“In an unexpected development, Venezuela has extended the reorganization shutdown of its crypto regulatory body, Sunacrip, due to a corruption scandal. This has left the nation’s crypto market unstable, highlighting the crucial role of transparent and responsible regulatory institutions in maintaining market stability and investor confidence.”

Category: Regulations

Crypto Recognition in China: Bitcoin’s Status Shift and Its Implications for Global Finance

“Shanghai’s Second Intermediate People’s Court has legally recognized Bitcoin as a distinct, irreplaceable digital asset. This recognition contradicts Beijing’s blanket ban, hinting at a potential change in China’s cryptocurrency approach. The decision holds significant implications for regulation, global perception of cryptocurrencies, and the integration of digital currencies into traditional finance.”

Crypto Regulatory Claims: The Bitspay Controversy and its Impact on User Trust

“The crypto firm Bitspay, alleged to have falsely claimed to be regulated in Estonia, has erased its fraudulent license data, shaking trust in the crypto community. This incident questions the credibility of other cryptocurrency platforms’ regulatory status, underscoring the importance of regular verifications and rigorous checks.”

Trials and Turbulence: Navigating Legal and Security Challenges in Crypto Landscape

“Sam Bankman-Fried (SBF) is facing legal battles involving the U.S. Department of Justice, hampered by incarceration. His counsel argues for SBF’s unique insights in preparing the defense strategy. His case highlights complexities in the digital currency landscape, emphasizing the need for vigilance, adaptability, and expert help.”

The US Political Unrest: A Roadblock for Crypto-focused Bills and Digital Asset Future

“The threat of a US government shutdown could influence the future of digital assets. Crypto-focused bills like the FIT, Blockchain Regulatory Certainty Act, and Keep Your Coins Act risk being delayed. Any shutdown could stall these bills’ progress until government funding is secured for the next fiscal year.”

Emergence of Taiwan’s Crypto Association: A New Era for Global Currency Adoption

Taiwan’s crypto community is set to establish an operational group this October, designed to facilitate digital currency adoption and self-compliance. Spearheaded by nine local cryptocurrency exchanges, this initiative aims to foster a healthy industrial environment and ensure the industry’s robust wellbeing, ultimately propelling Taiwan onto the global cryptocurrency stage.

Taiwan’s Crypto Exchanges Unite Under New Association Amid Regulatory Changes

“Major Taiwan crypto exchanges have initiated the Taiwan Virtual Asset Platform and Transaction Business Association in response to impending regulations. It provides industry direction, consensus building, and representation and also rallies diverse stakeholders in the volatile crypto market. This appears as a progress towards the industry’s maturity.”

Legal Storm Brews for Crypto Mogul, Bankman-Fried: Defense Team Pushes for Temporary Release

Crypto industry personality, Sam Bankman-Fried (SBF), awaits a high-stakes trial and his defense plea for temporary release cites the importance of unrestricted attorney-client interaction to prepare for the proceedings. Facing fraud and conspiracy charges linked to cryptocurrency exchange FTX’s downfall, Bankman-Fried asserts his innocence, ushering in considerable implications for the crypto realm.

Navigating the Pros and Cons of a Prospective ‘Digital Euro’

The European Central Bank (ECB) discusses its ongoing development of a Central Bank Digital Currency (CBDC) – a digital Euro. The CBDC aims to offer a user-friendly, cost-free alternative to physical cash. Privacy protection, while preventing illegal activities, is emphasized as a fundamental aspect. However, potential creation and acceptance issues raise concerns, and the decision to move forward wouldn’t be decided until later in October.

Navigating the Regulatory Maze: How Binance’s Belgium Comeback Reveals Crypto’s Future Challenges

“Binance, a leading cryptocurrency exchange, resumes services in Belgium through an entity in Poland, aligning with EEA member state guidelines. Amid regulatory hurdles, Binance also plans to delist stablecoins for the European market correlating with upcoming MiCA legislation.”

Cryptocurrency Critic Senator Menendez Embroiled in Bribery Scandal: Irony or Reality?

