“Crypto’s primary use is still to amplify wealth, but its potential extends well beyond that. Blockchain technology can revolutionize self-custody of assets, enable peer-to-peer connections, and spur innovative business models. Overcoming rampant speculation to highlight crypto’s actual utility is crucial.”

Search Results for: Economic Daily

Navigating the Cryptocurrency Landscape: Blue-chip Stagnation, Meme Coin Volatility and BTC20 Potential

While major cryptocurrencies like Bitcoin and Ethereum are relatively stable, high-volatility seekers are turning to the meme coin market. Coins such as Pegasus SniperBot, Scarab, and Ascend Coin have been gaining traction due to their unique features and growth trend. However, these investments often lack broader vision or function and carry significant risk, including buy and sell taxes. Investing in promising pre-sale projects, like BTC20 which aims to emulate Bitcoin on an ecofriendly Ethereum blockchain, can be more secure and rewarding. But, potential investors must always evaluate the risks involved in this high-risk asset class.

Navigating the Crypto Sphere: Market Fluctuations, Rising Interest in Ethereum, and the Cosmos Crisis

“The cryptocurrency market is undergoing changes, fluctuating with Bitcoin seeing reduced volatility rates that may prelude significant price swings. Interest in Ethereum’s ZkSync Era is rising, and despite economic uncertainties, new legislations and developments highlight the continuously evolving crypto landscape.”

