Singapore’s Monetary Authority is reinforcing its blockchain future with revised stablecoin regulations, enforcing value stability. Despite concerns about limiting scope, these regulations aim to boost confidence and security while fostering blockchain advancement in a rapidly progressing digital currency landscape.

Month: August 2023

Singapore Central Bank’s Stablecoin Guidelines: Pros, Cons and the Future of Blockchain Regulation

Singapore’s central bank, the MAS, unveils its regulatory framework for stablecoins, endorsing a three business day timeline for single-currency stablecoin transfers, similar to regular domestic money transfers. Critics argue this fails to fully leverage blockchain’s instantaneous transaction capabilities, suggesting regulatory flexibility is needed to harness the technology’s full potential.

Exploring Crypto-Backed Mortgages: The Future Fusion of Blockchain and Real Estate

“Crypto-backed mortgages, secured by cryptocurrencies like Bitcoin and Ethereum, offer a new way of accessing loans. These transactions use blockchain technology and smart contracts to ensure safety and transparency. Yet, market volatility and security breaches pose potential challenges.”

Dubai’s Tech Utopia: The Lure of Subsidized Licenses and Potential Roadblocks

“Dubai is heavily incentivizing AI and Web3 companies by offering a 90% subsidy on commercial licenses. This is part of a larger initiative to create a significant tech hub in the MENA region, with resources like AI facilities, training programs, and internal support. Dubai’s tech-friendly initiatives, including operational licenses to crypto exchanges, aim to stimulate innovation, attract global talent and investment, and build a prosperous technological ecosystem.”

Zimbabwe’s Gold-Backed Digital Tokens: A Bold Tackle on Bloating Inflation

Zimbabwe’s Reserve Bank is preparing to release Gold-Backed Digital Tokens (GBDT), also known as ZiG, designed for public use. This nationwide project aims to educate Zimbabweans on the benefits and usage of digital currency, while managing inflation and offering an alternative investment to the US dollar.

Regulating the Future: Implications of Singapore’s Revised Framework for Stablecoins

Singapore’s central bank, the Monetary Authority of Singapore (MAS), introduced a revised regulatory framework for single-currency stablecoins (SCS). The new guidelines aim to guarantee stability for SCS pegged to major currencies, potentially bolstering the use of stablecoins as a trusted digital medium of exchange.

Exploring the Correlation between Crypto Market Phases and U.S Manufacturing Index

Kevin Kelly, co-founder of Delphi Digital, predicts an impending bull run in the crypto market. He bases these predictions not only on typical crypto market indicators but also on the U.S manufacturing index, arguing that Bitcoin-associated indicators historically peak alongside this index. However, he warns that market growth doesn’t guarantee profits for all participants and that there are inherent risks in the market.

Binance vs SEC: A Power Struggle Shaping the Future of Crypto Regulation

“Binance is contesting SEC’s extensive communication demands and deposition requirements for senior staff, arguing the regulator’s actions are overreaching. This case’s resolution could impact future regulation of cryptocurrencies and blockchain technology, highlighting the need for clear boundaries and collaborative understanding between regulators and crypto organizations.”

