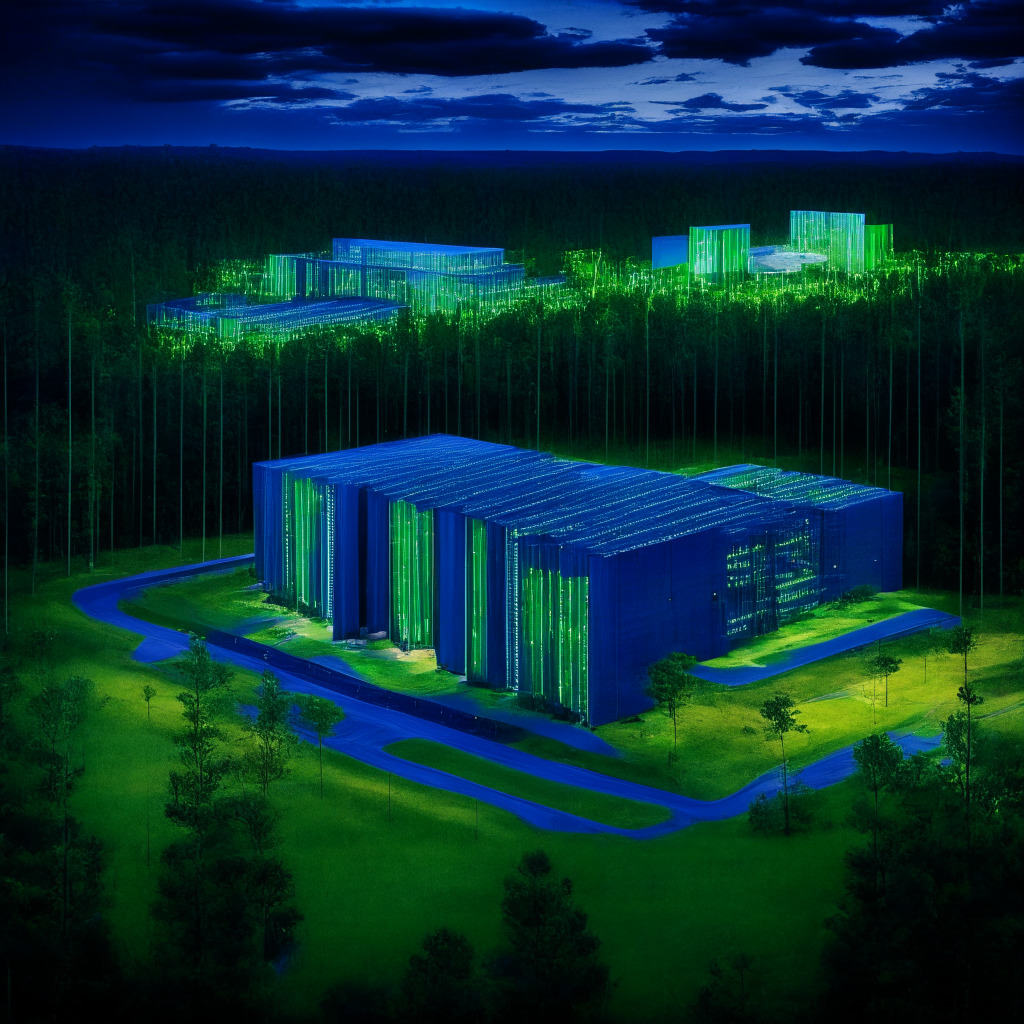

Cryptocurrency mining powerhouse Genesis Digital Assets recently made the news with the launch of three new data centers in South Carolina, marking the company’s notable expansion efforts in the United States. The facilities, which sprang into operation in February and March this year, are a testament to the company’s strategic move into the North American market. They stand, nestled in the western part of the state, their energy potentials waiting to be harnessed.

Being a purveyor of digital narratives, Genesis certainly drew attention by establishing the facilities in an area that once housed an abandoned warehouse. The first of these energy titans brings with it a total capacity of 18 MW, a notable addition to the ever-evolving digital mining landscape. Not far behind are the centers concealed between Union and Lockhart, boasting a combined output of 15 MW.

The company’s commitment towards the community painted a vibrant picture of mutual symbiosis. However, explorations of the issue present us another side of the coin. The centers’ combined capacity trails significantly behind the colossal 300 MW complex that Genesis opened in Texas in 2021, inviting questions on the actual scope of the recent expansion.

There’s another element in play here, the hint of ecological consciousness in the company’s operations. With a steadfast eye on clean energy use, Genesis intends for the Anderson center to operate on Hitachi dry-type distribution transformers and return power to the grid when necessary. The digital assets giant’s CEO, Andrey Kim, emphasized their aspiration to be industry forerunners showing the world that Bitcoin mining can be environment-friendly.

Genesis’ journey through establishing over 20 Bitcoin mining facilities across North America, Europe, and Central Asia shapes an intriguing tale. The overwhelming total capacity of over 400 MW certainly holds promises for the crypto sphere. The big question is whether the South Carolina move truly brings something remarkable to the table or perhaps Genesis could have aimed bigger.

Simultaneously, the Bitcoin hash rate has been steadily climbing, heating up the investing atmosphere with anticipation for the expected halving in April 2024. Whether the investment and expansion will bear profitable fruits in this volatile landscape remains to be seen. The complexity of Bitcoin continues to challenge both the technology enthusiasts and sceptics in us, creating an even more compelling drama to follow over the next years.

Source: Cointelegraph