“Bitcoin stands strong despite predicted CPI growth due to escalating oil costs. There’s been a small rise in the CoinDesk Currency Select Index and ether remains resilient. However, this rally might be a result of short covering and liquidity crunch rather than real sentiment change. A continued momentum in Bitcoin’s value requires steady close above critical resistance levels. Meanwhile, Curve’s CRV token trends downwards.”

Search Results for: BTC Echo

FTX’s Potential Liquidation and the Recoil it Provokes: Navigating Market Uncertainties

This excerpt gives an overview of the recent market fluctuations triggered by FTX’s potential liquidation of crypto holdings, featuring significant stakes in Bitcoin and Solana. Despite the panic, experts argue that this anticipated chaos may have been overhyped, with sales likely to be gradual and strategic.

Crypto Regulation Reforms: India’s Bold Stride for Blockchain Market Accountability

“India, a G20 summit member, is adopting robust regulations for cryptocurrencies instead of an outright ban. The proposed five-point crypto ordinance includes stricter Know Your Customer standards aligned with international anti-money laundering and FATCA regulations, real-time Proof-of-reserve audits, harmonised tax policy, and elevating crypto exchanges to authorised dealers.”

Navigating The Uncertain Future of CBDCs: Global Move and Its Impact on Bitcoin’s Health

“The rise of Central Bank Digital Currencies (CBDCs) demonstrates a global trend towards reliable digital finance. Despite challenges of potential cyber threats and increased financial surveillance, CBDCs promise improved payment efficiency and accessibility. Financial institutions need to educate about digital currencies and strategize integration efforts.”

South Korean Crypto Sentiment: Investment or Gambling? Public Perspective & Future Predictions

A recent South Korean survey reveals 80% of respondents view cryptocurrencies more as “gambling” due to lack of asset support, susceptibility to scams, price manipulation fears, and insufficient regulatory supervision. While 6% reported understanding underlying blockchain technology, most demonstrated partial or no comprehension, primarily investing for fun or quick gains.

Bitcoin vs. Ethereum: The Race Tightens Amid Market Lull and Regulatory Rumbles

“The crypto market leader, Binance, remains dominant despite regulatory concerns, with its bitcoin-tether pair contributing up to 86% of global transactions. Meanwhile, crypto analytics firm K33 predicts ETH will outpace Bitcoin in the next two months, while SOMA Finance is set to introduce the first legally issued digital security.”

Navigating the Crypto Gold Rush: The Rise of Blockchain Billionaires and the Inherent Risks

“The ‘Crypto Wealth Report’ reveals an increasing number of global millionaires hold significant crypto assets, particularly Bitcoin. Yet, concerns range from future trading prohibitions to tax policies on digital assets. Despite volatility and risks, many jurisdictions are encouraging safe storage policies, recognizing crypto as a legitimate asset class.”

Mixed Bag Future: Crypto Adoption and Skepticism Explored by World Federation of Exchanges

According to a survey by the World Federation of Exchanges, 41% of firms offer crypto services, while a third refuse due to regulatory concerns and fear of scams. Centralized exchanges record higher volumes despite higher fees, triggering skepticism about market instability and need for uniform regulations.

Shiba Inu’s Potential Recovery and the Rise of Newcomer Sonik Coin: A Comparative Analysis

“The Shiba Inu (SHIB) token’s price has declined notably but shows promising signs of recovery. Increasing trading volumes and high-value transfers hint at growing market interest. With the relaunch of Shibarium, a layer-two network, the SHIB ecosystem’s future could be bright. However, high-risk assets like crypto offer no guarantees.”

Understanding the Implications of Bitcoin’s Overbought Downturn: A Comprehensive Analysis

“Fairlead Strategies predicts an “overbought downturn” for Bitcoin (BTC), hinting at decelerating upward momentum. This correlates with Bitcoin’s continuous inability to surpass the “cloud resistance” at approximately $31,900. Historically, similar downturns precede notable price peaks. Despite this, a long-term neutral bias is suggested by the MACD histogram.”

Bitcoin’s Rough September: The Impact of Regulatory Delays and Inflation Worries

Bitcoin’s value declines amidst regulatory delays and macroeconomic concerns linked to a rising US budget deficit. Despite regulatory setbacks, positive outlook on a potential Bitcoin ETF remains. Australian “Digital Assets (Market Regulation) Bill 2023” undergoes examination, aiming to balance innovation and consumer safety in the digital asset ecosystem.