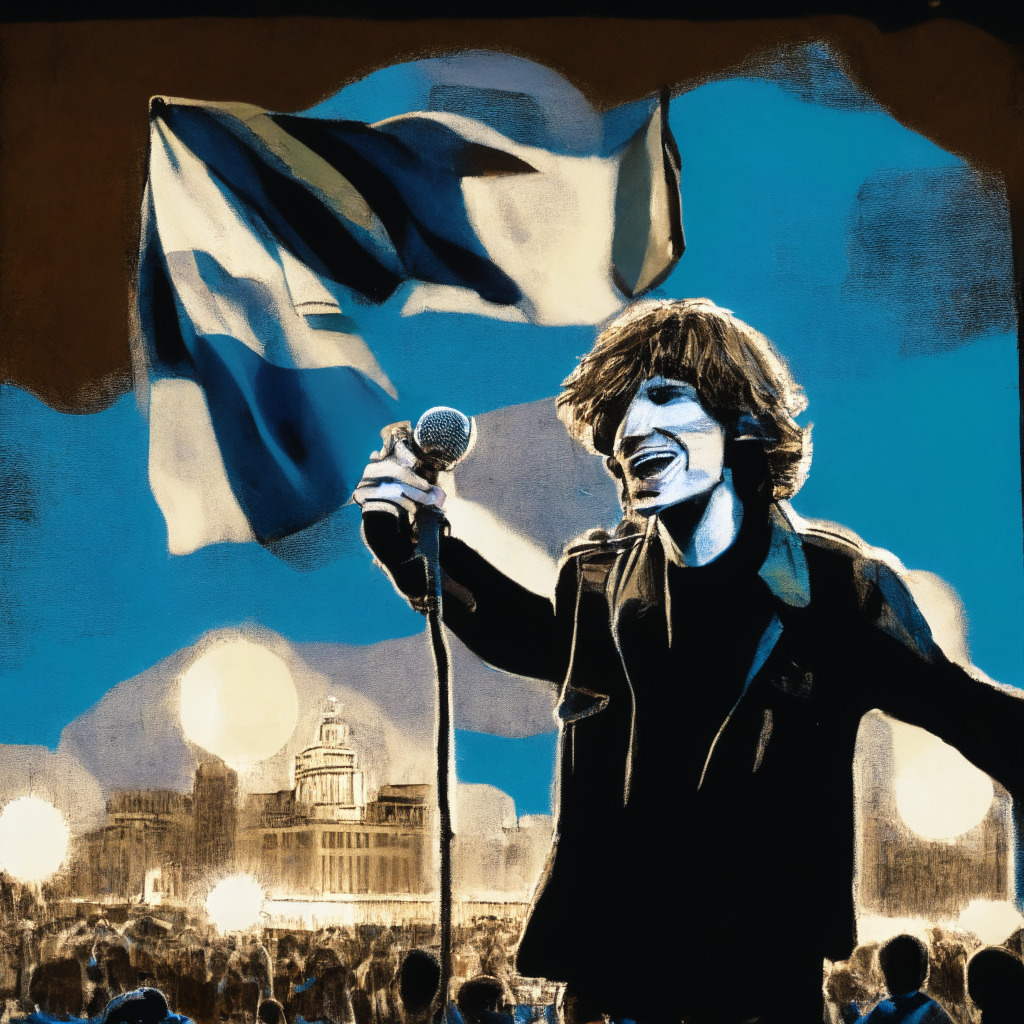

Crypto-friendly Libertarian Candidate’s Surprise Victory in Argentina: A Shift or a Risk?

“Libertarian candidate Javier Milei, known for endorsing Bitcoin and advocating for abolition of central banks, surprisingly won the preliminary presidential election in Argentina with 30.5% of votes. His success may affect Argentina’s crypto adoption and policy-making considering prevalent economic issues like the high inflation rate.”

FDIC Highlights Crypto Risk: The Crossroads of Innovation and Vulnerability

“In an act of unprecedented vigilance, the United States banking system has been alerted to the ‘novel and complex’ risks presented by cryptocurrencies, highlighted in a recent report by the Federal Deposit Insurance Corporation (FDIC). The FDIC has demarcated a critical area regarding digital assets risk in its annual risk review, focusing on the burgeoning and volatile crypto market.”

Rousing the Crypto Market from Slumber: Potential Catalysts on the Horizon

Analysts suggest potential market shifts like spot Bitcoin exchange-traded funds, PayPal’s stablecoin, and an Ethereum upgrade could disrupt the crypto market inertia. Despite recent lethargy, there are anticipations of rekindled enthusiasm due to increased institutional acceptance of cryptocurrencies and indicators of future crypto adoption.

Prime Trust’s Bankruptcy: Crisis or Catalyst for the Emerging Crypto Industry?

