“Despite overconfidence among Bitcoin bulls, there’s a need for Bitcoin to reclaim the $27.8K moving average for positive momentum. Skepticism around Bitcoin’s multi-year low RSI readings adds to the market uncertainty. Meanwhile, Binance’s modification of its zero-fee Bitcoin trading could incite market selloffs, shifting focus from TUSD to FDUSD stablecoin.”

Search Results for: Bull Bitcoin

Bear or Bull: Analyzing Ether and Bitcoin Options Trends in the Cryptocurrency Market

“Ether’s market indicators suggest potential price drop, with traders hedging against price downturns in near-term timeframes. This contrasts with Bitcoin’s long-term bullishness among traders. While Bitcoin is believed to benefit from positive macroeconomic shifts, Ether’s better performance can be attributed to ETH futures-based exchange-traded funds and hedging activities.”

Navigating Bitcoin’s Volatility: A Harrowing Plunge or a Bullish Take-off?

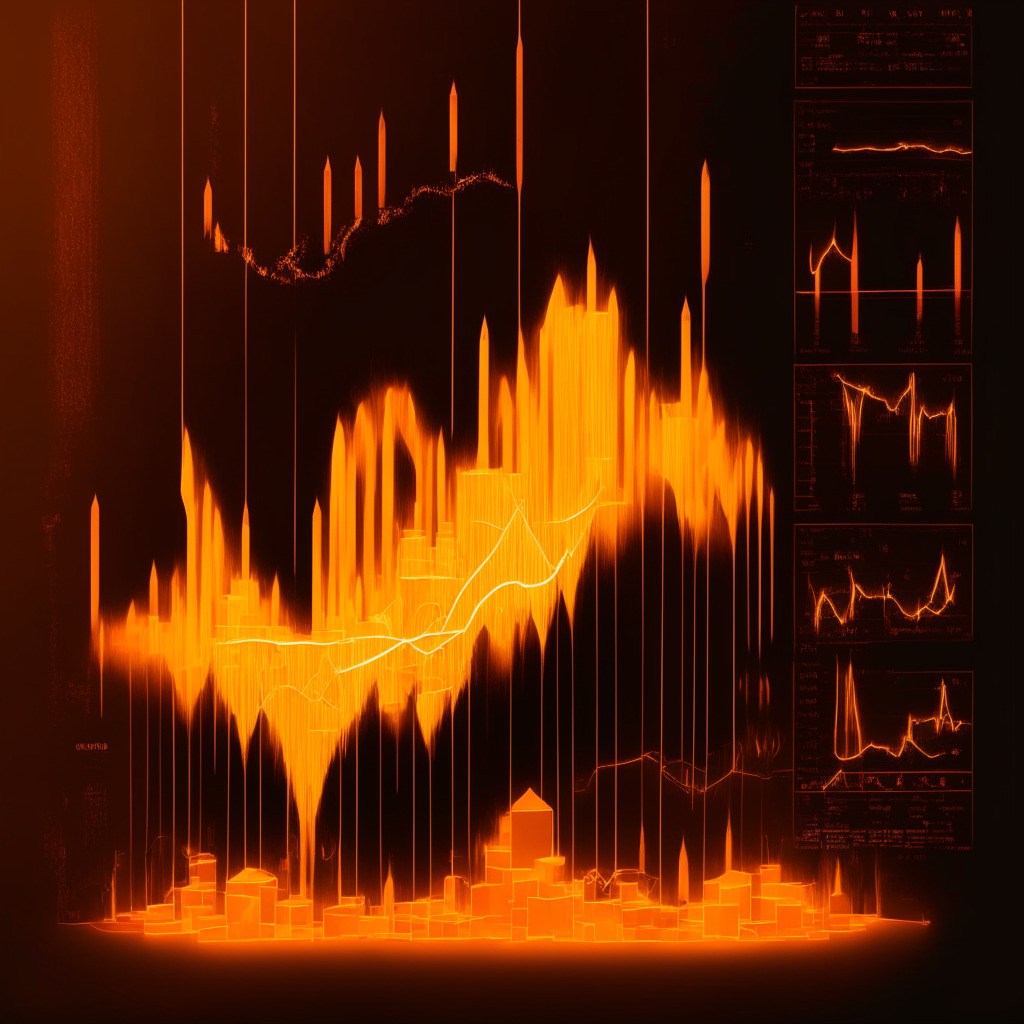

“Recent activity saw Bitcoin momentarily drop to the support level at $26,000. This glimpse into the bearish territory is now sparking renewed scrutiny from enthusiasts. Bitcoin’s price is wavering around $25,992 with a 24-hour trading volume of about $14.4 billion. The 50-day Exponential Moving Average has profoundly swayed Bitcoin’s direction, echoing prolonged bearish momentum.”

