Bitcoin OG Adam Back, CEO of Blockstream, predicts BTC will surpass $100,000 before the 2024 Bitcoin halving. Back has wagered one million Satoshis ($290) on this outcome, bringing speculative energy and discussion to the crypto market’s future development.

Search Results for: $30,000

Bitcoin Miners’ Peril: $98,000 BTC Required for Profits Post-Halving?

“Despite fluctuations in BTC’s value, Bitcoin miners may need the price to reach over $98,000 for profitability due to the upcoming halving. This price leap, crucial for their revenue sources, is viewed as a necessity than a prediction. Prolific organizations like Standard Chartered forecast a $120,000 Bitcoin price by 2024, providing an optimistic outlook despite the challenging landscape for Bitcoin miners.”

Bitcoin’s Surge to $30k: Impact, Market Response, and Potential Future Developments

“Bitcoin surged past the $29,000 mark, largely due to increased trading volumes, hitting a six-week high. MicroStrategy’s Michael Saylor disclosed another Bitcoin purchase, using $14.4 million from the company’s reserves, contributing to BTC’s renewed vigor. Also, KuCoin announced the suspension of its Bitcoin and Litecoin mining pools.”

Navigating the Potential $25,000 Downturn in Bitcoin Amid Macroeconomic Pivots

Despite a potential shift in macroeconomic conditions, Bitcoin’s market could experience a $25,000 dip, per a Capriole Investments analysis. While various market transformations could stimulate a bullish trend, Bitcoin’s liaison with a Bitcoin spot price exchange-traded fund still remains uncertain.

Bitcoin’s Resilience amid Rate Hike: Dipping Below $30K While Respecting Key Support Levels

“Despite Bitcoin’s recent dip below $30,000, it managed to hold above the Fib 0.382 support level, suggesting this could act as immediate support. However, 50-day EMA resistance may increase downward pressure. Meanwhile, tokens such as Optimism, IOTA20, and Bitcoin Cash display solid fundamentals and potential investment opportunity.”

Crypto Market Unravel: Bitcoin Dips Below $30k, Regulatory Challenges Intensify

The cryptocurrency market experienced a significant dip, driven by profit-taking activities. Bitcoin, Solana’s SOL, Ether (ETH), XRP, Cardano’s ADA, and Avalanche’s AVAX all saw considerable reductions. Meanwhile, a new digital assets oversight bill introduced by U.S. House Republicans adds regulatory uncertainty to the sector, while amplified market volatility resulted in over $66 million worth of liquidations in the past 24 hours.

Soaring Bitcoin Speculations in 2023: Examining BTC20’s Potential and the $50,000 Dream

“Bitcoin’s price dance hovers just above $29,500, with potential to reach $50,000 by 2023. However, caution at this point is crucial as impending bearish demeanour could emerge. Meanwhile, emerging cryptocurrency BTC20 is gaining momentum, turning heads with a funding milestone of over $469,600 three days post-launch.”

Unleashing the Power of Bitcoin ETFs: A $30 Billion Boom or a Fizzle?

Bitcoin spot exchange-traded funds (ETFs) could potentially bring a $30 billion influx to the digital asset market, sparked by applications from financial giants like BlackRock and Fidelity, according to NYDIG. Despite Bitcoin’s volatility, which is 3.6 times that of gold, the potential for a Bitcoin ETF could create significant additional demand.

Bitcoin’s Intense Battle to Reclaim $30K: Analyzing Market Dynamics and RSI Reset

“Bitcoin bulls are striving to reclaim the $30K threshold amidst a low relative strength index (RSI), posing unique dynamics for crypto enthusiasts. Despite recent price drops, some see potential for Bitcoin’s uptrend to bounce back in 2023. However, market volatility and fluctuating dynamics require careful monitoring.”

Three Factors Keeping Bitcoin ‘Stuck’ Around $30K: A Detailed Analysis

Bitcoin’s market stability at the $30K level is influenced by speculative trading behavior, accelerated sales from miners seeking liquidity before the 2024 block subsidy halving, and a decline in BTC price volatility. These factors contribute to a seemingly stagnant Bitcoin market, yet this could change swiftly due to market shifts or sentiment.