Prime Trust, a major custodian of digital assets, has filed for Chapter 11 bankruptcy due to a deficit in customer funds. This raises questions about financial risks in the largely unregulated cryptocurrency landscape and emphasizes the need for stronger regulation.

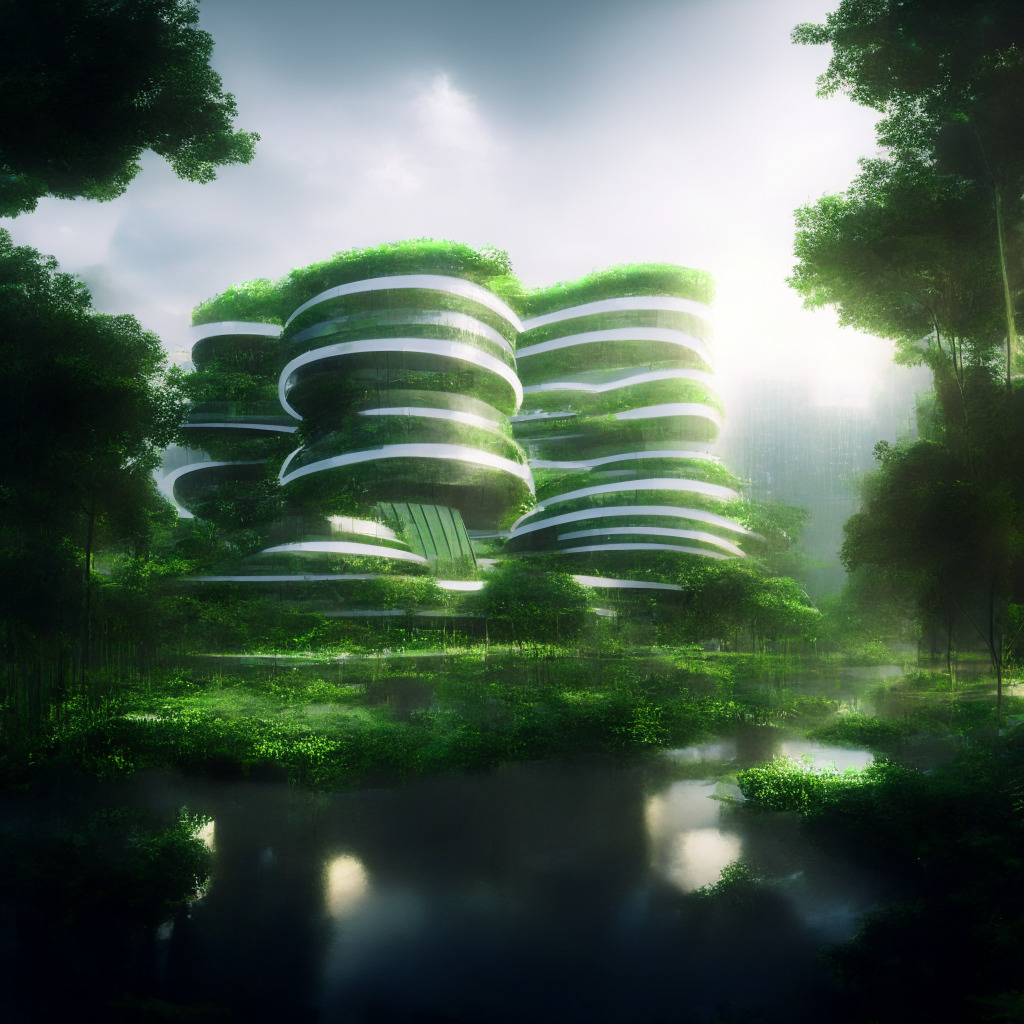

Leveraging China’s Digital Yuan for Green Financing: Pros, Cons, and Future Potentials

Zhongshan Jewelly Optoelectronics Technology, a Guangdong-based firm, has secured over $276,000 from China’s first digital yuan-powered green finance loan. Using the digital yuan offers cost-effective, efficiency for enterprises, with real-time fund transfer and no incurring handling and service fees. Meanwhile, its traceability can prevent misappropriation of green funding loans.

