“Bitcoin holds steady near $29,000, influenced by the optimistic predictions of investor Cathie Wood and institutional investors reducing their Bitcoin shorting. Wood suggests multiple Bitcoin ETFs could get simultaneous approval, influencing the industry’s direction. Meanwhile, changing attitudes among institutional investors point to a brighter Bitcoin future.”

Category: Market Overview

Bitcoin’s Potential Surge on Spot ETF Approvals and PayPal’s Stablecoin Impact

The market anticipates a Bitcoin retest at the $30,000 threshold due to the projected approvals for Bitcoin ETF applications and growing crypto acceptance. Influential figures predict ETF sanctioning in 4-6 months, potentially accelerating Bitcoin’s value. Concurrently, PayPal plans to launch an Ethereum-based stablecoin, enhancing crypto adoption. Bitcoin’s rally could continue if it surpasses the 50-Day Moving Average. However, factors like inflation data can impact sentiment.

Crypto Giants Report Stellar Q2 Profits Despite Regulatory Scrutiny: Unpacking the Figures

“Major crypto firms displayed strong financial performance last quarter due to a surge in crypto asset prices. Companies like MicroStrategy and Block reported significant profits and revenue increases, attributed to growing Bitcoin sales despite market fluctuations. The overall health of the crypto market shows its resilience and potential growth.”

Navigating the Roller Coaster: A Deep Dive into the Diverse Crypto Market Landscape

“Bitcoin and Ethereum show a small uptrend, but traders are venturing into the unpredictable meme coin markets. Despite a potential rug pull, these smaller-cap coins are attractive. Investors must exercise caution and due diligence in this volatile market teeming with risks and rewards.”

The Blockchain Buzz: Potential Approval of Spot Bitcoin ETFs – Hope or Hype?

“The crypto universe anticipates the approval of a bitcoin ETF, spurred by hopeful comments from Ark Invest and Galaxy Digital CEOs. The speculation suggests multiple approvals could occur, but concerns persist due to a history of repeated SEC denials.”

Coinbase’s Debt Buyback: A Risky Tradeoff between Blockchain’s Promises and Pitfalls

“Coinbase’s $150 million debt buyback at a 36% discount raises concerns about the firm’s capability to repay the debt. Amid SEC allegations and potential bankruptcy impact on users’ digital assets, the company exhibits robust finances and user deposit growth amidst looming risks.”

Bear Markets: A Paradise for Crypto Investment? Story of Zurich-based L1 Digital AG

Zurich-based L1 Digital AG (L1D) has raised $152 million for its second venture capital fund to support crypto startups and early-stage crypto-centric investment firms. L1D co-founder Ray Hindi explains their unique approach – investing most actively during bear markets. Their investments diversify across digital infrastructure, decentralized finance (DeFi), and decentralized science (DeSci).

PayPal’s Entry in Stablecoin Market: A Game-changer or Another Fizzle?

Despite Bitcoin and Ether’s recent lackluster performance, PayPal’s foray into the stablecoin market hasn’t sparked significant interest. Experts suggest an ETF-triggered catalyst or major crypto development could reignite excitement. Meanwhile, Bitstamp aims to boost its growth by welcoming strategic investors, signaling a potential shift in trading dynamics. Despite these industry moves, traders demonstrate a watch-and-wait approach towards stablecoins.

Binance’s Crypto Conversion Controversy: An Analytical Dive into Their Recent Proof-of-Reserves Report

Binance’s proof-of-reserves report reveals a major drop in its USDC reserves from $3.4 billion to $23.9 million within a month. The plunge was intensified due to the strategic shift of its USDC to Binance USD (BUSD), and the acquisition of prominent cryptocurrencies like BTC and ETH. Despite conjecture, Binance maintains a healthy financial state.

Long-term Bitcoin Holders: Guardians of Stability or Harbingers of a Volatility Crisis?

Crypto analytics firm Glassnode reveals that Bitcoin long-term holders now control a historic 14.599 million BTC, accounting for 75% of the circulating Bitcoin. This shift towards long-term holding, contributing to massively reduced price volatility, signals a significant change in Bitcoin’s dynamics.

