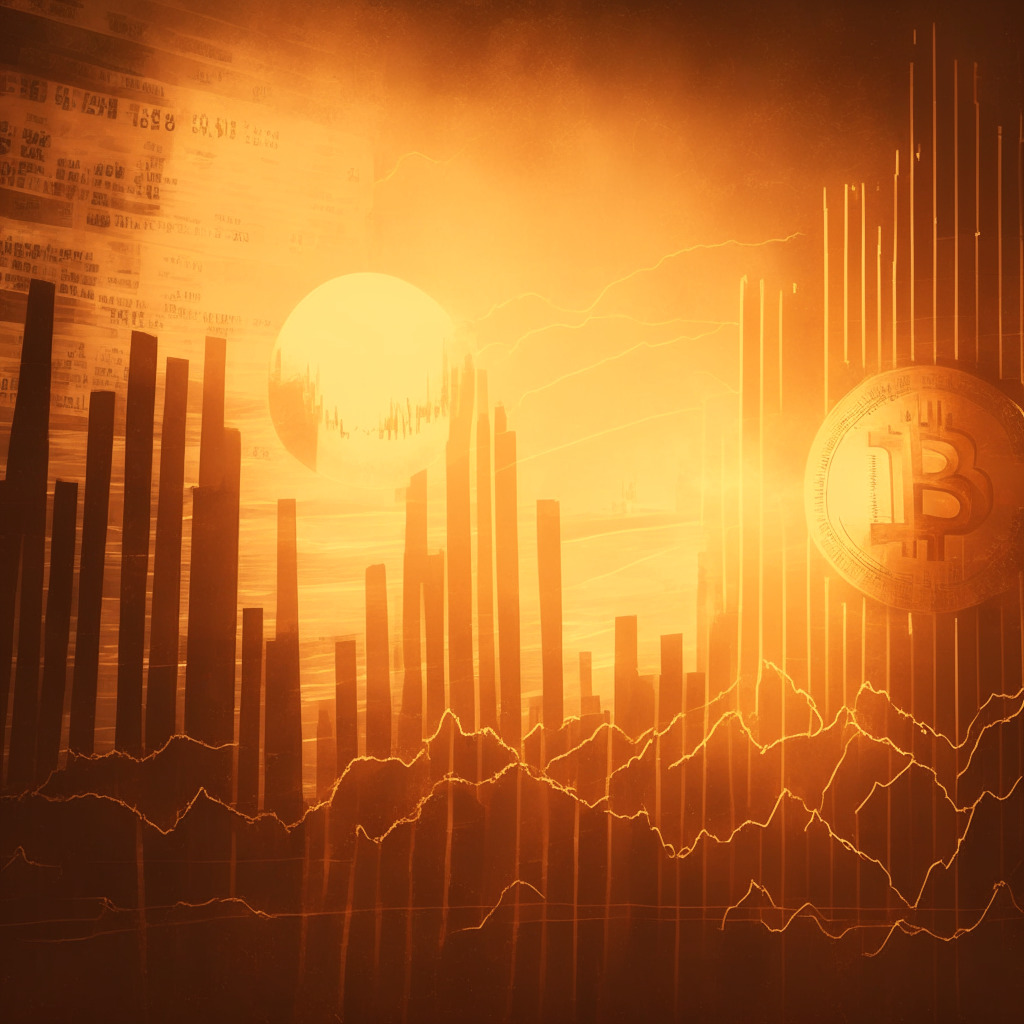

“Grayscale Bitcoin Trust (GBTC) is experiencing an upswing, trading only 17% below Bitcoin price parity, despite Bitcoin’s low market price. This resurgence is attributed to several factors, including the recent news of BlackRock’s plans for a Bitcoin spot price-based ETF. The ‘GBTC Discount’ also seems to be diminishing, indicating potential market dynamics not aligning with the weakening Bitcoin price.”

Search Results for: GBTC

GBTC Poised to Erase Bitcoin Price Discount by 2024: Opportunities and Challenges

“The Grayscale Bitcoin Trust (GBTC) may erase its BTC price ‘discount’ by 2024, claims an analysis on the CoinGlass platform. This follows a court victory against U.S regulators that has boosted GBTC performance. However, market conditions, regulatory decisions, and investor behaviour will play major roles in this potential shift in dynamics.”

