In the face of increasing regulatory ambiguity in the United States, global cryptocurrency exchange Bitstamp recently publicized the termination of its Ethereum staking service for US clients. Underlying this move is a veil of uncertainty hovering over the US regulatory landscape. As the said cutoff date of September 25 approaches, staked tokens will be duly withdrawn and returned to their rightful owners.

Notably, this decision from Bitstamp comes on the heels of an earlier announcement discontinuing seven other cryptocurrencies, including Polygon (MATIC) and Solana (SOL), under the premise that they are “unregistered securities” as per the US Securities and Exchange Commission (SEC).

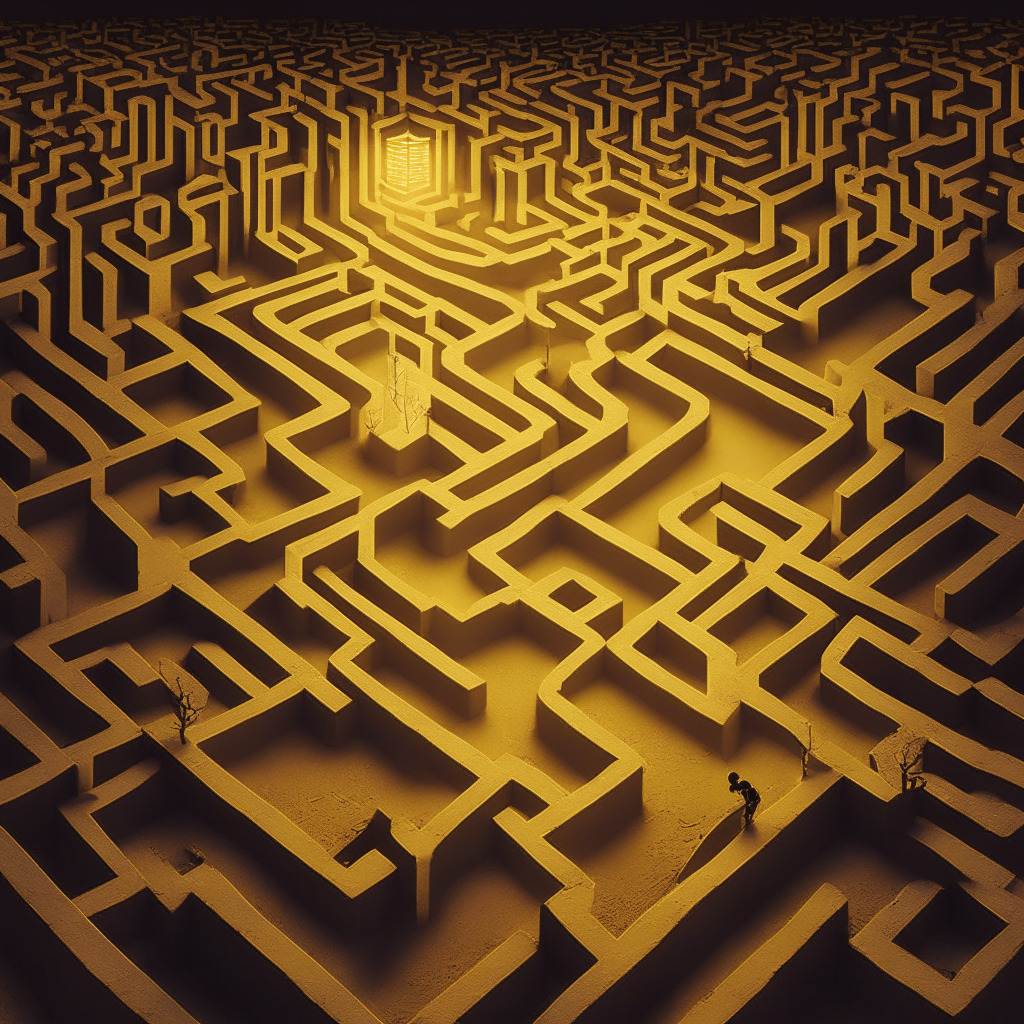

The SEC’s approach to cryptocurrency regulation is presently under a magnifying glass as they struggle to articulate its position on cryptocurrency status. The prevailing ambiguity has ruffled feathers among users and service providers. In some recent tumultuous events, the SEC has even initiated legal proceedings against heavyweight crypto exchanges like Binance and Coinbase on the grounds of suspected securities laws violations and offering unregistered securities.

The situation escalated when the US SEC slapped a hefty $30 million penalty on Kraken earlier this year for its staking services. Consequently, Kraken was left with no choice but to suspend its crypto-staking services for US patrons.

With Bitstamp’s latest decision, the intricacies of the matter multiply, especially considering the growing popularity of staking within the burgeoning Decentralized Finance (DeFi) sector.

Central to the regulatory maze is Ethereum’s flagship cryptocurrency, Ether. A burning question always surfaces: Should Ether be treated as a commodity or a security? While the Commodity Futures Trading Commission (CFTC) consistently labels Ether as a commodity, a conclusive verdict of Ethereum’s cryptocurrency characterization is yet to be reached.

The termination of the Ethereum staking for US users is testament to the urgent demand for transparent regulatory guidelines. What becomes increasingly clear is the need for a level playing field that encourages novelty while providing a safety net for investors’ interests.

Source: Cryptonews