MetaMask Snaps, a new plugin by Consensys, will allow different blockchain networks like Bitcoin and Solana to interact directly with the MetaMask wallet to facilitate transaction signing and smart contract understanding. However, concerns around user-friendliness, security checks, and notification inundation need to be addressed.

Search Results for: AMA

MetaMask’s Bold Moves: Expanding Crypto Conversion Amid Scam Woes

MetaMask has enhanced its user experience by allowing ETH conversion to fiat currency. Despite advancements, it faces scamming challenges with fraudsters creating bogus MetaMask sites for illegal activities. Users need to be vigilant and proactive in reporting any suspicious activity or compromised security details to MetaMask.

DeFi Drama: The Synapse-Nima Capital Incident and Crypto Bankruptcy Profit Surge

“In an unexpected move, Nima Capital’s withdrawal of liquidity from the DeFi cross-chain bridge Synapse caused a dramatic decrease in the value of SYN tokens, causing uproar in the crypto community. Despite this, Synapse reassures users of their platform’s security system integrity. Additionally, the escalating complexity of cryptocurrency bankruptcy cases is resulting in a staggering profit for legal practitioners.”

Race to SEC Approval: The Spot-Traded Bitcoin ETF Drama Unfolds

The digital asset landscape is witnessing intense activity regarding the approval of the first spot-traded Bitcoin ETF by the U.S. Securities and Exchange Commission. Notwithstanding setbacks and concerns around investor protection, the increasing interest among major institutions suggests the possibility of approval could be nearing. The SEC’s decision is anticipated by early 2024.

International Legal Drama Unfolds: How FTX’s Sam Bankman-Fried’s Fraud Case Could Impact Crypto Cities

Sam Bankman-Fried, founder and former CEO of crypto exchange FTX, is facing a fraud trial with allegations including wire fraud. The U.S Department of Justice questions the blurred lines between FTX’s international and U.S. operations, which Bankman-Fried’s defence argues to be legally separate. The fallout of the case could significantly impact the crypto landscape.

Unwrapping Amazon Prime’s Blockchain Gaming Play: Riding the NFT Wave or Hitting an Iceberg?

Amazon Prime is offering its subscribers free gaming NFTs through the Prime gaming portal. These include distinctive skins and playable characters, allowing users to explore the blend of gaming and crypto technology. However, the market’s response to these corporate blockchain efforts remains largely skeptical due to environmental concerns and scamming risks.

Tamadoge Gearing Up for Major Marketing Drive: New Features, Hidden Projects and Potential Risks

“Tamadoge, a Web3 play-to-earn gaming platform, is all set for a significant marketing campaign. This includes promoting its new staking and burn features, securing top exchange listings, unveiling hidden projects and giveaways, and launching a huge crypto marketing campaign focusing on major influencers and a possible airdrop.”

Ramaswamy’s Support and Regulatory Challenges: Unraveling the Future of Cryptocurrency in the US

“U.S. Presidential candidate Vivek Ramaswamy praised Grayscale’s victory over the federal securities regulator, asserting it could further Bitcoin and blockchain innovation. However, the legal landscape for cryptocurrency regulation remains complex and uncertain, despite support from industry influencers and active discussions for clear regulations.”

Tether’s New Link with Bahamas-Based Britannia Bank: A Boon or Bane for the Crypto Industry?

Tether, the issuer of popular stablecoin USDT, has established banking relations with Britannia Bank & Trust. This connection could streamline dollar transfers, improving Tether’s functioning within the traditional financial network. Britannia’s recent acquisitions and positive stance on crypto suggest this relationship is strategic for both entities, impacting the future of the crypto industry.

Driving the Future: Jamaica’s CBDC ‘Jam-Dex’ and Its Potential Impact on Public Transport

Jamaica’s public transport sector is expressing interest in the country’s central bank digital currency (CBDC), Jam-Dex. Aldo Antonio, NTAG executive chairman, suggests that Jam-Dex could improve operational efficiency, cut costs, and reduce risks for drivers. However, successful implementation relies on customer adoption and integration with current fintech trends.