Navigating the Crypto Landscape: Will Singapore’s President Bring Change or Continuity?

“Former finance minister Tharman Shanmugaratnam’s presidency bears ambiguity for Singapore’s crypto space. His skepticism yet hands-off approach towards cryptocurrencies provide a glimmer of optimism. The question looms; will his policy commitments hold amid crypto’s volatility and increased regulatory pressure?”

Navigating SEC’s Stance: The Hopeful Resurgence of U.S. Cryptocurrency Industry

The resurgence in the U.S. cryptocurrency industry is driven by key victories by Ripple and Grayscale against the SEC. The shift is largely due to initial clarity from state authorities, conflicting regulatory statements from SEC and CFTC. Amid this, recent positive court filings and decisions may inject fresh liquidity into the market and encourage institutional investments.

Spot Bitcoin ETFs: A Challenge for the SEC and a Leap for Crypto Industry

“The triumph of Grayscale, a digital currency asset manager, could increase the possibility of the SEC approving spot bitcoin ETF applications. This has enormous implications for the crypto industry, opening the floodgates for more institutional investors into the market without needing to acquire underlying digital assets.”

Exploring the Forces Shaping Bitcoin’s Spiraling Rise Above $27,000: A Market, Technical, and Global Outlook

“Bitcoin (BTC) has surged above $27,000, a jump many credit to Grayscale’s recent legal victory to turn its Bitcoin Trust into an ETF. Global cryptocurrency market capital grew roughly $50 billion in a day, raising hopes for future growth. Factors such as increasing acceptance of crypto by countries like Netherlands and endorsements by US figures further strengthen the market’s legitimacy.”

Ripple Effects of Grayscale’s Court Win: Impact on Cryptocurrency Market & U.S. Spot Bitcoin ETF Future

Grayscale’s recent legal victory against the U.S. Securities and Exchange Commission may potentially transform the company into the first-ever U.S. spot Bitcoin ETF. This development could make Alameda Research’s lawsuit against Grayscale, urging for lower fees and a redemption program, unwarranted. However, the lawsuit has brought the debate on fee structures and redemption policies into the spotlight, which could ultimately shape the future of blockchainization.

BlockFi’s Redemption Saga: From ‘Trade Only’ Assets to Gemini Dollars and Patricia’s PTK Crisis

BlockFi’s saga continues as the company seeks court authorization to convert ‘trade only’ assets into stablecoins for user withdrawal. This move, supported by the Committee of BlockFi creditors, is part of efforts to return user funds. However, uncertainty remains due to debt and questionable plans. Similarly, Patricia crypto exchange faces skepticism over its debt token, Patricia Token (PTK). These situations highlight tension between trust, regulation, and innovation in the crypto world.

EOS Network’s Dramatic Turnaround: Nod from JVCEA & Promises of the Japanese Market

EOS Network, a blockchain that garnered $4 billion in its initial coin offering, has been granted white-list approval by Japan’s regulatory body for crypto exchanges. This allows EOS to compete with major cryptocurrencies like Bitcoin and Ethereum on Japan’s regulated crypto exchanges. The approval signifies EOS’s compliance commitment and opens new opportunities for the network in the Japanese market.

Navigating Regulatory Shifts: Binance’s Shift, Impact Theory’s Legal Woes, and Emerging Blockchain Innovations

“Binance’s Belgian users can now dodge local regulations by accessing the platform via its Polish branch. This resourceful solution permitted them to continue operations within the European Economic Area after the parent company ceased. However, due diligence is important. On the other hand, Venezuela’s key banking institution has been removed from Binance’s P2P payment options due to alleged international financial sanctions.”

Diving Deep into Bitcoin’s Prospective Price Floor: A Look at $23,000 as Rock Solid Support

Capriole Investments founder, Charles Edwards, hints at a probable Bitcoin (BTC) price fall to $24,000 but sees solid support at $23,000. Edwards’ confidence in this “rock-solid support” and “incredible long-term opportunity” is based on the ‘Electrical Price’ (EP), a concept reflecting the global average miner’s electrical bill per BTC, which currently matches the $23,000 mark. However, potential market uncertainties should not be overlooked.

