“Ethereum’s integration of layer 2 networks marked a shift in industry practices, with auxilliary networks supporting developers and easing mainnet congestion. Base and Friend.tech, for instance, have seen significant growth. However, Messari’s analysts advise caution due to market uncertainties.”

Search Results for: KT

Sygnum Singapore’s Digital Breakthrough: Unpacking the Pros and Cons of Singapore’s Sieve-Like Crypto Compliance

Sygnum Singapore, a subsidiary of the Swiss-based crypto bank, has secured its Major Payment Institution License from the Monetary Authority of Singapore. The license enables Sygnum to provide regulated digital payment token brokerage services, breaking previous transaction limits, and paving the way for potential expansion into Asia-Pacific markets.

Tether’s Undisclosed Investment in Northern Data: A Blockchain Breakthrough or Transparency Crisis?

Tether has made an undisclosed investment in German-based crypto miner, Northern Data Group, potentially involving AI, P2P communications, and data storage solutions. Despite past controversies and questions around its financial management and transparency, this move could signify a turning point for Tether and have significant implications for the blockchain industry.

Decentralized Finance (DeFi): Embracing Breakthrough or Hastening Regulatory Recklessness?

“In a significant endorsement of decentralized finance (DeFi), Coinbase’s CEO, Brian Armstrong, promotes the need for conducive regulation, facilitating DeFi development rather than punitive enforcement. His stand reflects DeFi’s growing recognition within mainstream finance, but also stresses on avoiding over-regulation that could stifle technological advancement.”

Unpacking the Crypto Turbulence: Breakthroughs, Setbacks, and the Future Uncertain

“This week in crypto saw Grayscale Investments move closer to transforming its Bitcoin Trust into an ETF, despite SEC concerns. Meanwhile, turmoil rocked the BitBoy Crypto brand due to allegations against Ben Armstrong. The SEC delayed decisions on multiple Bitcoin ETF applications while Robinhood recovered 55M shares from ex-FTX CEO. These events underscore the balance needed between celebrating advancements and managing challenges in the blockchain and cryptocurrency world.”

Bitcoin Whales Expanding Their Wealth Despite Price Slumps: Breakthrough or Breakdown?

“Bitcoin ‘whales’ have significantly boosted their stakes, increasing assets by $1.5 billion in late August. This growth occurred despite a slump in BTC’s price, suggesting increased optimism among institutional investors. This follows a court resolution pushing for Grayscale to list a spot Bitcoin exchange-traded fund (ETF) in the U.S.”

Web3 Gaming Breakthrough: Zynga’s Exciting Foray and Emerging Challenges

“Zynga, a mobile gaming giant, takes a leap into Web3 gaming with the introduction of ZW3 and Sugartown. However, as highlighted at Istanbul Blockchain Week 2023, there are concerns about the adoption and mechanics of Web3 games despite the promising prospects.”

Harnessing Web3’s Potential: Hong Kong’s Push And Cautionary Tales of Tech Breakthroughs

“Web3, the next iteration of the internet, has been highlighted by the Financial Secretary of Hong Kong, Paul Chan Mo-po, as a main propeller for global technology growth. Chan supports blockchain technologies, non-fungible tokens, GameFi, Play-to-Earn gaming, and immersive entertainment as the driving forces for this digital innovation wave.”

Navigating the Digital Ruble: A Breakthrough or a Step Towards Financial Surveillance?

“The Central Bank of Russia is testing the digital ruble, a central bank digital currency (CBDC), with potential benefits like offline payment capability discussed. However, journalist Anastasia Tselykh raises concerns over benefits for ordinary citizens, and the implications of easier tracking of citizens’ money.”

Coinbase Breakthrough: Achieving Regulatory Approval for Crypto Futures in US

“Coinbase has gained approval to list crypto futures in the U.S., nearly two years after initiating the application. The National Futures Association green-lighted Coinbase as a Futures Commission Merchant. This move may reshape the crypto ecosystem, allowing broader financial marketplaces and providing a regulated platform for both institutional and retail investors.”

