“The New York Department of Financial Services (NYDFS) proposes stricter regulations on digital coin listings, increasing scrutiny for licensees and necessitating more comprehensive risk assessment. The updated list of “greenlisted” coins can be listed by licensees without facing additional regulatory hurdles.”

Year: 2023

Revolution in Blockchain: A Deep Dive into Coinbase’s Base and the Emerging FriendTech Phenomenon

Coinbase’s layer 2 blockchain, Base, has seen a surge in daily transactions due to FriendTech, a decentralized social network built on Base. Questions about sustainability and authentic user engagement of such platforms have risen. Meanwhile, potential market shock following the sale of tokens from bankrupt crypto exchange FTX may be avoided.

Bitcoin Defies Death Cross Predictions: A Tale of Resilience or Market Manipulation?

“BTC has surged 8% despite the looming ‘death cross’ indicating a potential downturn, suggesting resilience in the cryptocurrency’s value. The Federal Reserve’s probable unchanged rate also provides support to the Bitcoin boom. However, the future is unpredictable with shifting odds.”

Navigating Malta’s Shifting Crypto Policies: Harmonizing with EU’s MiCA Regulations or Stunting Innovation?

“Malta is reshaping its regulatory landscape for cryptocurrency firms to align with the incoming pan-European Markets in Crypto Assets (MiCA) regulations, impacting businesses from exchanges to portfolio managers. This move indicates Malta’s commitment to global standards and ensures a seamless shift for local Virtual Financial Assets (VFA) Service Providers.”

PayPal’s Entry into Stablecoin Could Disrupt Financial Markets: Quigley’s Forecast & Scrutiny

Tether co-founder William Quigley has noted that PayPal’s venture into stablecoin could revolutionize multicurrency transactions by reducing costs. However, whether PayPal will transfer these savings to end users or retain them as profit is yet to be seen.

Stable Weekend in the Crypto World: A Careful Balance or Lull before the Storm?

The weekend was a quiet one in the cryptocurrency world, with main tokens like Bitcoin and Ether remaining stable. The overall market capitalization increased slightly by 0.4%, with a notable drop in crypto futures liquidations. However, traders may need to watch the looming rate decisions from the U.S. and U.K. central banks that could affect investor sentiment.

Implications of FTX’s Bankruptcy: Asset Liquidation & Market Stability Amid Chaos

“The liquidation of Bankrupt crypto exchange, FTX’s assets, including $1.16 billion in Solana (SOL), $560 million in Bitcoin (BTC), $192 million in Ether (ETH) and other tokens, may not crash the market instantly. Post court’s approval, a cap of $50 million per week for sales is initially set preventing spontaneous market drops, but long-term market impact remains uncertain.”

Whale-Spotted: ETHER Market Drawn in Massive Naked Buy -A Bullish Joust or Deep Pitfall?

An investor speculated to be a whale has been trading substantial call options, acquiring nearly 92,600 ETH call option contracts valued at about $150 million on Deribit. This activity, despite the gloomy phase for ETH, demonstrates the optimistic outlook of some whales on the future of the ether market.

Multiswap Revolution: Avalanche’s Pioneering Leap Toward Multiple Token Swaps in a Single Transaction

In a significant advancement for blockchain technology, the CavalRe team has launched Multiswap on the Avalanche blockchain, enabling users to swap up to 300 different tokens in a single transaction. This function paves a new path for blockchain trading and empowers users to execute intricate trading strategies quickly and cost-effectively. However, the promising tool may present potential security risks.

Undervalued Ether? Evaluating Ethereum’s True Value in Light of Layer 2 Adoption

“According to RRx, Ether, the cryptocurrency of the Ethereum blockchain, is trading at a 27% discount to its intrinsic value. This valuation is based on a modified Metcalfe law model, considering both Ethereum’s mainnet active users and the usership of its layer 2 scaling networks.”

Mark Cuban’s $870,000 Loss: A Cautionary Tale Against Crypto Phishing Scams

Dallas Maverick owner, Mark Cuban, lost approximately $870,000 in various tokens due to a phishing attack. Phishing attacks in the crypto industry mislead users into exposing sensitive information or downloading malicious software, leading to significant financial losses. A counterfeit MetaMask wallet application initiated the fraud. Users are advised to exercise extreme caution, verify sources and conduct due diligence to avoid such incidents.