BlackRock ETF Filing: A Boon or Bane for Grayscale’s GBTC Future and Crypto Market

BlackRock’s recent spot Bitcoin ETF filing has raised questions about Grayscale’s future strategy. If Grayscale successfully converts its current structure into an ETF, it may benefit from reduced pricing deviation and enable 1:1 equivalent redemption between GBTC shares and Bitcoin. However, the SEC’s rejection of Grayscale’s 2022 ETF application remains a challenge.

GBTC Share Surge: ETF Conversion Hopes, Redemption Possibilities, and Ongoing SEC Conflict

GBTC’s share price soared past $16, fueled by hopes of its conversion into a Bitcoin ETF. Investor optimism was driven by redemption possibilities and Grayscale’s chances of winning an ongoing lawsuit against the SEC. Rumors of Fidelity filing for a spot BTC ETF further fueled optimism in the cryptocurrency space among traditional investment management firms.

GBTC Nears 2023 Highs Amid BlackRock ETF Filing: Boon or Controversy?

The Grayscale Bitcoin Trust (GBTC) nears 2023 highs amid BlackRock’s filing for a Bitcoin spot price ETF. GBTC’s negative premium reduces as optimism grows surrounding BlackRock’s ETF approval, potentially breaking the US spot ETF deadlock and impacting the cryptocurrency market.

BlackRock’s Bitcoin ETF vs GBTC: Analyzing Key Differences and SEC’s Role in the Outcome

BlackRock’s iShares Bitcoin ETF application with the SEC differs from Grayscale Bitcoin Trust (GBTC) due to its redemption feature, which seeks to closely track Bitcoin’s spot price. The case’s outcome could shape Bitcoin investment products’ future and market sentiment.

ProShares Adventures into Ether with Six ETF Futures: Growth or Excessive Risk?

ProShares Advisors has marked ether’s inaugural entry into the ETF market with six new futures products. These ETFs, backed by ether’s futures contract performance, provide regulated crypto market exposure. This development coexists with the ongoing SEC review of a prospective spot bitcoin ETF.

Navigating Bitcoin’s Tough Road to $30,000: Exploring the Underlying Challenges

Bitcoin’s struggle to surpass $28.5K is attributed to factors such as failed launch of Ether futures ETFs, US Federal Reserve’s economic concern, a dip in Bitcoin’s core trading metrics, and dwindling faith in the prospect of a spot Bitcoin ETF. The path towards $30,000 appears uncertain.

Navigating the Cryptocurrency ETF Waters: A Conversation with Peter Eberle of Castle Funds

Crypto expert Peter Eberle shares that while inevitable, crypto ETFs’ arrival won’t be imminent. Eberle highlights disparities in crypto financial products that impose limitations such as high fees and insufficient liquidity. He also points towards the need for clearer digital asset regulations. Despite inherent challenges, strategic developments like the EU’s MiCA consultations are charting a better regulatory path for cryptocurrencies.

Court Overrules SEC’s Dismissal on Bitcoin ETF: A New Dawn for Grayscale or a Risky Bet?

A US federal judge recently overturned the SEC’s dismissal of Grayscale’s proposal to convert its Bitcoin Trust (GBTC) into an ETF, causing ripple effects in the crypto market. Analysts project a 75% likelihood of spot Bitcoin ETF acceptance in 2023. This may lead to substantial consequences for the crypto market, potentially boosting Bitcoin price and possibly paving way for Ethereum’s approval.

Proposed DCG-Genesis Deal: A Lifeline for Gemini Earn Users or Crypto Regulatory Alarm?

Gemini Earn users could recover between 70%-90% of their cryptocurrency holdings due to a proposed agreement between DCG and Genesis. This agreement averts a Chapter 11 case. The recovery amount represents the soaring appreciation of digital currencies – “$85,000 for BTC and $8,500 for ETH.” However, the deal still requires creditor approval.

Bankruptcy and Redemption: Gemini Earn’s Potential Recovery amidst Crypto Market Turbulence

“A proposed remuneration deal for retail creditors of the Gemini Earn program promises a possible recovery of 95-110% of their claims. The payout is contingent on an agreement within diverse Genesis creditor groups and the final form of the agreement.”

Bitcoin’s Volatile Dance: Navigating the Bull-Bear Stalemate amidst Market Uncertainties

Bitcoin’s value oscillation continues to be captivating, currently sitting at $26,107 after testing the $25,000 support level. Despite a promising resurgence, Bitcoin is experiencing a competing struggle to gather momentum, contending with a 15% plunge since July, versus the stability of assets like S&P 500 index and gold. Future Bitcoin value trajectories likely depend on future events such as potential approvals of Bitcoin spot ETFs and the supply reduction post April 2024 halving.

