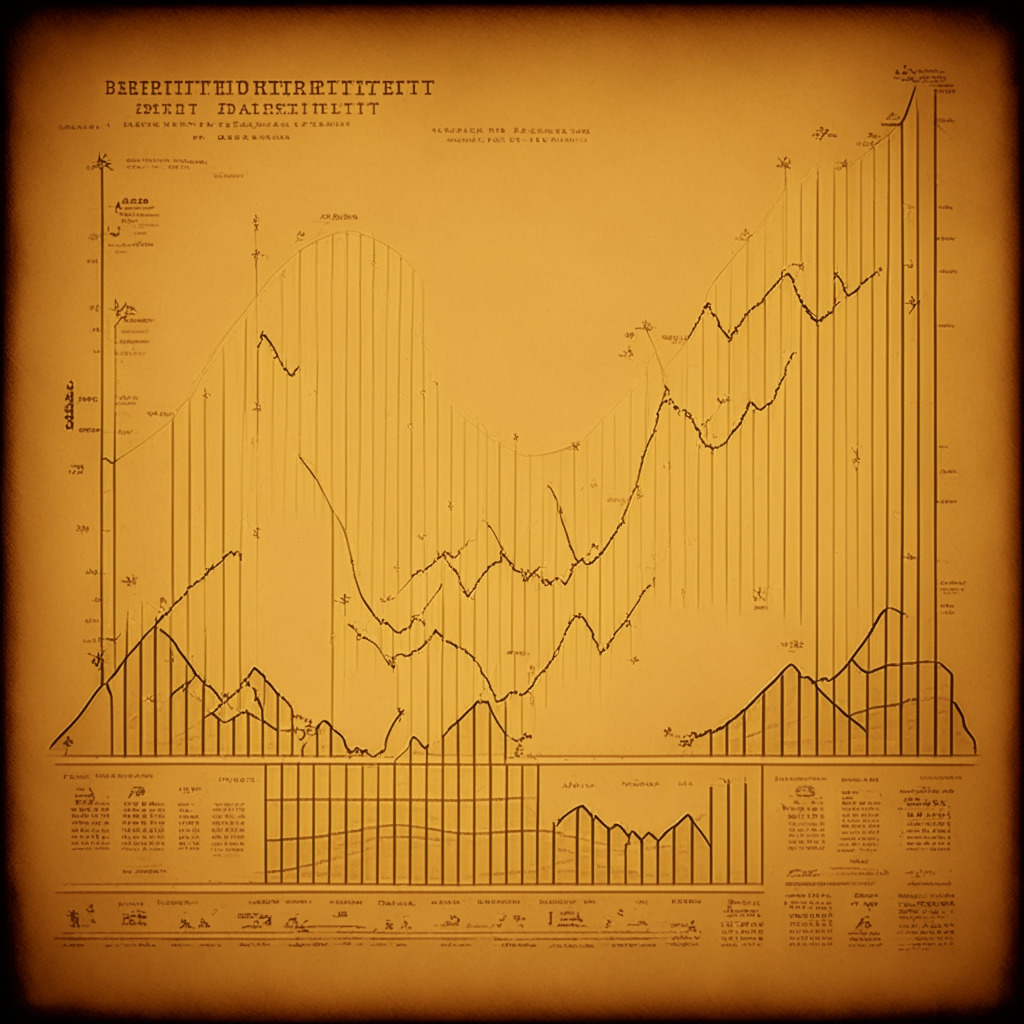

Drawing from a captivating graph that juxtaposes internet adoption with crypto adoption, it’s perceived that crypto, like the internet, is gaining users at a breathtaking pace. The internet, starting with virtually no users in 1990, now engulfs a staggering 62.5% of the global population, approximately 5 billion users. Echoing similar predictions, crypto could hit the 5 to 6 billion-user mark around 2047, all things being equal.

Before being swept off your feet by these forecasts, it is prudent to cast a discerning eye on the fundamental differences between these two digital behemoths. The internet’s ubiquity in our lives far outstrips that of crypto – it is impossible to compare their breadth. While crypto boasts of its many use cases, it typically serves the average consumer as either a speculative investment or a means of transferring value.

A more grounded approach is to dissect adoption patterns, assessing cryptos in the light of comparable financial services technologies. Case in point, mobile banking, an innovation that has been around for several years. McKinsey reports that by 2021, just over half of North Americans and less than half of Western and Central Europeans relied on mobile banking. Similarly, despite stock investing dating back centuries, only a fraction of Americans actively invest in stocks.

These figures shine a light on human behavior – evincing our slow pace in embracing even the most straightforward financial technologies. Observing that less than half of the world capitalizes on mobile banking, a staggering 26 years since its inception, implores us to reconsider crypto’s growth trajectory. Even with population growth forecasts, it’s likely crypto might struggle to hit the predicted 5 billion users by 2047.

The complexity of crypto may pose a significant barrier to widespread adoption. The traditional banking system is still actively rising and has not reached full adoption. One could surmise that if regulation does not throw a wrench in the works, a more conservative user estimate would be between 2-3 billion users.

Whether cryptos might outpace or even blend with the current methods needs careful analysis. Crypto has the monumental task of challenging or aligning with the current system, which is caught up in a constant whirl of adaptation and modernization.

Source: Coindesk