“Bitcoin (BTC) has surged above $27,000, a jump many credit to Grayscale’s recent legal victory to turn its Bitcoin Trust into an ETF. Global cryptocurrency market capital grew roughly $50 billion in a day, raising hopes for future growth. Factors such as increasing acceptance of crypto by countries like Netherlands and endorsements by US figures further strengthen the market’s legitimacy.”

Category: Market Overview

Unmasking the Truth: Decreased Bitcoin Deposits on Exchanges & Future Market Predictions

Bitcoin’s recent departures from centralized exchanges could suggest a bullish outlook or indicate trust in custody solutions. However, SEC regulatory actions, declining buyer interest, and lower daily volumes suggest traders may be reluctant to actively trade the asset.

Market Shivers: Cryptocurrencies Navigate Bearish Waters amid Grayscale Legal Tiff

Bitcoin’s recent dip to $27,240 and Ether’s slight decrease reflects uncertainty following Grayscale’s court victory against the SEC. The court order for SEC to reconsider its rejection of Grayscale’s transformation of GBTC into a spot bitcoin ETF could be a catalyst towards a future for BTC ETFs. Nevertheless, caution is suggested due to potential further downside for Bitcoin if it doesn’t overcome the $28,000 level.

The Grayscale Effect: Cryptocurrency Market Response and Forecast Uncertainty

“Cryptocurrency markets temporarily reenergized after Grayscale’s lawsuit victory against the US Securities and Exchange Commission, yet struggled to sustain gains. Traders seem focused on crypto-specific news, neglecting broader financial trends, indicating the crypto market’s high volatility. Despite the uncertainty, crypto-enthusiasts remain hopeful and persistent in their investment strategies.”

Bitcoin’s Resilience Amid Market Doubts: A Closer Look at BEPE, EMERSO, and XPEPE

Bitcoin’s recent surge over $28,000, boosted by a favourable court decision for Grayscale, has stirred mixed sentiments in the market. Analysts relate Bitcoin’s trajectory to previous patterns and question the sustainability of the surge, particularly given low spot market volumes. Meanwhile, new cryptocurrencies like BEPE and EMERSO show volatility, with impressive gains and subsequent adjustments. However, investing in crypto always carries high risk.

Crypto Updates: The Volatility of Friend.tech, Growing Pains of Shibarium, and Perils of DeFi Platforms

“The crypto market remains a blend of promise, innovation and uncertainty. Understanding the nuances of the technology and markets is vital for investors. Emerging trends and regulatory scrutiny constantly shape exchanges like Binance, while projects like Shibarium highlight the potential volatility of platforms.”

Exploring Vietnam’s Meteoric Rise in Crypto: A Financial Revolution Amid Contradictions

“Vietnam leads in global crypto adoption with 76% of Vietnamese crypto owners relying on referrals for investment decisions. Despite the market’s volatility, 75% of respondents favor regulatory interventions. Almost 90% are involved with DeFi activities, reflecting a desire for investment diversification.”

Bitcoin’s Future: The Effects of a Potential ETF and Market Volatility

The average trade size of Bitcoin on crypto exchanges hit a record high following a federal court ruling that encouraged the U.S. Securities and Exchange Commission (SEC) to reconsider Grayscale Investments’ Bitcoin Trust ETF. Large trader activity increased, effectively driving Bitcoin’s price up by over 7%. However, regulatory uncertainties and market volatility continue to pose challenges.

Unleashing Crypto Potential: Why Professional Indexing is Crucial for Blockchain Market Progress

“The digital asset market lacks widely adopted indexes, posing a challenge for investors. The lack of regulatory support and index adaptation specific to crypto markets hinders investment. The absence of reliable indexes leaves investors aimless in assessing fair values. Professionally managed indexes enhance investor confidence, provide risk management, enhance transparency, and aid in understanding market trends. They play a critical role in attracting institutional investors, increasing liquidity and advancing the asset class maturity.”

Bearing Witness to Bitcoin’s Bounce: Revved Rally or Misguided Momentum?

