Binance, a renowned cryptocurrency exchange platform, has confirmed it will resume its services in Belgium, following a directive by Financial Services and Markets Authority (FSMA) in June. The exchange was found to be offering services from non-European Economic Area regions, a breach of regulations.

The FSMA had originally demanded a halt to Binance‘s operations in Belgium on account of violations pertaining to Anti-Money Laundering and the financing of terrorism. However, the regulatory body seemingly opened a path for resumed operations through a legal entity falling under the purview of another EEA member state.

Heeding to jurisdictional guidelines, Binance established an entity in Poland last month, to manage its Belgium-based clientele, amid a regulatory firestorm. The exchange platform’s operations in Belgium are hence, under the jurisdiction of Poland’s Know Your Customer requirements, contrary to previous legislations.

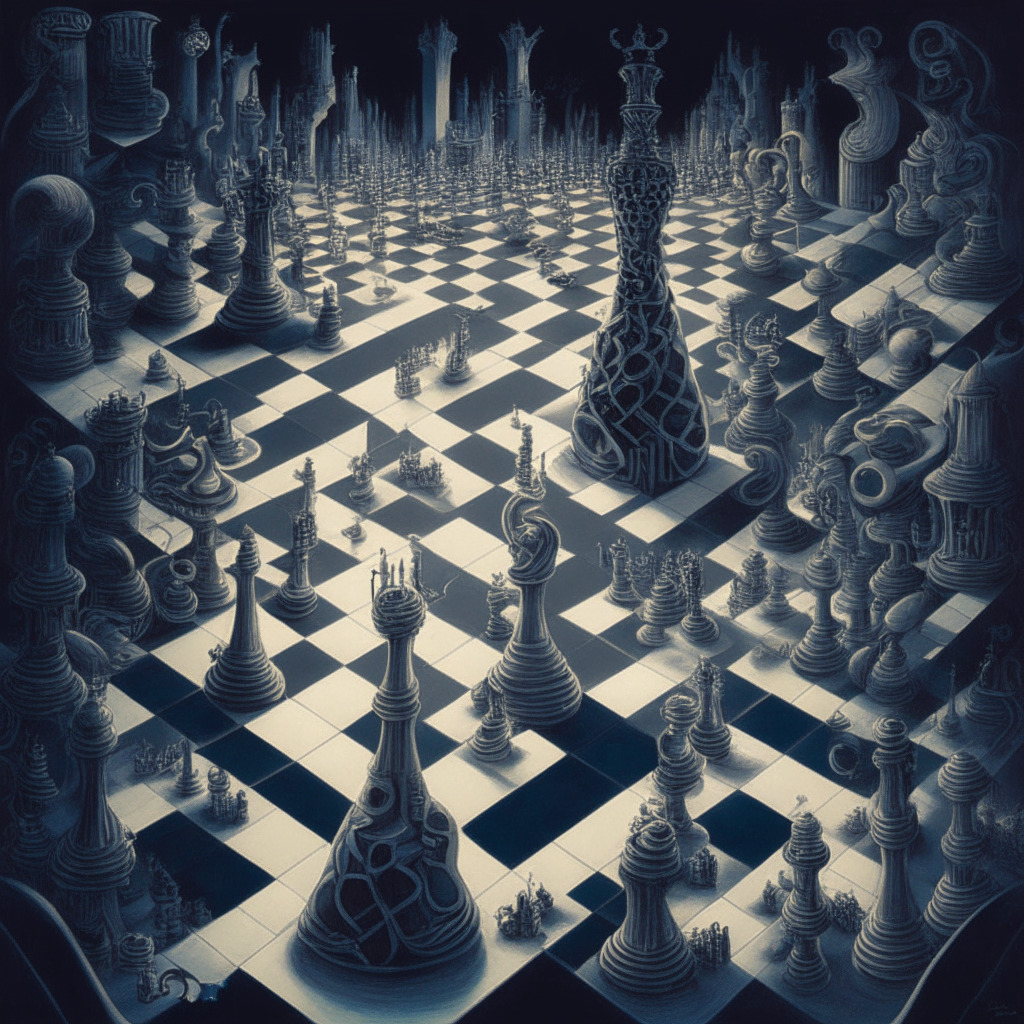

Binance‘s chess-like move comes with its fair share of challenges. July saw the exchange halting services for Dutch users over the lack of a virtual asset service provider license. Whilst dealing with these issues, CEO Changpeng Zhao and his exchange are in the middle of a lawsuit filed by the United States Securities and Exchange Commission.

In another turn of events, Binance, as part of its compliance strategy, has announced plans to delist stablecoins for the European market by June 2024. This move correlates with the forthcoming Markets in Crypto-Assets (MiCA) legislation, set to uniformly govern crypto assets among European Union member states.

However, it is intriguing to note the dynamic strategy deployed by Binance through the years. Remember the rumored delisting of privacy-coins in Europe, that was swiftly reversed?

In the Grand Rubik’s Cube that forms the crypto regulatory landscape, Binance’s moves suggests the immense complexity of these standards, and the nimble footwork actors must engage in for sustainable operations. If this is representative of what’s to come, we can only anticipate a more puzzling landscape ahead in the era of blockchain.

Source: Cryptonews