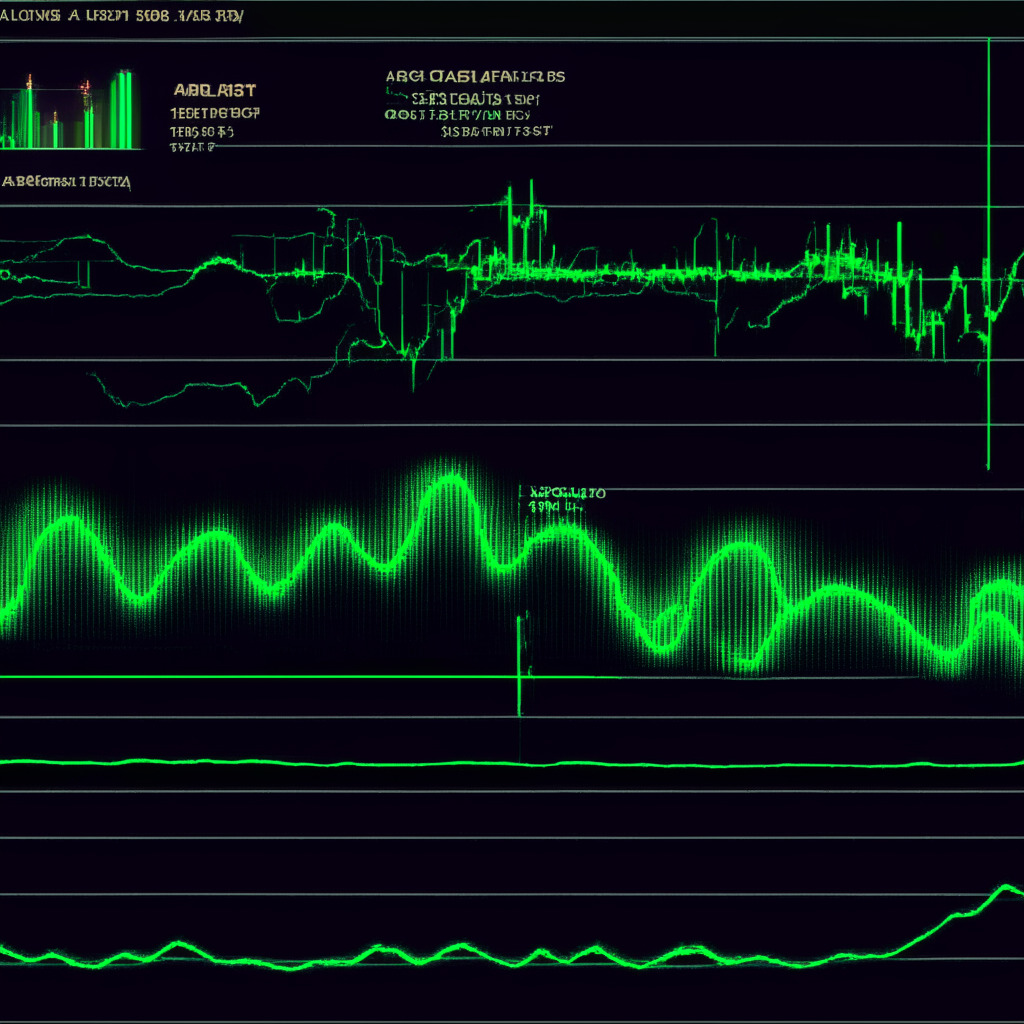

The crypto market has been experiencing a tug-of-war between buyers and sellers, with no identifiable long-term trend at the moment. Bitcoin presently seems positioned for temporary consolidation, but the short-term downtrend remains in force. A wedge pattern signals that the cryptocurrency’s price could drop before a significant upswing occurs. Bearish momentum across the market appears to be gradually decreasing due to the formation of a falling wedge pattern. In order for a bullish recovery to take place, however, a breakout beyond the overhead resistance trendline is essential.

Tradingview‘s statistics reveal that Bitcoin’s intraday trading volume sits at $12.2 billion, marking a 22% loss. As buyers and sellers struggle to gain control in the market, it’s best to rely on short-term trends for near-future projections. Affected by the falling wedge pattern, Bitcoin’s price has wavered between two converging trendlines for months. If the pattern’s downsloping trendline remains undamaged, the coin could potentially fall to the $24,000 mark within the month.

Nonetheless, buyers still harbor a bullish outlook due to a couple of factors. Firstly, the wedge pattern is typically characterized as an uptrend continuation setup that could offer a considerable leap upon breaking out of the resistance trendline. Additionally, there is a long-standing support trendline that might provide significant pullback chances. In the case that market sentiment remains indecisive, Bitcoin’s price might descend to lower levels, possibly reaching the next major support benchmarks at $25,000 and $24,000 respectively.

The Moving Average Convergence Divergence (MACD) emphasizes the persistent market uncertainty through its narrow fluctuations and numerous crossovers between the MACD (blue) and signal (orange) lines. Furthermore, the Super trend’s red projection on the daily indicator underlines the prevailing bearish market trend.

While the information presented here includes the author’s personal opinion, it’s essential for readers to conduct their own market research before making any investments in cryptocurrencies. Market conditions are subject to change, and both the author and the publication hold no responsibility for any personal financial losses.

Source: Coingape