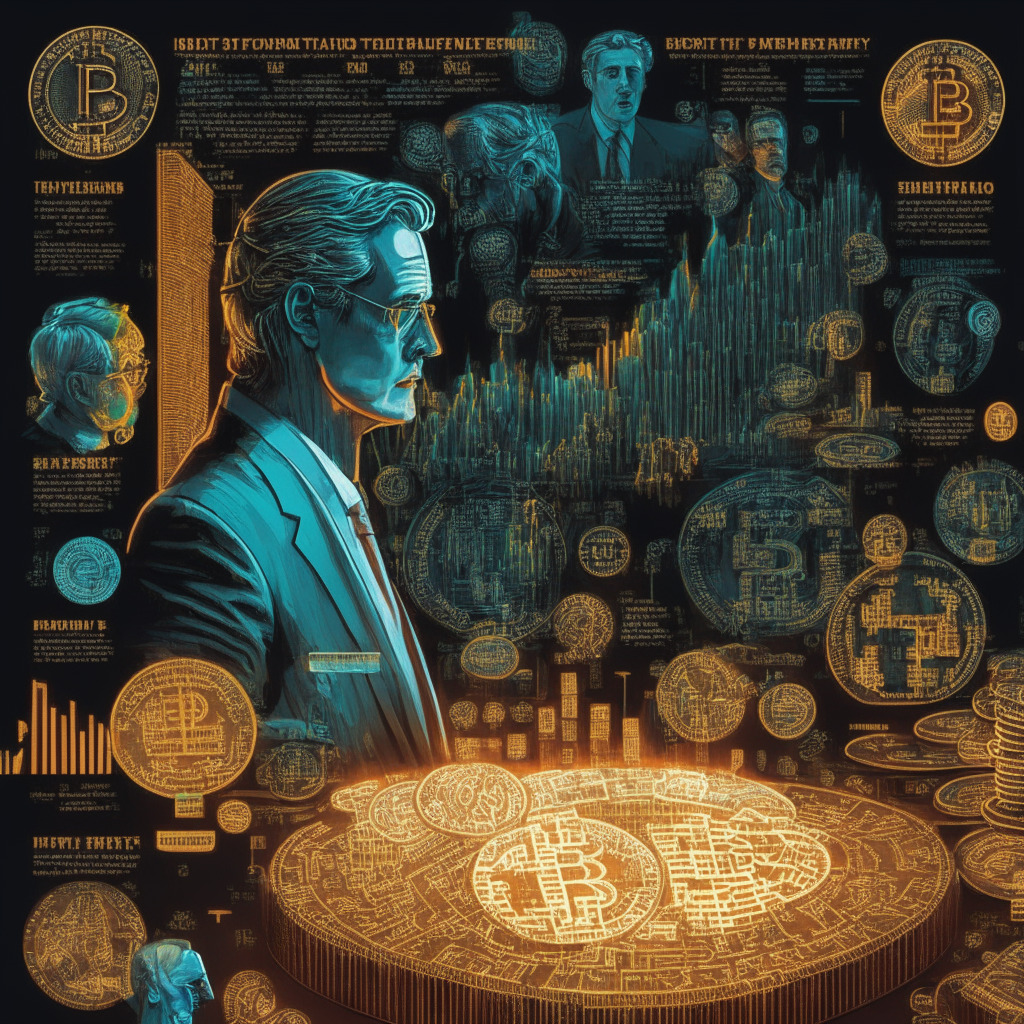

Federal Interest Rate Hike and the Surprising Ignition of Cryptocurrency Markets

Cryptocurrency prices, including Bitcoin and Ethereum, have welcomed the anticipated interest rate increase by the U.S. Federal Reserve. Bitcoin experienced a 0.8% surge while Ethereum saw a 0.5% rise. According to Lex Sokolin of Generative Ventures, crypto’s overall story remains unaffected despite macroeconomic events. Equity markets show mixed responses, but further rate hikes might occur.

Ethereum Faces Unsettling Death Cross: Exploring Potential Outcomes and Mitigation Factors

The Ethereum network may be overpriced, as suggested by the high NVT reading of 120. Despite the potential for a price drop, current holders’ profit levels and the decrease in Ethereum’s liquid supply might mitigate this fall. The ETH supply drop since the Shapella upgrade and a steady increase in staked ETH for validation provides a likely firm bottom. Nonetheless, traders need to be watchful of potential risks amid looming bearish scenarios.

Navigating the Bitcoin Mining Labyrinth: Texas’ Struggle between Economy and Ecology

“Texas, a significant bitcoin mining hub, is experimenting with integrating mining into power grids. However, this move has been criticized for potentially prioritizing an environmentally harmful industry over local communities. On the other hand, supporters highlight the potential grid benefits and job opportunities, but concerns about sustainability and water usage persist.”

Cryptocurrency’s Rollercoaster: Bitcoin’s Slump and the Potential Rise Ahead

“With a recent downward trend, questions emerge on whether Bitcoin (BTC) can maintain key support margins. Yet, long-term macro factors and Bitcoin’s historic correlations with the US stock market and US dollar hint at potential market value upsurge. The reimagining of Bitcoin as a safeguard against inflation, depicted by CoinMetrics.com’s charts, contributes to this paradigm shift.”

The Candy Digital–Palm NFT Studio Merger: Fast-tracking Licensed NFT Projects or Pushing Cryptocurrencies into Dangerous Territory?

Digital collectibles giant, Candy Digital, and Web3 company, Palm NFT Studio, have unveiled a collaborative merger aimed to enhance digital interactions across varied fields such as sports and entertainment. The merging of these companies hopes to improve fan engagement through the creation of NFTs, providing an expanded platform for brands to connect with fans.

Riding the Crypto Rollercoaster: Surviving Dips with Toncoin and Golteum’s Promising Safe Havens

Golteum (GLTM), a platform nested within the Golteum ecosystem, mitigates risks inherent in fluctuating crypto assets through seamless crypto trading and simplified ownership of precious metals. Backed by Fireblocks Web3 engine, GLTM promises solid technology and easy execution in transactions like tokenization of precious metals.

Transforming iGaming with Blockchain and Tokenization: Pros, Cons, and Main Conflict

The TFS Token native to Fairspin casino, built on blockchain technology, offers transparency, unique earning possibilities through staking programs, and dual compatibility with Ethereum and BNB Smart Chain networks, setting it apart from other iGaming assets.