Regulatory Hurdles and Cryptographic Breakthroughs: A Dive Into the World of Digital Currency

The global payment powerhouse, PayPal, has introduced its Ethereum-based stablecoin, PYUSD, stirring up the digital currency landscape. Simultaneously, cryptographic activities like Sam Altman’s Worldcoin faces regulatory challenges in Kenya. Meanwhile, Curve Finance showcases resilience by recovering 73% of funds stolen in a recent hack. Despite occasional regulatory complexities, these developments affirm the dynamic growth in the cryptographic domain.

Worldcoin’s Iris-Scanning Identity Project: Breakthrough Innovation or Data Privacy Nightmare?

“Worldcoin, a digital ID crypto project, introduces a digital identity system based on iris scanning to differentiate humans from AI entities. Despite concerns about data privacy, it has secured $115 million funding and over 2 million sign-ups. However, industry experts question Worldcoin’s ability to manage personal information securely.”

Bitcoin Awaits Breakthrough Amidst Mixed US Unemployment Data and Dollar Strength

“As Bitcoin’s price reached $29.3K, amidst mixed U.S. unemployment data and a strengthening dollar, the market displayed resilience. Financial markets react to these shifts, indicating an extremely dynamic crypto environment, with enthusiasts envisioning potential rebound opportunities despite the uncertain economic landscape.”

BTC20: The Breakthrough Token Outpacing Bitcoin and Pepe Coin in Google Trends

The ERC-20 token, BTC20, is exceeding both Pepe coin and Bitcoin in popularity and has gathered over $3.4 million in presale in just nine days. Offering potential yields up to 520%, it attracts investors with the concept of owning bitcoin on the Ethereum blockchain at bitcoin’s original 2011 price with added environmental benefits.

Namibia Embraces Crypto Regulations: A Breakthrough or a Setback?

“Namibia has signed a law regulating Virtual Asset Service Providers, reversing its 2017 ban on crypto exchanges. The law aims to enhance consumer protection, curb market abuse, and mitigate money laundering and terrorism financing risks. However, severe penalties apply for non-compliance and cryptocurrencies still hold no legal tender status in Namibia, potentially creating a hostile environment for crypto businesses.”

Ethereum’s Quantum Leap: Breakthrough Speed vs. Comprehensive Network Development

“Starknet’s latest upgrade, “Quantum Leap,” significantly improves Ethereum’s transaction processing speed, potentially enabling hundreds of transactions per second. This upgrade facilitates faster, efficient, and seamless network functionalities for developers, allowing real-time on-chain transaction confirmations. The upgrade, however, is still early-stage, and future success hinges on real-world application and user adoption.”

The Crypto Rollercoaster: A Week of Breakthroughs, Setbacks and Controversy

“Bitcoin continues to attract institutional investors, while Ethereum users propose ERC 7265 to counter DeFi hacks. Solana’s liquid staking protocols see a 91% surge, hinting at mainstream market’s growing crypto acceptance. Yet, regulatory tensions, security concerns, and the rise of crypto-related cybercrimes pose significant challenges in the crypto landscape.”

Bakkt Aims for International Expansion Amidst Unclear US Regulatory Landscape

Bakkt, a crypto-economy firm, expresses interest in expanding its operations to Hong Kong, the United Kingdom, and some European Union regions due to favorable regulatory environments. This follows Bakkt’s acquisition of Apex Crypto, leveraging partners like Webull, Public.com, and Stash to facilitate global growth. However, pesky regulatory uncertainties in the U.S. complicate alliances and force delisting of certain cryptocurrencies.

Brazil’s Digital Real Rollout: Transparency Questions and Potential Breakthroughs

Brazil’s Central Bank has archived central bank digital currency (CBDC) related documents on GitHub, providing insight into the core aspects of the digital real. However, the document’s incompleteness sparked requests for the source code, which is promised to be made public after necessary audits. The bank plans to use the Hyperledger Besu blockchain and aims to introduce the digital token by 2024.