“U.S. Senator Robert Menendez, known for his disapproval of cryptocurrencies like Bitcoin, ironically finds himself in a scandal involving traditional bribery means. He’s accused of accepting bribes, pointing out the contrast to his criticisms of crypto enabling criminal activities.”

Cry for Crypto Regulation: Ex-SEC Official Urges for Greater DOJ Involvement

Former SEC official John Reed Stark argues that the SEC’s current capabilities are insufficient to handle the growing, flexible crypto sector. Stark believes that the Department of Justice’s involvement is indispensable to impose penal measures as the SEC’s mandate restricts it to civil enforcement.

Celsius Creditors Support Reorganization: A Case Study in Transparency and Accountability in Crypto

“Celsius creditors have approved a plan to return approximately $2 billion in Bitcoin and Ethereum. This significant redistribution awaits final confirmation from an October 2 hearing at the US Bankruptcy Court. However, these developments emphasize concerns on transparency and accountability in the crypto world, stressing the importance of regulation and consumer responsibility in volatile crypto markets.”

Understanding the NYSE Arca and Bitwise’s Revamped Bid for Bitcoin ETF Approval

NYSE Arca Exchange has proposed a revised application for Bitwise’s Bitcoin exchange-traded fund (ETF) Trust, addressing SEC’s concerns about Bitcoin spot ETFs. Bitwise postulates a strong correlation between Bitcoin futures and spot prices, and argues that a surge in spot Bitcoin ETF wouldn’t significantly distort CME futures market prices.

Crypto Progress: Are Pending US Bills at Risk Due to a Government Shutdown?

“The imminent US government shutdown threatens several crypto-focused bills awaiting a House vote, casting uncertainty over their fate. The longer the shutdown persists, the more delayed will be crucial crypto reforms. In this scenario, potentially causing regulatory stagnation in crypto markets.”

Balancing Acts: mBridge’s CBDC Project, Opportunities and Geopolitical Concerns

The mBridge Central Bank Digital Currency (CBDC) project, comprising members from China, Hong Kong, Thailand, UAE, and BISIH, is preparing for expansion. The project offers faster, cost-effective, and transparent cross-border transactions. Concerns rise from potential exploitation for sanctions evasion.

Global Crypto Regulatory Trends: A Challenge or an Opportunity?

Recent global legislative actions are intensifying cryptocurrency regulation discussions. Hong Kong is focusing on regulated exchanges to decrease fraud-related investor losses, Thailand is taxing overseas crypto profits, Brazil is advocating for digital assets protection, and the U.K. and U.S. are developing bills targeting illegal crypto use and curtailing Central Bank Digital Currencies respectively. Regulatory changes highlight the balance between encouraging financial innovation and protecting citizens.

Unraveling the JPEX Controversy: Impacts on Hong Kong’s Crypto Trust and Regulatory Outlook

The recent JPEX controversy, considered the largest fiscal fraud in Hong Kong’s history, poses significant setbacks to retail trust in cryptocurrencies. The scandal underlines a lack of understanding of digital assets among the general public, potentially obstructing the government’s plans to expand the sector. Subsequent enforcement actions reflect Hong Kong’s commitment to a robust digital asset economy and investor protection.

Bipartisan Battle for Crypto: A Deep Dive into U.S. Digital Asset Regulation

Senators Kirsten Gillibrand and Cynthia Lummis have introduced a new crypto bill, the Responsible Financial Innovation Act, aimed at addressing regulatory ambiguity in the US cryptocurrency industry. This legislation could shift the oversight of most digital assets from SEC to the Commodity Futures Trading Commission.

Exploring Tether’s Surprise ToS Shift: Unseen Implications for Singapore-Based Users and Crypto Futures

“Tether, the largest stablecoin issuer, has made a significant shift in its terms of service (ToS), restricting access for certain Singapore-based clients, causing anxiety among the crypto-user base. This may be a strategic adherence to regulatory compliance after a major Singaporean crypto scandal or a rebuttal against potential restrictions jeopardizing their operations.”

Navigating the Shadows: The Challenge of Crypto Fraud Prevention in India

Amid a rise in crypto-related scams in India, the absence of clear cryptocurrency regulations becomes alarming. This regulatory gap encourages criminal activity and leaves scam victims feeling helpless and vulnerable. The situation complicates the categorization of cryptocurrencies for legal proceedings and discourages the reporting of fraud, but robust regulatory actions could help address these issues.