Bitcoin at $30,000: Impact of Fed’s Interest Rates and Key Resistance Levels to Watch

Bitcoin’s future price movement relies on significant resistance at $30,800 and economic events like Unemployment Claims data and Federal Reserve Chair Powell’s testimony. Potential interest rate hikes, inflation, and technical aspects such as “three white soldiers” and Fibonacci retracement levels also play critical roles in determining Bitcoin’s market trajectory.

Navigating Post-ZIRP: Refocusing Web3 on True Innovation and Sustainability

As interest rates rise, the Web3 space will contract, eliminating unfavorable actors and speculative projects. The industry must demonstrate resilience, build sustainable solutions, and prioritize security, stability, and practical utility over volatile, high-risk investments in the post-ZIRP world.

Crypto Market Volatility: Impact of Fed Policy, CBDCs, and Exchange Crackdowns

Cryptocurrencies experienced significant declines, with Bitcoin dropping below $25,000 and altcoins like MATIC and ADA falling up to 9%. This comes after the Federal Reserve’s policy decision to suspend rate hikes, yet signaled further monetary tightening. Meanwhile, the European Commission plans to propose a draft law affecting digital euro operations, and Binance Smart Chain faces challenges as total value locked drops to its lowest since March 2021. These events reflect the crypto space’s volatility and uncertainty, with ongoing debates on CBDCs, regulatory actions, and global economic influences impacting its future.

SEC Crackdown on Binance and Coinbase: Latin American Traders Flock to Bitget

The SEC crackdown on Binance and Coinbase led to a surge in new account registrations with Bitget, a popular Latin American crypto derivatives exchange. This highlights the crypto market’s adaptability and traders’ desire to find alternatives amid increased regulatory scrutiny.

SEC vs Ripple Lawsuit: How It Affects XRP Price and Future Valuation Debate

The ongoing SEC lawsuit against Ripple has affected XRP’s price growth. A report by Valhil Capital estimates XRP’s fair value between $3.5K and $22K, outnumbering its current trading value. Factors considered in the study include global transaction volume, discount rate, daily transaction value, and economic growth, among others.

Federal Reserve’s Next Move: Impact on Bitcoin and Market Volatility

The jobs report and Federal Reserve’s potential rate hikes, alongside a recently passed debt ceiling deal, play crucial roles in shaping the overall market mood. With the VIX index at a 52-week low, cheaper options prices and macroeconomic events could significantly impact markets.

Bitcoin Momentum Amid US Nonfarm Payroll and Mining Expansion: Risks and Rewards

Bitcoin’s price gains momentum as market participants anticipate positive outcomes from the US Non-Farm Payroll data release and its impact on the US dollar. Growing demand in cryptocurrency mining and CFTC’s reassessment of risk management regulations create a bullish momentum for Bitcoin.

Navigating Crypto Investments Amid US Debt Ceiling Crisis: Key Tokens to Watch

This article highlights the recent decline in Bitcoin and other leading cryptocurrencies, which coincides with the U.S. House of Representatives voting to suspend the national debt ceiling. Amid economic turbulence, cryptocurrencies such as WSM, IOTA, ECOTERRA, LTC, YPRED, XLM, and DLANCE emerge as noteworthy purchase considerations. The Wall Street Memes token ($WSM) presale is gaining attention and drawing investment.