Jamaican Cab Drivers Embrace Jam-Dex: Relevance, Challenges and Potential Outcomes

Jamaican cab drivers are optimistic about the nation’s Central Bank Digital Currency, “Jam-Dex”, aiming to revolutionize public transportation by eliminating cash and its associated security concerns. Despite a lukewarm public response, proponents believe Jam-Dex could significantly improve daily transactions if successfully adopted by customers.

EOS Network’s Dramatic Turnaround: Nod from JVCEA & Promises of the Japanese Market

EOS Network, a blockchain that garnered $4 billion in its initial coin offering, has been granted white-list approval by Japan’s regulatory body for crypto exchanges. This allows EOS to compete with major cryptocurrencies like Bitcoin and Ethereum on Japan’s regulated crypto exchanges. The approval signifies EOS’s compliance commitment and opens new opportunities for the network in the Japanese market.

Unmasking the Grayscale vs SEC Drama: A Testament to Crypto’s Regulatory Tug-of-War

Grayscale, a Digital Asset Management firm, recently won a significant case against the Securities and Exchange Commission (SEC), paving the way for regulatory clarity within the crypto industry. This case highlighted the ongoing battle between innovation and regulation in the crypto market space.

Crypto Courtroom Drama: Sam Bankman-Fried’s Future Hanging by a Trade and Pepecoin’s Insider Trading Scandal

“Sam Bankman-Fried is contending with serious allegations and a voluminous amount of newer evidence in an impending trial. Separately, controversies surrounding Pepecoin highlight the risks and need for regulation in the crypto world, for safety and community trust.”

Unraveling Meta’s Code Llama: The Next Frontier in Crypto or a Threat to Decentralization?

“Meta’s new tool, ‘Code Llama’, offers a community-licensed AI meant for generating and discussing computer coding. This platform could prove critical for businesses and individuals, including bot developers and crypto exchanges. However, it also prompts questions around neutrality and US SEC scrutiny, especially as it signifies a move towards blockchain and crypto project decentralization.”

