The United States Treasury Department has proposed a new set of rules focusing on digital assets taxes, causing a quick reaction from the crypto community. The loudest controversies seem to surround the potential implications for decentralized operations, with many claiming the regulations are unfeasible.

Miller Whitehouse-Levine, CEO of a Decentralized Finance (DeFi) advocacy group, described the proposal as excessively expansive. It appears that the contentious plan may apply to a broad range of organizations, such as self-hosted wallets. He argues that despite recognizing the autonomy of these wallets, the proposal flouts logic by seeking to identify external parties accountable for the transfer actions of self-hosted wallet users.

Questions also abound on the proposal’s reach, specifically its impact on wallet vendors, decentralized exchanges, and smart contract systems with multisignature security. The rules’ implementation might necessitate these players to establish new know-your-customer requirements for their user base.

However, it seems crucial to remember, as CEO of the Blockchain Association, Kristin Smith, highlighted, that the proposal, if executed properly, could alleviate a significant hindrance for crypto enthusiasts – the ability to file taxes correctly. This clear path could facilitate an easier engagement with digital assets.

There is an upcoming, open period until October 30 for pushbacks and arguments against this proposal. Public hearings will follow, scheduled for November 7 and 8, providing another platform for industry objections. Encouragingly, the proposal’s authors have included an invitation to crypto professionals for innovative ideas within the comprehensive document.

On an optimistic note, the proposal seems to exclude crypto mining operations, a concern that emerged after the 2021 infrastructure law necessitated these tax regulations.

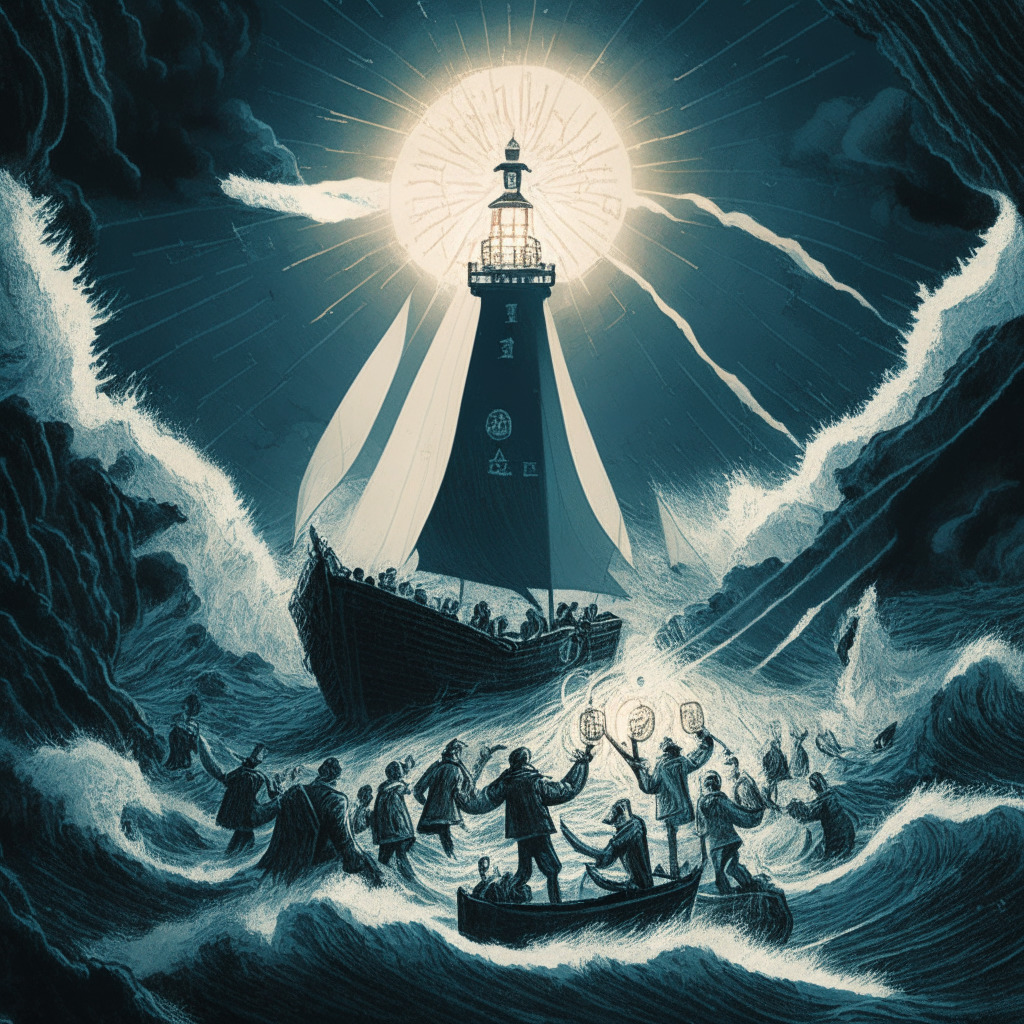

Overall, this ongoing scenario sets a challenging navigation path for DeFi, as it grapples with regulatory balance and the very essence of decentralization. In a market as variant as crypto, the effectiveness of one-size-fits-all regulations is questionable. The process leading up to standardization, be it through these proposed policies, other amendments or industry adaptation, will undoubtedly be intricate, involving a myriad of voices from around the table.

Source: Coindesk