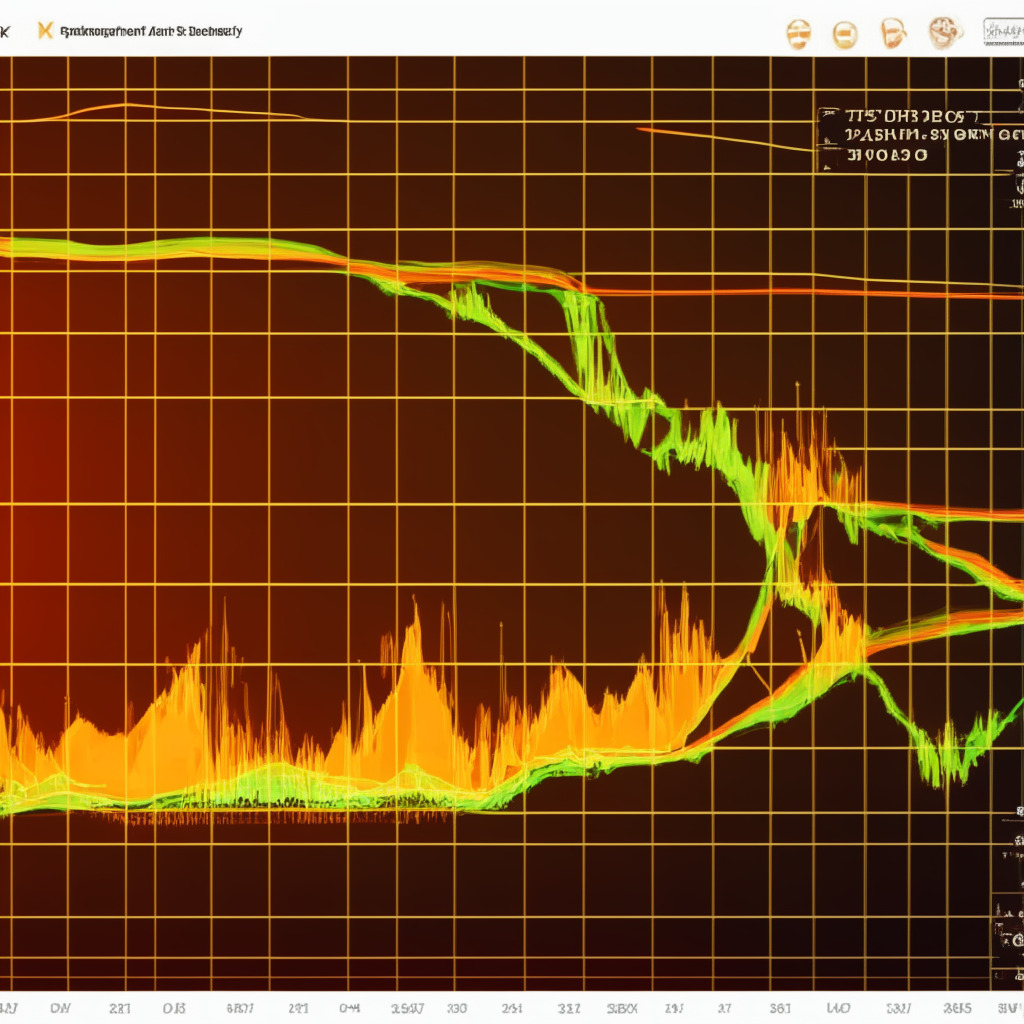

The recent events surrounding the BNB coin have captured the attention of crypto enthusiasts worldwide. On June 10th, BNB experienced a massive breakdown from its support trendline within the symmetrical triangle pattern. This was anticipated to trigger further decline in the coin’s value. However, the improving bullish sentiment in the crypto market has brought about a minor consolidation phase just below the breached trendline, raising questions about the sellers’ ability to maintain lower levels.

Notably, the formation of an ascending triangle pattern on the lower time frame chart suggests a gradual increase in underlying bullish momentum for BNB. This pattern is a bullish continuation sign that can potentially lead to a significant upswing if the neckline resistance is broken. With BNB currently trading at $246.8 and experiencing an intraday loss of 0.32%, there’s a possibility that buyers can break through the $0.253 neckline resistance and reclaim the previously mentioned trendline.

In light of these technical analysis findings, crypto investors have their eyes set on potential future movements. A breakout above the ascending triangle’s neckline could fuel buying pressure, sending BNB prices back up toward the $300 level. However, it’s essential to consider that the long-term trend for Binance coins remains bearish. If the coin’s price were to break the lower trendline of the ascending triangle, it would signal a return to the previous downtrend and could push the coin’s value down to $220 or even $200.

While the market remains unpredictable, it’s worth noting that some technical indicators are pointing to potential opportunities. For instance, the exponential moving average (EMA) over 20 days is hovering near the $253 mark, which may further consolidate resistance at that level. Moreover, a bullish crossover between the moving average convergence divergence (MACD) and signal lines may introduce more buying orders into the market.

The recent Binance Coin developments coincide with growing interest from large asset management companies in the spot Bitcoin ETF. This increased attention has sparked optimism among investors and contributed to the bullish sentiment in the crypto ecosystem.

To conclude, while the future remains uncertain, recent market trends and technical indicators suggest that BNB prices could experience significant shifts in the near term. As always, crypto enthusiasts should conduct thorough research and take into account the risks associated with investing in digital currencies. The market remains subject to volatility, and personal financial loss remains a possibility for those who invest without adequate knowledge.

Source: Coingape