The surging interest in cryptocurrencies, notably Bitcoin, is creating a new breed of billionaires. A recent report from London-based investment migration consultancy firm Henley & Partners points to the unforeseen wealth creation spurred by the rise of digital currencies. Going by the numbers presented in the ‘Crypto Wealth Report’, out of the 88,200 millionaires globally, an increasing number possess significant crypto holdings, particularly in Bitcoin, which tallied up to more than 40,500. Surprisingly, six out of the 22 crypto traders, who held more than $1 billion, are said to have chalked up their fortunes through Bitcoin trade.

But there’s an element of caution as well. Dr. Juerg Steffen, the CEO of Henley & Partners, states that there has been a significant uptick in queries from these enriched individuals. The concerns range from securing their assets against potential future prohibitions on cryptocurrency trading in their countries to lessening the risk of hard-hitting tax policies on digital assets.

It’s not all doom and gloom, though. Many jurisdictions are understanding the legitimacy of the crypto-based wealth, encouraging safe storage mechanisms and policies that put it on equal footing with other tangible or intangible asset classes. This sentiment is echoed by cybersecurity specialist Ali Khan, who also underscores that several regions are yet to take the leap.

The narrative gets more enticing as the list of these crypto millionaires and billionaires features industry magnates like Digital Currency Group’s founder and CEO Barry Silbert and Binance’s CEO Changpeng Zhao, amongst others.

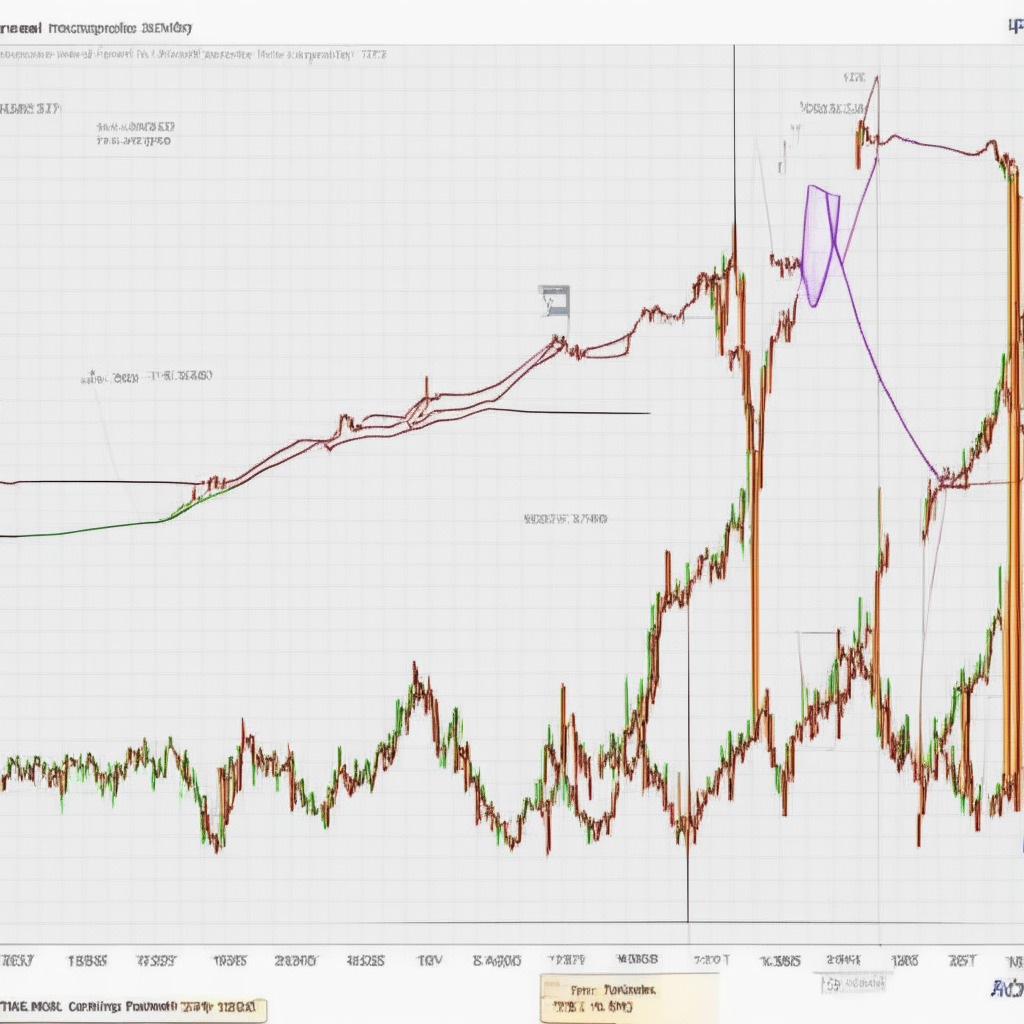

However, the crypto market’s volatile nature comes rearing its head pretty soon. Evidence of this is the market crash of 2022, which led to a drastic decline of about 80,000 in crypto wallet addresses holding equivalent of more than $1 million. This points to the ephemeral nature of the crypto riches as major industry players experienced a collective loss exceeding $116 billion.

These revelations encapsulate the thrilling and at times, treacherous world of cryptocurrencies. They underscore the prolific wealth generation possibilities but not without the inherent risks. So, the question is, how ready are we for this financial revolution?

Source: Cointelegraph