Deribit, the largest cryptocurrency options exchange, announced plans to introduce options trading for altcoins Solana, Polygon, and Ripple. Despite tumbling prices and regulatory uncertainties, this move could boost liquidity, enable risk management, and strengthen Deribit’s position in the volatile market.

Search Results for: MATIC

Navigating New Waters: First European Film Funded by NFTs Stirs the Cinematic World

‘The Quiet Maid’, the first European feature film funded through NFT sales, represents a new era of blockchain technology in the creative industry. Despite uncertainties surrounding NFTs, this film’s funding model garners worldwide attention. The evolution of blockchain in filmmaking is yet to unfold.

Unearthing the Bitcoin Enigma: Hal Finney’s Enigmatic Role in Blockchain’s Genesis

This article discusses speculation around Hal Finney’s involvement in creating Bitcoin, his use of zero-knowledge proof systems, and rumors of him being Satoshi Nakamoto. The mystery of Bitcoin’s creation and Finney’s role remains ambiguous and unsolved.

Dramatic Sentencing in Crypto Fraud Case Raises Investment Concerns: A Market Analysis

The former CEO of Turkish cryptocurrency exchange Thodex, Faruk Fatih Özer, has been sentenced to 11,196 years in prison amid concerns about digital asset exchange integrity. This decision comes after Thodex shut down and Özer vanished, allegedly with $2 billion worth of investors’ assets, resulting in charges of fraud and manual laundering.

BluiCoin’s Dramatic Rise and Fall: A Precarious Sea or a Golden Opportunity? Vs. Wall Street Memes’ Ascending Wave: Risky Ride or a Sound Investment?

The crypto market recently witnessed an extraordinary surge of BluiCoin (BLUI), followed by a significant drop. Despite a turbulent market, BLUI’s trading volume and market cap indicate significant interest. The profitable rise and eventual fall may present a prime buying opportunity.

EOS Network’s Dramatic Turnaround: Nod from JVCEA & Promises of the Japanese Market

EOS Network, a blockchain that garnered $4 billion in its initial coin offering, has been granted white-list approval by Japan’s regulatory body for crypto exchanges. This allows EOS to compete with major cryptocurrencies like Bitcoin and Ethereum on Japan’s regulated crypto exchanges. The approval signifies EOS’s compliance commitment and opens new opportunities for the network in the Japanese market.

Unraveling the Enigmatic Ties: The Trifecta of Sun, Bankman-Fried, and Kwon & Their Cryptocurrency Reign

This article explores the influences of Justin Sun, Sam Bankman-Fried, and Do Kwon in the cryptocurrency industry. It examines their methods, impacts and the potential consequences of their actions. Comparing Sun’s Tron to Kwon’s Terra, the article questions whether Sun’s potential downfall could cause even greater harm.

Dramatic Plunge in Ether Futures on Binance: Unsettling Calm or the Start of a Storm?

The U.S. dollar value in active ether perpetual futures contracts on Binance has dropped to $1.41 billion, the lowest in over a year. Binance has seen its ether futures notional value dip 35% within a week, reflecting a system-wide leverage washout. This suggests a lower probability of future volatility instigated by liquidations.

Elon Musk’s Enigmatic Ventures into Cryptoverse: Impact, Uncertainty, and Infinite Possibilities

“The intriguing saga of billionaire wunderkind, Elon Musk’s unpredictable ventures into the crypto landscape continues, with revelations of his company SpaceX’s discreet disposal of approximately $373 million worth of Bitcoin. Despite a volatile market, technology and financial institutions remain unfazed by blockchain technology’s potential risks and uncertainties, appreciating its futuristic vision.”

Nigeria’s Blockchain Response to Counterfeit NYSC Certificates: A Pragmatic Move or a Cybersecurity Threat?

The Nigerian government plans to combat counterfeit National Youth Service Corps (NYSC) certificates by digitising them onto the blockchain for easier verification. This strategy aims to foster transparency and maintain the program’s integrity, potentially positioning Nigeria as a global leader in blockchain governance.

