“The US-based exchange Kraken plans to acquire Dutch cryptocurrency exchange Coin Meester B.V. (BCM), aiming for European expansion and leveraging the EU’s MiCA regulatory framework. This ambitious move, though promising high cryptocurrency adoption, may lead to greater regulatory scrutiny and operational complexities.”

Search Results for: Slope

The Balancing Act of Tokenization: Bridging Blockchain and Traditional Finance Amid Regulatory Challenges

“Tokenization, or representing real-world assets as blockchain tokens, offers advantages like easier asset management. However, firms must comply with regulation standards, understand duties linked to tokenized assets’ public offerings, and regularly audit assets. An adaptable compliance solution is crucial, given the evolving nature of token regulation.”

Navigating the Blockchain Future: The Role and Risks of Blockchain Explorers

“Blockchain explorers, an effective tool in the crypto industry, provide real-time insights into transactions and network activity, enhancing transparency and trust. They empower users with detailed transaction data, aiding in detecting suspicious activities and maintaining network health. However, this transparency raises questions about privacy and misuse of user information.”

Shopify’s Leap into Crypto: Solana Pay Integration Unlocks a New Payment Frontier

“Shopify’s integration of Solana Pay, a payment protocol built on the Solana blockchain, enables users to make purchases using USDC – bridging the gap between crypto wallets and online retail. However, despite its convenience, this brings a new layer of complexity for consumers with a steep learning curve.”

Unraveling the SHIB Price Drop: Shibarium’s Technical Woes and Meme Tokens’ Potential

“The SHIB token price experienced a significant drop following the tumultuous public launch of Shibarium, a layer-two network, with technical glitches leading to a loss of trust and depreciation in the token’s value. Amid this, the new ERC-20 meme token Sonik Coin (SONIK) exhibits potential for near-future growth, though crypto investments carry high risk.”

Surge of Bitcoin in Argentina: A Result of Political Shifts or an Inflation Hedge?

“Bitcoin has surged in Argentina following the primary win of Bitcoin-friendly candidate, Javier Milei, attaining new highs in Argentine’s crypto market. Interestingly, this rise is tied to Milei’s successful run, who plans to abolish the central bank and sees Bitcoin as a counter against inflation exploitation.”

US-China AI Tug-of-War: National Security or Economic Coercion?

“The US aims to control investments in semiconductors, quantum computing, and AI technologies, leading to global effects. The friction is impacting global trade, with criticism of potential divergence from market principles. In response, China controls export of AI chip-making materials, while other countries contemplate the implications.”

DeFi Deviation: Aave’s Rocky Road or Green Crypto Chimpanzee’s Rising Star

“In the aftermath of a $47m cyber exploit on Cure liquidity pools, DeFi markets and cryptocurrencies like Aave face a challenging future. Some investors are now focusing on innovative projects like Green Crypto Chimpanzee, which integrate environmental sustainability into blockchain technology, offering alternative investment platforms.”

Steady Amid the Storm: Bitcoin’s Stability in Turbulent DeFi Times

“The Bitcoin community observes the currency’s steady performance around $29,183, amidst upheaval in the DeFi space, including a $24M exploit of Curve Finance. Analysts anticipate potential breakout patterns, with metrics suggesting promising buying opportunities if Bitcoin surpasses the $29,500 price point.”

Downward Spiral of Rocket Pool’s RPL: Navigating through Price Collapse and Overvaluation Concerns

Rocket Pool’s utility token, RPL, has seen a sharp decline of approximately 7.5% in a single day, earning it the title of the worst-performing cryptocurrency among the top 100 in market cap. Amid bearish predictions, it now teeters on the brink of a potential price collapse. Furthermore, a declining growth rate in market share and lower yield for ETH stakers compared to its competitors add to the concerns about RPL’s future.

