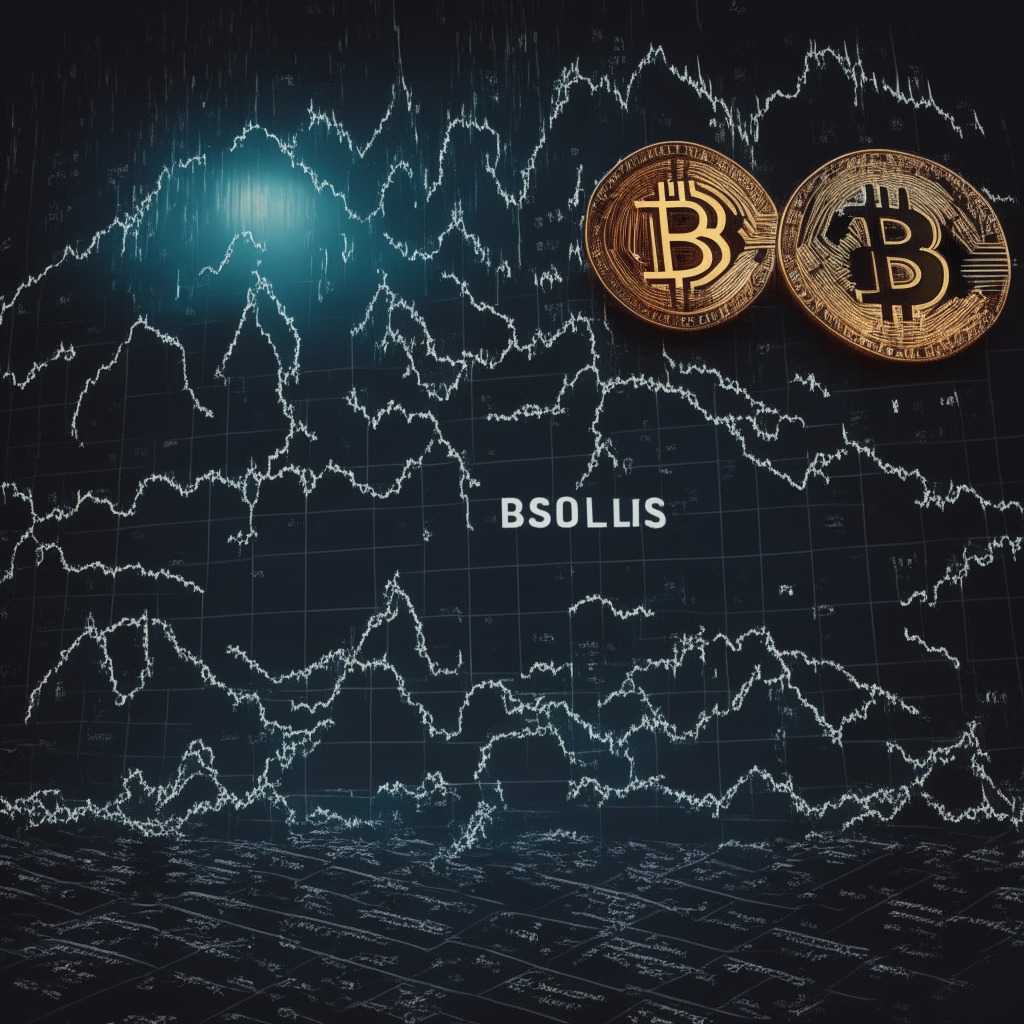

The crypto market recently experienced a sharp sell-off, causing several cryptocurrencies to tumble in price. On June 11th, the leading cryptocurrency Bitcoin (BTC) showed a nearly 3% fall, although by press time it has recovered somewhat, currently down 1.79%. This rejection of lower prices indicates that buyers are defending the digital asset, keeping its upward potential intact.

Despite the recent market sell-off on June 5th and June 10th, BTC’s price managed to sustain above the lower trendline, reflecting a strong accumulation level for buyers. This development occurs within a falling wedge pattern, which is generally considered a sign of decreasing selling pressure, potentially leading to a massive bullish upswing. Currently, the converging trendline is narrow enough to project a no-trading zone, suggesting that BTC’s price may prolong its sideways trend for a few more sessions before an actual breakout.

A potential breakout would offer traders a long entry opportunity with a target price of $31,170. The wedge pattern’s support trendline remains strong even in the face of a highly volatile market scenario. Coin buyers utilize this support to prevent a massive downfall and recuperate the bullish momentum. As long as this trend remains intact, BTC is not likely to plunge below $25,000.

However, the Moving Average Convergence Divergence (MACD) indicator currently shows a bearish alignment between its blue (MACD) and orange (signal) lines, accentuating a steady downtrend in BTC’s price. The daily chart also displays overhead resistances at $27,680 and $29,500, with important support levels at $25,500 and $23,750.

It’s essential for investors to do their market research before investing in cryptocurrencies, as the author or publication of this article cannot hold responsibility for personal financial losses. The increased negativity in the crypto market may further hinder the progression of BTC and other digital assets. However, as the buyers defend their positions, the possibility of an eventual bullish breakout remains plausible. Time will tell if BTC can rise above its resistances and continue the prior recovery rally, signaling a continuation of the digital asset’s upward momentum.

Source: Coingape