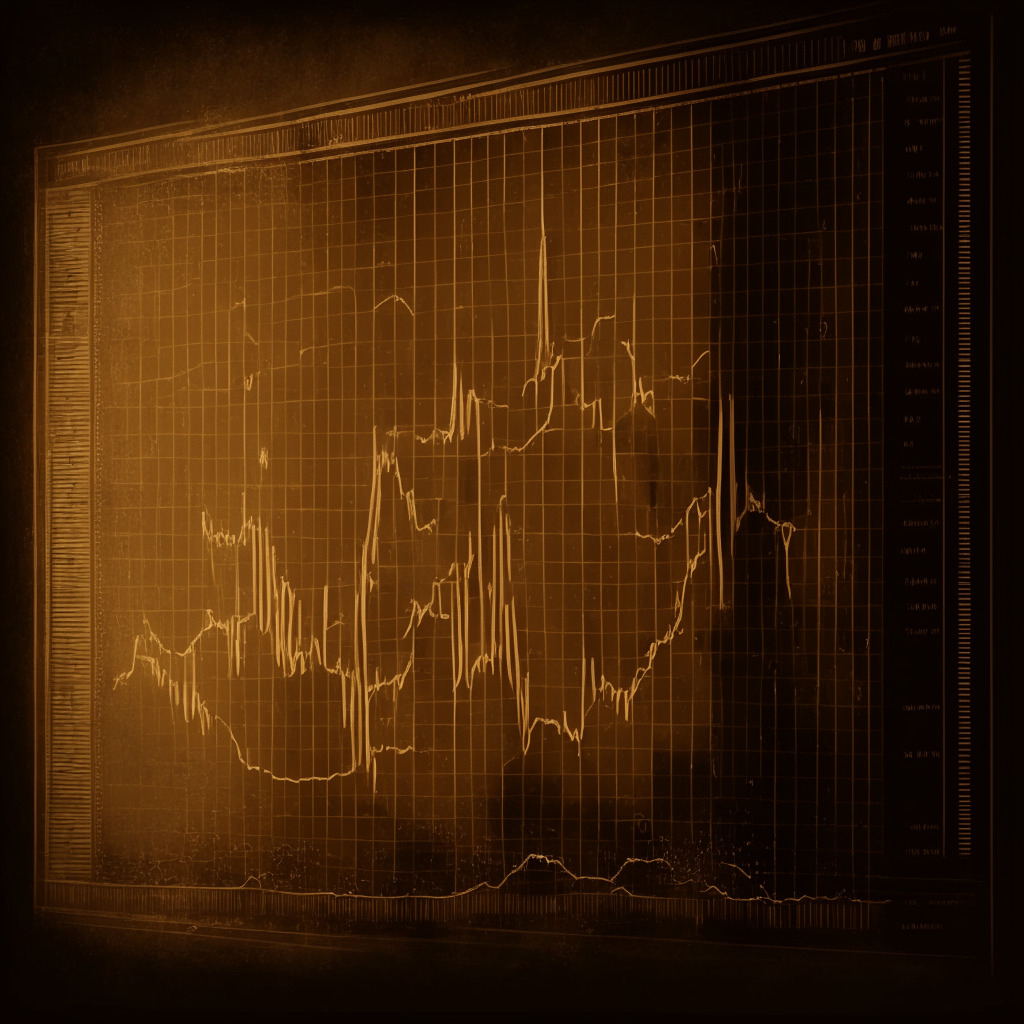

Dramatic Plunge in Ether Futures on Binance: Unsettling Calm or the Start of a Storm?

The U.S. dollar value in active ether perpetual futures contracts on Binance has dropped to $1.41 billion, the lowest in over a year. Binance has seen its ether futures notional value dip 35% within a week, reflecting a system-wide leverage washout. This suggests a lower probability of future volatility instigated by liquidations.

Cypher’s Gamble: An Innovative Response to the Damaging Hacking Incident

Cypher, a decentralized exchange on the Solana blockchain, is revamping its token sale strategy following a damaging hack in August that resulted in a loss of over $1 million assets. The forthcoming sale aims to recoup losses and compensate depositors, largely by issuing a debt token that may enable recovery of investors’ financial losses as the protocol grows.

Market Highs and Lows: Bitcoin’s Latest Slide, the Dipping Drama of BNB, and Australia’s CBDC Stance

Bitcoin experienced a dip under the $26,000 mark, with enthusiasts awaiting the outcome from the Jackson Hole central bankers’ meeting. Meanwhile, the Binance-linked cryptocurrency BNB plunged significantly due to increasing regulatory pressure and investor concerns over a troubled BNB-backed loan.

Blockchain’s Regulatory Drama: Balancing Innovation and Trust Amid Insider Trading Scandals

“A former OpenSea product manager was sentenced to a 3-month prison term and a $50,000 fine for insider trading in the NFT space. Despite penal consequences, debates persist whether these strict regulatory measures stifle innovation or maintain trust and integrity within the blockchain industry.”

Forced Liquidation Drama: Notorious Crypto Wallet Disrupted BNB Chain Ecosystem

A notorious wallet linked to a chain exploitation underwent forced liquidation, unsettling the crypto market. The wallet, borrowed over $150 million from Venus Protocol platform, faced liquidation due to falling prices of BNB tokens. This event could disrupt the multi-billion dollar decentralized finance ecosystem built on BNB Chain, emphasizing the importance of caution and preparedness in navigating the crypto world.

Arbitrum’s Meteoric Rise and Airdrop Drama: A Tale of Blockchain Resilience and Risk

“In Q2 2023, Ethereum’s rollup, Arbitrum, faced a significant “sell-the-news” reaction after ARB airdrop caused a surge in user transactions. Despite an initial drop in ARB token’s price, there’s a steady rise in transactions, revealing increased organic engagement and Arbitrum’s potential in shaping the blockchain future.”

Presidential Hopeful Vivek Ramaswamy Banks on Crypto: Innovating Campaign Funding or Legal Liability?

“Up-and-coming US Republican presidential candidate, Vivek Ramaswamy, known for his pro-crypto stance, is accepting Bitcoin contributions for his campaign, reflecting the increasing influence of digital currencies in the financial landscape. However, his political journey faces potential setbacks due to legal issues with previous employees.”

