Cuscal, in partnership with Zepto, has imposed new banking restrictions on cryptocurrency exchanges in Australia. Blockchain Australia criticizes these actions and invites a roundtable discussion on June 27. The new restrictions include a 24-hour hold on first-time inbound payments, real-time user identity verification, and undisclosed transaction limits on exchange payments.

Month: June 2023

End of Non-Securities Crypto Trading: Legal Implications & Future Adaptions

The era of trading cryptocurrencies as non-securities may be ending, says Itai Avneri, COO at INX. With legal implications affecting exchanges, a focus on categorizing cryptocurrencies within the financial landscape is crucial for compliance with regulatory guidelines and balancing innovation with financial security.

Unlocking the Power of Layer-1 Marketing in the Blockchain World: Building Trust and Loyalty

A solid marketing strategy for blockchain projects begins with establishing a strong brand identity, or layer-1, encompassing values, ideas, narratives, and visuals. Integrating essential characteristics like decentralization, immutability, transparency, and longevity can lead to long-term success and valuable connections with the target audience.

Revolutionizing Parametric Insurance with AI and Blockchain: The dRe Platform Debate

Arbol’s dRe platform offers AI and blockchain-driven parametric insurance for reinsurance, targeting severe storm catastrophes. Leveraging dClimate’s weather data and Chainlink’s oracle network, the platform automates claim initiation, notifications, and loss calculations for faster payouts and improved transparency, aiming to revolutionize the reinsurance market.

Alibaba’s New Chairman Sparks Crypto Dreams: Is China Ready to Embrace Web3?

Alibaba appoints crypto-friendly Joseph Tsai as new Chairman amidst restructuring, sparking interest in the crypto community. Tsai is an advocate of cryptocurrencies and digital assets, prompting speculation of Alibaba embracing Web3 and crypto in China. Hong Kong’s recent regulatory framework for crypto shows growing interest in digital assets.

Deutsche Bank’s Crypto Custody Move: A Shift Towards Acceptance or Centralization Concerns?

Deutsche Bank, Germany’s largest banking institution, has applied for a digital asset custody license from the German financial regulator BaFin, signaling a shift in attitude towards the crypto sector. While this move increases acceptance of digital assets, it also raises concerns about excessive centralization and potential regulatory challenges.

European DeFi Startups Boom: Unraveling the Web3 and AI Investment Phenomenon

European DeFi startups witnessed a 120% increase in VC funding in 2022. Investing in Web3 is considered a “hedge against disruption,” with generative AI driving interest in the space. However, regulatory challenges and the crypto market’s volatility raise concerns about the potential integration of blockchain and AI.

Tate Brothers Scandal: A Wake-up Call for Crypto Regulation and Community Responsibility

The Tate brothers’ involvement in alleged human trafficking and organized crime raises concerns about digital asset misuse, emphasizing the need for robust regulatory measures and vigilance within the crypto community to uphold the technology’s core values and ensure its transformative potential isn’t overshadowed by malicious actions.

EDX Markets: A Leap Towards Crypto Adoption or Risky Business for Wall Street?

EDX Markets, a crypto exchange backed by established broker-dealers and venture capital firms, has launched. Offering safe and compliant trading services for select cryptocurrencies, the platform aims to attract brokers and investors while addressing regulatory scrutiny from US regulators. This launch signifies a significant step towards broader adoption and integration of cryptocurrencies into the traditional financial system.

Upcoming Bitcoin Halving & ETF Approval: Igniting the Next Bull Cycle?

Several factors, including the upcoming Bitcoin halving in 2024, BlackRock’s Bitcoin ETF application, and technical analysis predictions, could potentially ignite the next Bitcoin bull cycle, contributing to new price rallies and market dominance.

Deutsche Bank Dives into Crypto Custody: Milestone or Centralization Concern?

Deutsche Bank, with $1.3 trillion in assets, has applied for a digital asset custody platform license from Germany’s finance regulator. This move positions the bank to potentially establish a minimum viable product in 2021, signaling a significant step toward embracing digital assets in the traditional financial sector.

Deutsche Bank Goes Crypto: Exploring Their Move into Digital Asset Custody and Its Implications

Deutsche Bank, Germany’s largest banking institution, has applied for a digital asset custody license with BaFin, aiming to expand its digital asset custody services, including cryptocurrencies. This marks a shift from the bank’s previous critical stance toward the volatile and unpredictable crypto market.

Exploring the $5 Trillion Tokenization Opportunity: Benefits, Challenges, and Key Players

Tokenization is predicted to reach a massive $5 trillion opportunity over the next five years, with leading forces including stablecoins, CBDCs, private market funds, securities, and real estate. However, regulatory challenges and market volatility could significantly impact its realization.

Binance Fends Off Scams: Importance of Due Diligence in Crypto Landscape

Binance issued a cease and desist order to a fraudulent company, Binance Ltd, which falsely claims affiliation with the cryptocurrency exchange. This incident highlights the importance of due diligence and caution when navigating the crypto landscape, amidst scammers seeking to profit from the thriving sector.

