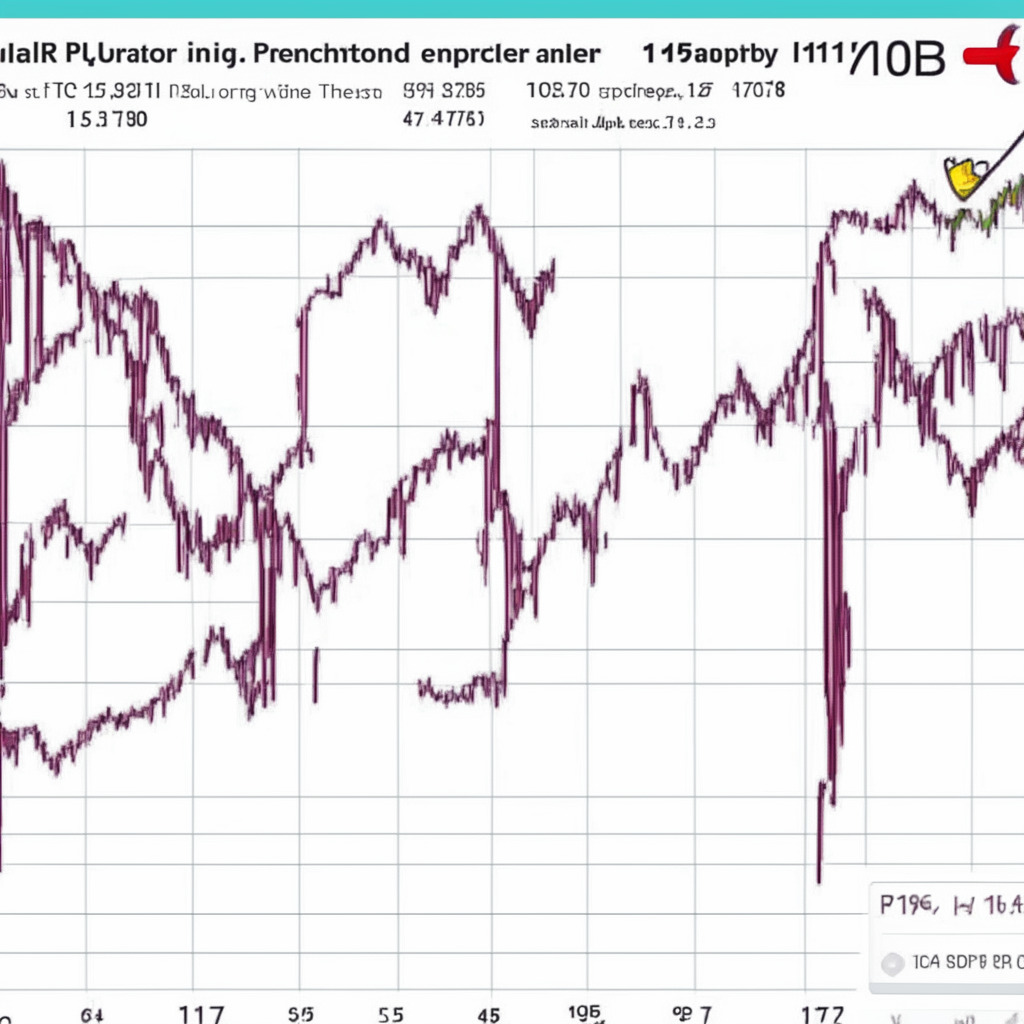

The crypto market has been abuzz with excitement as the U.S. Securities and Exchange Commission (SEC) recently approved the 2x Bitcoin Strategy ETF, also known as BITX. This groundbreaking decision paves the way for the launch of the Volatility Shares ETF on Tuesday, June 27, 2023, making it the first-ever leveraged crypto ETF to receive the SEC’s green light. With the BTC price surpassing $31,000 on Friday, it seems that the approval of BITX could not have come at a better time.

What makes the Volatility Shares ETF so notable is that it will allow customers to gain exposure to the crypto market with just 50 per cent of Bitcoin’s price. The timing of this development coincides with recent news of investment management giant Blackrock filing for a Bitcoin ETF application with the SEC. This renewed interest in the crypto market from mainstream financial firms has undoubtedly played a role in Bitcoin’s price recovery.

As if that wasn’t enough to excite crypto enthusiasts, it’s worth noting that other companies such as Valkyrie Investments and Bitwise also have plans to launch their Bitcoin ETF funds. The race to be a part of this new financial wave is certainly on, and it’s clear that many major players in the financial world are eager to join in on the action.

Despite the anticipation surrounding the Volatility Shares 2x Bitcoin Strategy ETF launch, it’s important to consider the potential risks that may come with investing in such a product. Stuart Barton, the company’s chief investment officer, mentioned that the SEC hasn’t denied the ETF application thus far, which effectively leaves the company open to launching the Bitcoin ETF. The ETF filing also stated that the Volatility Shares ETF will link up with the CME Bitcoin Futures Daily Roll Index.

As the crypto market continues to evolve and more mainstream financial giants are showing interest in this space, it is important for investors to approach these new offerings with caution. With the approval of the first-ever leveraged crypto ETF and rumors of a Bitcoin CME Gap at $34K-$35K, which could signal a significant rally in July, there’s no doubt that the crypto market is entering a new era. Nevertheless, understanding the inherent volatility and risks associated with this emerging asset class remains key to making prudent investment decisions.

While the approval of BITX and the launch of the Volatility Shares ETF is certainly a noteworthy milestone, it’s essential for investors to conduct their market research diligently before diving into the world of cryptocurrencies. The author or this publication does not hold any responsibility for an individual’s personal financial loss. Always approach such investments with a healthy dose of skepticism and ensure you are well-informed about the potential risks and rewards.

Source: Coingape