Drama in the Crypto Arena: FTX’s Co-founder Faces Legal Challenge amidst Accusations of Fund Misuse

FTX’s co-founder, Sam Bankman-Fried, seeks temporary release from detention to strategize with attorneys over documents relevant to his case. Accused of fund misappropriation and more, his ordeal reflects the need for caution and transparency in the fast-paced crypto arena.

DeFi Drama: Curve Finance Exploit, Zunami Protocol Losses and the Rise of Ethereum’s Linea

“In response to a $62 million hack, Curve Finance is assessing each impacted user for potential reimbursement. In contrast, the DeFi protocol Zunami Protocol suffered a $2.1 million loss via an attack on its ‘zStables’ pools. On a positive note, ConsenSys launched its Ethereum scaling rollup Linea, bridging over $26 million in ETH.”

FTX Legal Ordeal: Unfolding Drama, $176 Million at Stake, and Future of Crypto Safety

FTX cryptocurrency exchange faces a legal filing involving a proposed settlement with Genesis entities worth $176 million. If successful, FTX and its affiliates could bypass various complications and gain significant economic advantages. Wider discussions highlight the crucial role of such legal decisions in shaping future cryptocurrency regulation and safety.

Tether Discontinues Bitcoin, Kusama and Bitcoin Cash-Based Stablecoins: Impact on Crypto Landscape

“Tether, the issuer of popular stablecoin USDT, discontinues its Bitcoin, Kusama, and Bitcoin Cash-based stablecoins due to low usage. It reflects Omni’s crucial role and considers reinstating Omni Layer version if utility increases. Also, Tether plans to introduce a new Bitcoin-based smart contract system, “RGB”.”

Shifting Fortunes as Hedera Outshines Bitcoin and Ethereum Amid Legal and Corporate Drama

“Hedera Hashgraph’s HBAR token saw a 15% surge following its integration into the U.S. Federal Reserve’s instant payment solution, FedNow. Meanwhile, Bitcoin and Ethereum remained stable, highlighting how different tokens react uniquely to market factors. Also, Bank of America believes PayPal’s new stablecoin, PYUSD, may struggle to gain adoption due to competition and changing market conditions.”

Cryptocurrency Predictions in Futurama: Plot Parallels or Stark Urgency?

In the latest episode of animated series Futurama, “How the West Was 101001,” viewers are entertained with a satirical view of cryptocurrency’s future. The storyline involves a bitcoin investment that crashes, leading to bankruptcy—mirroring the volatile nature of bitcoin mining. Drawing parallels with the search for gold, the episode also addresses concerns about the high electricity consumption linked to bitcoin mining and critiques the lack of regulatory scrutiny in the crypto realm.

Futurama’s Satirical Take on Bitcoin Mining: Farce or Harsh Reality?

“Futurama’s satire takes a comedic look at Bitcoin mining in the future, highlighting issues such as excessive electricity consumption and price volatility. This increased focus on cryptocurrency themes in entertainment underscores digital currencies’ growing relevance in our everyday lives.”

Bitcoin Bouncing Back: Unfolding Drama between Optimism and Skepticism in Crypto Markets

Bitcoin’s price has demonstrated a strong recovery back above $29,000. Despite this, skeptics argue the Bitcoin bears are still in control. However, on-chain analytics suggest that Bitcoin is “close to being oversold”, indicating a potential forthcoming price rebound. Advocates and critics continue to debate the likely trend.

Unfolding Drama in CryptoWorld: Coinbase Outperforms Amid Regulatory Turbulence & Plagiarism Claims in Ethereum Tech

“Crypto powerhouse, Coinbase, reported a Q2 2023 income of $708 million, partly due to its custody deal with Blackrock and a focus on institutional interests. Meanwhile, Matter Labs faces accusations of plagiarizing code from Polygon Zero’s Plonky2 library.”

Alibaba’s AI Rivals Meta’s Llama 2: Unpacking the Open Source Drama and Consequences on DeFi

Alibaba has disclosed two novel open-sourced AI models, Qwen-7B and Qwen-7B-Chat, aiming to enrich AI operations. These models support the academia, researchers, and commercial institutions, offering code, model weights, and documentation access. However, large corporations need a license for use.