Grayscale’s Ruling: Will Bitcoin ETF Approval Reshape the Crypto World?

“The verdict on Grayscale’s effort to convert its Bitcoin trust into an accredited Bitcoin ETF is due soon. Analysts think this could revolutionize the crypto world, lend unprecedented legitimacy to cryptocurrency and significantly influence the future trajectory of the digital currency market.”

Exploring Immutable’s zkEVM: A Game Changer for Web3 Gaming or a High Risk Load?

Immutable is testing its new blockchain technology layer, zkEVM, aiming to reduce reliance on singular network infrastructure. The zkEVM, designed to lower gas fees and boost transaction rates, seamlessly integrates with the Ethereum Virtual Machine, enabling easy transition of existing smart contracts. However, developer autonomy brings potential risks and challenges in infrastructure connectivity.

Shifting the Gaming Landscape: Immutable zkEVM and the Unpredictable World of Crypto

Immutable’s zkEVM, a Ethereum-compatible gaming platform developed with Polygon Labs, has begun public testing. This platform uses zero-knowledge proofs to secure transfers, decreasing development costs and enhancing security. However, Ethereum founder Vitalik Buterin warns it may cause data inefficiency and latency issues.

Tokenizing Ghana’s Commodities: A Blockchain-Backed Path to Prosperity or a Fear-Induced Stalemate?

“Tokenization of commodities like gold, cocoa, and oil through blockchain could transform economies of African nations such as Ghana. This process would reduce transaction fees, amplify revenue, and open new trading avenues. However, hesitation in adopting and integrating crypto technologies in regulatory frameworks remains a significant obstacle.”

Surge in Bitcoin Market: Pros, Cons and Future Predictions from a Former SEC Chair

Former SEC Chair, Jay Clayton comments on the transition of the crypto market from early speculative stage to a more institutionalized state in his CNBC interview. He highlights the evolving regulatory landscape of cryptocurrencies, retail access to Bitcoin, and the need for guidelines balancing innovation and investor protection.

Kraken Ventures’ Bold Move: Doubling Down on Blockchain Investments Amid Market Decline

“Kraken Ventures plans to raise $100 million in its second funding round, targeting early-stage founders in the blockchain and cryptocurrency sector. Despite crypto market instability, the firm believes smaller, more hands-on fund operations yield better results and intends to distribute this capital across numerous projects.”

The Fall of FTX: Lawsuits, Allegations and a New Era for Blockchain Regulation

“The former FTX CEO, Sam Bankman-Fried, faces allegations of campaign finance law violations, part of a wire fraud scheme. He’s accused of embezzling customer’s deposits, using over $100 million to influence cryptocurrency regulation by making campaign contributions. The ongoing legal trials highlight the blurred lines between digital assets and legal boundaries.”

Breaking Tradition: Rethinking Investment Contract Definitions in Coinbase vs SEC Dispute

A consortium of U.S. law scholars are supporting Coinbase in its dispute with the SEC, arguing the SEC’s understanding of “investment contract” may be flawed. This dispute accumulates around aligning blockchain technology with evolving regulatory frameworks and interpretations. The outcome could set a precedent for future crypto regulation.

Regulatory Roulette: The Impact of Legal Tussles on the Future of Cryptocurrency

“The ongoing saga of Sam Bankman-Fried’s arrest and subsequent lawsuits against FTX’s former partners has added complexity to the regulatory environment surrounding cryptocurrencies. Affecting venture capital investment and increasing U.S. Federal Reserve involvement, these events are shaping fintech’s future amidst global regulatory flux and uncertainty.”

Former SEC Chairman’s Unexpected Endorsement for Spot Bitcoin ETF: Implications and Risks

Former SEC chairman, Jay Clayton endorses a spot Bitcoin Exchange Traded Fund (ETF), citing the evolved Bitcoin trading atmosphere and increased global retail participation. The spot Bitcoin ETF, dissimilar to Bitcoin futures ETF, tracks Bitcoin’s real-time price and could invite a potential market rally.