Crypto Investment Fund Surge: Bitcoin Dominates, Momentum faces ‘Neutral’ Fear and Greed Index

The crypto market has seen four weeks of positive movement with $137 million going into investment funds. This upwards trend, largely carried by Bitcoin, has helped to offset previous outflows. However, despite being a dominant force, Bitcoin’s market capitalization hasn’t significantly surged, reflecting in its stagnant price action. Bitcoin accounted for $140 million of the total inflows, despite a downtrend from other currencies.

The Uncertain Future of Bitcoin SV and the Rise of AI in Crypto Trading

“Bitcoin SV, since its inception in 2018, has experienced volatile price movements with discussions of a possible crash looming. Meanwhile, AI is revolutionizing crypto trading, as exemplified by yPredict, which uses machine learning for proactive decision making and market trend predictions.”

Stellar’s Ups and Downs: WisdomTree Launch, FedNow Threat and the Rise of Thug Life Token

“Stellar’s XLM experienced a slight dip mirroring the crypto market’s trend. Despite a gloomy weekly decrease, it boasts a 14% monthly and 36% annual increase. The recent launch of the WisdomTree personal finance app, run on Stellar blockchain, is a significant milestone, although overshadowed by potential competition from the Federal Reserve’s instant payment system, FedNow.”

Navigating Uncertainties in Crypto: An In-depth Look at XRP and the Emerging THUG Token

“The blockchain market reveals a stagnation, with XRP price remaining relatively flat. Much of XRP’s fortune is tied to Ripple’s SEC case; a positive verdict could spur the price beyond $1. Meanwhile, the ERC-20 meme coin, Thug Life Token (THUG), draws substantial attention with rapid accumulation indicating a strong investor community.”

Exploring the Rise of Tokenized Treasurys: Huge Market Growth vs Security Concerns

“Blockchain-based investment products that turn U.S. Treasury bills, bonds, and money market funds into tokenized forms amass a market value of $614 million, with the potential to reach $5 trillion over the next five years. However, the tokenizing assets trend needs regulatory oversight and potential market manipulation consideration.”

Navigating the Bitcoin Rollercoaster: The Battle at $30,000 and the Future of Cryptocurrency Finance

Bitcoin neared the $30,202 mark amid selling pressure, largely due to the recent release of the FOMC minutes. Despite this, BlackRock’s increased interest in Bitcoin ETFs and supportive statements from CEO Larry Fink, hint at the potential of cryptocurrency to disrupt traditional banking and encourage institutional investors towards this market.

Shiba Inu Price Recovery: Analyzing Resistance, Downtrend, and Future Prospects

Shiba Inu price experienced recovery, encountering resistance and a potential downtrend due to high supply. Decentralized exchange usage is advised for SHIB holders. For a lasting recovery, surpassing the resistance trendline is vital, while bearish momentum dominates the market.

Bitcoin Cash Surge: Sustained Growth or Temporary Boost from EDX Listing?

Bitcoin Cash has surged 115.5% in price, reaching $236.6, likely due to its listing on EDX Markets. The rally may lead to an 11.5% increase hitting the $260 mark, but a potential correction phase and resistance level could impede further growth.

Cardano Double Bottom Pattern: Bullish Reversal or False Hope? Analyzing Market Indicators

Cardano coin price found support at $0.24, hinting at a higher possibility of a bullish reversal. A double bottom pattern suggests a potential upswing with ADA trading at $0.282. The market remains volatile, and thorough research is essential for making informed cryptocurrency investment decisions.

Ethereum’s Battle at $1926: Consolidation, Breakthroughs, and Key Indicators to Watch

Ethereum’s ongoing recovery rally encounters a roadblock at $1926, with sellers and buyers creating a narrow price range between $1867 and $1926. The overall market sentiment leans towards optimism, increasing the likelihood of breaking the $1926 resistance level and resuming Ethereum’s recovery. Traders should monitor key indicators like RSI and EMAs for informed decision-making.