Exploring the BALD Token Mystery: Dramatic Surges, Plunges, and Possible Manipulation in Crypto Markets

“The BALD token surged 4,000,000% before crashing as deployers withdrew liquidity, leaving investors reeling. Speculations tie the token’s creator wallet to Alameda Research, linking activity potentially to Sam Bankman-Fried. However, due to Bankman-Fried’s ongoing legal issues, this seems improbable. This incident accentuates crypto market vulnerability and the necessity for investor vigilance.”

Redrawing the Landscape: Sequoia Capital’s Dramatic Cutbacks in Crypto Investments

“Venture capital titan, Sequoia Capital, has notably reduced its cryptocurrency fund by over 65%, from $585 million to $200 million, amidst a fluctuating crypto market. The company’s strategic shift involves focusing on nascent start-ups rather than investing in larger firms. This comes as the firm, and other venture capitalists, retract their crypto investments amid turbulent market conditions.”

Unveiling Bitcoin’s Enigmatic Role in Climate Change: A Boon or a Bane?

Bitcoin mining contributes only 0.14% of total global emissions, and isn’t likely to significantly promote renewable energy growth or help meet decarbonization targets. However, it plays a part in promoting sustainable development, mitigating methane emissions and potentially turning mining revenue into a subsidiary factor in broader energy operations.

Unfolding Crypto Dramatics: Bitcoin’s Downturn, the Rise of Meme Coins, and The Debut of Worldcoin

The crypto market sees a significant downturn with Bitcoin facing a 1.92% dip. Despite the volatility, investors remain optimistic. Surges in ‘meme coins’ highlight profitable possibilities in the middle of the Bitcoin and Ether’s low volatility. Meanwhile, Worldcoin makes its debut with a notable 62% surge and the practice of spread trading prompts interesting tactics amongst traders.

Unraveling the Intricacies of Polygon’s Token Strategy: Maturing from MATIC to POL

Polygon, an Ethereum scaling solution, plans to change its native token from MATIC to POL. Touted as a “3rd generation token”, POL optimizes user experience across the protocol’s layer 2 ecosystem and enables holders to earn rewards as validators across multiple chains. This change prompts validators to embrace multi-chain roles, yielding varying rewards and potentially significant benefits.

Unpacking Polygon’s Proposal: From MATIC to POL, a Multipurpose Token Revolution

Polygon has proposed an upgrade to transform its MATIC token into a multipurpose one, now called POL. If approved, POL will be capable of serving multiple chains across all Polygon protocols without security compromise. This will introduce features like limitless scalability and seamless transitions, paving the way for broader blockchain use-cases and potential mass crypto adoption.

MATIC Price Recovery: Can Polygon Coin Surpass $0.75 Amid Market Sentiment Shift?

The MATIC price displays a steady uptrend with dynamic support to buyers, suggesting the potential to surpass the $0.75 mark. However, decreasing volume in its current recovery and possible selling pressure from overhead trendlines could impact this momentum. Technical indicators suggest a short-term buy signal, but market conditions remain subject to change.

Crypto Recovery Cycle and the Rise of MATIC: The Perfect Time to Invest?

The recent recovery cycle in the crypto market, linked to major asset management companies’ interest in spot Bitcoin ETF, has greatly benefited MATIC’s price, with potential for a 12-15% rise before encountering significant resistance. However, consider possible minor pullbacks and overall market volatility before investing.

Bankrupt BlockFi’s SEC Penalty Relief: A Boon or Problematic Precedent?

Bankrupt crypto lender BlockFi received temporary relief from the SEC regarding a $30 million penalty, following a $50 million payment and agreeing to pay additional fines. This decision could significantly impact the relationship between regulatory authorities and crypto companies, highlighting potential challenges crypto businesses face amid a constantly evolving digital asset landscape.