Zimbabwe’s Launch of Gold-Backed Digital Tokens: A Bold Move in Turbulent Economic Times

Zimbabwe’s central bank is contemplating the introduction of gold-backed digital tokens (GBDT) for retail transactions as an alternative to the heavily relied upon US dollar. The GBDTs are backed by physical gold reserves and offer divisibility, making them more convenient and value-preserving. These could potentially help in combating the crippling inflation rate and provide a base for a future central bank digital currency ecosystem.

Decentralization Boom: Unveiling the Upsides and Downsides of Blockchain’s Promising Future

“Blockchain technology brings potential solutions to traditional banking issues, offering decentralization and improved online security. However, its anonymous nature invites exploitation, market volatility, high energy consumption, and a steep learning curve pose significant challenges. Balancing these opposing realities shapes blockchain’s future.”

Anticipating the Future: Will SEC Greenlight a Spot Bitcoin ETF Soon?

The US Securities and Exchange Commission’s (SEC) decision to postpone the Bitcoin ETF decision has left crypto backers anticipating the outcomes of upcoming ETF applications including Bitwise Bitcoin ETP Trust, BlackRock, VanEck, WisdomTree, and Invesco. Insiders predict further delays, despite hopes for futures-backed Bitcoin ETFs’ potential approval.

HBAR Rises as FedNow Integrates Hedera’s Dropp: A Seismic Shift in Blockchain Landscape?

“Hedera Hashgraph’s digital token HBAR sees a value surge following its decentralized applications (dApps) Dropp’s listing by the US Federal Reserve’s payment service, FedNow. Dropp offers an affordable micropayments platform and infrastructure for the trending non-fungible token market, positioning Hedera’s applications on the brink of a significant shift in the blockchain technology landscape.”

Striking a Balance: UK’s Rigorous Crypto Regulation Process and its Potential Backlash

The Financial Conduct Authority’s (FCA) rigorous registration process has led to only 13% of crypto companies receiving approval, as the requirements are deemed too challenging by some firms. The FCA’s stern warning that any information deficiency will lead to application rejection, along with a proposed ban on crypto incentives, further complicates the crypto industry’s operation in the UK.

Navigating the Volatility of Meme Coins: Opportunity, Risk, and the Tranquil Macroeconomic Backdrop

“Cryptocurrencies are experiencing mild bullishness. Bitcoin and Ethereum still await clarity on US regulations and expected Bitcoin ETF approvals. Meme coin sector exhibits volatility, new entrants like spurdo and FOOM seeing substantial growth. Yet, caution is demanded due to potential risks.”

Navigating Through the Bull and Bear Markets: Uncertainties and Predictions for Bitcoin’s Future

“The rise in the U.S. dollar index (DXY) might be an obstacle on Bitcoin’s recovery path. The DXY’s upward trend has likely influenced risky assets negatively, with equities markets seeing a corrective phase. While experts predict Bitcoin consolidation within a specific range, trends in the Ethereum market currently favour the bears.”

Voyager Digital’s Recent Moves: Signs of Consolidation or a Crypto Sell-Off in Progress?

The bankrupt crypto lender, Voyager Digital, recently moved 1,500 Ether (ETH) and 250 billion Shiba Inu (SHIB) tokens to Coinbase, sparking speculation about potential liquidation. This aligns with Voyager’s ongoing trend of trimming its SHIB holdings, leading to concerns about its financial challenges and the potential impact on the wider crypto market.

Hedera Hashgraph HBAR: A Micropayment Powerhouse Attracting Market Attention or a Fleeting Trend?

“Hedera Hashgraph’s HBAR token sees over 15% surge following the inclusion of Dropp, a Hedera-based micropayments platform, on the FedNow. HBAR’s unique use of hashgraph consensus permits over 10k transactions every second. Its growth also aligns with a 288% jump in daily active accounts and a notable spike driven by non-fungible tokens (NFTs).”