“Launchpad XYZ, a new initiative designed for both newcomers and seasoned pros in cryptocurrency, aims to demystify the complex jargon of crypto and blockchain. Offering a curated portal with access to cutting-edge blockchain projects, it facilitates user control over owned assets and integrates Web3 elements like NFTs and play-to-earn games to educate novices.”

Day: August 1, 2023

MicroStrategy’s Bold $750M Bitcoin Investment Plan: Market Boon or Volatility Catalyst?

“MicroStrategy, a software developer, plans to raise $750 million through stock sales to expand its substantial bitcoin holdings. This move could stimulate increased market demand for bitcoin, affirming cryptocurrency’s credibility. However, it might also exacerbate bitcoin’s vulnerability to price volatility, raising questions on risk versus reward.”

Surfing the Crypto Wave: An Analysis of Recent Market Volatility and Opportunities

“Bitcoin climbed back near $29,200 amidst market volatility following Curve’s recent exploit, while Tron founder stabilizes the troubled CRV token. Despite chaos, investors are drawing strength from Sun’s relief efforts, hinting at market’s increasing sophistication. However, market sentiment remains jittery.”

Navigating the Bitcoin Paradox: Exploring Alternatives Amidst Market Uncertainties

“The crypto world remains largely unperturbed despite concerns about Bitcoin’s uncertainty and potential drops in value. The equity market’s upswing and potential changes in the Federal Reserve’s policy may strengthen Bitcoin’s prospects. Meanwhile, various crypto options including Trust Wallet, Wall Street Memes, Rocket Pool, Shibie, Immutable X, and XRP20 are creating investment interest and diversion from Bitcoin.”

Reincarnating Allen Ginsberg: The Innovation of AI-Powered Poetry

AI is giving a new lease of life to the work of American poet Allen Ginsberg. An AI-powered camera, developed by NFT poetry gallery TheVERSEverse and the Tezos Foundation, is used to transform visual images into textual poetry. This creative endeavor generates a poetic ensemble inspired by Ginsberg’s work and demonstrates AI’s potential to perceive and interpret. It offers fresh perspectives on the blending of AI and the arts, raising questions about originality, ethics, and the future of such fusion.

Exploring Litecoin’s Halvings: Disinflation, Price Predictions and Blockchain Dynamics

“Litecoin, like Bitcoin, employs ‘halvings’ – a 50% reduction in the new issuance rate of cryptocurrency every four years. These periodic changes facilitate mass adoption without undercutting network security, and incentivize miners who validate transactions. Litecoin’s price after these halvings can illustrate economic laws and shed light on blockchain dynamics.”

Cryptocurrency Variance: Analyzing July’s Market Performances and Looming Prospects of Diverse Crypto Markets

“MakerDAO’s MKR advanced by a remarkable 47% in July, outpacing other Coindesk Market Index constituents. Ripple Labs’ XRP followed closely with a growth of 46.6%, linked to a U.S. Judge’s ruling. Contrastingly, Bitcoin and Ether each lost 4% in July, shedding light on the unpredictable volatility of cryptocurrencies.”

RFK Jr. Defends Bitcoin Amid Environmental Criticisms: Unveiling A Path To Financial Liberty

Robert F. Kennedy Jr. countered common environmental criticisms of Bitcoin, arguing that such narratives should not limit financial liberty. He concurred with Sangha Systems’ Daniel Feldman who proposed Bitcoin mining could bolster renewable energy production, further improving the electric grid. This divergent perspective also underscores the neglected economic advantages of Bitcoin mining.

MicroStrategy’s Bitcoin Portfolio: A Look at the Impairment Charge, Market Volatility and Future Prospects

MicroStrategy has announced a $24.1 million impairment charge to its Bitcoin portfolio for Q2, reflecting market volatility. Despite this, the firm’s holdings have increased, equating to approximately $4.5 billion, illustrating both potential risks and rewards in the crypto market.

Curve Finance Hack and the Tentative Balance in DeFi’s Future

“The DeFi segment suffered a setback when Curve Finance, an Ethereum-based decentralized exchange, was hacked, leading to a 20% price drop in its token (CRV). Founder Micheal Egorov’s substantial loans backed by CRV triggered a panic-induced price drop. However, Egorov’s partial loan repayments and an intriguing pattern in the derivatives market suggest a potential near-term rally for CRV.”

