Bitcoin has reached a significant milestone once again, as the pioneering digital currency hit the $30,000 mark for the first time since April. Enthusiasts and investors alike will remember that Bitcoin surpassed this threshold on April 10th, only to experience a slow decline in the following days. The downturn lasted for two months, predominantly due to heightened concerns from US regulators causing jitters among investors.

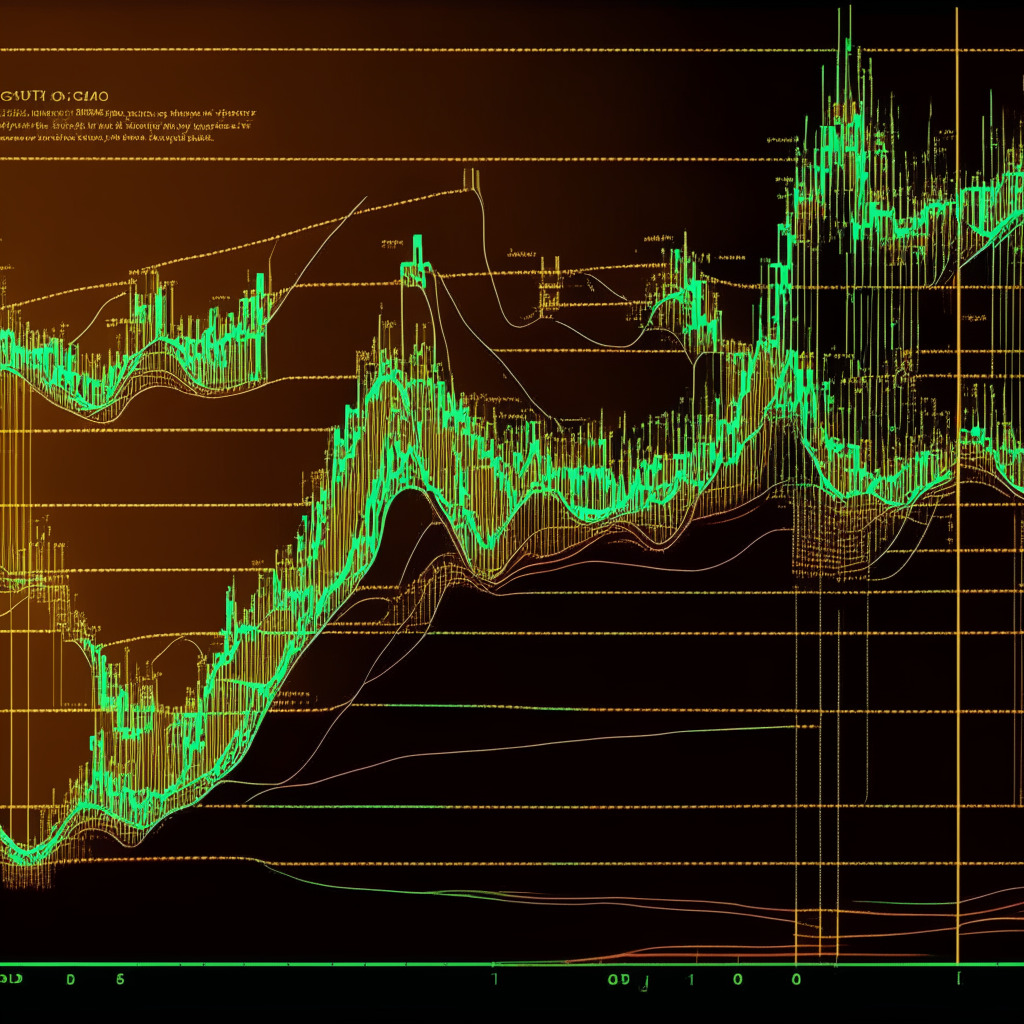

The price of Bitcoin at the time of writing this article floats just above the $30,000 mark, with an impressive 10% increase for the day, based on TradingView data. This upward movement seems to be contagious, as the rest of the crypto market, including typically stagnant altcoins like Bitcoin Cash, is witnessing similar surge.

The question emerges: what is driving this sudden spike? It’s worth noting that the surge in the overall cryptocurrency market follows what seems to be a restoration of confidence among institutional investors in digital gold. For instance, EDX Markets, a new digital asset exchange backed by renowned financial giants Fidelity, Charles Schwab, and Citadel Securities, launched just a day prior. The exchange claims to be attracting institutional capital by “bringing the best of traditional finance to cryptocurrency markets,” according to CEO Jamil Nazarali.

On the other hand, some skepticism still exists concerning the long-term sustainability of this market resurgence. Earlier this week, digital asset management firm CoinShares reported a noticeable shift in sentiment among institutional investors after BlackRock, the world’s largest asset manager, applied for a Bitcoin ETF with the US Securities and Exchange Commission (SEC). The SEC has historically denied multiple ETF applications, but some believe BlackRock’s strong reputation and track record with the SEC could improve its odds.

Bitcoin’s journey has been quite eventful, as it started the year valued at $16,615 per coin. Fast-forward to the present, the digital currency is up by over 80% since the beginning of 2023. However, it is still a long way from reaching its all-time high of $69,044, which was achieved in November 2021.

While the market’s bullish landscape is certainly a cause for celebration among crypto enthusiasts, it is essential to remember that there is an underlying battle between believers and skeptics. While the surge following renewed interest from institutional investors hints at a robust future for digital assets, the fate of Bitcoin and other cryptocurrencies ultimately lies in the decisions made by regulatory authorities and the stability of the market itself.

Source: Decrypt