Navigating Cardano’s Current Slump: Predicted Recovery and Emerging Alternatives

“Cardano’s ADA, though slipping recently due to market discomfort, remains robust as its platform saw a 49% surge in daily dapp transactions between Q2 and Q3 2023. Its growing popularity, 50% uptick in ADA locked quarter-on-quarter, and significant growth in stablecoin value signal Cardano’s emerging strength as a leading layer-one blockchain platform.”

Ripple’s Struggles and the Rise of XRP20: An Investment Showdown in the Crypto World

Ripple’s value faces a downtrend following the Ripple vs SEC case, signaling potential recovery and hitting $0.61. Meanwhile, XRP20, a new altcoin that emulates Ripple’s philosophy while focusing on retail markets, exhibits potential with its staking rewards system in a deflationary ecosystem. Remember, crypto investing carries high risk and requires vigilance.

XRP’s Resilience in Bear Market – A Potential Recovery or Just a Mirage?

“XRP registered slight growth today and despite overall market bearishness, technical indicators suggest recovery could be imminent. The altcoin remains fundamentally strong owing to Ripple’s partial SEC case win in July. However, while long-term projections hint at sustained growth, short-term investors are looking at newer avenues like XRP20.”

PayPal’s Foray into Stablecoin: Implications and Potential Dilemmas in the Crypto Market

“PayPal plans to create a stablecoin, PayPal USD (PYUSD), in partnership with Paxos Trust Co., marked as the first from an established financial institution. PYUSD multifaceted utility includes payments, conversions, and transfer capability to supported digital wallets. However, regulatory acceptance continues to be a major hurdle.”

Dormant Bitcoin: Positive Long-Term Holding or Impending Threat from Financialization?

The latest data reveals that 13.3 million Bitcoins, about 68.54% of the total circulating supply, remained unspent for a year, indicative of a bias towards holding for long-term gains. However, these positive implications must also consider Bitcoin’s increasing financialization, which might disrupt potential market upswing.

Shibarium’s Launch: A Catalyst for Shiba Inu’s Surge or a Stark Reminder to Look Towards Newer Altcoins?

“Shiba Inu (SHIB) price increased 7.5% last week despite a 1.5% dip and grew 18% over the past month, reflecting optimism about the impending launch of Shibarium, SHIB’s dedicated, layer-two network. Current trends suggest a possibly bullish wind as Shibarium’s debut could lead to SHIB’s price resurgence.”

Binance’s Financial Conduct Amidst Unstable Conditions: A Closer Look into Crypto Exchange Transparency

“Binance’s USDC reserves dipped from $3.4 billion to a mere $23.9 million post Silvergate collapse, revealing a major conversion of reserves to BTC and ETH. In the wake of such drastic shifts, questions rise about transparency and safeguards for customer wealth in major crypto exchanges.”

Bitcoin Bouncing Back: Unfolding Drama between Optimism and Skepticism in Crypto Markets