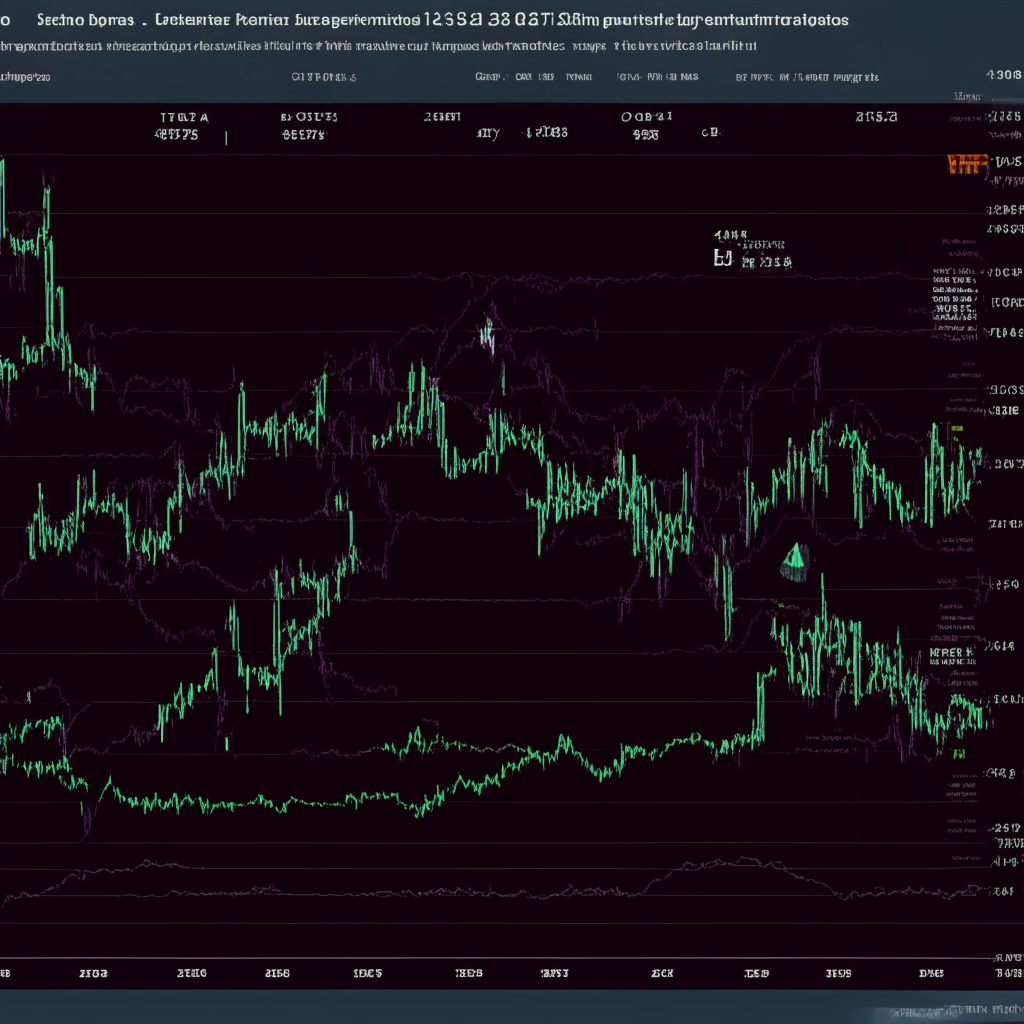

Ethereum’s Battle at $1926: Consolidation, Breakthroughs, and Key Indicators to Watch

Ethereum’s ongoing recovery rally encounters a roadblock at $1926, with sellers and buyers creating a narrow price range between $1867 and $1926. The overall market sentiment leans towards optimism, increasing the likelihood of breaking the $1926 resistance level and resuming Ethereum’s recovery. Traders should monitor key indicators like RSI and EMAs for informed decision-making.

South Korean Giant KT’s $5.3B AI Ambition: A Game Changer or Overreach? Pros, Cons, and Conflicts

South Korean mobile giant KT pledges to invest $5.3 billion in AI research and development over the next five years to become an industry leader. With plans in AI-driven customer service, healthcare, education, logistics, and robotics, KT faces tough competition from global tech giants like Amazon, Microsoft, Adobe, and Zoom in this highly competitive market.