Sam Bankman-Fried Saga: A Cautionary Tale for Blockchain Celebrity Endorsements

“This case involving Sam Bankman-Fried underlines the tricky path of combining celebrity allure with cryptocurrency’s fringe status to attract potential investors. It emphasizes the need for transparency, stricter regulations, credibility, due diligence and caution in dealing with new technologies and their promotion.”

JPEX Exchange Halts Operations: A Setback or a Gateway to Decentralized Future?

The Hong Kong cryptocurrency exchange, JPEX, has temporarily ceased operations due to a legal probe by the Securities and Futures Commission, resulting in the arrest of a key person. JPEX, operating without a local license, has faced user grievances and is also undergoing friction in Taiwan with affiliated influencers.

Ethereum’s Holesky Testnet Launch Misfires: A Hiccup or Long-Term Concern?

Ethereum’s anticipated test network, Holesky, faced a launch setback due to a misconfiguration, resulting in a two-week delay. Despite being intended to address Ethereum’s scaling issues and allow for increased validators, the event highlighted vulnerabilities. However, the existing Goerli testnet remains functional, supporting continued application testing. This incident does not affect Ethereum’s subsequent hard fork, Dencun.

Exploring The New Frontier: Bitcoin Metaverse Ecosystem and Gaming Tokens

Animoca Brands plans to develop a metaverse ecosystem token on the Bitcoin network, centered around Bitcoin Ordinals. The game, Life Beyond, by Darewise Entertainment aims to pilot the Bitcoin-based metaverse token for in-game assets and virtual land transactions with Horizen Labs’ assistance. The initiative explores Bitcoin’s utility in the evolving digital gaming environment, despite scalability concerns.

FTX Cryptocurrency Exchange: The Fallout, Resolution and Future Bound by Bankruptcy and Cybersecurity

FTX exchange has reopened its customer claims portal, after a cybersecurity breach in August. The exchange, now bankrupt, allows users to claim for their digital assets held prior to November 2022. FTX reports assets of around $7 billion, which include Bitcoin and lesser-known tokens. The shocking revelation involves 36,075 filed customer claims, amounting to an appalling $16 billion.

Ethereum’s Prospects Amid Testnet Troubles & The Rise of Non-Traditional Crypto Assets

“Ethereum’s recent trading volume exceeded $2.6 billion, boosting its price over the $1,600 benchmark. Despite a hiccup in the Holesky testnet launch due to data entry errors, Ethereum’s mainnet remains unaffected emphasizing the need for testnets in improving validation and staking processes.”

Bitcoin’s Bullish Streak: Will the $26k Uptrend Persist Amid Economic Shifts and Technical Indicators?

“Bitcoin breaches $26,000 benchmark with a live price at $26,553, showing strong demand via a trading volume of $6.6 billion. Upcoming economic events could influence Bitcoin’s price dynamics, including the Federal Reserve’s Federal Funds Rate announcement and economic data later in the week.”

Undulating Landscape of Cryptocurrencies: Ripple’s XRP Court Battles and the Rise of $WSM

“The Torres Ruling has fostered enthusiasm among XRP supporters, although Ripple’s maneuvers with XRP remain unclear. Despite positive court decisions, Ripple and XRP still exist in a ‘regulatory grey area’. In related news, the rise of Wall Street Memes’ $WSM underlines the dynamic nature of the cryptocurrency landscape, with potential for significant reward and risk.”

Lazarus Calling: North Korean Hackers Threaten Crypto Security Amidst $240 million Digital Heist

“Lazarus, a North Korean hacking group, has reportedly stolen $240 million worth of cryptocurrencies in the last 104 days. A rising number of breaches, particularly within the Ethereum network, demand strengthened security frameworks and proactive defense mechanisms to detect, prevent cyber attacks and safeguard digital assets.”

Navigating Bitcoin Surge: Is Now the Time to Invest or Beware?

“Bitcoin’s price point crossed the $26,500 mark, with its market cap at a staggering approximate $517 billion. But, insights into Bitcoin’s future show a somewhat bearish outlook. Despite this, several technical indicators suggest a buying trend and continued bullish momentum.”