Navigating Through the Cryptosphere: Recognizing Scams in the New Era of Digital Currency

Despite heightened security in the decentralized financial world, scams persist. A recent significant hoax involves a counterfeit ‘GBTC’ token giveaway impersonating the Grayscale Bitcoin Trust. The fake account’s blue checkmark, which was previously a trust signal, has compounded the confusion, emphasizing the need for heightened awareness and rigorous security checks among users.

Navigating the Storm: The Rise of Cryptocurrency Scams on Social Media Platforms

A dubious offer of a $25 million giveaway in a new token named GBTC on a social-media platform stirred the crypto community. The account running the scheme, @Grayscale_FND, was unaffiliated with the actual Grayscale company, marking it as a scam. Cryptocurrency scams are on the rise, reinforcing the importance of cybersecurity for digital assets.

Dissecting the ETHE to ETF Transformation: Fluctuating Markets, Investor Sentiment and Projections

As reported by CryptoQuant data, the regulatory filing of a spot ether exchange-traded fund (ETF) has triggered a reduction in the Grayscale Ethereum Trust’s discount to net asset value. This anticipated shift could potentially transform Ethereum’s future, fueling speculation about Grayscale converting its product into an ETF. Whether the transition will obliterate the discount to zero remains uncertain due to fluctuating investor sentiment.

Grayscale’s Billions in Bitcoin: A Hidden Treasure or Exaggerated Claim?

Arkham Intelligence recently unveiled that Grayscale is the world’s second-largest BTC holder, with over 1,750 wallet addresses and holdings worth $16.1 billion. However, Grayscale has not disclosed wallet addresses due to security concerns, igniting speculation and skepticism within the crypto community.

Pushing the Boundaries: Grayscale Urges SEC for Speedy Bitcoin ETF Approval Amid Rising Crypto Investments

Cryptocurrency investment manager Grayscale has petitioned the U.S. Securities and Exchange Commission (SEC) to expedite the conversion of Grayscale Bitcoin Trust (GBTC) into a Bitcoin exchange-traded fund (ETF). This follows a court reversal of a previous rejection of GBTC’s ETF bid, causing Grayscale to argue there’s no justifiable cause to deny their ETF application.

Grayscale’s Push for Bitcoin Spot ETF: A Potential Market Game Changer or Overestimated Bullish Belief

“Yesterday, Bitcoin’s price noted a slight increase as Davis Polk, a legal firm, vigorously pushed for the SEC’s approval of the Bitcoin spot ETF. This news could potentially expand investment opportunities and enhance the liquidity of the crypto market. However, analysts believe that the crypto market hasn’t yet reflected this bullish perspective in Bitcoin’s prices. Amidst this, high-net-worth individuals are showing increased interest in Bitcoin, further elevating its financial footprint.”

Grayscale’s Stalled Bitcoin ETF Conversion: A Tussle with the SEC and its Impact on Crypto Adoption

Grayscale, a major crypto investment firm, is in talks with the U.S. Securities and Exchange Commission (SEC) regarding its stalled Bitcoin Exchange-Traded Fund (ETF) conversion proposal. Grayscale argues that stakeholders deserve a swift resolution, while the SEC focuses on minimizing potential fraud in the volatile Bitcoin market. This confrontation could significantly influence crypto’s mainstream financial acceptance.

Ether ETF Anticipation: Predicting a Bull Run or Navigating a Bubble?

The U.S. SEC nears the deadline for the approval or rejection of the first ether ETF which, according to a report by K33 Research, could cause a considerable boost in ether’s price. Comparing it to the 60% gain bitcoin experienced upon the launch of its first futures-based ETF, the analyst suggests a favorable market impact. Despite the SEC’s delay and consequent dip in bitcoin’s fortune, aggressive accumulation is recommended due to long-term potential.

Grayscale vs SEC: The Crypto ETF Dispute Echoing Across Regulatory Landscape

Grayscale Investments argues there’s “no basis” for the SEC’s refusal of its Grayscale Bitcoin Trust (GBTC) conversion into an ETF. The argument raises questions about the SEC’s decision-making process, suggesting potential inconsistencies. This highlights an ongoing debate within the crypto and regulatory spheres about balancing regulation and technological advancement. The final decision will set a precedent for future cryptocurrency regulation.