Unraveling the BALD Token Mystery: Blockchain Future and Market Dynamics in Focus

Analyst Marcel Pechman explores links between FTX founder Sam Bankman-Fried and BALD token, which suffered an 85% drop in price after liquidity was removed from DEXs. Pechman also examines Bitcoin’s price in relation to the U.S. Dollar Index and the potential impact of U.S. government’s new debt issuance.

Navigating MiCA: Ukraine’s Struggle with new EU Crypto Regulation Measures

As Ukraine nears EU membership, it faces a critical shift with the impending Markets in Crypto-Assets Regulation (MiCA). The law’s stringent requirements for crypto service providers might reduce the attraction of Ukraine’s jurisdiction. Moreover, compliance challenges could discourage new entrants, potential legal risks, and steep issuance costs, affecting crypto exchange services. The regulation also overlooks certain crypto assets, leaving a potential legislative gap. However, feasible adaptation of MiCA could help Ukraine influence European crypto policy upon getting full EU membership.

GameStop Abandons Crypto Wallets: Combat or Capitulation Against the US Regulatory Pressure?

“GameStop, after a year of providing crypto wallets, plans to withdraw support due to US regulatory uncertainties. The removal of these crypto conduits, facilitating transactions on GameStop’s NFT marketplace, aligns with considerable staffing reductions. This reflects intense scrutiny by regulatory bodies, prompting some cryptocurrency companies to consider overseas operations.”

Surfing Crypto Waves: CoinShares’ Q2 Triumph Amidst Trading Challenges

“CoinShares’ Q2 revenue increased 33%, heavily backed by the firm’s proprietary trading activities. However, asset management fees saw a 25% decline. CoinShares ventured into decentralized finance, resulting in nearly £9 million from these activities in Q3 2023.”

Navigating Uncertainty: Progress and Hurdles in the U.S. Crypto Regulation Landscape

“Crypto enthusiasts are celebrating progress toward a new U.S. oversight system for digital assets despite uncertainties. The development involves digital assets legislation addressing regulation framework, stablecoins, and crypto-related money laundering. The law guiding crypto operations leaped over two House committees, indicating progress in U.S. crypto regulation.”

The Rise and Crisis of DeFi: A Close Brush with Disaster and Its Implications

“The DeFi community recently faced a potential crisis when Curve Finance’s founder risked significant funds on his platform’s tokens. This precarious scenario could have toppled the entire DeFi sector. The incident has sparked questions about the system’s integrity, transparency, and overall stability, reminding us of the inherent risks of the rapidly evolving DeFi world.”

Mystery Whale Fuels $WSM Token Presale: Behind the Hype and the Uncertainties

“A crypto giant recently invested a hefty amount in Wall Street Memes’ $WSM token presale, surpassing the formidable $20 million threshold. This has landed $WSM attention as a potentially viral meme coin, in line with Shiba Inu and Dogecoin, backed by an enthusiastic community.”

SEC vs Terraform Labs – The Future Clash of Regulatory Oversight and Blockchain Freedom

U.S District Judge Jed Rakoff dismissed Terraform Labs’ plea to drop a securities fraud lawsuit by the SEC. Rakoff argued that the company’s TerraUSD stablecoin could be deemed a security, given its value fluctuations. The ruling presses on the unresolved tension between crypto industry and regulatory bodies.

Zuckerberg’s Metaverse: An Undervalued Investment or an Overambitious Gamble?

Mark Zuckerberg’s metaverse initiative cost Facebook and Meta an estimated $21 billion, with tangible outcomes far less than invested. Despite only selling around 20 million units of the Quest VR headset and attracting a mere 200,000 users to Meta’s flagship VR experience, Horizon Worlds, Zuckerberg remains unfazed. Critics argue this detracts from their original advertising business while questioning the financial feasibility of the metaverse project.