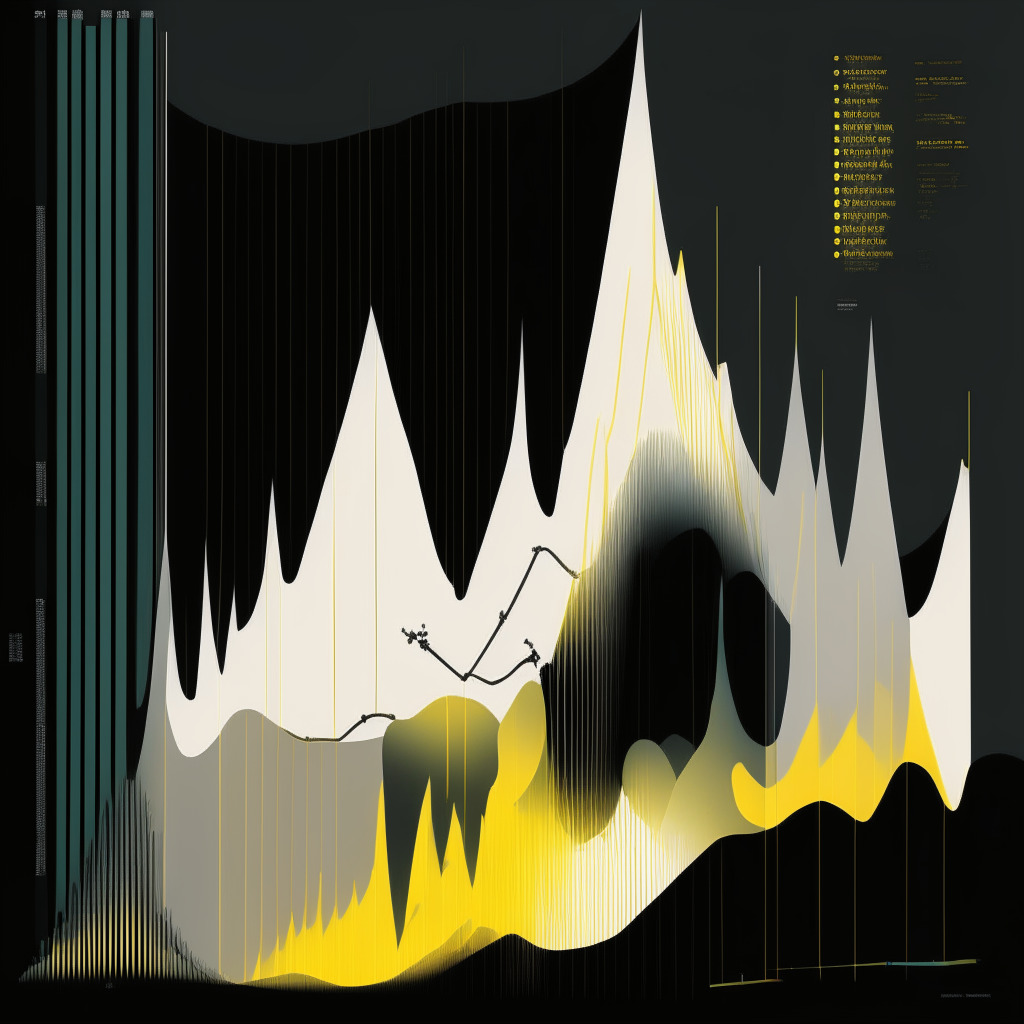

The BTC price recently neared $23,000 amid growing interest in digital currencies, according to Cointelegraph. Despite this, doubts linger regarding the sustainability of this rally, as on-chain analytics indicate low genuine buyer interest. Some analysts speculate a possible pattern shift from $26,000 acting as support to resistance, which may instigate further downside.

Sonik Coin: The New Kid in the Meme Coin Block Primed for Success or Ripe with Risks?

The new meme coin, Sonik Coin, has already attracted more than $750,000 from investors. Its innovative feature allows token holders to claim passive income, with 26.3 billion tokens already staked. However, the meme coin sector’s hyper-speculative nature presents some risks.

Grayscale’s Legal Triumph Fuels Hope for Bitcoin ETF, Yet Obstacles Remain

A federal judge’s ruling favorably for Grayscale in their SEC disputes positively affected the cryptocurrency market, sparking hopes for a Bitcoin ETF’s arrival. The verdict means Coinbase could potentially share data related to trading to mitigate market manipulation risks. However, a Bitcoin spot ETF remains absent due to SEC’s reluctance. Investors seek a direct investment instrument to Bitcoin.

