The recent dramatic plunge of Bitcoin, one of its more significant in memory, was seemingly a consequence of the strengthening economy potentially leading to extended high interest rates. Last week’s data on consumer spending and new home sales for July surprisingly showed robust figures, prompting an escalation in the Atlanta Fed’s GDPNow tool’s prediction for a stunning 5.8% GDP growth in the third quarter. Such statistics are common in post-recession scenarios, with the US experiencing similar rapid growth in some quarters following the economic degeneration spurred by Covid lockdowns.

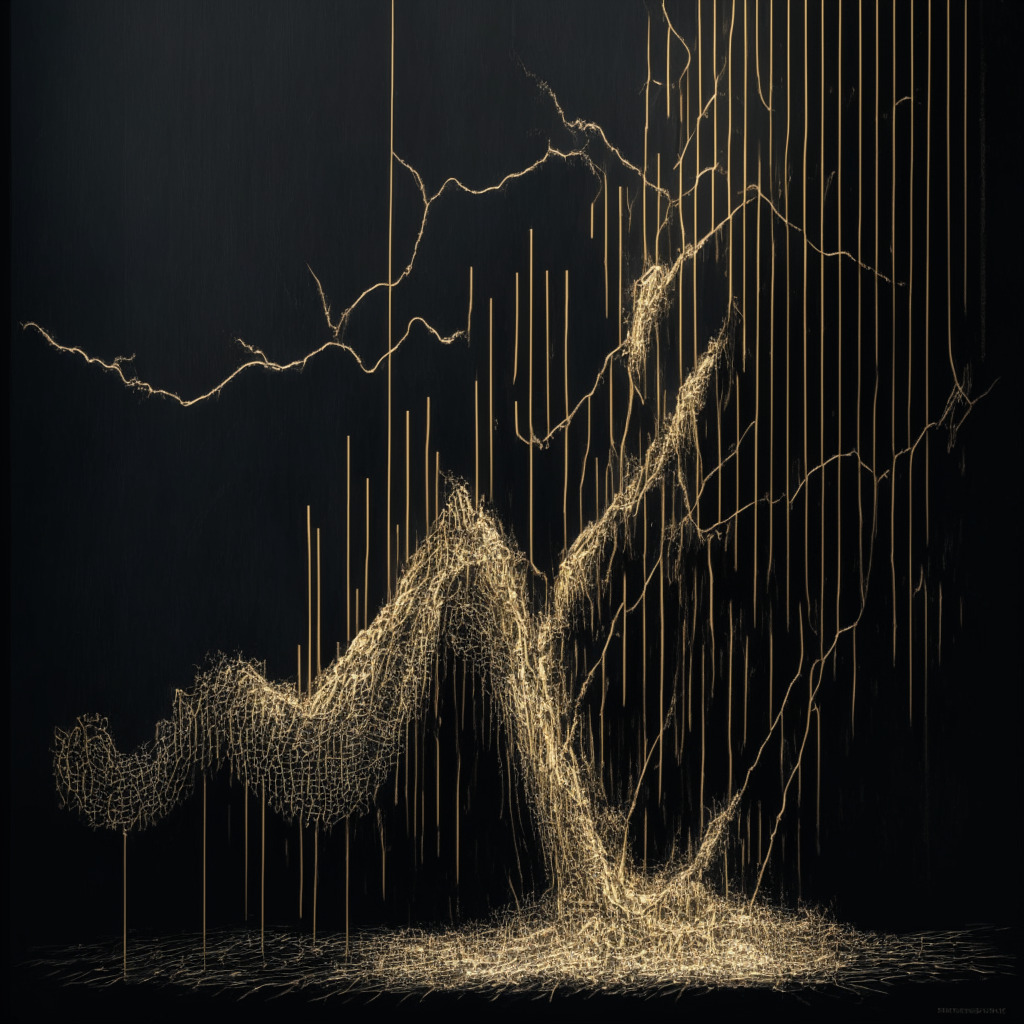

Following an extended period of hovering between $29,000 and $30,000, Bitcoin suddenly dropped to the low $28,000s, ignited by the aforementioned economic reports. This unexpected dip triggered a string of stops and liquidations, causing the cryptocurrency to further plummet below $25,000. Since this happened, there’s been a modest recovery, pushing Bitcoin up to $26,000 at the time of writing.

The approaching week features the Kansas City Federal Reserve’s annual Jackson Hole Economic Symposium, during which a speech is expected from US Federal Reserve Chairman, Jerome Powell. Ahead of this, a column by Nick Timaros of the Wall Street Journal cast light on the speculation that officials might consider the neutral rate of interest to be higher than previously assessed. This rather complex topic hints at the possibility that the Fed’s benchmark funds target may last longer at a high than investors anticipate.

Furthermore, a column by Jason Furman, who acted as the chief economic advisor during the Obama administration, urged the Federal Reserve to aim for a 3% inflation rate, an increase from the existing 2%. Furman claims that this allows the economy to better withstand severe recessions. The bond market responded swiftly to this information, with the 10-year Treasury yield soaring to a new 16-year peak of 4.34%.

Instruments connected to interest rates are rivals to risk assets such as Bitcoin for investment capital; higher rates can result in reduced interest in Bitcoin. For instance, an investor might question the logic of purchasing Bitcoin when there is the option to get a 5% return on a 6-month CD with no associated risk. Conversely, should the US central bank show willingness towards permitting an inflation rate above the current 2% target, it could be viewed as an official sanction of monetary debasement – an event Bitcoin enthusiasts have long cautioned against.

Source: Coindesk