Volition: The Breakthrough Set to Slash Ethereum Fees and Unlock Micropayments

StarkWare’s innovative product, Volition, aims to drastically reduce Ethereum transaction fees, enabling micropayments comparable to Bitcoin’s Lightning Network. Set to launch with Starknet v0.13.0, Volition promises to provide users more control over transactions and foster wider crypto adoption, particularly in developing economies.

Bitcoin’s $30,000 Breakthrough: A Sustainable Rise or Regulatory Roadblock?

Bitcoin surpasses $30,000 amid economic uncertainty and regulatory crackdown on crypto exchanges like Binance. The rally is attributed to speculative buying, cryptocurrency adoption by major companies, and high-profile figures like Elon Musk. However, concerns over sustainability and regulatory pressures remain.

Blockchain Breakthrough: Innovation vs Environmental Impact and Market Risks

The blockchain industry’s future is promising yet uncertain, with a recent breakthrough igniting debates on its potential and controversies. Crypto enthusiasts must stay vigilant, monitoring market shifts and discussing implications of advancements, navigating challenges and opportunities ahead.

Bakkt Delists Solana, Polygon, Cardano: Regulatory Impact on Crypto’s Future and Adoption

Bakkt delists Solana, Polygon, and Cardano due to regulatory uncertainty following the US SEC’s announcement considering them securities. This decision mirrors Robinhood, and both are proactively awaiting further clarity on offering a compliant list of coins.

Bakkt Delists Top Cryptos: Regulatory Clashes Impacting Crypto Markets and Innovation

Bakkt delists major cryptocurrencies Solana, Cardano, and Polygon due to regulatory uncertainty, following the SEC’s legal actions against Coinbase and Binance. This highlights the need for clear regulations that ensure a stable trading environment without inhibiting growth and innovation.

Ripple Navigates SEC Challenges: XRP’s Potential Breakthrough and yPredict’s AI Trading Edge

Amid turbulent crypto markets and SEC enforcement actions, Ripple (XRP) is positioning itself for a potential positive outcome in its ongoing legal battle. With strong technical structure and developments in the SEC vs. Ripple case, XRP could experience an upside move soon, making it an attractive entry point for investors. Utilizing innovative AI-powered trading platforms like yPredict($YPRED) can offer traders a competitive edge in the increasingly complex crypto trading landscape.

AI in TV Writing: Creative Breakthrough or High-Tech Plagiarism? Pros, Cons, & Conflict

OpenAI’s ChatGPT generated a summary of existing “Black Mirror” episodes instead of a new plot, disappointing creator Charlie Brooker. As generative AI potentially impacts human writers, concerns about replacing writers and high-tech plagiarism arise, fueling debate in the entertainment industry.

AI’s Role in the War on Superbugs: Breakthroughs, Challenges, and Ethical Dilemmas

Scientists from McMaster University and MIT used AI and machine learning to discover a new antibiotic, abaucin, capable of fighting drug-resistant superbug Acinetobacter baumannii. Although further testing is required, this breakthrough highlights AI’s immense potential in improving public health and demonstrates the need for continued exploration and development in the field.

Ethereum’s $1870 Resistance: A Breakthrough or Bearish Reversal? Analyzing the Market Struggle

The crypto market witnessed a significant uptick in buying activity, resulting in notable price gains for major cryptocurrencies, including Ethereum. Ethereum’s recent price surge faces resistance at $1870, and sellers’ strong defense suggests a possibility of a bearish reversal. Key pivot levels and the average directional index indicate potential market fluctuations.

Ecoterra’s Web3 Recycle-to-Earn Breakthrough: Major Brands Join Battle Against Climate Change

Ecoterra, a web3 Recycle-to-Earn platform, integrates major beverage brands like Coca Cola, Carlsberg, and Evian to boost its environmentally conscious protocol. Users can recycle bottles via Reverse Vending Machines and earn cryptocurrency rewards, promoting eco-friendly behavior and combating climate change through blockchain technology.

Worldcoin’s Decentralized Identity: Security Breakthrough or Privacy Nightmare?

Worldcoin, co-founded by OpenAI CEO Sam Altman, raises $115 million for its decentralized World ID and World App, a crypto wallet. The project uses zero-knowledge proofs for digital identity security, but faces concerns about surveillance, personal data misuse, and censorship.