Navigating the Stirs of Crypto Volatility: Evergrande Collapse, Grayscale Triumph and Altcoin Security

“In this era of volatility, the potential Evergrande bankruptcy could have a silver lining for the crypto market. Even though insolvencies like Evergrande might signal trouble for risk-driven assets, it could shift investors toward Bitcoin. However, new scams like the disappearance of 16 trillion Pepecoin tokens highlight the need for crypto holders to remain cautious and scrutinize investments.”

Rising Phoenix: XRP’s Resurgence and the Emergence of New Altcoins like WSM

“XRP has seen a 3% gain, boosting its price to $0.529853 and an increase in trading volume to $1.5 billion overnight. Market indications suggest a promising future for XRP, with a 55% price increase since the year’s start. Supporting its optimistic outlook are Ripple’s recent partnerships and steady XRP sales, hinting at stronger performances ahead.”

SUI Network’s Rally Fades: Is it All Downhill or Reprieve in Sight? Plus, Rise of Sonik Coin

“Sui Network’s recovery wanes despite an initial 40% rally. Although struggling with variable market conditions, its layer-1 technology for faster smart contracts sees growth, with active accounts nearly doubling in a week. However, technical structures suggest possible future downturns. Meanwhile, Sonik Coin is gaining momentum, with a promising staking APY and a community-focused vision, distinguishing it in the meme coin market.”

Unveiling Patricia Token: A Debt Management Tool or A Scandal in Disguise?

Nigeria’s Patricia crypto exchange introduced its new Patricia Token (PTK), aiming to manage users’ debts, likening it to an IOU system. However, the token’s introduction following a security breach in 2023 has left users concerned and skeptical.

Stacks (STX) Surge: The Ripple Effect of Grayscale’s Triumph and Promising Altcoin Prospects

“Despite a previous decrease, Stacks (STX) leads today’s cryptocurrency market with a recent surge of 16.5%. This is believed to follow Grayscale’s win with the SEC. The future implications of BTC ETF approvals promise further STX gains, while new opportunities for investors like the Launchpad.xyz (LPX) platform continue to emerge, suggesting the ever-evolving nature of the crypto landscape.”

Decoding the PigLido Coin Surge and its Impact on Rising Wall Street Memes Project

The DEX token PigLido witnessed a stunning surge of +30,000% in just 24 hours, attracting attention in the crypto world. However, an audit uncovered potential pitfalls such as blacklisting, a hidden owner, and more, raising suspicions of a scam. Meanwhile, the Wall Street Memes token, backed by a robust community and democratic price point, has raised over $25 million in presale and offers an attractive staking mechanism with a 282% APY. Despite potential scams, the crypto market holds considerable moon-shot potential.

Bitcoin Cash Bounces 15% on Grayscale Victory: A Rally Bolstered by Bitcoin or its own Merits?

Following Grayscale’s court victory against the SEC, Bitcoin Cash’s price surged by 15% in 24 hours. The news might prompt further cryptocurrency exchange-traded funds, including a potential BCH ETF, promoting growth in other Bitcoin-related tokens like Bitcoin SV and Stacks.

GBTC Poised to Erase Bitcoin Price Discount by 2024: Opportunities and Challenges

“The Grayscale Bitcoin Trust (GBTC) may erase its BTC price ‘discount’ by 2024, claims an analysis on the CoinGlass platform. This follows a court victory against U.S regulators that has boosted GBTC performance. However, market conditions, regulatory decisions, and investor behaviour will play major roles in this potential shift in dynamics.”

Bitcoin Bull Run Masterminds: Grayscale’s Legal Triumph and Canaan’s Impressive Q2 Earnings Report

The recent surge in Bitcoin’s price is attributed to Grayscale’s legal victory over the Bitcoin ETF Conversion Lawsuit and Canaan’s impressive Q2 earnings report. This sends a strong bullish signal, potentially driving Bitcoin’s price toward the $28,600 mark.

Binance Expands Crypto-to-Bank Services in Latin America: Opportunities and Challenges

Binance is expanding its reach in Latin America offering a crypto-to-bank account payment scheme, named ‘Send Cash’. This allows users from nine Latin American countries to transfer crypto funds directly into bank accounts, leveraging Binance’s native crypto payment technology platform, Binance Pay. Binance’s initiative aims to overcome challenges linked to the financial exclusion in Latin America.

