Amidst regulatory challenges and liquidity issues, the crypto market, particularly Bitcoin and Ether, continues to demonstrate resilience. Recent actions from U.S. regulators are targeting major crypto exchanges and declaring several altcoins as securities, which carries negative connotations within the crypto sphere.

Despite these setbacks, Bitcoin’s current performance remains robust, opening the Asia trading week with a 0.4% increase to $25,912, while Ether sees a slight decline to $1,748. According to Johnny Teng, Senior Researcher at LBank Labs, the liquidity situation has considerably worsened. This is due to the withdrawal of institutional investors, who anticipate potential scrutiny from the SEC.

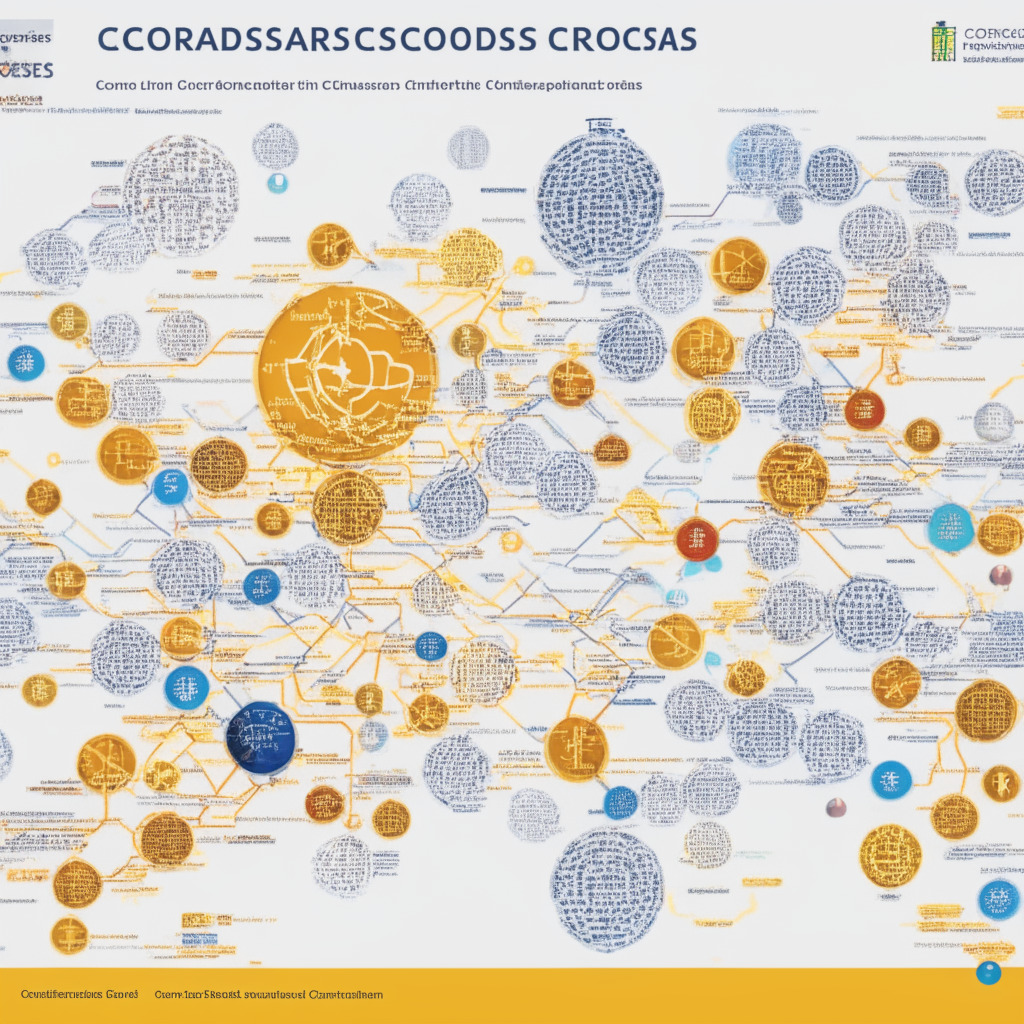

Crypto enthusiasts are now discussing whether this is the right time for crypto exchanges to have simpler corporate structures. Following FTX’s bankruptcy proceedings, its restructuring team released a chart detailing the complexity of Sam Bankman-Fried’s former empire. The organization, with 300 employees, controlled 130 companies when it filed for bankruptcy in November 2022.

Currently, the main focus is on Binance as it faces dual cases from the CFTC and SEC. As part of legal actions against Binance, the SEC has recently listed dozens of corporate entities controlled by Changpeng ‘CZ’ Zhao. Inca Digital, a crypto forensics company, published a more comprehensive list showing the network of companies connected to CZ and top Binance associates.

The case for simplifying the corporate structure of crypto exchanges is worth considering. FTX’s restructuring team is charging tens of millions of dollars a month to untangle the corporate web. Furthermore, Binance’s claims that CZ did nothing wrong could be more easily believed if their transactions appeared more straightforward to the trained eye. If Binance didn’t rely so much on companies controlled by CZ, it wouldn’t resemble comingling to the SEC’s accountants.

For comparison, Coinbase has 15 subsidiaries, according to a Feb 2023 filing with the SEC. This shows it’s possible for a large crypto exchange to maintain a corporate structure that fits within an A4 piece of paper.

In the current tumultuous climate, it is essential for market participants to keep a close eye on indications from regulators and decisions made by Binance, Coinbase, and other exchanges. As the SEC launches wide-ranging lawsuits against crypto’s biggest players, only time will reveal the lasting effects on the industry. Meanwhile, the debate on the benefits of simpler corporate structures for crypto companies continues to occupy the minds of industry participants.

Source: Coindesk