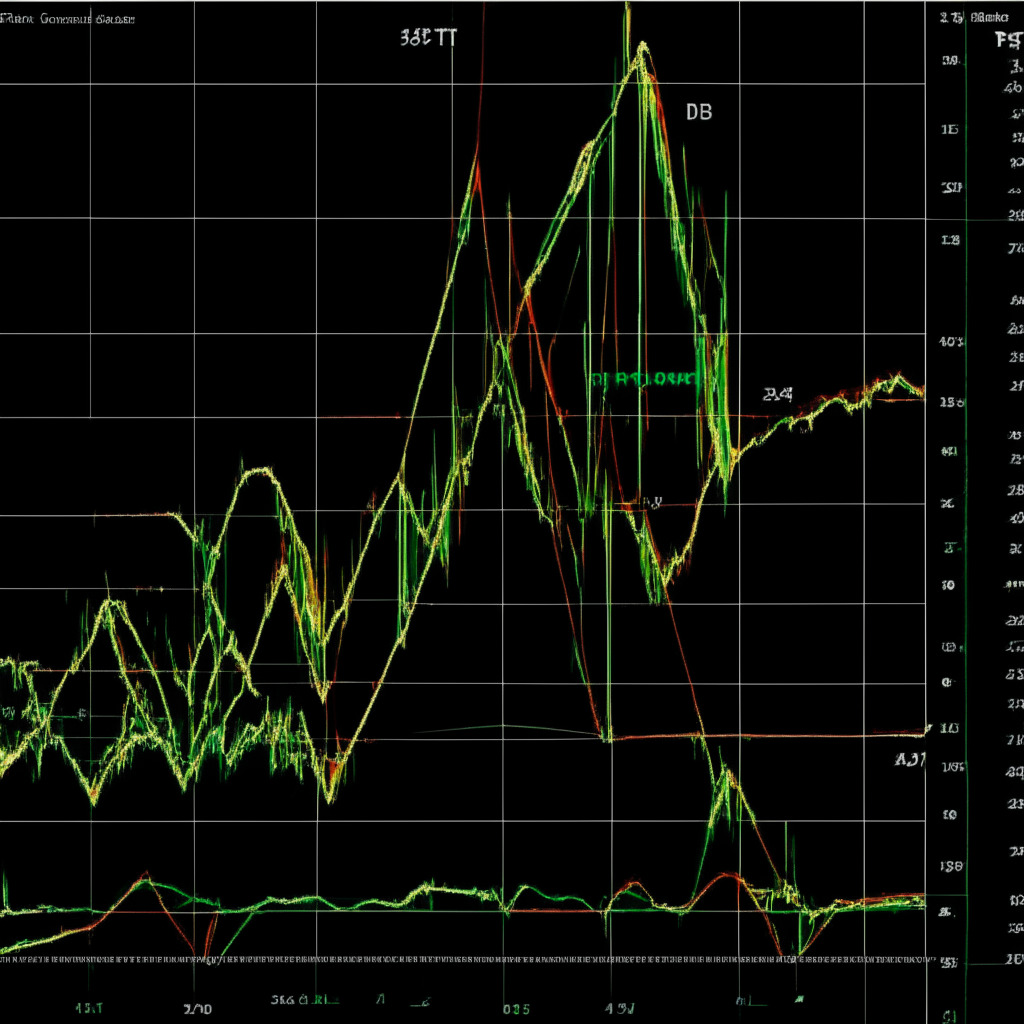

The crypto market has been displaying a moderate but perplexing behavior with an impressive 0.57% increase in Bitcoin (BTC), putting it at an almost touching distance from the coveted $30,000 mark. On the other hand, Ethereum (ETH) remained so flat it could be used as a spirit level, puzzling crypto enthusiasts and traders alike.

But the million-dollar question lingering on everyone’s lips is: What catalyst will propel the lion of crypto past the 30k hurdle? Prominent voices believe the forthcoming U.S July Consumer Price Index report could serve as a favorable wind from the front, amid expectations of a 0.2% monthly growth and a 3.3% annual increase. The anticipation surrounding the report is undoubtedly fueled by a backdrop of the Federal Reserve’s historical tendency to tighten monetary policies and the market’s habit of predicting rate cuts.

However, as some hope for a bullish bang, there’s a quite reasonable possibility of bearish whimper as higher than expected CPI could point to unfinished business with rate hikes. A recent commentary by Glen Goodman, the author of “The Crypto Trader”, doused the market’s anticipations with a cold shower of skepticism. In Goodman’s views, BTC is far from impressive with its almost frozen price and shattered correlation with the S&P 500. This perceived disintegration has led him to theorize a potential dive below $25,000, which Goodman sees as the final curtain call for the 2023 bull market.

Goodman also touched upon another pressing matter, the dire need for tangible reforms in the regulatory landscape. He underscored the existing trust deficit in crypto exchanges, emphasizing that they need to be as dependable as their traditional counterparts like the New York Stock Exchange.

Nevertheless, the current crypto market atmosphere isn’t all gloom as a faction of traders continue to bet against the rumors of an impending volatility upheaval. This strategy against price instability seems to pay off given the Bitcoin’s plateau-like tendency since July 24.

As a side note, there also emerged news about PayPal’s plans to roll out an Ethereum-based stablecoin, an AI chatbot named “ChatBTC” that aims not to “hallucinate” when answering queries about blockchains, and an encouraging recovery of 73% of the funds stolen from Curve. Furthermore, milestones were accomplished by Mantle and Lido, adding to the dynamic and ever-evolving nature of the crypto ecosystem.

Source: Coindesk