The buzzing crypto market showcases a remarkable contrast of scenes as the price of LTC risks a likely 30% drop if recurring LTC futures’ historical trends continue unabated. LTC’s price, which currently sits around $94.07, has declined by 19% in the last 18 days yet has shown upbeat performance with a rise of 31% in the present year. Much of the gains were seen between June 29 and July 2, with a 34% rally pushing the price to a 14-month high of $115.

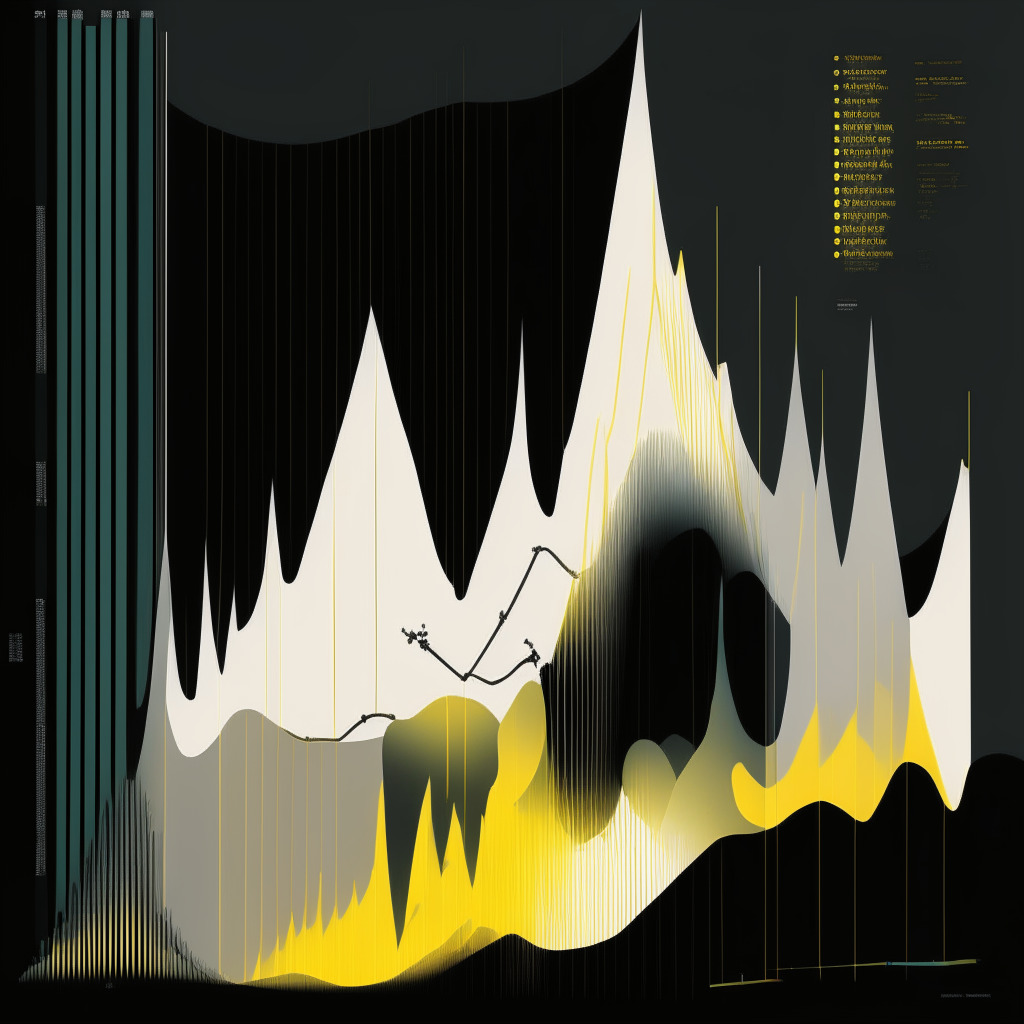

However, historical data from the derivatives market brings sobering news to Litecoin bulls. Previous instances where Litecoin futures’ open interest dropped below the $500 million mark have often consequent price falls of 38% or higher. This potentially resonates with the current situation.

It’s important to appreciate the implications of active contracts (open interest). High open interest is generally seen as a positive sign as it enables investors demanding a specific market size to participate. Although not always bullish for price momentum, it does facilitate larger price swings due to leverage and potential liquidations when a trader’s position must be closed due to a lack of margin.

Looking back at the crash in November 2021, we see that Litecoin’s open interest dropping below the $500 million threshold could be a reliable indicative of investors’ dwindling interest. This scenario was confirmed the three times this happened as its price took drastic hits each time. On Feb 8, 2021, Litecoin’s open interest skyrocketed above $500 million, marking a 64% price gain. However, the same day it dropped below the threshold, leading to a 38% price reduction in the coming eight days.

At present, with Litecoin’s open interest remaining above the $500 million mark, a significant drop from current levels could suggest a potential 30% drawdown from $94 to $62. Regardless, all investments and trading moves entail risk, hence investors are advised to conduct personal research before making any decision.

Source: Cointelegraph