Bitcoin’s Tightrope Walk at $30K: Market Sentiment, On-Chain Indicators and Whale Movements Decoded

Bitcoin is battling to maintain the $30K level with no clear trend in sight, leaving investors in a stalemate. On-chain data suggests a reaccumulation phase among investors. However, concerns about a potential drop to $27,400 linger, while on-chain data shows Bitcoin whales stirring market interest. Large BTC moves near $30,000 indicate a potentially pivotal point in trading history.

The Battle of the Bears and Bulls: Will Bitcoin’s $30k Support Crumble on July 14?

The Bitcoin weekly options expiry on July 14 may shift market attitudes, with potential for the $30,000 support level to crumble. The recent U.S. inflation drop could encourage investors to pivot to fixed-income investments, making Bitcoin less appealing. However, the final outcome remains uncertain, given latest macroeconomic data and critiqued exchange practices.

Exploring the Impact of a $300 Million BTC Transfer Linked to Silk Road Case

The U.S Department of Justice reportedly transferred nearly 10,000 BTC linked with the Silk Road case, triggering speculation about the intent and potential market impact of such a massive move. While some fear a crypto catastrophe, others see no significant market shifts, indicating the need for prudence in this volatile ecosystem.

Bitcoin’s Ascend to $250,000: Adjusted Timelines and Regulatory Challenges

Billionaire venture capitalist Tim Draper remains firm in his conviction of Bitcoin reaching $250,000 per coin by 2025. Despite setbacks and regulatory challenges, luminaries like Draper back Bitcoin’s potential for an impressive comeback, and continue viewing it as the future of everyday transactions.

Bitcoin’s Revival Amid Inflation Fears: A Rally to $50,000 or a Fall into Recession?

“Bitcoin soared above $31,000 indicating a recovery of investor enthusiasm after June’s bitcoin ETF filings by financial titans. Fears around inflation have eased, contributing to this recovery. British multinational bank, Standard Chartered, predicts bitcoin to reach $50,000 by 2022’s end. Major events are anticipated to influence the crypto market’s future stability.”

Navigating Through Bitcoin’s $30k Intersection: The Impending Impact of Scaling Solutions

“Ethereum’s co-founder, Vitalik Buterin, underscored the necessity of scaling solutions for Bitcoin to supersede its current role as a mere payment option. Buterin advised using second-layer scaling solutions like ZK Rollup to improve Bitcoin’s sluggish transaction volume and improve its scalability.”

Bitcoin’s Impending Surge to $120,000: Evaluating the Forces at Play

“Standard Chartered Bank recently updated their Bitcoin forecast, suggesting it could hit $50,000 by year’s end and possibly reach $120,000 by 2024. The report cites increased miner profitability and looming banking-sector crisis as pivotal factors impacting Bitcoin’s potential growth.”

Will Bitcoin hit the $100,000 Mark: Analyst Predictions vs Market Reality

Bitcoin’s fluctuating market has prompted speculation about a potential $100,000 valuation this year. Advancements, like institutional interest in spot Bitcoin ETFs, may set a robust foundation for a dynamic market. However, volatility and resistance levels also present risks. As always, careful assessment is critical before investment.

Bitcoin Plunges to $30,600: Unexpected U.S. Employment Data Shakes Financial Markets

The value of Bitcoin plunged to $30,600 following surprising US employment data indicating 497,000 private-sector jobs added in June. This resulted in significant financial market fluctuations, with speculation of further Federal Reserve rate hikes affecting crypto and stock markets negatively.

Navigating Bitcoin’s $31,000 Challenge: Downward Shift or Golden Buy Opportunity?

“Crypto enthusiasts are closely watching the bearish chart pattern of Bitcoin, as it hovers around the $30,450 range, anticipating whether this could become a golden buying opportunity. Bitcoin, still leading on CoinMarketCap, faces resistance at the $31,000 mark, signalling a possible bearish correction.”