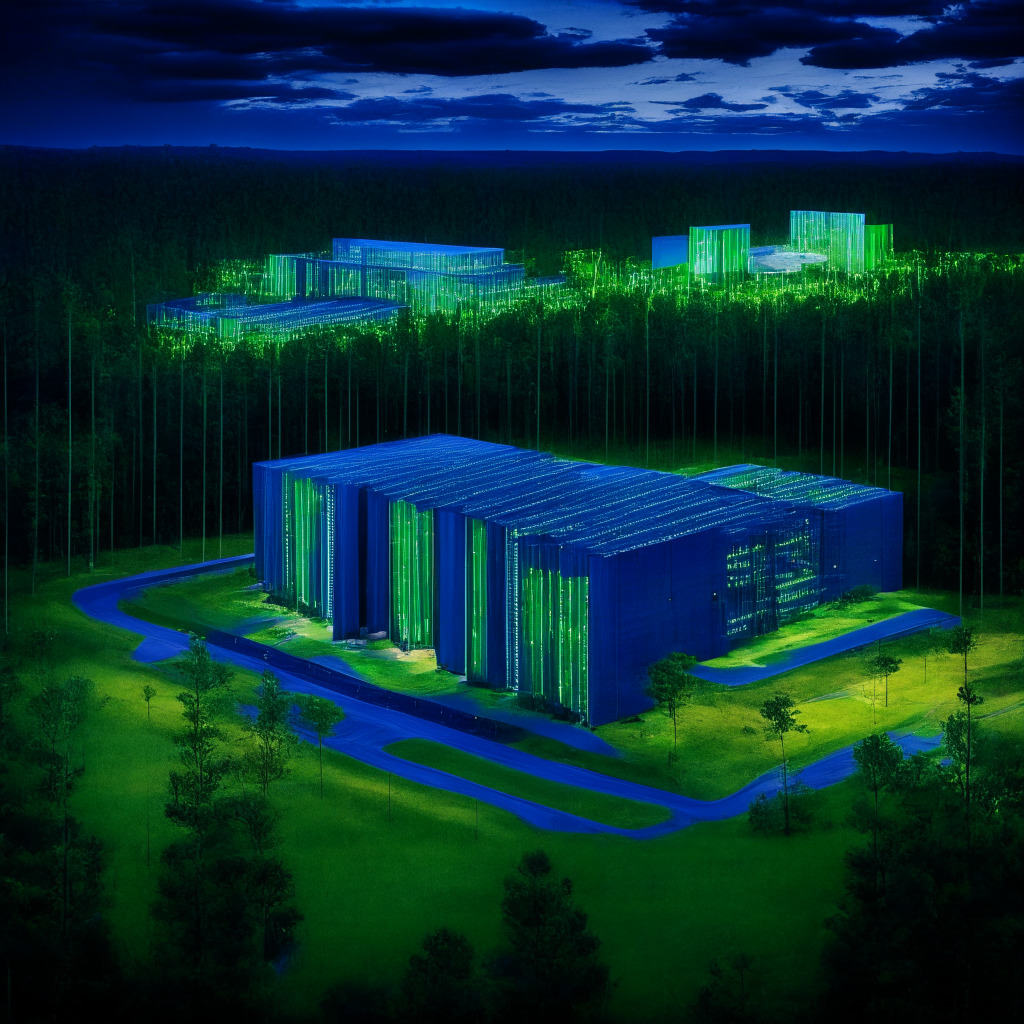

Crypto Giant’s Expansion: Genesis’ New Data Centers and the Push for Eco-Friendly Mining

Genesis Digital Assets has expanded their cryptocurrency mining operations with three new data centers in South Carolina, marking its strategic move into the North American market. CEO, Andrey Kim, emphasizes the company’s aspiration for industry leadership in environmentally-friendly Bitcoin mining.

BlackRock CEO’s Bitcoin Conversion: A Turning Point or Mere Market Strategy?

Outspoken CEO of BlackRock, Larry Fink, a former Bitcoin critic, has now endorsed the cryptocurrency, triggering positive reactions. His change of stance first became noticeable when BlackRock submitted an application for a Bitcoin spot ETF. Fink’s newfound Bitcoin approval and BlackRock’s ETF aspirations could trigger an “adoption cycle” and potentially help Bitcoin exceed its record high.

Unveiling Politics of Crypto: RFK Jr. Advocates Bitcoin Despite Environmental Controversy

U.S. presidential candidate Robert F. Kennedy Jr. proposes a less alarmist view on Bitcoin’s environmental impact, saying it shouldn’t limit financial freedom. Should he win, he plans to exempt Bitcoin from capital gains tax and shows interest in backing the U.S. dollar with Bitcoin.