Defending Crypto: John Deaton’s Champion Stance for LBRY against the SEC’s Heavy Hand

“After facing a hefty penalty from the SEC, LBRY gains support from renowned attorney John Deaton for their appeal case. Despite setbacks, there’s industry optimism after recent court victories by Ripple and Grayscale against the SEC. Cryptocurrency stakeholders dispute the SEC’s decision due to its impact on the industry.”

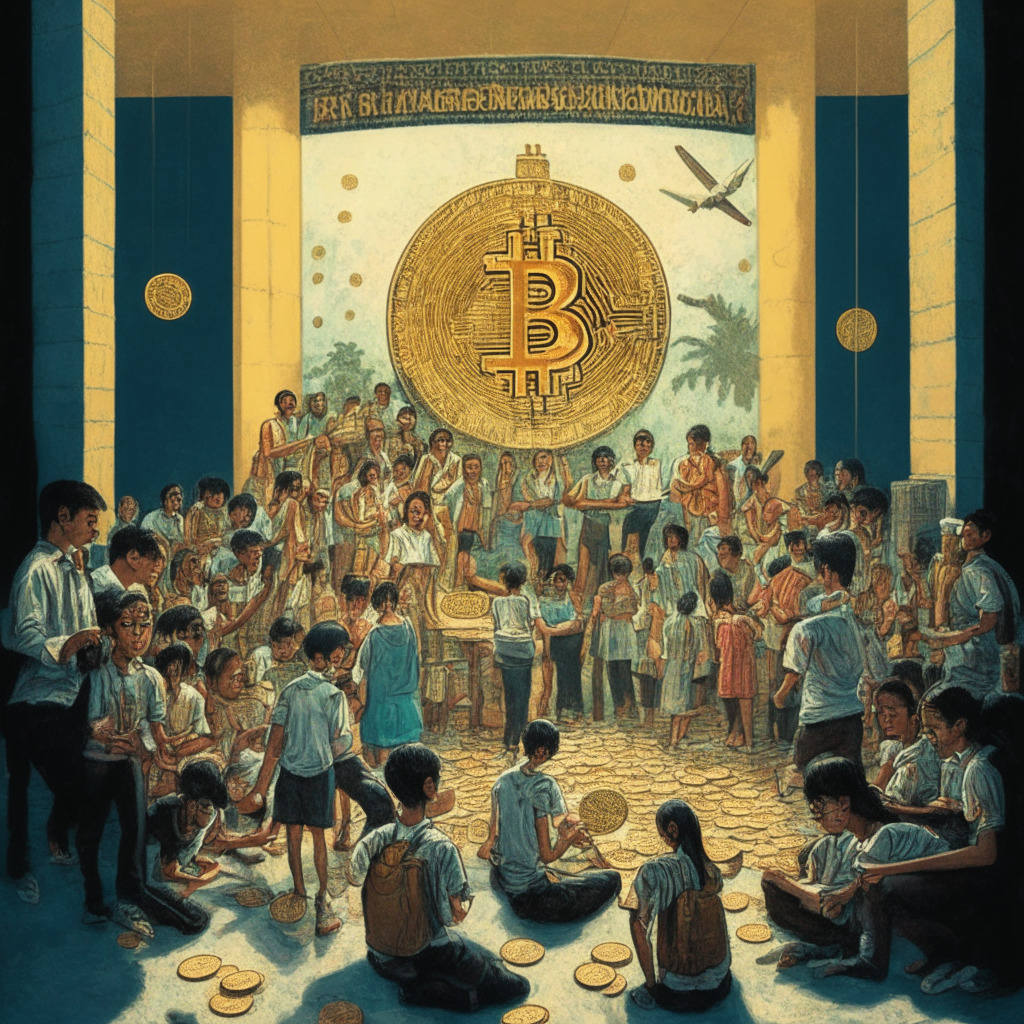

Crypto Galore: El Salvador’s Bitcoin Education to Binance’s Legal Tussle – the Week in Review

“The week in the crypto world was replete with notable developments from El Salvador’s Bitcoin literacy initiative to security issues identified with Telegram Bots by Certik. Meanwhile, high-profile legal battles and regulatory changes kept the industry on its toes. Despite challenges, tech giants like Sony and PayPal advanced their blockchain and crypto endeavors, emphasizing the market’s enduring dynamism.”