Bitcoin’s Bull Cycle on Horizon: An Analysis of RHODL Metric’s Forecast & Cautionary Notes

“Cryptocurrency, particularly Bitcoin, is entering a new bull cycle according to on-chain analytics. The Realized Cap HODL Waves (RHODL) tool signals a market surge by measuring Bitcoin’s realized price against the time it last moved. Market preparation for higher Bitcoin prices suggests imminent heat up.”

Bitcoin’s Future: The Battle between Bullish Optimism and Regulatory Uncertainty

Cryptocurrency markets, particularly Bitcoin, are seeing significant fluctuations, with predictions both optimistic and pessimistic. Some analysts express confidence due to an increase in Bitcoin adoption by major investors, while others cite regulatory ambiguity as a cause for potential prolonged market dips. Navigating these varying predictions requires careful research and expert advice.

Navigating Bitcoin’s Turbulent Whirlwind: Grounding a Bullish Stand at $28,000

In the recent bearish cryptocurrency market, the BTC price is working to maintain a foothold at $28,000. However, with a risk of a breakdown and due to a slump in buyside interest triggered by Federal Reserve minutes, the BTC/USD dipped to nearly two-month lows of $28,300. Market observers are preparing for potential further support retests.

Bearish Wagers and Bullish Endeavours: Navigating Bitcoin’s Latest Slump Amid Macroeconomic Woes

“The flagship cryptocurrency, BTC, is currently embroiled in a surprising pullback amidst market apprehensions sparked by banking sector worries and a potential recession in China. Meanwhile, leverage funds have increased bearish wagers in cash-settled Bitcoin futures, indicating a possible shift of sentiment in the crypto space.”

Bitcoin’s Dance with the $29,000 Mark: A Tense Standoff Between Bulls and Bears

Despite Bitcoin’s value skirting around the $29,000 mark and general downward crypto prices, investors remain watchful of Bitcoin’s trajectory and stability. Bitcoin’s current bearish dynamics below the 50-day moving average suggest possible future market alterations. Investors are encouraged to consult multiple sources and conduct thorough research due to cryptocurrency’s volatile nature.

Predicting Bitcoin’s Future: Echoes of 2015-2017 Bull Run or Misplaced Hopes?

“Recent analysis from Delphi Digital suggests that the current consolidation on Bitcoin near $30,000 mirrors pre-bull market cycle from 2015-2017, predicting a resurgence by end of 2024. The report highlights the cyclicality of crypto markets, and emphasizes the unpredictable nature of cryptocurrency fluctuations despite historical trends.”

Navigating Through the Bull and Bear Markets: Uncertainties and Predictions for Bitcoin’s Future

“The rise in the U.S. dollar index (DXY) might be an obstacle on Bitcoin’s recovery path. The DXY’s upward trend has likely influenced risky assets negatively, with equities markets seeing a corrective phase. While experts predict Bitcoin consolidation within a specific range, trends in the Ethereum market currently favour the bears.”

Altcoins Shine Amid Bitcoin Stalemate: A Tale of Bulls, Bears, and Potential Surges

“Bitcoin’s compressed values approach territory visited only four times since its inception, hinting at possible rise. Low volatility, however, has led to a slump in Bitcoin futures trading. Altcoins like SHIB, UNI, MKR and XDC present opportunity amidst Bitcoin’s uncertain market state.”

Federal Reserve’s Potential Rate Cuts: A Bullish Future for Bitcoin?

“There is a growing sentiment that the Federal Reserve may turn toward rate cuts, which could bode well for Bitcoin. This, along with expected spot Bitcoin ETF approvals, could boost Bitcoin prices; however, these developments are not likely to materialize before early 2024.”