Navigating the Crypto World: Market Fluctuations, Legal Challenges, and Growth Opportunities

“This week’s bearish sentiment among crypto traders forced Bitcoin under $26,000. Current market behavior indicates possible surge in volatility. Meanwhile, market is apprehensive about potential firming of rates to control inflation resurgence. Legal cases and settlements also impact the crypto world.”

Surging Bitcoin And Brewing Economic Worries: Feast or Famine for Crypto Investors?

Bitcoin recently reached the $26,000 mark, sparking discussion about its potential as an investment. However, economist Peter Schiff predicts a full-blown financial crisis, while data shows the US dollar remains dominant in international transactions. Charles Hoskinson, the mind behind Cardano, claims his cryptocurrency will surpass Bitcoin and Ethereum. Despite volatility, Bitcoin’s technical structure remains solid within a specific trade range.

Bitcoin’s Resilience amidst Monetary Shocks: A Debate on Investment Stability versus Volatility

Jerome Powell’s hawkish remarks prompted an initial dip, then rebound, for bitcoin, showcasing the cryptocurrency’s resilience to external monetary shocks. Despite volatile tendencies, cryptocurrencies may offer an alternative, potentially stable investment option, even amidst fluctuating traditional markets and restrictive monetary policies.

BlackRock’s Alleged Bitcoin Wallet: Benefactor or Malefactor in the Cryptocurrency Labyrinth?

Speculation about the world’s third largest Bitcoin wallet residing under financial giant BlackRock stirs uncertainty in the crypto community. Crypto advocate Lark Davis expresses skepticism over BlackRock’s alliance with Bitcoin, cautioning that their powerful influence may extend into the crypto space. Despite ambiguity surrounding BlackRock’s intentions, their dominant position and high ETF application success rate suggest they could significantly impact the crypto landscape.

