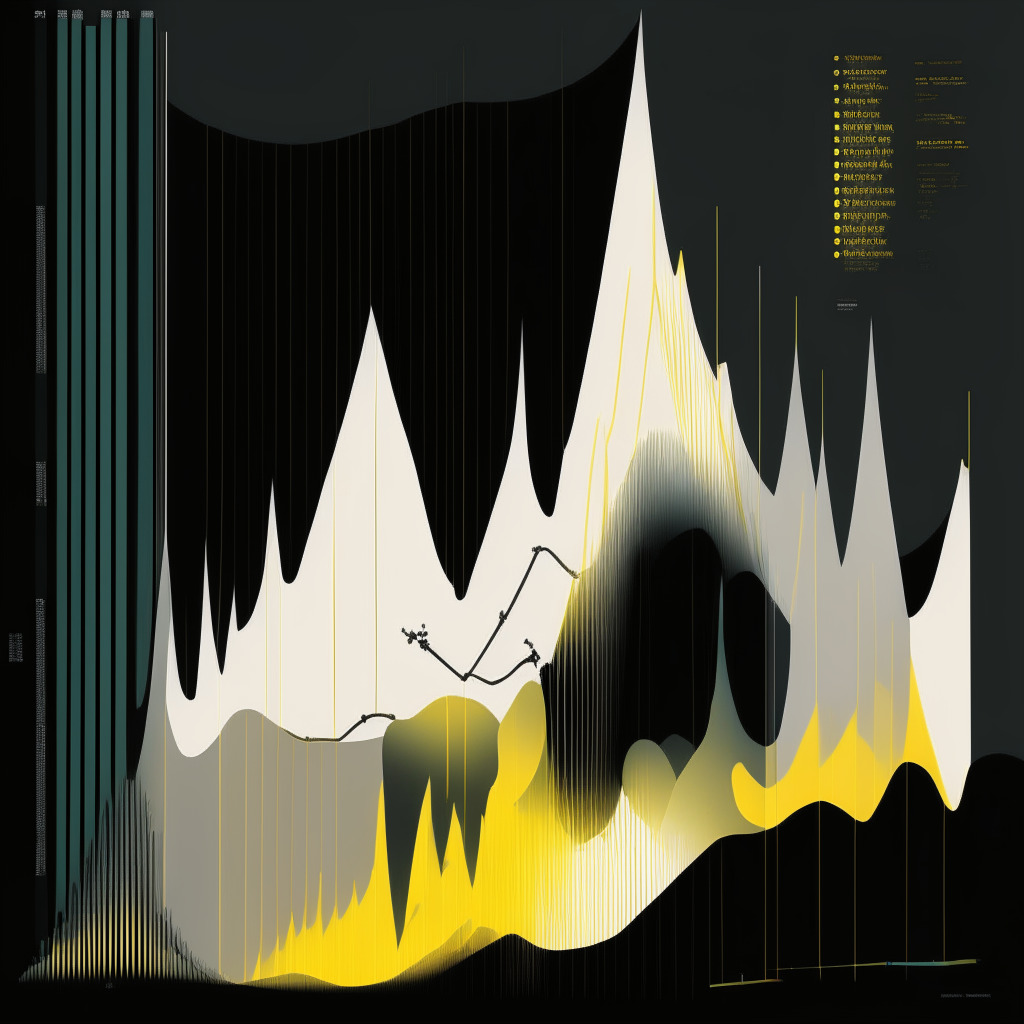

“Bitcoin’s recent 7% jump correlates with Grayscale’s efforts to turn its Bitcoin Trust into a spot Bitcoin ETF. However, Arca’s CIO, Jeff Dorman, warns it’s premature to consider this a sign of sustained growth and highlights the importance of major players like BlackRock promoting Bitcoin.”

Month: August 2023

Mainstreaming Crypto: The Future of Digital Transactions Unfolds on Social Media Platforms

“Social media giant, X, has established cryptocurrency payments for its global audience, following recent approval from regulatory authorities. This brings good tidings for X’s network of 400 million users who can potentially interactively share via cryptocurrencies, transforming the social media platform into an ‘everything app’.”