Hong Kong’s SFC to Publicly List Licensed Cryptocurrency Exchanges: A Step Towards Transparency

Hong Kong’s Securities and Futures Commission (SFC) plans to publish a list of cryptocurrency trading companies that have applied for operational licenses, bringing transparency to the industry. Nevertheless, this doesn’t guarantee rule conformity. This follows a major financial scam involving unlicensed cryptocurrency exchange JPEX which reportedly caused significant losses for investors. The SFC emphasizes strict governance measures including asset safety and market manipulation prevention to ensure investor protection.

Crypto Market Clash: Citadel Securities vs. Portofino Technologies, A Battle for Integrity or Intimidation?

In the crypto market, the founders of Portofino Technologies, Alex Casimo and Leonard Lancia, are accused by Citadel Securities of underhanded business practices and violating employment agreements. Portofino sees this as an intimidation tactic and effort to stifle competition. A critical dispute involves Citadel’s allegations of Portofino recruiting Vincent Prieur, Citadel’s ‘whiz kid’ of crypto.

Hong Kong’s Tightening Crypto Regulations: Striking the Balance between Control and Innovation

Hong Kong’s Securities and Futures Commission (SFC) is intensifying scrutiny on unregulated virtual asset trading platforms, following the JPEX exchange scandal. The SFC plans to publish lists of regulated and non-regulated platforms to create greater transparency. However, this regulatory tightening could potentially inhibit the local crypto market’s growth and innovation.

Crypto Scandal Alarm: JPEX, Financial Fraud and the Dire Need for Better Oversight

“The JPEX scandal, involving massive increase in withdrawal fees and resultant difficulties withdrawing cryptocurrency, has sparked global conversation around protection, regulations, and the efficacy of existing oversight measures in the crypto market. This situation underscores the need for firm, international solutions and increased vigilance.”

Coinbase’s AML Registration in Spain: Catalyst for Crypto Influence or Regulatory Dilemma?

Coinbase has obtained an Anti-Money Laundering compliance registration from the Bank of Spain, marking an expansion of its influence in Europe. The cryptocurrency exchange can now offer its products to users in Spain, adhering to local legal frameworks. Also, similar approvals have been received in Italy, Ireland, Netherlands, Singapore, Brazil, and Canada.

Accidental Millionaires: The $10.5M Crypto.com Misstep and Its Implications

“In May 2021, a Melbourne couple mistakenly received $10.5 million AUD from Crypto.com. The couple allegedly spent a substantial amount before the exchange discovered the error in December 2021. The mishap underscores the need for robust checks within cryptocurrency exchanges to mitigate such significant blunders.”

Legal Troubles Ripple Through Crypto Space: FTX Controversy and Coinbase’s AML Victory

The article discusses legal disputes in the crypto world, highlighting a lawsuit involving legal team Fenwick & West and cryptocurrency exchange FTX, caught up in allegations of fraudulent activities. On a positive note, it mentions Coinbase’s recent AML compliance registration from the Bank of Spain, indicating global advancements in cryptocurrency regulation.

Coinbase Obtain AML Compliance in Spain: Striking Balance between Global Expansion and Regulatory Challenges

Coinbase has secured an Anti-Money Laundering compliance registration from Spain’s central bank, enabling crypto services in the country. As Coinbase expands globally, it faces possible complications from varying regulatory frameworks and is urged to prioritize asset security as skeptical holders consider withdrawing assets.

Navigating Rough Seas: Bybit’s Suspension in Response to UK Regulation Clampdown

Bybit, a popular cryptocurrency exchange, is suspending its UK operations following stringent regulations by the Financial Conduct Authority. This move, along with warnings about non-compliance penalties and possibly stricter regulations, signifies a complex stand-off between blockchain innovation and governance.