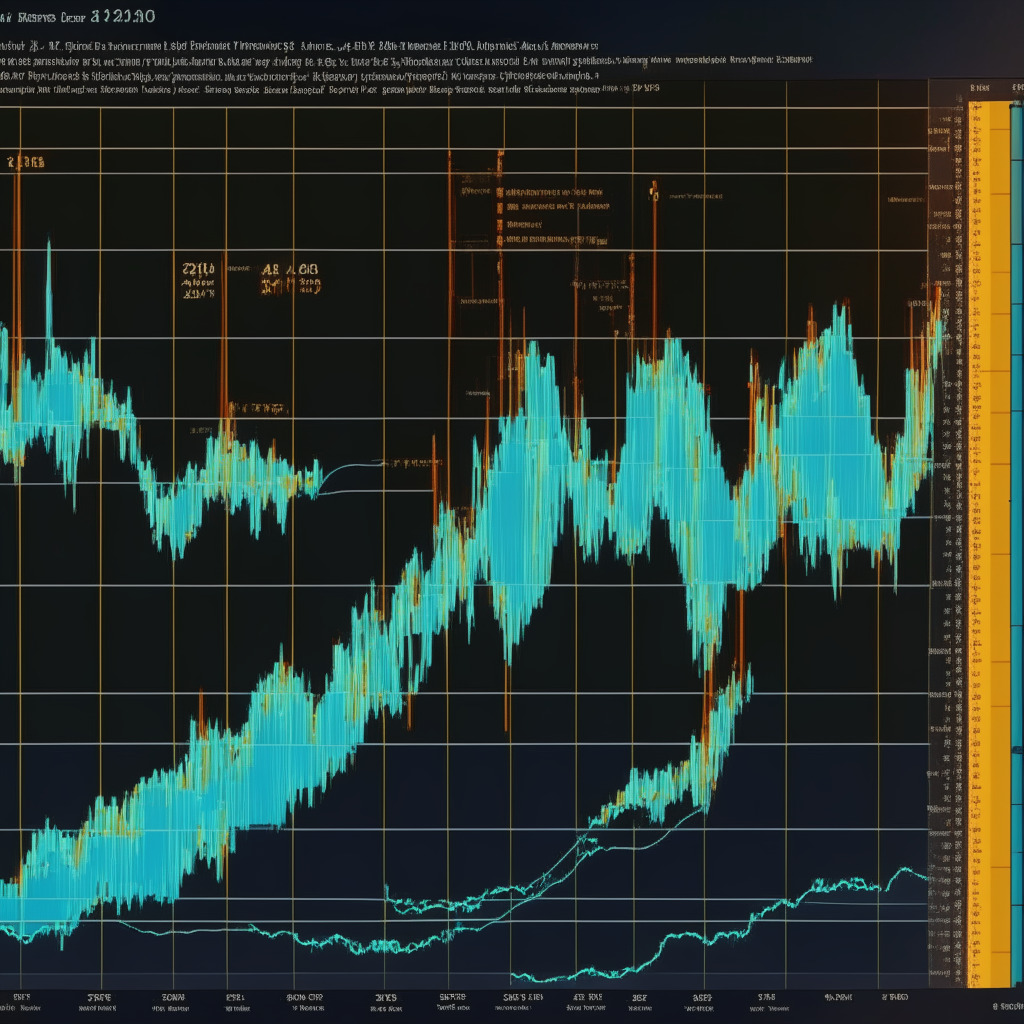

Bitcoin Volatility Dips, but Will June Bring a Decisive Price Move? Pros & Cons Explored

Bitcoin’s volatility has dropped significantly due to macroeconomic uncertainty and low market liquidity. However, on-chain and options market data suggest a decisive price move in June. Long-term holders are preparing for a breakout, while options market data highlights a growing bearish sentiment, resulting in potential market turbulence and price fluctuations for the month.

Bullish Patterns Emerge Amid Crypto Recovery: Spotlight on Solana, Chainlink, and Cosmos

The cryptocurrency market witnessed a surge in buying pressure due to macroeconomic events like the US debt ceiling deal. Cryptocurrencies like Solana, Chainlink, and Cosmos demonstrate bullish patterns, suggesting potential growth in the anticipated recovery rally. However, thorough market research is vital before investing, as conditions can change.

Unprecedented Bitcoin Stability: Market Factors & Implications for Investors

Bitcoin exhibits historic stability for 70 consecutive sessions, confounding investors and market watchers. Macro catalysts such as debt-ceiling negotiations and the Federal Reserve’s interest rate policy contribute to this unexpected calmness, causing traders to exercise caution and adopt a wait-and-see tactic.

Solana vs Ethereum: Scalability and Affordability Battle Amid Rising Gas Fees

Solana’s rising popularity as an affordable, scalable alternative to Ethereum’s high gas fees could prompt SOL price growth. Factors influencing SOL’s future include macroeconomic influences and regulatory landscape shifts. The increasing adoption of Solana, along with developments like the ChatGPT plugin integration and AI accelerator program, positions Solana as a cryptocurrency to watch in 2023.