Dogecoin’s Rocky Path to Recovery: Exploring Market Sentiment and Technical Barriers

The Dogecoin price has surged nearly 18% after a recent upswing in buyer accumulation, currently trading at $0.067. However, a downsloping resistance trendline presents a challenge for further recovery. A bullish breakout could potentially lead to a 22% upswing, reaching $0.083, but traders should be cautious and conduct thorough market research before investing.

Coinbase Share Price: Analyzing Bullish Reversal, 42% Rally Potential, and Key Challenges

The Coinbase share price demonstrates a prominent bullish reversal pattern known as the double bottom, suggesting active accumulation and a potential 42% rally. Despite challenges posed by neckline resistance and EMA indicators, a sustained buying could push the asset price further, backed by an optimistic market outlook.

Pepepcoin’s V-Shaped Recovery: Temporary Pullback or Sustainable Rally Ahead?

Pepepcoin’s price has risen 82% amidst a positive crypto market sentiment, showcasing high buying momentum and increasing trading volume. A minor pullback is expected before continuing the prevailing recovery trend, possibly presenting dip opportunities for traders before the resurgence of the recovery rally. Conduct thorough market research before investing.

Bitcoin ETF Hopes Fuel Rally: Can Bullish Momentum Sustain or Is a Pullback Imminent?

Bitcoin price experienced a remarkable recovery, rising 25.4% in two weeks, driven by the possibility of a US spot Bitcoin ETF. The rally reflects a bullish momentum, but a minor pullback might occur before continuing the upward trend. Key indicators project a strong bull trend, but investors should consider potential market fluctuations before making decisions.

XRP’s Bullish Recovery: Can It Break the $0.55 Multi-Month Resistance? Pros & Cons

XRP price broke through the $0.487 resistance level on June 19th, showing bullish recovery. The altcoin’s value hovers around $0.49, with potential to surge 9.6% and retest the substantial $0.55 resistance barrier. An ascending triangle pattern formation strengthens the bullish momentum, but proper market research is essential before investing.

Cardano’s Recovery Rally: Sustainable Growth or Looming Correction?

Cardano’s recent recovery rally resulted in a 17.6% surge in prices, hitting the psychological barrier of $0.3. The coin’s current price trades at $0.29, wavering below the $0.3 resistance. Investors should carefully consider their moves, taking into account market sentiment and potential buyer sustainability at higher prices.

Ethereum’s Impressive Recovery: Will It Continue or Face a Correction Soon?

The crypto market shows impressive recovery, with major altcoins surging and Ethereum experiencing an 18.1% price growth. Ethereum’s price faces supply pressure at $1,926, and a potential reversal could provide opportunities for traders to retest support and resistance levels before moving forward.

XRP Price Rebound: Analyzing the Ascending Triangle Pattern and Hurdles to $0.55

The XRP price has rebounded 7.66% from a support trendline, surpassing immediate resistance at $0.487, and potentially rising further 11% to hit the $0.55 barrier. However, market indicators like the Average Directional Index reveal the need for more buyer aggression to trigger an aggressive rally and breach this multi-month resistance.

MATIC Price Uncertainty: Analyzing Symmetrical Triangle Pattern & Market Indicators

The MATIC price moves sideways after early June’s bloodbath, indicating no clear dominance from buyers or sellers. A symmetrical triangle pattern reveals potential for a rally during this uncertainty, but a bullish breakout from the resistance trendline is needed for significant recovery.

Cardano Price Decline: Potential Recovery or More Corrections Ahead?

The Cardano price decline seems to be losing momentum, raising questions about regaining bullish momentum or further price correction. Despite overall bearish market trend, decreasing prices and dropping trading volume signal a higher likelihood of a bullish reversal, as technical indicators suggest possible consolidation or recovery.

Dogecoin’s Stagnant Price: Analyzing the Future of DOGE Amid Uncertainty

Dogecoin’s price has remained stagnant below $0.063 resistance, with daily charts showing short-bodied candles and indecision among buyers and sellers. Traders are stabilizing price action after a plunge on June 10th, and a bullish breakout above $0.063 could hint at an upcoming relief rally. The 20-day EMA and converging DMI slopes may indicate a decline in bearish momentum.