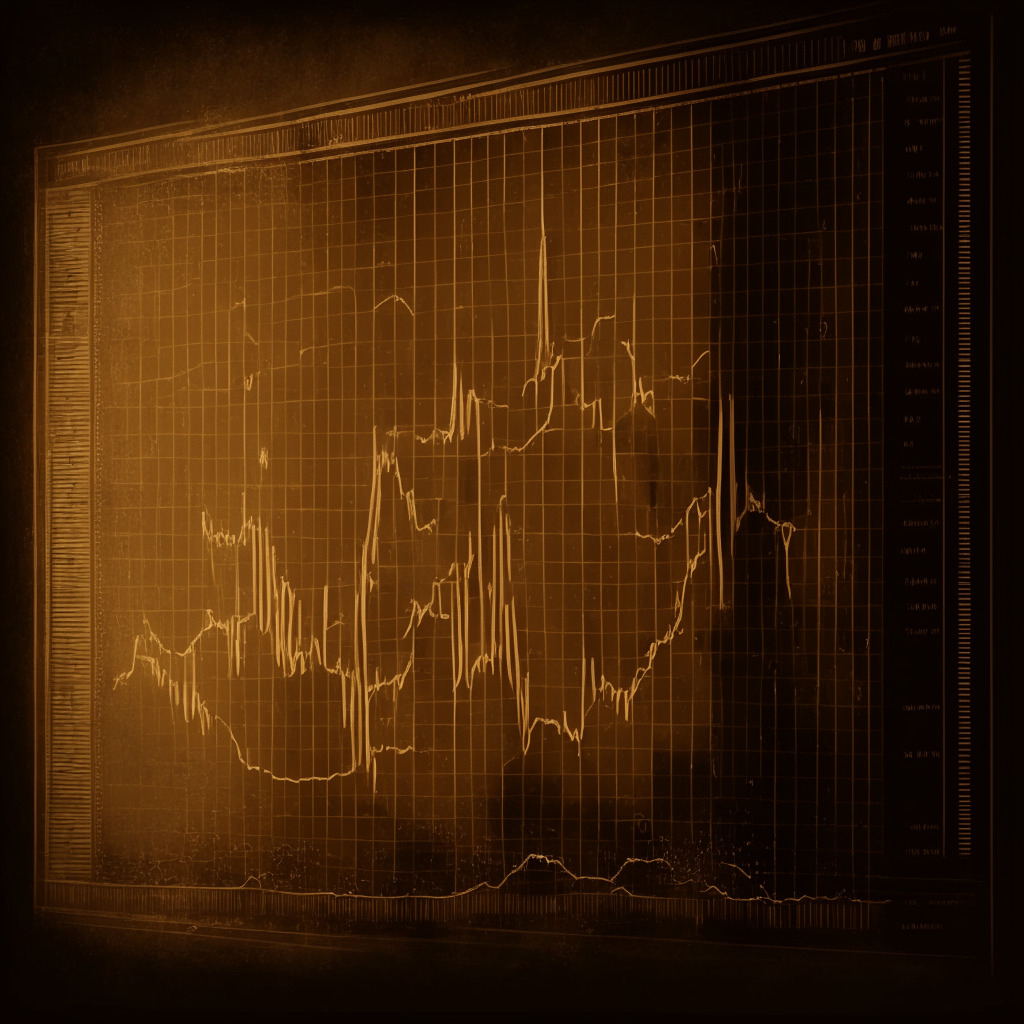

Bitcoin’s price has demonstrated a strong recovery back above $29,000. Despite this, skeptics argue the Bitcoin bears are still in control. However, on-chain analytics suggest that Bitcoin is “close to being oversold”, indicating a potential forthcoming price rebound. Advocates and critics continue to debate the likely trend.

Crypto Exchange Bitstamp’s Global Expansion Plans: A Bold Move or Risky Venture?

Bitstamp, a pioneering crypto exchange, is planning a major expansion to enlarge its operational scope. The capital raised will be invested in derivatives trading, extending to Asian markets, and increasing services in the UK. Notably, Bitstamp’s global chief executive asserts they’re raising funds to broaden services, not for company sale. However, doubts rise due to their altered stance towards investment, and the challenge of navigating complex international crypto regulations.

Bitstamp’s Expansion Plans: A Leap Towards Blockchain Future or a Risky Gambit?

Bitstamp, a global cryptocurrency trading platform, plans to secure strategic investment for major expansion, potentially introducing new products and services for crypto customers. Despite inherent risks, this transformative move, advised by Galaxy Digital Holdings, may significantly impact the crypto trading market.

Bitcoin’s Battle for $30,000: A Dance with the Whales and Predictions for Future Growth

In this article, Bitcoin’s ambiguous stance remains steady above $29,000, despite not reaching the significant $30,000 marker. Influenced by PayPal’s introduction of its own stable digital currency—PayPal USD (PYUSD)—expectations for Bitcoin’s value rise. Potential developments like Bitcoin ETFs and Ethereum growth due to DeFi expansion are also under discussion, suggesting a revolution in the financial landscape towards digital currency. However, caution and careful research are advised due to cryptocurrencies’ volatile nature.

Rocketing Reddit Tokens: The Rise of MOON and BRICK on Kraken’s Platform

“MOON and BRICK, Reddit community tokens, have seen a significant boost, with Moons increasing by 47% and Bricks by 50% following support from cryptocurrency heavyweight exchange, Kraken. These tokens, rewards for user activities within their respective communities, can be traded, tipped, or used in unique ways within the community.”