Bitcoin Bull Run: Macroeconomic Factors, ETF Optimism, and Impending Risks

“Bitcoin’s value increased by 1.60%, influenced by key macroeconomic aspects including the expected CPI report and impending Federal Reserve interest rate decision. Rising hopes for a Bitcoin ETF approval also catalyze this strengthening. However, Bitcoin faces challenges in surpassing the $30,200 barrier according to technical indicators.”

Bitcoin’s Bullish Surge: Analyzing the Taker Buy-Sell Ratio and Its Role in Crypto Market Rebounds

“Bitcoin’s ‘taker buy-sell ratio’ on crypto exchanges peaked at 1.36 recently, indicating strong bullish sentiment. This suggests that buy volume is exceeding sell volume, a classic sign of bullish trading. Some attribute this to large Bitcoin investors, often termed ‘whales’, increasing their buying volume.”

Bitcoin’s Puzzling Standstill: A Precursor to Bull Run or Bear Crawl?

The crypto market shows a moderate increment with Bitcoin nearing the $30,000 mark, and Ethereum remaining stagnant. The forthcoming U.S July Consumer Price Index could serve as a catalyst, but concerns exist regarding potential bearish trends and the need for regulatory reforms. Recent developments include PayPal’s Ethereum-based stablecoin, an AI chatbot, and restoration of stolen funds.

Navigating Turbulence: Predictions, Whales and Fear in Bitcoin’s Bullish Future

Bitcoin’s value could skyrocket pre-2024 halving event, according to Blockstream CEO Adam Back, with “whales” confidently accumulating Bitcoins despite market volatility. Bitcoin’s current value sits at $29,080, with key factors, such as the Bitcoin ETF approval and report releases like July’s Consumer Price Index, potentially stirring market dynamics. Cryptocurrencies remain high-risk investments, emphasizing the need for personal research.

Anticipating Bitcoin’s Bull Market: Whales, Fish and the Vital 200-week SMA

In the unpredictable crypto market, analysts suggest that Bitcoin could undergo a “full bull” upswing in the coming month. This potential uptrend is indicated by increased activity among Bitcoin’s whale investors. However, Bitcoin price needs to sustain above its 200-week simple moving average for this to happen.

Institutional Embrace of Bitcoin: The Road to the Next Bull Market?

“The issuer of dominant USD-pegged stablecoin USDT, Tether, bought 1,529 Bitcoins valued at $45.4m in Q2, aligning with plans to invest 15% of quarterly earnings into Bitcoin. This underscores the growing institutional acceptance of Bitcoin, suggesting a surge in companies and institutional investors building Bitcoin portfolios. While a bullish long-term perspective, the immediate uptrend has been influenced by factors such as US SEC regulation against cryptocurrencies.”

MicroStrategy’s Massive Bitcoin Acquisition: A Bull Run Trigger or Market Turbulence Ahead?

“MicroStrategy disclosed its plan to sell almost $750 Million of its stocks, with a significant portion of the proceeds being utilized for Bitcoin acquisition. However, factors such as potential regulation concerns and potential turbulence in the DeFi space could hinder a near-term rally.”

Bitcoin’s Validation as Global Asset: Bullish Momentum and Cautionary Notes Amid Crypto Market’s Dynamics

“Bitcoin’s current favorable standing, as per Mike Novogratz and Larry Fink’s recent remarks, has contributed to the upward momentum of BTC/USD. However, Bitcoin-based NFTs have not enjoyed similar optimism. Despite regulatory challenges, Bitcoin’s unique market standing has fostered investor trust.”

Bitcoin’s Struggle Amid Macroeconomic Factors: Is a Bullish Rebound Projected or Not?

“Bitcoin’s (BTC) stability remains unperturbed by the recent exploit with Curve Finance, as investors are urged to practice vigilant risk management. Although a significant price boost isn’t anticipated until 2024’s halving, BitBull Capital CEO, Joe DiPasquale, anticipates a prolonged positive market shift.”

Bitcoin Below $30,000: A Blip in an otherwise Bullish Journey

Bitcoin’s recent fall below $30,000 is viewed as a temporary deviation in an otherwise bullish trend, according to SynFutures CEO, Rachel Lyn. The absence of traders selling $30,000 bitcoin call options suggests a lack of belief in a fundamental resistance, supporting this view. Despite fluctuations, the broader blockchain landscape presents a promising future.