Intricacies of Sam Bankman-Fried’s Case: Crypto Industry’s Legal and Technological Conundrum

Former FTX CEO, Sam Bankman-Fried finds himself involved in a legal battle, contesting evidence included in a lawsuit against him. Key to the case is access to and the integrity of documents in Bankman-Fried’s Google account, raising questions about the use of personal accounts as potential evidence. This case underscores the need for clearer boundaries and stricter regulations in the crypto industry’s use of digital tools and platforms.

Ruling in Favor of Grayscale: Turning Tides for Spot Bitcoin ETFs in the US

U.S. appeals court favorably ruled on Grayscale Investments’ quest for the launch of a spot bitcoin ETF, potentially smoothing the path for the first spot bitcoin ETF in the country. The ruling depended on whether the SEC could adequately demonstrate that the bitcoin market is resistant to manipulation. This decision could reshape the future of cryptocurrency investments in the United States.

Future of Financial Forecasting: Embracing AI in Modern Finance with yPredict

“yPredict aims to revolutionize financial forecasting using AI-powered predictive tools and blockchain technology. It leverages ARIMA and LSTM models to predict Ethereum prices and reveal potential future price trajectories, offering a range of services for traders and AI/ML developers.”

Bridging the Gap: ChatGPT as the Unlikely Hero in Web3 Development and Blockchain Adoption

“ChatGPT has emerged as a key tool in Web3 development, bridging knowledge gaps and simplifying learning about smart contract formations. It facilitates interaction with decentralized networks, assists in understanding the role of decentralized identities, and provides insights on future Web3 trends.”

Blockchain Partnerships: Unlocking Potential for Traditional Companies and Navigating Pitfalls

“Traditional companies partnering with blockchain projects can enhance transparency, improve efficiency, control workflows and access new communities. These collaborations could bring competitive advantages and new revenue opportunities. However, navigating volatility in the Web3 market is challenging, making long-term alliances more preferable.”

Bitcoin ETF Dreams: Court Orders SEC to Reconsider Grayscale Appeal Impact on Crypto Market

“A federal appeals court directive for the SEC to reassess its dismissal of Grayscale Investments’ motion to modify Grayscale Bitcoin Trust into an ETF led to Bitcoin’s surge on the market. This legal success could introduce a spot Bitcoin ETF in the U.S., encouraging broader public participation in Bitcoin investment while avoiding complexity and custodial concerns. This could lead to a more inclusive crypto market while raising concerns about possible regulatory inconsistencies.”

When Blockchain Meets Regulation: A Tale of NFTs, SEC and Unseen Chains

In an unprecedented move, the U.S. SEC has classified a non-fungible token (NFT) as a security, underlining the regulatory complexities as crypto technologies evolve. The incident serves as a warning to crypto projects, revealing that despite the inherent freedom within the crypto landscape, invisible chains bound them when engaging in regulated activities.

Navigating the Gray: Binance, Grayscale, and the Uncharted Legal Landscape of Crypto

“Binance, a leading cryptocurrency exchange, faces possible legal action from the US Securities and Exchange Commission (SEC), potentially linked to violations of sanctions involving Russia. Meanwhile, the SEC and Grayscale experience a landmark clash, highlighting evolving regulatory issues and the role of self-regulation in preserving the balance between financial freedom and investor protection in crypto markets.”

Unmasking the Grayscale vs SEC Drama: A Testament to Crypto’s Regulatory Tug-of-War

Grayscale, a Digital Asset Management firm, recently won a significant case against the Securities and Exchange Commission (SEC), paving the way for regulatory clarity within the crypto industry. This case highlighted the ongoing battle between innovation and regulation in the crypto market space.

Grayscale’s Legal Triumph: Boost for Bitcoin or Forewarning for Crypto Firms?

“Grayscale, a prominent digital asset management firm, overcame US regulators to secure its rights to launch the very first Bitcoin spot ETF. Despite the celebrations, it’s worth noting how this victory underscores the delicate state of crypto companies in the face of regulator bodies like the SEC.”