Unraveling the Huobi Enigma: Sudden Whale Deposits Amid Market Uncertainty

Recent on-chain data shows two significant deposits made by a crypto whale into Huobi, potentially impacting the volatile crypto market. These deposits boosted Huobi’s USDT supply to a notable $273 million. Meanwhile, Huobi faces a contradictory situation with sustained outflows, amidst rumors of detainment of its executives in China. This demonstrates the complex and interconnected nature of the crypto market.

Bitcoin’s Puzzling Standstill: A Precursor to Bull Run or Bear Crawl?

The crypto market shows a moderate increment with Bitcoin nearing the $30,000 mark, and Ethereum remaining stagnant. The forthcoming U.S July Consumer Price Index could serve as a catalyst, but concerns exist regarding potential bearish trends and the need for regulatory reforms. Recent developments include PayPal’s Ethereum-based stablecoin, an AI chatbot, and restoration of stolen funds.

Deciphering Market Signals: Bitcoin Shorting Subsidizes Amidst Potential Surprise Volatility Surge

The shorting of Bitcoin seems to be decreasing, with the destructive influence of the past three months starting to wane. However, the exit from Bitcoin-related funds and intense regulatory scrutiny have created notable market challenges. Yet, analysts highlight potential imminent volatility, suggesting an eruption in the Bitcoin marketplace may be near.

BlackRock’s Bitcoin ETF: A Leap Toward Mainstream Adoption or a Threat to Cryptocurrency Ethos?

“BlackRock’s application for a Bitcoin Exchange-Traded Fund (ETF) signals its bid to bring cryptocurrencies to traditional stock markets. While ETFs may introduce security, accessibility, and wider mainstream investments in cryptocurrencies, they contrast with the principles of decentralization and autonomy fundamental to Bitcoin. This integration could either spark an evolution or dilute Bitcoin’s transformative essence.”

Unmoved Bitcoin ushers Attention to Emerging Altcoins: Exploring potentials and Pitfalls

PayPal launched its own stablecoin, PayPal USD (PYUSD), yet Bitcoin’s price remains steady. Potential crypto market outliers like XDC Network, Wall Street Memes Token, Kaspa, XRP20, and Algorand are gaining attention due to their sturdy fundamentals and promising technical analysis. Still, as the crypto market’s unpredictable nature is undeniable, investors should proceed with caution.

Decoding the Recent Trends in Crypto Outflows: A Profit-Taking Phase or Market Uncertainty?

“Cryptocurrency assets experienced a $107 million outflow in the week ending Aug. 4, largely influenced by Bitcoin. Amidst this trend, Solana enjoyed inflows worth $9.5 million, a steep increase compared to the previous week. Ether funds prolonged their negative streak, contributing to Solana’s bullish trend. Experts suggest current market uncertainties are possibly causing Bitcoin’s sidelining sub $30,000.”

Navigating The Storm: Unpredictability and Unrest in the Cryptocurrency Market

Cryptocurrency markets are exhibiting considerable unpredictability, with bulls struggling to keep BTC above $29,000, indicating weak demand at higher levels. Market speculators forecast a potential for increased selling pressures, but remain hopeful for a Bitcoin rally before its 2024 halving.

Bitcoin’s Triumphant Rally Surpasses Underperforming Crypto Hedge Funds: A 2023 Reversal

Despite attempts to shield investments from volatility, crypto hedge funds underperformed in H1 2023 with a modest 15.2% return, compared to Bitcoin’s 83.3% return. Factors include defensive approaches during industry turmoil, closure of crypto-friendly banks, and a murky regulatory situation. The underperformance underscores the importance of maintaining a balanced portfolio for long-term security and rewards.

Unveiling the Mystery of Aptos Token Unlocks: A Boon or a Bane for the Market?

Aptos blockchain’s upcoming unlock of more than 2% of the APT token’s circulating supply could potentially lead to a significant drop in its value, based on data from TokenUnlocks. Traditionally, these unlocks often correlate with asset price decreases as investors preemptively sell their holdings before additional tokens saturate the market. This impending event continues to draw attention from crypto enthusiasts.

Cryptocurrency Showdown: Major Coin Pullback Versus Meme Coin Frenzy

Major cryptocurrencies like Bitcoin and Ether are nearing bearish trends without any recent triggering news, possibly due to traders banking on profits elsewhere. Meanwhile, meme coins like 科太币 and Toshi are gaining attention but come with a potential risk of rug pull due to non-locked liquidity.