Bitcoin’s Market Rollercoaster: Billionaire Influence, Technical Indicators and Future Prospects

“Bitcoin’s recent tumultuous journey has raised eyebrows with an 11% decrease this month, and a speculated association with billionaire Prigozhin stirring market sentiment. Despite this, bullish indicators suggest a resilient momentum that could see Bitcoin reach $28,600, provided there’s a bullish breakout above $26,800.”

Binance Shakes Up Latin American Crypto Market: Suspends Debit Cards but Launches ‘Send Cash’

Binance’s new product in Latin America, “Send Cash”, combines crypto payment tech with licensed services for enhanced efficiency and lower transaction costs. Less than 1% of users will be impacted by the suspension of Binance’s debit card services. ‘Send Cash’ is a compensatory move targeting all Latin American nations with favorable rates, marking a strategic move towards feasible financial solutions to the region.

The Tale of Two Countries: Bitcoin Adoption Variance in Argentina and El Salvador

Argentina wrestles with spiralling inflation, meanwhile Bitcoin takes root driven by economic conditions and political changes. Conversely, El Salvador, the first country to mark Bitcoin as legal tender, responds with caution due to its volatility and complex integration into existing infrastructures.

Grayscale’s Legal Victory Spurs Bitcoin Surge and Highlights Crypto’s Regulatory Challenges

“Yesterday’s Bitcoin surge was a reaction to the ruling in favor of Grayscale against the SEC, seen as a win for the broader crypto industry. Cryptocurrencies like XDC Network, Wall Street Memes, Avalanche, yPredict, and Algorand emerged as strong candidates in light of this regulatory development. However, approval for the first U.S. Bitcoin ETF is still needed, indicating ongoing regulatory challenges.”

Surge in Bitcoin Value Hints at Crypto Watershed: Grayscale, Bitwise and BlackRock Await ETF Decisions

“The Bitcoin market experienced significant changes, surging 7% following the court ruling favoring Grayscale’s lawsuit against the SEC. This sets the stage for potential approval of a spot BTC ETF, driving prices beyond $30,000. Simultaneously, the Bitcoin Network hash rate and mining activities have displayed steady growth, indicating a vibrant future for the cryptocurrency sector.”

Navigating China’s Economic Woes: Uncertain Impact on Bitcoin and Global Markets

China’s economic struggles, apparent in July’s output deceleration and lower loan numbers, brew concerns for global economic growth. Particularly, investors fear China’s issues could negatively impact the U.S. dollar, commodities, and Bitcoin’s price. Amidst market uncertainty, the People’s Republic of China works to restore investor confidence with measures that, despite criticism of their short-term effectiveness, may impact Bitcoin’s future performance.

The Balance of Bitcoin: Catalysts, ETFs, and Cautionary Measures

“Bitcoin’s recent 7% jump correlates with Grayscale’s efforts to turn its Bitcoin Trust into a spot Bitcoin ETF. However, Arca’s CIO, Jeff Dorman, warns it’s premature to consider this a sign of sustained growth and highlights the importance of major players like BlackRock promoting Bitcoin.”

Diving Deep into Bitcoin’s Prospective Price Floor: A Look at $23,000 as Rock Solid Support

Capriole Investments founder, Charles Edwards, hints at a probable Bitcoin (BTC) price fall to $24,000 but sees solid support at $23,000. Edwards’ confidence in this “rock-solid support” and “incredible long-term opportunity” is based on the ‘Electrical Price’ (EP), a concept reflecting the global average miner’s electrical bill per BTC, which currently matches the $23,000 mark. However, potential market uncertainties should not be overlooked.

Argo Blockchain’s Half Year Financial Resilience amidst Crypto Market Turmoil

Argo Blockchain has managed to decrease its losses to $75 million amid a bearish crypto market. Despite financial challenges like a 21% revenue shrink, the company raised $24 million in revenue and reduced its debt profile by $68 million. Operational restructuring and strategic decisions reflect the firm’s determination to stay competitive in the crypto mining industry.

Crypto Chaos: The Rising Tension and Uncertainty Surrounding PEPE’s Future

Memecoin PEPE has seen an 80% decline in value because of rumors of a potential “rug-pull” by its developers. After changing token transfer rules, they moved $16 million worth of PEPE to exchanges, leading some to predict a crash. However, increased buying and oversold indicators point towards a possible market rebound.