Bitcoin Teeters on the Edge: Trading Strategies for the $31,000 Threshold

With the current market value at roughly $30,763, Bitcoin faces resistance at the $31,000 mark. Viewing Bitcoin’s bullish engulfing candlestick, analysts predict a possible upward trend should it break a $31,350 resistance. However, if it dips below $29,650, we could witness a gradual slide towards $28,650.

Bitcoin at $33,000: Tipping Point for Speculative Selling or Market Recovery?

Market researchers warn that Bitcoin speculators may sell if the price surpasses $33,000, potentially causing a market correction. Key indicators like MVRV and SOPR suggest short-term holder profit-taking risk and seller exhaustion, making $33,000 a critical level for investors to watch.

Navigating Bitcoin’s Bullish Outlook: Potential $38,000 Highs and Max Pain Threshold Dangers

Bitcoin price sustains above $30,000, attracting more buyers and aiming to challenge seller congestion between $31,000 and $32,000. Despite consolidation, investors should remain cautious as the Relative Strength Index (RSI) retraces from the overbought region, potentially leading to market turbulence.

Breaking the $31,000 Barrier: Analyzing Bitcoin’s Double Top Resistance and Market Predictions

Bitcoin faces a significant challenge with a double top resistance at the $31,000 level, sparking concerns about a potential bearish correction. This article delves into the technical analysis to determine if Bitcoin’s upward momentum will continue or face a minor correction.

Boost in Bitcoin Price Due to US ETF Hype: Analyzing the $30k Mark, Accumulation Trends, and Broader Market Adoption Conflict

Crypto enthusiasts hope US trading will boost Bitcoin’s price due to ETF hype from institutional product applications submitted in the US. Glassnode confirms the trend, suggesting it could be part of a long-term shift in US-led demand. Analysts predict that any downside will likely be experienced as dips during uptrend continuation.

Bitcoin’s Struggle at $30k: Analyzing Market Structure, MACD Signals, and Exchange Supply

Despite a recent 1.1% loss, Bitcoin’s market structure shows an uptick above all applied moving averages and a short-term descending trendline since mid-April, suggesting buyer dominance. With supply held across exchanges at its lowest since 2017, reduced selling pressure and increasing demand set the stage for a potential rally.

Bitcoin’s Bull Run Struggle: Japan’s Tax Reform vs $31,000 Double-Top Resistance

The surge in Bitcoin’s price has sparked questions about a new bull market, but the cryptocurrency faces challenges breaking the $31,000 double-top pattern. Japan’s tax rules and the introduction of new Bitcoin ETFs could generate positive sentiment and potentially boost demand for the cryptocurrency.

Bitcoin Bulls Eye $35,000 While ETFs Gain Traction: Analyzing Market Drivers

Bitcoin bulls hold onto the $30,000 level as BTC price consolidates after a recent rally, with sentiment high for a potential rise to $35,000. Increasing interest in crypto assets and Bitcoin ETF filings, along with the upcoming 145,000 BTC options expiry on June 30, are key market events to watch.

Bitcoin’s $30K Comeback: Bulls vs Bears Amid Regulatory Battles & ETF Hopes

Bitcoin retains its $30,000 position as bulls regain market control amidst a $715 million BTC options expiry and easing regulatory pressures. However, bears strategize with Bitcoin ETF applications and ongoing Binance investigations, making cautious optimism essential in this volatile market.

BTC at $27,000: Breakout Imminent or Stuck in Familiar Territory? Pros, Cons & Conflicts

BTC hovers around $27,000 with an imminent breakout predicted. Despite the calm trading range, chances of reaching $30,000 increase as the 200-week moving average stays intact. With varying investor sentiments, large Bitcoin whales accumulating positions may fuel market surprise and volatility resurgence.

Bitcoin’s Slip Below $27k: CME Futures Gap Impact and the Hopes for a $30k Breakout

Bitcoin slipped below $27,000 at May’s end, with traders and analysts pointing to the CME futures gap as a potential market bottom. Despite mixed outlooks, some remain hopeful for a breakout towards $30,000, while others adopt a wait-and-see approach amidst key liquidity areas and moving averages.