Navigating Regulatory Shifts: Binance’s Shift, Impact Theory’s Legal Woes, and Emerging Blockchain Innovations

“Binance’s Belgian users can now dodge local regulations by accessing the platform via its Polish branch. This resourceful solution permitted them to continue operations within the European Economic Area after the parent company ceased. However, due diligence is important. On the other hand, Venezuela’s key banking institution has been removed from Binance’s P2P payment options due to alleged international financial sanctions.”

Binance and the SEC: Unraveling the Mystery behind the Secret Court Filing

“Binance, the massive cryptocurrency exchange, is facing escalating scrutiny due to a mysterious court filing from the Securities and Exchange Commission (SEC). The filing, controversially submitted under seal, has raised speculations about Binance’s forthcoming predicaments. Among the conjectures, one suggests the SEC is looking to avoid interference with a potential parallel criminal investigation.”

Grayscale’s Legal Triumph vs. SEC & Iris Energy’s AI Ambitions: Contrasting Crypto Moves

“In a significant legal case, Grayscale Bitcoin Trust triumphed over the SEC regarding its GBTC application for a Bitcoin ETF. However, this doesn’t guarantee a listing. Meanwhile, Iris Energy bought 248 Nvidia H100 GPUs for AI technologies and Bitcoin mining, presenting issues around energy consumption and sustainability in the crypto sector.”

Court Orders SEC Reevaluation: Grayscale’s Path to Bitcoin ETF Conversion

“A federal court has directed the U.S. Securities and Exchange Commission to reconsider its dismissal of Grayscale Investments’ bid to convert its Bitcoin Trust into a bitcoin exchange-traded fund. Although the conversion could potentially eliminate GBTC’s discount completely, there are hurdles and complexities in this fluctuating financial landscape.”

Iris Energy’s $10M Nvidia GPU Investment: Advancing Bitcoin Mining & AI or Overburdening Power Resources?

Iris Energy acquires 248 state-of-the-art Nvidia GPUs worth $10 million, aiming to explore the domain of generative AI and Bitcoin mining. The company, already operational in renewable-rich locations, faces competition from Genesis Digital Assets Limited and sustainability concerns. Critics fear overburdening power resources and possible future bubble bursts.

Armstrong’s BitBoy Crypto Controversy: An In-depth Analysis of Cryptocurrency’s Paradoxical Persona

“Insider news unveiled a divergence between Ben Armstrong and his creation, BitBoy Crypto, sparking upheaval in the cryptocurrency industry. Armstrong’s controversial reputation, alleged pay-to-play operation, and the performance of his token, $BEN, have garnered scrutiny. Despite backlash, his follower base remains strong and questions about blockchain’s future persist.”

Navigating the Promise and Perils of a Blockchain-Powered Future

“Blockchain technology presents unprecedented opportunities and potential pitfalls, transforming sectors like finance and supply chains, and democratizing financial access. However, there are security risks, regulatory challenges and concerns over data misuse and environmental impacts. Effective methods to capitalize this technology while mitigating risks are crucial.”

Polygon’s Ambitious Leap: Is The Cryptoworld Ready for the ZK-Powered Value Layer?

Ethereum scaling firm Polygon has unveiled a toolkit for blockchain developers to create customized Layer 2 chains with zero-knowledge (ZK) proofs. This opens up potentials for evolving ‘Supernets’ using the firm’s ZK technology, aiming to build the “Value Layer of the internet”.

Diving Deep into Bitcoin’s Prospective Price Floor: A Look at $23,000 as Rock Solid Support

Capriole Investments founder, Charles Edwards, hints at a probable Bitcoin (BTC) price fall to $24,000 but sees solid support at $23,000. Edwards’ confidence in this “rock-solid support” and “incredible long-term opportunity” is based on the ‘Electrical Price’ (EP), a concept reflecting the global average miner’s electrical bill per BTC, which currently matches the $23,000 mark. However, potential market uncertainties should not be overlooked.