Embattled FTX Exchange’s Court Saga: A Tangle of Fraud, Bankruptcy, and Billion-Dollar Debts

FTX, a struggling crypto exchange, has accused former employees of fraudulently withdrawing $157.3 million before its bankruptcy filing. This case highlights the urgent need for stricter regulations that could prevent such malpractices in the crypto industry. Despite challenges, FTX managed to recoup $7 billion in liquid assets and continues its recovery efforts.

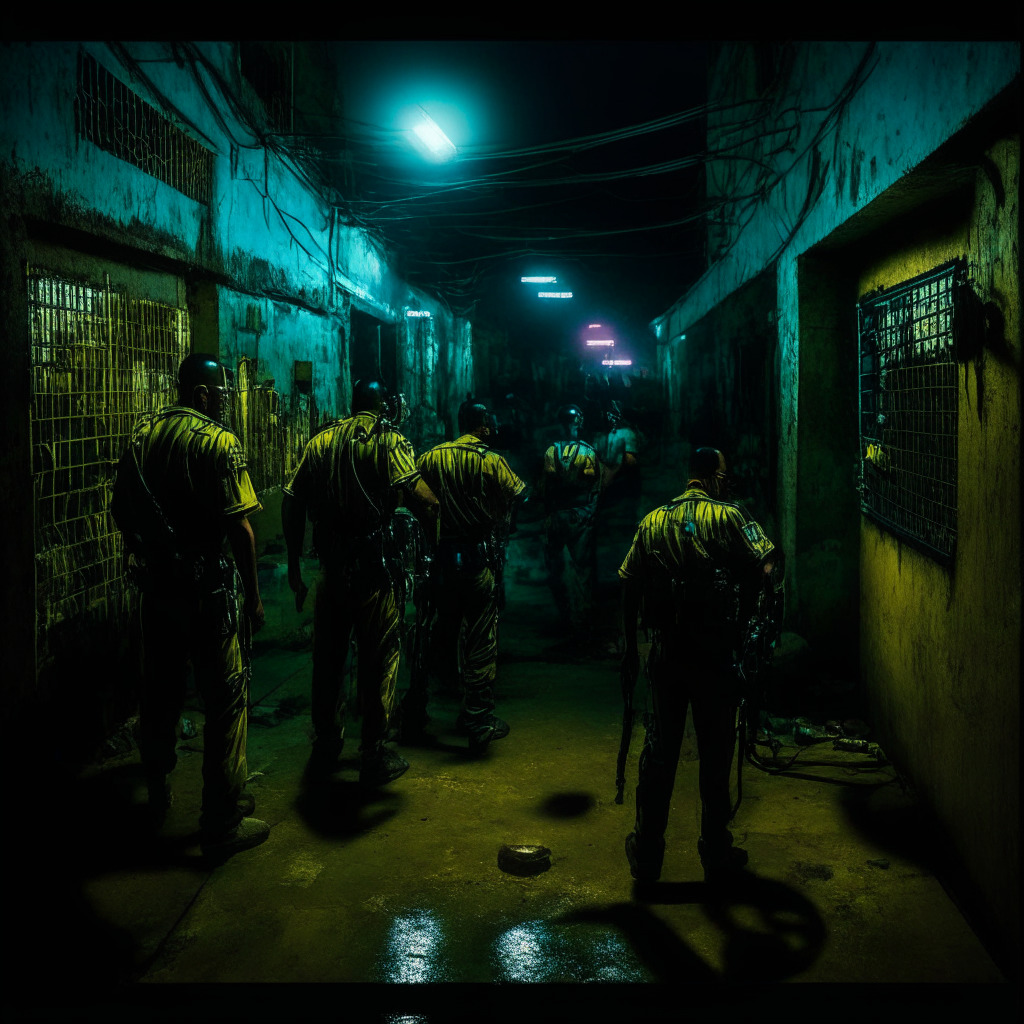

Unearthing Hidden Bitcoin Mines in Venezuelan Prisons: Economic Boon or Bane?

In a recent Venezuelan police operation, undisclosed Bitcoin mining activities were discovered within a notorious prison. This reflects the growing popularity of crypto mining in the country, despite authorities’ efforts to curb these activities due to their high power demand and resultant socio-economic complexities. The event highlights the conflict between security, sustainability, and economic growth in the crypto realm.