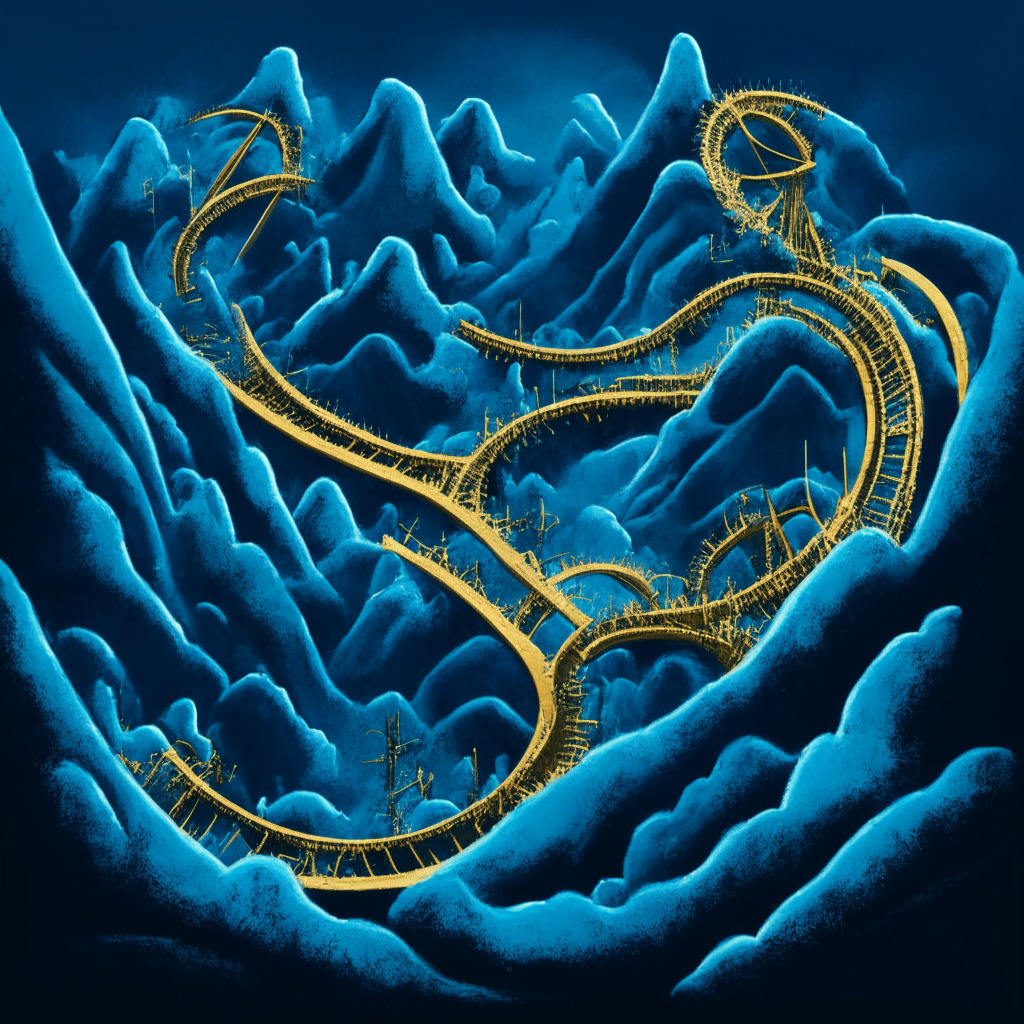

In a seemingly instantaneous twist of fate, the digital market experienced an unexpected setback as the price of Bitcoin collapsed, descending by more than 3% from a previous $31,750 to $30,290. With the volatility of cryptocurrency, this swift downfall caught many a savvy investor by surprise, raising questions and speculations about Bitcoin’s next price target.

An interesting factor that might have played a role in this sudden sale flurry could be a stronger-than-anticipated Preliminary University of Michigan (UoM) Consumer Sentiment figures’ impact on Bitcoin. With the UoM consumer sentiment index revealing a solid 72.6, it surpassed predictions and last month’s data. An optimistic consumer sentiment often catalyzes a robust economy and traditional market confidence, potentially deflecting funds away from volatile assets like Bitcoin.

In this time of uncertainty, traders and meticulous observers are looking for signs and indications that might predict Bitcoin’s next price destination. So far, Bitcoin’s price action has encountered a considerable pullback after the unsuccessful attempt to cross the critical resistance of $31,793, and currently trades around the range of $30,300. Aided by an upward trendline, Bitcoin finds a safety net near the $30,000 mark, but faces potential resistance at the $30,411 threshold. Should the $30,000 base crumble, the following safety ledge to watch out for is the $29,500 mark. Meanwhile, bearish indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) reside in alignment with a notable resistance level near $30,750.

If the $30,000 barrier crumbles, Bitcoin may continue on its downward ride towards the $28,711 mark, targeting $29,500 along the way. However, surpassing the $30,400 level may herald renewed bullish potential, breaking a path to higher price targets of $30,700 and possibly, $31,350.

In the light of this analysis, it becomes pivotal to watch the $30,000 mark. A breach above could hint at a bullish uprising, while failure to sustain it may result in the return of a bearish trend. After cautious review, Bitcoin’s immediate support floats around $30,000, while resistance lingers around $30,400. Any breach below this support could apply additional bearish pressure toward $29,500; however, any breakthrough above the $30,400 level could kickstart a bull run with the potential to soar towards $30,700 and even, $31,350.

As always, investors and traders are urged to watch these key price points and adjust their strategies to suit Bitcoin’s short-term price direction. To stay at the digital frontier, explore the top 15 digital assets to watch out for in 2023 and discover the opportunities they offer. While cryptocurrency projects can provide substantial return on investment, their inherent volatility entails significant risk—vigilance and thorough research are crucial.

Source: Cryptonews