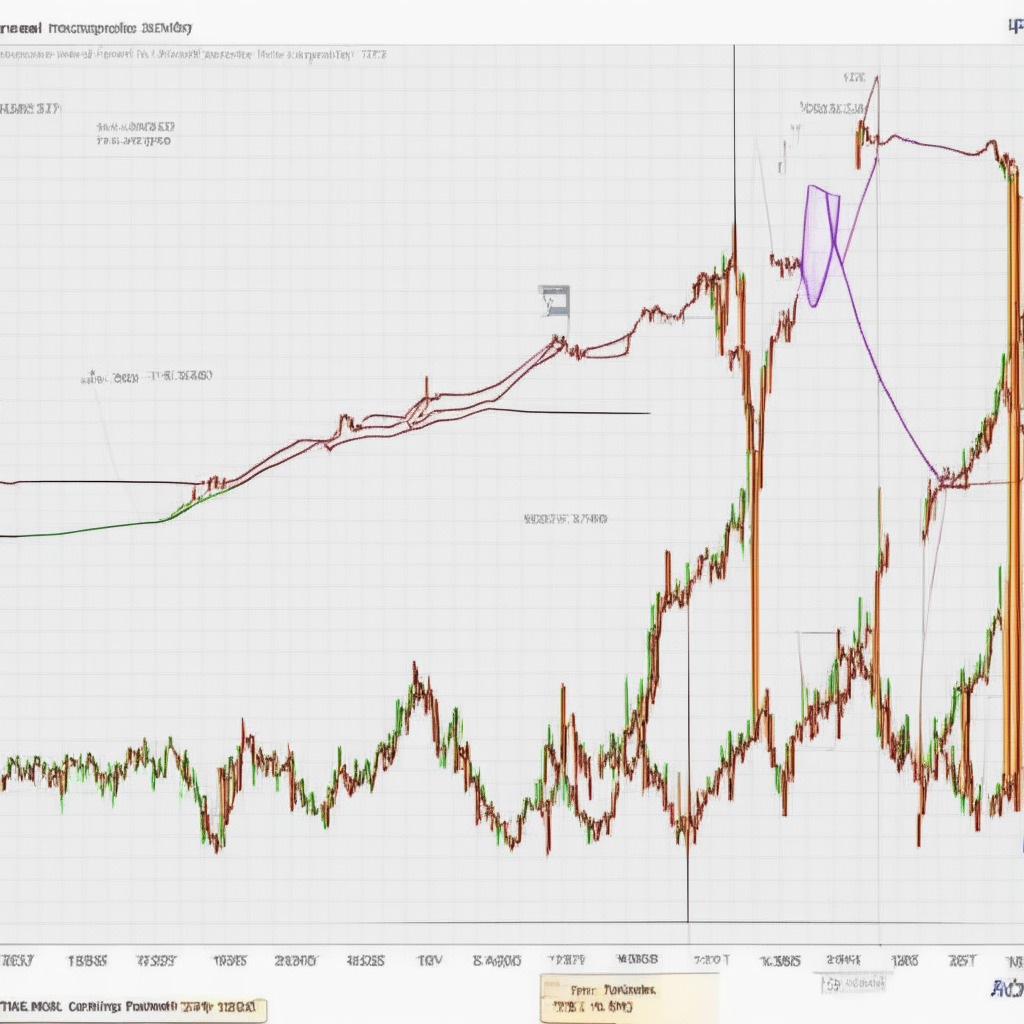

Ethereum Price Rally: Analyzing the Resistance Barrier and Potential Breakout Prospects

The Ethereum price recently experienced an 8.5% surge after encountering a crucial support level, reaching a resistance zone of $1775-$1765. However, selling pressure halted the rising momentum, suggesting possible consolidation before a significant recovery rally. JPMorgan recently backed Ethereum, despite some disagreements within the crypto community.

Binance Embraces Lightning Network: Speed vs Centralization Concerns

Binance confirms plans to integrate the Bitcoin Lightning Network, a layer-2 scalability solution for rapid and low-fee transactions. This move follows transaction processing issues in May and aims to make deposits and withdrawals on Binance’s platform faster and easier.

IMF’s CBDC Push: Power Grab or Genuine Financial Inclusion Effort? Pros and Cons Explored

The IMF’s pursuit of central bank digital currencies (CBDCs) and the “XC platform” for cross-border payments has been met with resistance from the crypto community. Criticisms include accusations of a power grab and concerns about government control. However, potential benefits include simplified cross-border payments and financial inclusion.

Unified Ledger Revolution: Merging CBDCs, Tokenized Money, and Assets on One Platform

The Bank for International Settlements (BIS) proposes a unified electronic ledger to improve the global financial system by combining central bank digital currencies, tokenized money, and assets on a single platform, using blockchain and automated smart contracts. This innovation could offer novel securities settlement methods, reduce trade finance costs, and eliminate inefficiencies in cross-border transactions.

