencies, as there are no guarantees, and the author or publication bears no responsibility for any personal financial loss.

Source: Coingape