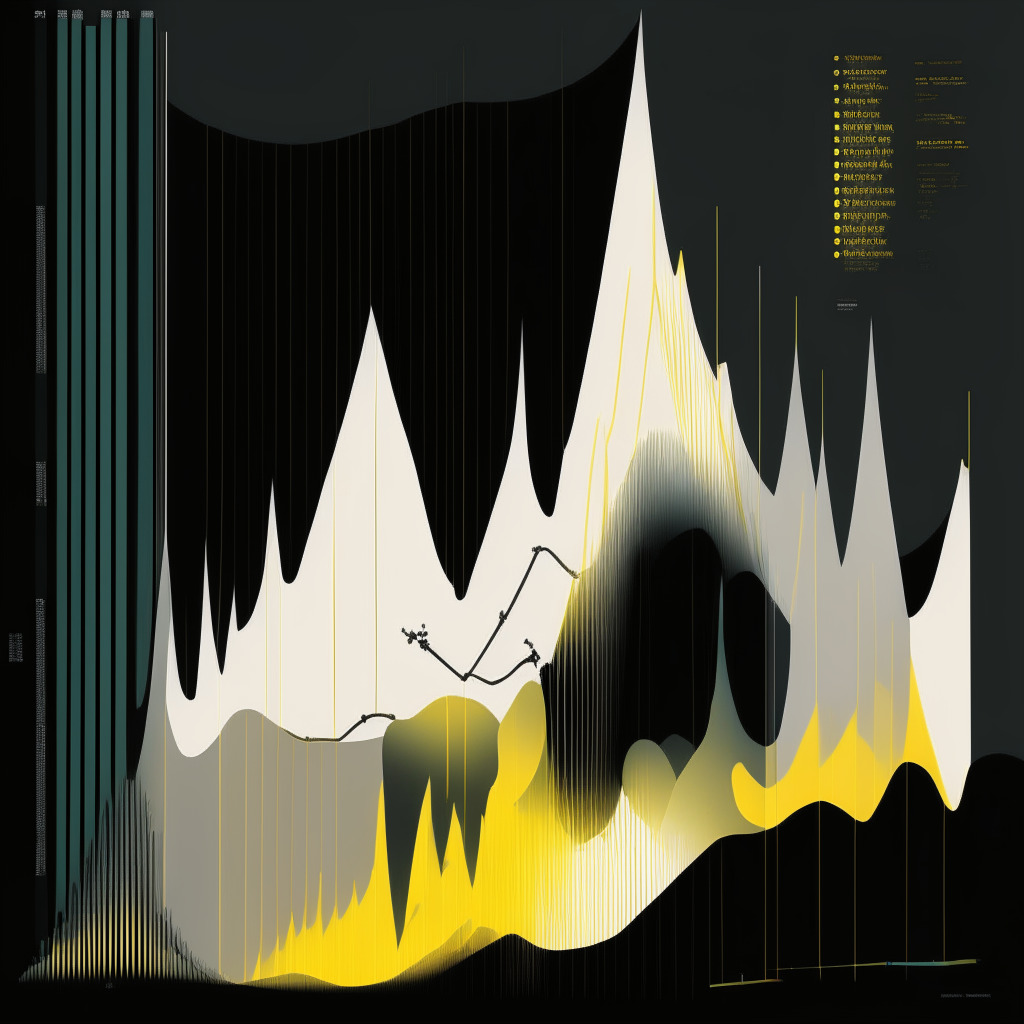

Crypto Correction and Market Downfalls: The Bittersweet Symphony of Financial Growth

The cryptocurrency market, including Bitcoin and Ether, is in a ‘significant downtrend,’ following last week’s sudden drop. This mirrors a downwards trend in traditional markets such as the Nasdaq Composite and S&P 500. Despite this, the economy continues absorbing policies from the past 16 months without visible harm to spending or job creation.

Binance Shakes Up Crypto Market: From Zero-Fee Bitcoin Trading to VIP Taker Fees

Binance’s recent decision to modify their zero-fee Bitcoin trading program has stirred the crypto community. Commencing from September 7, traders will now face a standard taker fee, potentially leading to a drop in trading volumes. However, Binance users can now benefit from zero maker and taker fees trading FDUSD Bitcoin, despite FDUSD’s current lower trading volume.

Dramatic Plunge in Ether Futures on Binance: Unsettling Calm or the Start of a Storm?

The U.S. dollar value in active ether perpetual futures contracts on Binance has dropped to $1.41 billion, the lowest in over a year. Binance has seen its ether futures notional value dip 35% within a week, reflecting a system-wide leverage washout. This suggests a lower probability of future volatility instigated by liquidations.

Strategizing Amid Market Whipsaws: Crypto Upsurges and Potential Pitfalls

“Bitcoin rose more than 3% to above $26,600, demonstrating resilience after last week’s sharp fall. Close on its heels, Ether marked a 3.5% advance. Altcoin giants like Ada from Cardano, DOT from Polkadot, and BNB from Binance too mirrored these gains with rises ranging between 3%-5%.”

Navigating Uncertainty: Evaluating Contributing Factors to Crypto Market’s Recent Slump

“Recent market dynamics show a significant decrease in the total crypto market valuation over a span of 10 days. Contributory factors include rising interest rates, increasing finance costs, a decrease in consumer spending, and a liquidation of investments. Nevertheless, expert analysis suggests possible economic resilience and a diminished likelihood of a long-lasting recession. At the same time, regulatory pressure and heavy offshore trading stirs controversy in the crypto industry.”

Thermodynamics of Cryptocurrency Investing: Navigating the Shifting Risks and Returns

“In the cryptoverse, risks and returns constantly transform through an investment cycle. With each phase of structural risk modification, return opportunities change. For example, Bitcoin’s ‘existential risk’ diminished and its value surged, setting a new price equilibrium. Now, the ‘regulatory risk’ might be next, signaling another major risk transformation in cryptocurrency.”

Navigating Bitcoin’s Volatility: A Harrowing Plunge or a Bullish Take-off?

“Recent activity saw Bitcoin momentarily drop to the support level at $26,000. This glimpse into the bearish territory is now sparking renewed scrutiny from enthusiasts. Bitcoin’s price is wavering around $25,992 with a 24-hour trading volume of about $14.4 billion. The 50-day Exponential Moving Average has profoundly swayed Bitcoin’s direction, echoing prolonged bearish momentum.”

Blockchain Under the Dragon: Crypto Future in a Tightening Chinese Regulatory Landscape

“A Chinese government official has received a life sentence due to his involvement in illicit activities, including a Bitcoin mining business. Xiao Yi was found guilty of corruption and the abuse of power. His charges tie back to his relations with Jiumu Group Genesis Technology. The company operated a significant number of Bitcoin mining machines and consumed around 10% of Fuzhou city’s electricity. Yi’s sentence highlights China’s strict stance on illegal cryptocurrency operations.”