Labor Day Market Fluctuations: Bitcoin Declines but Solana Shines

Following Bitcoin’s recent dip to $25,700, market uncertainty pervades, driven by SEC’s delay of other Bitcoin ETF applications like BlackRock and Fidelity. Factors such as decreasing trading volume, multi-year lows in Google search trends, and record low volatility point towards a prevailing indifferent attitude. Nevertheless, with Solana’s SOL token rising and Visa’s initiative to expand settlement capabilities on blockchain, optimism still persists in crypto space.

Grayscale’s Bitcoin ETF Approval: A Pivotal Moment or a Narrow Victory?

The U.S. Court of Appeals Circuit Judge has granted Grayscale Investments’ request to convert its Bitcoin Trust into a listed Bitcoin exchange-traded fund (ETF). But as the industry hails the decision as a victory, it’s worth questioning the real implications for the crypto industry and the broader acceptance of crypto ETFs in the future.

Gary Gensler and the Crypto Conflict: A Shift from Advocacy to Regulation

Gary Gensler, Chair of the Securities and Exchange Commission (SEC), has adopted a circumspect approach towards cryptocurrencies since his appointment, voicing concerns over potential systemic risks. Amid criticism, he increased his legal actions against prominent industry players like FTX, Binance, and Coinbase. However, a recent judgement favoring Grayscale could compel SEC to reconsider its regulatory rigidity towards the crypto market.

Approaching $22,000 BTC Amid Bearish Derivatives and Uncertain Regulations

“Recent data on Bitcoin futures highlights a potential correction to a $22,000 BTC. This is amid bearish derivate trends and U.S. regulatory uncertainties including postponed BTC ETFs and potential indictment of leading cryptocurrency exchanges Binance and Coinbase by the DOJ.”

Securing Bitcoin’s Future: ETF Decisions and Market Movements Unveiled

Bitcoin’s recent market activity has been relatively stable, oscillating between $25,800 and $26,000, after surpassing the $28,000 mark. This movement followed a court order directing the SEC to reconsider denying Grayscale Investments’ GBTC-to-ETF conversion. However, the postponement of a key ETF decision has cast doubt on long-term recovery prospects.

Grayscale’s Milestone Victory: Paving the Way for Crypto ETFs and the Challenges Ahead

“The asset management industry could see massive commercial breakthroughs in an expanding crypto class, thanks to recent legal victories like Grayscale’s. However, establishing clear regulatory frameworks is crucial for investor safety and market stability. As we experience a shift from retail to institutional capital flow, the dynamics of the crypto market may change.”

SEC vs Grayscale: The Bitcoin ETF Challenge That Could Shake Up the Crypto World

The Securities and Exchange Commission’s refusal to transform Grayscale’s Bitcoin Trust into a spot Bitcoin ETF is being challenged following a federal court directive. Accusations suggest arbitrariness in SEC’s decisions, given contrasting dispositions towards futures-based Bitcoin ETFs. This situation could potentially alter the crypto market regulatory landscape.

The Unpredictable Dance Between Bitcoin and Employment Rates: A Dive into Market Turbulence

“The recent U.S. employment statistics have impacted the cryptocurrency market, especially Bitcoin’s price. Despite brief spikes, inherent volatility and external factors like the U.S. employment numbers influence market outcomes. Sustainable growth may require focus on regulatory compliance, economic growth, and finding a balance between stability and volatility for a maturing blockchain future.”

Bitcoin ETFs: A Tug of War between Market Fluctuations, Regulatory Battles and Future Stability

Despite an 11% drop in August Bitcoin’s price, the market remained relatively stable due to the possibilities of a Bitcoin ETF. This was spurred by Grayscale’s legal victory against SEC’s planned obstruction of its Bitcoin Trust conversion to an ETF. However, SEC’s delay in approving other ETF applications signals authorities’ hesitancy to fully embrace cryptocurrencies. Regardless of regulatory uncertainties and market oscillations, optimism for cryptocurrency technology’s future remains.

Navigating the Choppy Waters: Crypto Regulation’s Impact on Future Market Stability

The future of significant cryptocurrencies like Bitcoin may hinge on regulation. This comes as the U.S. Securities and Exchange Commission (SEC) delayed crucial decisions on spot bitcoin exchange-traded fund (ETF) applications, causing major cryptos to lose their weekly gains. The impact of this emerging era of crypto regulations remains difficult to predictable, posing a paradox of digital currency liberation versus regulatory control.