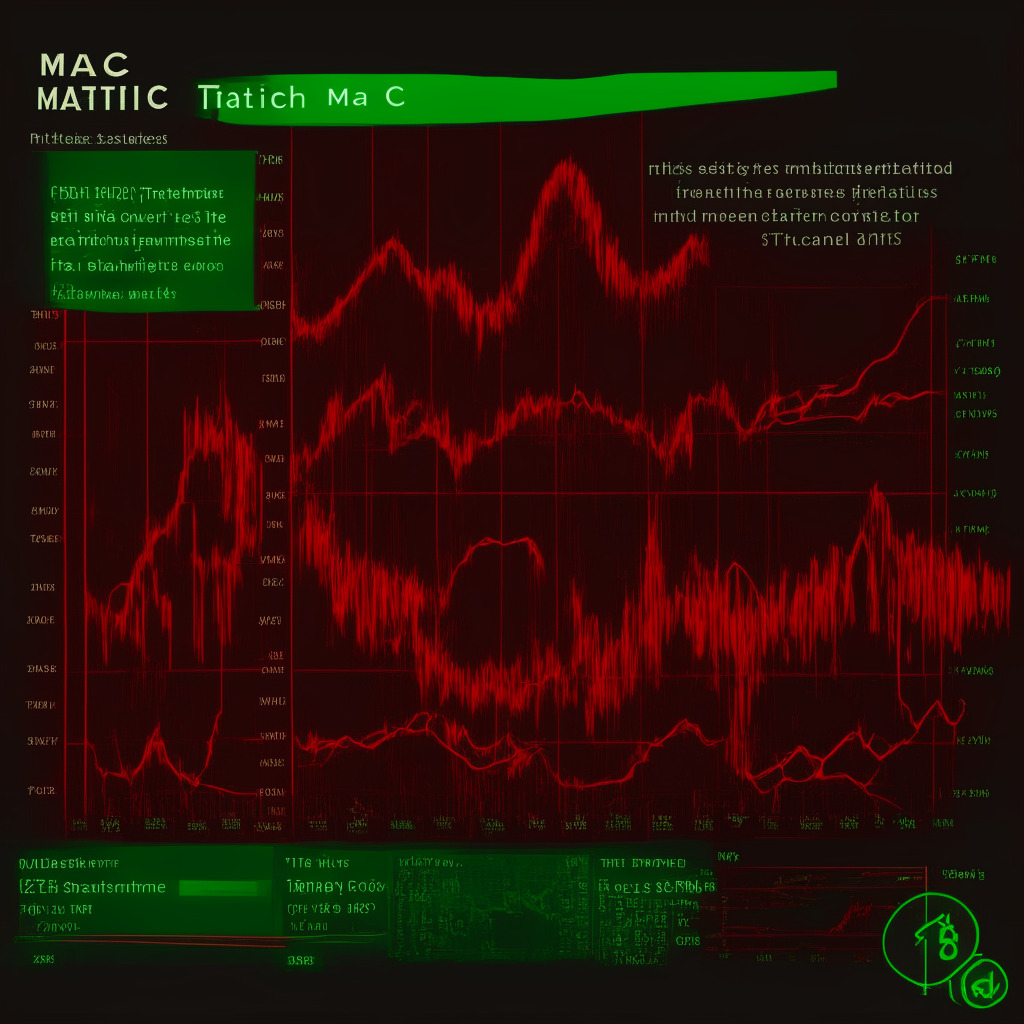

MATIC Price Uncertainty: Analyzing Symmetrical Triangle Pattern & Market Indicators

The MATIC price moves sideways after early June’s bloodbath, indicating no clear dominance from buyers or sellers. A symmetrical triangle pattern reveals potential for a rally during this uncertainty, but a bullish breakout from the resistance trendline is needed for significant recovery.

MATIC Price: Navigating the Resistance and Key Support Levels Amid Volatility

MATIC price faces renewed bearish momentum, with investors watching if it will retest the $0.51-$0.5 support. With Polygon 2.0’s release, MATIC price rose 2.5% while intraday trading volume increased by 28.5%. High market volatility is expected, making it essential for traders to monitor key levels and conduct thorough market research.