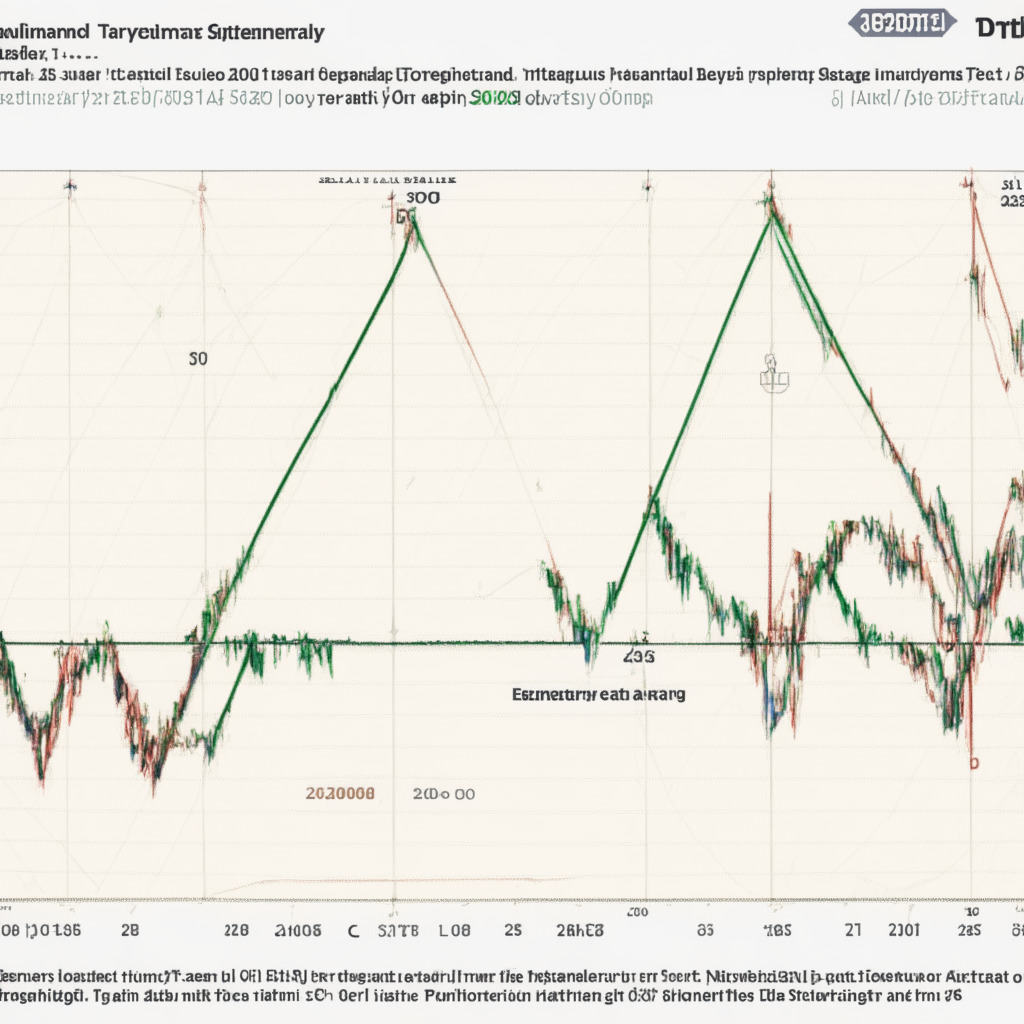

Bitcoin Sideways Trend: Triangle Breakout Decides Next Move Between $25K-$30K

Bitcoin’s future trend relies heavily on a breakout from the current symmetrical triangle pattern, with potential gains of 7% or losses of 5-6% at stake. The Bitcoin Fear & Greed Index, currently at 49%, mirrors the uncertain market trend. Price movements depend on breaking the triangle pattern and surpassing the channel pattern’s trendline.