Navigating the Era of DeFi Micro-Primitives: Innovation or Complexity Overload?

“DeFi micro-primitives, a growing trend, represents more nuanced, decentralized & trustless DeFi protocols that are concurrently becoming complex. With inherent advantages and challenges, these micro-primitives hold potential to sculpt a DeFi landscape that’s refined, adaptable, programmer-friendly, and multifaceted.”

Binance Marches Back Into Japan: Strategic Move or Risky Gamble for the Crypto Giant?

“Binance, a leading global cryptocurrency exchange, recently launched its Japan-based branch amid earlier regulatory issues. Their presence in Japan, acquired through Sakura Exchange Bitcoin, aims to boost the Japanese digital-asset markets and aligns with the Prime Minister’s plans for promoting Web3 innovations.”

Navigating the Potential $25,000 Downturn in Bitcoin Amid Macroeconomic Pivots

Despite a potential shift in macroeconomic conditions, Bitcoin’s market could experience a $25,000 dip, per a Capriole Investments analysis. While various market transformations could stimulate a bullish trend, Bitcoin’s liaison with a Bitcoin spot price exchange-traded fund still remains uncertain.

Navigating the Crypto Sea: Bank of England’s Shift with Sarah Breeden’s Era

Sarah Breeden, a part of the BoE’s Central Bank Digital Currency task force, will become the Deputy Governor of the Bank of England from Nov. 1, 2023. Her leadership may have significant implications for Britain’s cryptocurrency landscape. Her role in determining the potential prospects and risks of digital currencies holds major interest for cryptocurrency enthusiasts.

Dubai’s Crypto Expansion: VARA Grants Operational License to Japan’s Nomura Subsidiary

“Dubai’s Virtual Asset Regulatory Authority (VARA) expands crypto services throughout the United Arab Emirates by granting an operational license to Laser Digital, the crypto branch of the Japanese financial giant Nomura. This approval empowers Laser Digital to offer diverse crypto services, including broker-dealer services and investment management. This aligns with Dubai’s strategic positioning as a regional cryptocurrency hub.”

Presidential Hopeful’s Take on Bitcoin: Asset, but Not Dollar Stabilizer

Republican Presidential candidate Vivek Ramaswamy, while expressing fondness for Bitcoin, would not consider it as a component to stabilize the U.S. dollar. He believes the U.S. Federal Reserve should focus on maintaining dollar stability against traditional commodities.

Exploring Bitcoin’s Existential Threats and The Besieged Reality of Crypto Exchanges

“Crypto trader Mohit Sorout suggests two scenarios that could potentially threaten Bitcoin: the development of a way to decode seed phrases making Bitcoin vulnerable, and the risk of a hash power takeover, which could put blockchain control into malicious hands. Despite these, Sorout remains optimistic about Bitcoin’s survival.”

Unraveling DeFi Instability: Curve Founder’s Actions as Catalyst for Market Risks

Michael Egorov, founder of Curve Finance, destabilized on-chain lending markets by leveraging his CRV holdings for large token loans, potentially triggering a wide-scale liquidation and distressing debts within the DeFi ecosystem. The situation underscores the importance of robust response strategies in the decentralized finance world.

Blockchain’s Future: Unprecedented Transparency vs. Complex Privacy and Energy Concerns

“Blockchain technology, with its transparency and accountability, brings trust and confidence to numerous sectors, from finance to agriculture. However, significant challenges such as interoperability issues, energy consumption, and privacy concerns need immediate resolution for widespread adoption and realization of a decentralized utopia.”

Unleashing the Future: The Role of AI-Driven DAOs in Reshaping the DeFi Landscape

“Former BitMex CEO Arthur Hayes envisions a future where Decentralized Autonomous Organizations (DAOs) powered by AI could revolutionize the DeFi space. These AI DAOs, such as PoetAI, offer transparency, resilience against government control, and operational efficiency through cryptocurrencies like Ethereum. Platforms like Ethereum could greatly benefit from this new DeFi landscape. However, questions remain about the maturity of the DeFi arena and the readiness for fully autonomous DAOs.”