Delisting ADA, SOL, and MATIC: Balancing Regulatory Compliance and Crypto Innovation

Bakkt Inc delists Cardano, Solana, and Polygon following their designation as investment contracts by the SEC. This move aims to ensure compliance with regulatory guidelines, but may hinder the growth potential of affected digital currencies and the broader crypto industry.

MATIC Price: Analyzing the Sell-Off, Recovery Potential, and Key Resistance Levels

The MATIC price experienced a significant sell-off on June 10th, breaching yearly support at $0.687 and reaching a low at $0.518. Recently, the MATIC price rebounded from $0.518, indicating a period of accumulation and a potential bullish upswing. However, underlying selling momentum remains high in the market.

MATIC Crash: Potential Recovery or Further Decline? Analyzing Market Indicators

The recent altcoin crash caused MATIC price to plunge to $0.518, a 45% tumble within a week. Despite a sharp lower price rejection, a potential recovery faces intense supply at $0.687 and $0.744. Observing market conditions and cryptocurrency trends is vital for investment decisions.

Robinhood Delists ADA, MATIC, SOL: Crypto Market Chaos & SEC Lawsuits’ Impact

Cryptocurrencies faced a significant downturn after Robinhood announced the delisting of Cardano (ADA), Polygon (MATIC), and Solana (SOL) following SEC lawsuits against exchanges Binance and Coinbase. Users are now concerned about the long-term implications of regulatory actions on the market.

Elon Musk’s Enigmatic Dogecoin Tweet Fails to Boost Price: Analyzing Market Triggers

Elon Musk’s recent enigmatic tweet about Dogecoin failed to drive bullish market activity for the cryptocurrency. The market’s lack of positive response suggests a need for more definite triggers for recovery and reflects the negative sentiment caused partly by SEC lawsuits against Binance and Coinbase Exchange.

MATIC Price Plunge: Whales, Regulatory Scrutiny, and Robinhood Delisting Impact

MATIC tokens face a sharp price decline due to significant transfers among whales and institutions, Robinhood’s delisting announcement, and regulatory scrutiny. A massive transfer of MATIC tokens on exchanges like Binance and Coinbase suggests a possible coordinated sell-off, leading to a 29% drop in price within 16 hours.

Robinhood Delists ADA, SOL, MATIC: SHIB Unaffected and Burning Tokens Skyrockets

Robinhood announced delisting of Cardano (ADA), Solana (SOL), and Polygon (MATIC) by June 27, 2023, but Shiba Inu (SHIB) remains unaffected. This follows Robinhood’s review of its crypto offerings, amidst speculations of recent SEC lawsuits’ influence on exchange operations and regulatory compliance.

Altcoins in Peril: ADA, SOL, MATIC Delisting After SEC Lawsuit – What’s Next?

Three popular altcoins, Cardano (ADA), Solana (SOL), and Polygon (MATIC), face a double-digit correction following Robinhood’s decision to delist the coins after the SEC identified them as securities. The delisting, affecting investor sentiment, and market regulation concerns have extended the coins’ weekly losses to nearly 25%.

Robinhood Ends Support for ADA, MATIC & SOL: Impact on Markets and Regulatory Compliance

Robinhood is ending support for Cardano (ADA), Polygon (MATIC), and Solana (SOL) on June 27, 2023, after regular review of their crypto offerings. The decision follows SEC lawsuits against Binance and Coinbase, which claimed these tokens were unregistered securities, raising questions about the crypto market and regulatory compliance.

The Enigmatic Rise and Fall of $TATE Coin: Beware of Pump and Dump Scams in Crypto Markets

The low market cap coin Tate experienced a 50,000% pump on Uniswap before crashing 96%. Despite massive gains, influencer Andrew Tate hasn’t mentioned $TATE on Twitter. Such coins’ precarious nature reminds investors to exercise caution and thoroughly research before investing in unknown projects.

From Marvel Cinematic Universe to Web3: Mythos Studios Founder’s Vision for Digital Art and NFTs

Even as self-funded and independent from mainstream Hollywood production houses, the early days of Marvel […]