Crypto Market Decline Amid UK Inflation Surge and Binance Allegations: Navigating Complexities

UK inflation hit 6.8%, Bitcoin fell under $27,000, and Binance faced allegations of commingling customer funds with company revenue. Japan prepares stricter anti-money laundering measures, while Cardano’s ADA sees whale accumulation. These complexities impact the crypto market, highlighting a battle between transparency and skepticism.

Reversing History: 1 BTC for 10,000 Pizzas and the Debate on Faster Crypto Adoption

A recent BTC transaction saw 10,000 pizzas purchased for 1 Bitcoin, reversing history from 13 years ago when 1 pizza was sold for 10,000 BTC. Growing crypto adoption could bring benefits to various sectors, but skeptics warn of risks and volatile market nature.

Bitcoin’s Price Dip: Puell Multiple Suggests Bearish Outlook or Temporary Blip?

Bitcoin price saw a brief dip below the 200-week moving average before rebounding, but on-chain data like the Puell Multiple indicate a bearish outlook, suggesting investors should consider booking profits. Factors affecting BTC prices include macroeconomic forces, false sell-off reports, and high transaction fees. It’s crucial for investors to conduct thorough research before making decisions to avoid unexpected losses.

Crypto Market Dips: Opportunity or Warning? Uncovering Top Picks Among AI, XLM, ATOM & More

Bitcoin has fallen below $27,000, causing concern for the crypto market’s immediate future. However, some investors are eyeing a potential dip to buy. Despite recent developments, AI, BGB, SPONGE, XLM, YPRED, ATOM, and DLANCE remain strong investment opportunities with solid fundamentals and technical analysis.

Bitcoin at $27K: The Struggle of Bulls, Macro Indicators, and a Golden Cross Clash

As Bitcoin (BTC) heads toward $27,000, bulls struggle to regain support amid weak market disposition. However, cautious optimism arises from positive macroeconomic indicators, such as the U.S. PPI and unemployment data, hinting at a possible pause in June rate hikes.

Cryptocurrencies as Inflation Hedge: Theoretical Appeal but Lacking Data

S&P Global highlights cryptocurrencies as potential inflation-protective assets, particularly in emerging markets. However, the agency emphasizes the insufficient data to support this claim, urging investors to approach the topic with skepticism and consider factors like crypto’s sensitivity to interest rates in financial decisions.

Coinbase Revenue Growth Amid Loan Halt: Impacts on Bitcoin, Ethereum, and Other Cryptocurrencies

Coinbase sees impressive 23% revenue growth to $773 million in Q1 2021, while Bitcoin prices approach $30,000. Despite market fluctuations and regulation changes, the Commodity Channel Index displays a positive signal for Bitcoin, while Ethereum, Ripple, and Litecoin face challenges.

Bank Collapses Fuel Crypto Adoption: Risks and Rewards in a Turbulent Financial Landscape

The recent collapse of major banks has raised concerns about financial infrastructure stability, leading to increased skepticism about centralized banking policies. This may result in a significant rise in cryptocurrency and NFT prices, with more people turning to Web3 alternatives for improved flexibility, efficiency, and decentralized finance solutions across multiple industries.

Memecoins Boom, Crypto Markets Shift & Diverging Opinions on Blockchain Future

The BRC-20 token standard has spurred 8,500 different tokens, mostly memecoins, while Bitcoin regained $28,000 and Ethereum topped $1,850. UK lawmakers eased advertisement approvals for registered cryptocurrency firms, but some remain skeptical of long-term prospects amid fluctuating market values.

Coinbase International Exchange: Catering to Institutional Clients and Global Regulatory Changes

Coinbase launches Coinbase International Exchange, targeting institutional clients outside the US and offering perpetual swaps for Ethereum and Bitcoin. This move aims to capitalize on growing demand for trustworthy crypto trading services and adapt to the evolving global regulatory landscape.