Massive Crypto Heist Sparks Debate: Transparency vs Security in Blockchain Technology

Hackers targeted Atomic Wallet, stealing $35 million and using THORChain to launder their gains. Blockchain analysis firm MistTrack tracked the stolen funds, exposing the transparency of blockchain technology. Yet, concerns about digital asset security and decentralization misuse persist.

Powell’s Upcoming Speech: A Potential Catalyst for Crypto Rally or Regulatory Scrutiny?

As the global crypto market cap reaches $1.08 trillion, investors await Jerome Powell’s testimony before the US Senate House committee, which could impact market sentiment and influence future interest rate decisions. Amid regulatory scrutiny on crypto exchanges, Powell may also address the state of crypto regulation and the Fed’s stance on innovation in digital assets.

Binance’s European Exodus: Sign of Sinking Ship or Resilient Adaptation?

Binance, the world’s largest crypto exchange, faces legal complications with global financial watchdogs, leading to key European executives departing the company. This raises questions about Binance’s long-term stability in the European market and highlights the importance of market research before investing in cryptocurrencies.

IMF’s Vision for a Global CBDC System: Revolutionizing Cross-Border Payments

IMF’s Tobias Adrian proposes a global central bank digital currency (CBDC) system called “XC” platform, aiming to address issues such as high costs and slow processing in cross-border payments. Utilizing a trusted global ledger, the system enables efficient international transactions without introducing middleware cryptocurrencies, while automating contracts and maintaining central banks’ control over reserve allocation.

Bitcoin Accumulation Booms Amid Regulatory Risks: What It Means for Investors

Bitcoin is experiencing the fastest accumulation rate in six months, with illiquid entities now holding a record high of 15,207,843 BTC. This growing trend signifies confidence in Bitcoin’s future price, despite macroeconomic uncertainty and regulatory risks. The market appears to be in a period of quiet accumulation, suggesting an undercurrent of demand.

Japan’s Crypto Margin Trading Debate: Higher Leverage for Growth or Investor Risk?

Japanese cryptocurrency exchanges urge regulators to reconsider strict margin trading restrictions, as the Japan Virtual and Crypto Assets Exchange Association (JVCEA) advocates for higher leverage limits to boost market growth and attract new participants. The push aims to draw diverse traders and enhance market liquidity.

Binance Lightning Network Integration: Fast Transactions vs Blockchain Security Risks

Binance, a leading crypto exchange, is working towards integrating Bitcoin’s Lightning Network for faster and cheaper transactions. Despite no set timeline for completion, this move highlights the network’s growing popularity among users and exchanges, while also raising concerns regarding potential risks to blockchain security and decentralization.

Binance Lightning Integration: Future of Crypto or Centralization Concern?

Binance’s move to incorporate Lightning nodes for Bitcoin transactions addresses network congestion issues and promises faster transaction times with minimal fees. Although the Lightning network offers improvements, concerns on scalability, security, and decentralization still persist in the crypto community.

Cardano’s Future: Mainnet and Wallet Upgrades Amid Regulatory Challenges

Cardano announces the launch of Node 8.1.1 mainnet release and Lace 1.2 wallet upgrade, offering improvements and new features. Despite regulatory challenges, the community remains committed to enhancing the network. These innovations could impact ADA’s price, but caution and thorough market research are essential.

Arkon Energy’s US Expansion: Renewables, Bitcoin Mining Growth, and Industry Challenges

Arkon Energy plans to expand its operations to the US after acquiring a site in Ohio and raising $26 million in capital. The new facility aims to provide bitcoin mining firms with server hosting services, creating a predictable revenue stream in the challenging crypto market. Amid uncertainties, Arkon’s innovative adaptation offers growth opportunities for industry stakeholders.

Binance Integrates Bitcoin Lightning Network: Boost for Faster Transactions or Limited Adoption?

Binance plans to integrate the Bitcoin Lightning Network for faster, cheaper transactions, addressing scalability issues. Despite its potential, the Lightning Network’s liquidity is less than 0.5% of Ether locked in DeFi contracts, raising questions about mainstream adoption and its impact on cryptocurrencies and cross-border payments.

Binance Integrates Bitcoin Lightning Network: Boon or Bane for Users?

Binance is integrating the Bitcoin Lightning Network for quicker deposits and withdrawals, addressing recent challenges with pending BTC withdrawals. This move will enable faster, more scalable Bitcoin transactions, reduced transaction costs, and improved efficiency, though some potential network drawbacks remain.

IMF’s Role in the Future of CBDCs: Pros, Cons, and Global Regulatory Debate

The IMF is working on a global infrastructure for interoperability between central bank digital currencies (CBDCs) to prevent underutilization. Meanwhile, France’s AMF advocates globally coordinated rules for DeFi, and Ethereum developers consider raising the maximum validator balance for network efficiency.

Cardano’s 8.1.1 Upgrade: Smoother Transitions and The Impact on ADA’s Value

The recent Cardano 8.1.1 upgrade aims to streamline epoch transitions, enhancing network processing speeds and offering an improved user experience. Additionally, the update includes fixes for peer-to-peer communications and the Cardano-based domain name system, showcasing developers’ dedication to refining the platform.