Flash Crash Sweeps Bitcoin: Unraveling the Mystery Amidst Bullish Market Signals

“On July 24, Bitcoin experienced a flash crash to $29,000, attributed to substantial Bitcoin holders potentially liquidating their positions. While this caused a stir, Bitcoin’s main trading metrics maintained a bullish outlook, with professional traders largely retaining their leverage longs. A sudden increase in whales’ inflow to crypto exchanges was reported amidst these dynamics.”

Bitcoin’s Shaky Footing: A Dive to $19k or a Bullish Run Ahead?

“Bitcoin stands at a watershed moment, expecting significant price alterations. The crypto market monitors fluctuations below $30k, concerned about a substantial decline. The upcoming seven days add to this volatility as the US Federal Reserve’s decision on interest rates could trigger significant Bitcoin’s price changes. Stakeholders wait, ready to capitalize on Bitcoin and crypto market’s direction.”

Bitcoin Bulls vs Bears: The Battle at the $30,000 Mark and Spot ETF Proposals

The upcoming Bitcoin options’ expiry on Friday could reinforce the $30,000 resistance level, indicating potential control by the bears. However, the bulls might leverage spot ETF proposals under SEC scrutiny. Amidst this, the transformative power of blockchain technology remains unperturbed, despite volatile market dynamics.

Bear vs Bull: Navigating Bitcoin’s Price Amid Unstable Market Factors and Political Influences

“Cathie Wood from Ark Invest forecasts Bitcoin’s price to reach up to $1.5 million by 2030, highlighting growing trust in the cryptocurrency. Despite US Congressman Ritchie Torres’ concerns over SEC’s stance towards cryptocurrency, Bitcoin’s resilience remains strong above the $30,000 mark.”

Bitcoin’s Crab Market: An Intense Dance of Bulls, Bears and Accumulators

“The recent Bitcoin price dip, coupled with a rise in Accumulation Trend Score and Total Balance in Accumulation Addresses metrics, signals strong accumulation amid price dips. This reflects investors’ growing interest and confidence in Bitcoin’s long-term prospects, despite current market volatility.”

Bitcoin’s Bullish Surge amid ETF Hopes: Europe Leads, while the US Grapples with Regulatory Hurdles

“The Bitcoin market has recently surged, driven by a $25 billion influx, breaking the resistance level at $31,000. Europe leads in the initiation of a Bitcoin ETF, bolstering global crypto enthusiasm. Meanwhile, despite SEC-related challenges, U.S. interest in Bitcoin ETFs increases, potentially boosting investor confidence and Bitcoin’s value.”

The Battle of the Bears and Bulls: Will Bitcoin’s $30k Support Crumble on July 14?

The Bitcoin weekly options expiry on July 14 may shift market attitudes, with potential for the $30,000 support level to crumble. The recent U.S. inflation drop could encourage investors to pivot to fixed-income investments, making Bitcoin less appealing. However, the final outcome remains uncertain, given latest macroeconomic data and critiqued exchange practices.

Bitcoin Hovering: Signs of a Bullish Phase or Merely a Brief Respite?

Bitcoin remains steady around $30,500, igniting speculation of a potential bullish phase. It found support at $30,400, accelerating robust debate amongst analysts. Relative Strength Index indicates strong buying pressure, yet a slowdown in bullish momentum is hinted at by the Moving Average Convergence Divergence.

Decoding the Bullish Sentiment in Bitcoin’s Options Market amidst Choppy Pricing Trajectory

“Despite recent volatility and speculative downturn in cryptocurrency, the options market remains optimistic, with a palpable, positive call-put skew signaling a persistently bullish sentiment. Significant trading action indicates market expectations for Bitcoin values to breach the $31,000 barrier, potentially revitalizing the rally.”

Stagnant Bitcoin: A Look into Halting Bull Runs and the Global Currency Debate

Recent market data suggest a possible stall for Bitcoin around the familiar $30,000 mark. Predicted recovery in Q4 depends on a trifecta of factors: a halt on rate hikes, Bitcoin halving, and clearing of regulatory storms, thus indicating a complex near future.