Unraveling Crypto Adoption: Growth Momentum in Lower Middle Income Countries Vs. Homogenized Landscape

The 2023 Chainalysis Global Crypto Adoption Index reveals a rise in cryptocurrency adoption in Central and Southern Asia, with countries like India, Vietnam, and the Philippines capturing significant positions. Lower Middle Income countries, which house 40% of the world’s population, show resilience in adoption trends, and are poised to shape the future of global cryptocurrency adoption.

Legal Boundaries in Crypto Trials: A Close Look at Sam Bankman-Fried’s Controversial Case

The US DOJ has shown concern over potential jury questions suggested by Sam Bankman-Fried during a trial concerning the FTX crypto exchange under fraud allegations. Critics view these questions as overly intrusive, seemingly aiming to shape a narrative in Bankman-Fried’s favor and raising questions on anonymity, skepticism, and justice in the cryptosphere.

A $510,000 Mistake or a Hefty Tip: Scrutinizing Paxos’ Unprecedented Bitcoin Transaction Fee Blunder

Paxos, a financial infrastructure firm, unintentionally overpaid a transaction fee by 19.8 BTC, leading to skepticism in the cryptocurrency community. Paxos was challenged to claim their lost funds within a tight timeframe or lose them to the crypto-mining community. The potential loss, sparked robust debates within the crypto community, underscoring the unpredictable nature of blockchain technology.

3LAU Ditches Friend.tech Over Regulatory Concerns: Uncertainty Proves to be Crypto’s Arch-nemesis

Well-known DJ and crypto enthusiast, 3LAU decided to disengage from Friend.tech, a decentralized social media platform, citing potential regulatory risks. His concerns revolve around the Automated Market Maker (AMM) feature which facilitates the trading of user keys. This feature, he believes, could unintentionally lead to regulatory issues for users. The decision sparked mixed reactions but ultimately underlines the delicate balance between potential gains and regulatory ambiguities in the world of blockchain technology and decentralized platforms.

Billionaire Mark Cuban’s Cryptocurrency Heist: A hard Lesson on Crypto Safety

Billionaire investor Mark Cuban recently lost nearly $900,000 in crypto from his hot wallet in a swift heist. The security breach highlights the inherent risks of dealing with cryptocurrencies, stressing the need for robust anti-money laundering, fraud detection, and regulatory measures. Even seasoned investors like Cuban are reminded to maintain vigilance and ensure precautions when interacting with these digital assets.

Erroneous Crypto Transactions: A Potentially Costly Oversight Amid Promising Investment Opportunities

Cryptocurrency requires precision in transactions, as evidenced by Paxos’ accidental transfer of a $510,000 fee. F2Pool, however, returned the payment, demonstrating transaction integrity. This incident underscores the importance of meticulousness in the crypto market. Furthermore, while currencies like THORChain and Wall Street Memes show promise, it’s essential to remember that crypto is a high-risk asset with potential for volatility.

Resilience in Blockchain: How Germany Stands Tall among Global Economic Pressures

The German blockchain sector witnessed a 3% YoY funding increase despite a global downturn of over 50% in blockchain ecosystem. Germany secured $355 million through 34 venture deals, a stark contrast to the 62% plunge in global funding and 44% drop in deal numbers.

Navigating the Storm: Binance’s Legal Challenges and the Future of Crypto Regulation

Binance CEO, Changpeng Zhao dismisses rumors of Binance.US CEO, Brian Shroder’s departure amidst legal issues involving the SEC and CFTC. He notes Shroder’s significant contributions to the platform’s resilience and growth, despite growing legal and regulatory challenges. Binance.US recently appointed Norman Reed as the new CEO.

Legal Tug-of-War: US Government’s Crypto Regulatory Stance Sparks Controversy

“The U.S government’s recent objection to juror selection questions for ex-FTX CEO, Sam Bankman-Fried, has reignited discussions about regulatory frameworks for cryptocurrencies. Critics view this as an attempt to limit broader conversations on the financial landscape changes triggered by cryptocurrencies.”