Argo Blockchain’s Half Year Financial Resilience amidst Crypto Market Turmoil

Argo Blockchain has managed to decrease its losses to $75 million amid a bearish crypto market. Despite financial challenges like a 21% revenue shrink, the company raised $24 million in revenue and reduced its debt profile by $68 million. Operational restructuring and strategic decisions reflect the firm’s determination to stay competitive in the crypto mining industry.

Crypto Chaos: The Rising Tension and Uncertainty Surrounding PEPE’s Future

Memecoin PEPE has seen an 80% decline in value because of rumors of a potential “rug-pull” by its developers. After changing token transfer rules, they moved $16 million worth of PEPE to exchanges, leading some to predict a crash. However, increased buying and oversold indicators point towards a possible market rebound.

Binance’s Existential Crisis: Will the Crypto Giant Exit Russia Amidst Growing Legal Woes?

“Binance, the leading crypto exchange, is considering an absolute exit from Russia amid increasing Western sanctions. This comes after allegations of enabling transactions related to sanctioned Russian banks, escalating global legal issues, and potential indictments for possible infringement of anti-money laundering laws.”

Crypto Giant Exodus: India’s Tax Reform and Market Downturn Impact on CoinSwitch and CoinDCX

“Two of India’s leading crypto exchanges, CoinSwitch and CoinDCX, have started reducing their teams due to the cryptocurrency market downturn. CoinSwitch has let go 44 employees and CoinDCX has reduced its workforce by about 12%. The restructuring is a response to decreased customer queries and the impact of new tax reforms on overall business performance.”

Navigating the Crypto World: Market Fluctuations, Legal Challenges, and Growth Opportunities

“This week’s bearish sentiment among crypto traders forced Bitcoin under $26,000. Current market behavior indicates possible surge in volatility. Meanwhile, market is apprehensive about potential firming of rates to control inflation resurgence. Legal cases and settlements also impact the crypto world.”

Canaan’s Financial Rollercoaster: Soaring Bitcoin Mining Revenues Offset by Expanding Losses

“Canaan, a Bitcoin mining giant, reports a remarkable 43% rise in 2Q revenue, fueled by a revived Bitcoin market. However, net losses also escalated by 31% to $110 million, highlighting the unpredictability of the crypto industry.”

Cryptocurrency’s Global Market Influence: A Deep Dive into Dogecoin’s Diverse Performance

Dogecoin has seen a 10% drop this year, impacted significantly by European trading hours. Trading in the US shows a -25% return, whereas Asian trading hours see an increase of 25.6%. This highlights a clear geographical market response pattern. The SEC’s recent litigation against altcoins may impact meme coins, amid an uncertain regulatory environment.

Sailing into Uncharted NFT Waters: FirstMate’s Vision of Creator-Owned Marketplaces

“FirstMate, a budding blockchain startup, has received $3.75 million in funding for the development of an ‘NFT storefront builder’ platform. Aimed at rectifying the existing focus discrepancy on NFT platforms, it promises to enhance creators’ experience by allowing them to exhibit collections, dictate royalty conditions, and create a marketplace that truly reflects their artwork’s quality.”

XRP’s Market Rollercoaster: Drastic Dips, Promising Peaks, and the Quest for Stability

XRP has dipped 28% recently due to market sentiment and macroeconomic uncertainties. Despite its oversold status, the crypto asset has shown resilience, potentially offering a good opportunity for investors. However, XRP’s future still holds uncertainties, with conflicting market indicators and the possibility of dropping below $0.50.

Indian Crypto Unrest: The Tale of CoinSwitch and Blockchain’s Uncertain Future

The Indian cryptocurrency sector, currently undergoing upheaval, sees major job cuts at crypto unicorns CoinSwitch and CoinDCX due to decreasing trading volumes and strict crypto taxation. This situation reflects an uncertain future for blockchain technology and markets in regions with vigorous crypto tax regimes.

Navigating the Paradox: The Risks and Rewards of AI Adoption in the Media Industry

“Media companies grapple with the use of AI technologies like OpenAI’s ChatGPT. While some, including CNN and the New York Times, have implemented measures to prevent AI’s access to their content, others like Netflix explore AI’s potential. Amid potential and risks, businesses tread the road ahead cautiously.”