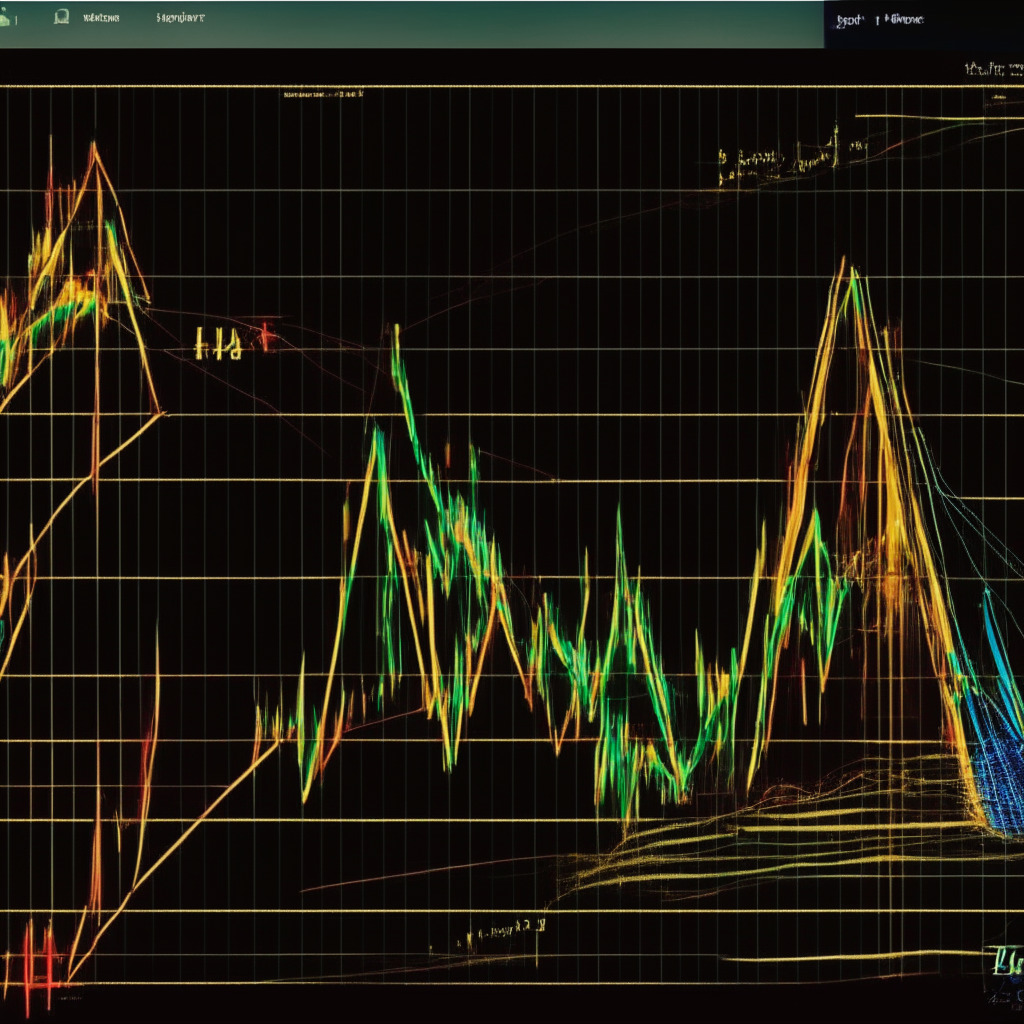

Bitcoin Recovery Rally: Temporary Growth or Start of a Bull Cycle? Pros and Cons

The Bitcoin fear and greed index at 48%, indicating neutral market sentiment, suggests the recent 5% price recovery rally may be temporary. Observing price behavior at the trendline is essential for determining future prospects, as a reversal may prolong the current downfall, while an upside could allow sustained recovery.